The three major U.S. stock index futures fell collectively, Intel rose over 5% in pre-market trading, European stocks declined, and gold, silver, and copper all rose together

The three major U.S. stock index futures fell collectively, while Intel rose over 5% in pre-market trading, reportedly seeking investment from Apple. Most Chinese concept stocks rose. European stock markets opened lower. Gold prices remained near record highs. Spot silver's gains expanded to 2%, and London copper rose nearly 1%, reaching a new high since May 2024. The U.S. second-quarter GDP final value, PCE price index, and the number of first-time unemployment claims for this week will be announced at 20:30 tonight

After the upward trend driven by the Federal Reserve's interest rate cuts showed signs of fatigue, U.S. stocks fell for two consecutive days, entering a brief stabilization period. Investors are turning their attention to the second quarter GDP final value, PCE price index, and the number of first-time unemployment claims to be announced tonight at 20:30, hoping to find direction for the next steps in the stock market.

On Thursday, U.S. stock index futures showed little change after two days of pullback, with Intel's pre-market shares rising over 5% amid reports that Intel is seeking investment from Apple. Most Chinese concept stocks rose, with XPeng up 3.5%. European stock markets opened lower. The Japanese stock market closed higher.

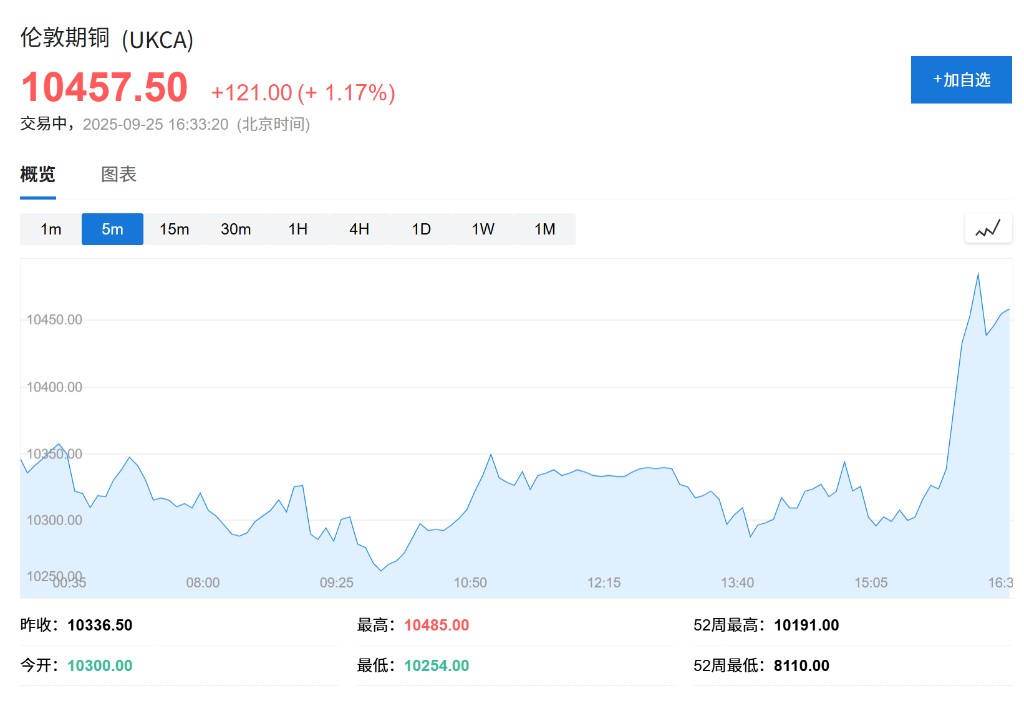

The U.S. dollar exchange rate remained stable, while oil prices retreated after experiencing the largest single-day increase since July. Gold prices remained near record highs. Spot silver rose by 2%, while London copper increased by nearly 1%, reaching a new high since May 2024.

In pre-market trading, most Chinese concept stocks rose, with XPeng up 3.5%, Bilibili up 2.5%, Nio up about 1%, and JD.com up about 2%. Intel's pre-market shares rose over 5%, with reports that Intel is seeking investment from Apple.

European stock markets opened lower, with the pan-European STOXX 600 index down 0.5%, and both the German DAX index and the UK FTSE 100 index down 0.4%. The declines in the healthcare and industrial sectors were the main drag.

The Nikkei 225 index closed up 0.3%, at 45,754.93 points. The Tokyo Stock Exchange index rose 0.5%, at 3,185.35 points. The Seoul Composite Index closed nearly unchanged, at 3,471.11 points.

The U.S. dollar spot index changed little, with the euro almost unchanged at 1.1742 USD.

The yield on the 10-year U.S. Treasury bond changed little, at 4.14%.

Spot silver rose by 2%, at 44.82 USD.

London copper increased by nearly 1%, reaching a high of 10,457.00 USD/ton, a new high since May 2024.

Spot gold rose by 0.5%, at 3,755.94 USD/ounce.

Ether fell by 4.7% on Thursday to 3,969 USD, while Bitcoin, as the market leader, fell by 1.7%.

U.S. Stocks Stabilize After Consecutive Declines, Market Awaits Inflation Data Guidance

In pre-market trading, most Chinese concept stocks rose, with XPeng up 3.5%, Bilibili up 2.5%, Nio up about 1%, and JD.com up about 2%. Intel's pre-market shares rose over 5%, with reports that Intel is seeking investment from Apple.

Although the S&P 500 index successfully broke the "curse" of September, which is typically the worst-performing month for the stock market, the index failed to gain upward momentum on Wednesday, raising concerns about a bottleneck in this round of gains. The AI theme that has driven the rise of U.S. stocks this year seems to be losing its upward momentum.

Craig Johnson from Piper Sandler stated:

"The strong upward trend has not yet ended. However, as stock prices continue to rise and potential momentum weakens, the short-term risk-reward situation is becoming more strained."

This week, investors' core focus will be on Friday's PCE data. Market forecasts indicate that the core PCE price index, excluding food and energy, may rise by 0.2% month-on-month in August, down from 0.3% in July. However, the year-on-year increase is expected to remain at a high level of 2.9%. This data will provide the Federal Reserve with room to assess inflationary pressures while addressing the weakness in the labor market.

European Stock Markets Under Pressure, Regional Performance Diverges

European stock markets opened lower on Thursday, with the pan-European STOXX 600 index down 0.5%, and both the German DAX index and the UK FTSE 100 index down 0.4%. The declines in the healthcare and industrial sectors were the main drag.

Among them, healthcare stocks were particularly hard hit. Shares of German medical technology company Siemens Healthineers fell 6% after the U.S. Department of Commerce announced a new national security investigation into the imports of personal protective equipment, medical supplies, robots, and industrial machinery. UK company Smith+Nephew's shares also fell by 1.1%.

In contrast to the weakness in the U.S. and European markets, some Asian markets, especially the Chinese technology sector, showed strong resilience.

Bloomberg Industry Research analyst Marvin Chen stated:

"The technology and AI themes continue to drive regional markets, with Chinese tech giants leading the way again. Companies like Alibaba are accelerating their investment plans, indicating that compared to the U.S., China's AI development is still in a relatively early stage, and investors may see better growth potential from this."

Safe-Haven Sentiment and Rate Cut Expectations Boost Gold

Against the backdrop of a wait-and-see period in global stock markets, demand for gold as a traditional safe-haven asset remains strong. Geopolitical tensions, coupled with the risk of a potential U.S. government shutdown next week, provide ongoing support for gold.

Rate cut expectations are another key factor supporting gold prices. JP Morgan's Weiheng Chen predicted in a research report that as the Federal Reserve signals more rate cuts, gold prices could reach $4,050 to $4,150 per ounce by mid-2026. A lower interest rate environment reduces the opportunity cost of holding non-yielding assets like gold.

Additionally, strong central bank demand and record inflows into gold ETFs also provide a solid foundation for gold prices. Technical charts show that Comex gold futures are consolidating below the resistance level of $3,800 per ounce, but a generally bullish technical pattern still exists. Spot gold rose 0.5% to $3,755.94 per ounce.

London copper rose nearly 1%, reaching a high of $10,457.00 per ton, the highest since May 2024.

Spot silver's increase has expanded to 2%, reported at $44.82.

Spot silver's increase has expanded to 2%, reported at $44.82.