Morgan Stanley: AI-driven TSMC performance shows "rocket-like" growth with significant contributions from N2/N3 processes

摩根大通維持台積電 “增持” 評級,將 2026 年目標價從 1275 新台幣上調至 1550 新台幣。預計 2026 年營收將增長 24%,主要受 N2/N3 製程需求、先進製程 ASP 提升及 AI 需求增長驅動。數據中心 AI 業務被視為台積電長期增長引擎,2024-2029 年數據中心 AI 營收復合增長率預期上調至 53%。

智通財經 APP 獲悉,摩根大通發表研報,維持台積電 (TSM.US)“增持” 評級,將其台股 2026 年 6 月目標價從 1275 新台幣上調至 1550 新台幣,同時上調 2025-2026 年每股收益預期及 2026 年營收增速預期。小摩指出,數據中心 AI 需求的強勁增長、先進製程 (N2/N3) 產能釋放及毛利率維持高位等積極因素,將成為支撐台積電業績增長的核心驅動力。

小摩表示,預計台積電 2026 年以美元計價的營收將增長 24%,主要得益於四大因素:一是 N3 製程需求旺盛,英偉達 (NVDA.US)、AMD(AMD.US) 等企業的高性能計算 (HPC) 加速器 (含 GPU、TPU 及 Tranium ASIC) 訂單充足;二是 N2 製程需求發力,2026 年下半年起所有 iPhone 機型的應用處理器將採用 N2 製程,同時高通 (QCOM.US)、聯發科的新旗艦 SoC 也將貢獻增量需求;三是先進製程 ASP(平均銷售價格) 提升,N5、N4、N3 等領先製程 ASP 預計增長 6%-10%;四是先進封裝業務高速增長,2026 年 CoWoS 晶圓出貨量將增長 60%。另外,該行預計,由於 WiFi 7 和射頻收發器需求增強,N7 產能利用率在 2026 年將略有改善。

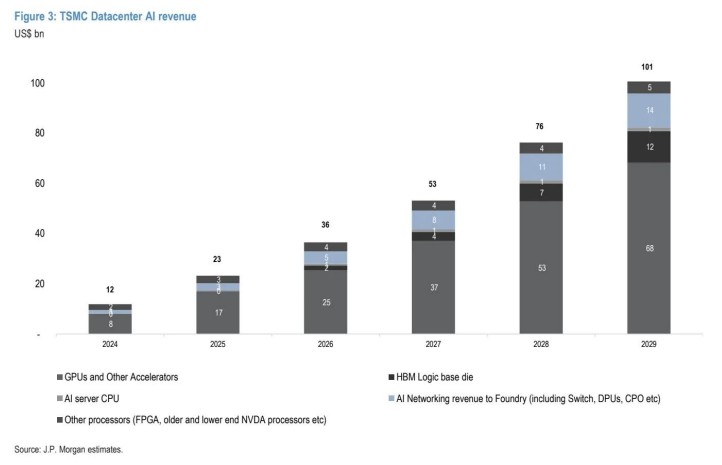

小摩強調,數據中心 AI 業務已成為台積電的核心長期增長引擎。該行將台積電 2024-2029 年數據中心 AI 營收復合增長率 (CAGR) 預期上調至 53%,並預計台積電可能在 2026 年 1 月發佈 2026 年業績指引時,將五年數據中心 AI 營收 CAGR 指引從當前的 40% 中段進一步上調。

從需求結構看,AI 加速器 (GPU 與 ASIC) 仍是核心驅動力,預計到 2029 年將佔台積電數據中心 AI 總需求的 68%。小摩指出,2026 年全球大型雲服務提供商、新興雲企業、AI 實驗室及主權國家 AI 項目的算力需求持續釋放,將推動 GPU 需求維持高位,且多數 AI 加速器將從 2025 年底開始從 N4 製程遷移至 N3 製程,進一步拉動 N3 產能利用率。

網絡設備與 HBM(高帶寬內存) 基礎芯片需求也將成為重要增量。小摩預測,2024-2029 年台積電 AI 網絡設備營收 CAGR 將達 58%,隨着 GPU/AI 集羣規模擴大,硅光 (Silicon Photonics)、共封裝光學 (CPO) 技術普及加速,2029 年網絡設備將佔數據中心 AI 需求的 20%(2025 年為 17%);HBM 基礎芯片方面,2026 年起英偉達、AMD 等企業將逐步採用 HBM4 配置,預計 2027-28 年 HBM 基礎芯片需求將顯著增長,2029 年台積電 HBM 基礎芯片營收將達 120 億美元,佔數據中心 AI 總營收的 12%。

為應對強勁需求,小摩預計台積電 2026 年資本開支將從之前的 450 億美元增至 480 億美元,重點投向 N2、N3 先進製程產能及先進封裝領域。具體來看,2026 年台積電 N2 製程產能將新增約 5 萬片/月,年底量產產能將達 6.5 萬片/月 (光刻等效產能達 10-10.5 萬片/月),以滿足蘋果 (AAPL.US)、高通等客户需求;N3 製程方面,台積電計劃將部分 N4 產能轉換為 N3 產能,同時可能提前啓動亞利桑那州工廠第三階段 N3 產能建設,以應對 AI 加速器需求超預期的情況。

總體而言,受益於蘋果、AI 數據中心需求優於預期,以及半導體關税豁免,小摩目前預計台積電 2025 年第四季度營收將環比持平 (此前隱含指引為環比下降 9%),2025 財年美元營收增長將達到 35% 的水平。該行還認為,受產能利用率提升及新台幣匯率走弱支撐,台積電第四季度毛利率可能維持在 50% 高位的水平;預計台積電 2026 年毛利率仍將維持在 50% 高位,主要支撐因素包括新台幣匯率穩定、美國工廠產能稀釋低於預期、先進製程提價及領先製程需求持續旺盛,即便 2026 年折舊成本增長 25%,強勁的 AI 需求與價格上漲仍將保障毛利率穩定。