Former Bank of Japan official: Rate hike may occur as early as next month, with a potential increase of 1% in this cycle

前日本央行官員櫻井誠預計,日本央行最早可能在下月加息 1%。市場對 10 月 30 日政策會議加息的預期增強,因通脹穩定和經濟韌性。儘管存在不確定性,官員們可能會等到 12 月再做出決定。櫻井指出,近期的投票顯示出政策轉變的跡象,反對維持利率不變的委員主要基於通脹嚴重性。

智通財經 APP 獲悉,據一位前日本央行委員會成員稱,日本央行最快可能在下個月上調基準利率,這進一步加劇了市場對於即將採取行動的猜測。前日本央官員櫻井誠 (Makoto Sakurai) 週三在接受採訪時表示,日本央行可能會在 10 月採取行動,這一決定將很大程度上取決於當局所尋求行動證據的確信程度,屆時的經濟數據可能會較為強勁,因為關税影響的顯現存在延遲。

市場對於央行在 10 月 30 日下次制定政策時進行加息的預期正在不斷增強,因為通脹水平保持穩定,經濟也表現出較強的韌性,即便美國的貿易政策衝擊了全球貿易。鑑於不確定性仍然很高,他還表示,不排除官員們會等到 12 月再做出更堅定的判斷,以確認關税政策的影響。

在一些知情人士本月早些時候表示日本央行官員認為 2025 年可能還會再次加息之後,貨幣市場加大了對年底加息的押注力度。而在日本央行上週維持鷹派政策立場之後,這些押注進一步增強。

日本央行委員會在 9 月 19 日的政策投票中出乎分析師們的意料。這是在行長植田和男任職期間首次出現兩名成員反對維持利率不變的情況。櫻井誠表示,這些投票可能意在表明即將出現政策轉變的跡象。

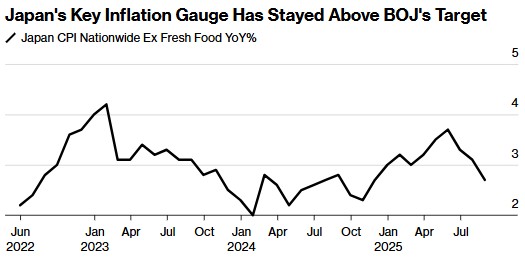

兩位持反對意見的議員——田村直樹 (Naoki Tamura) 和高田創 (Hajime Takata)——主要依據通脹的嚴重性來做出投票決定。櫻井誠表示,他對於這種理由有點難以理解,因為通脹率已經連續三年保持在或高於日本央行設定的目標水平。

這些持反對意見的人原本在 6 月份就可以採取同樣的行動,並給出同樣的解釋。櫻井誠表示,這表明此次投票可能是委員會發出的統一信號的一部分,如果日本央行只是關注通脹情況,那麼他們隨時都可以提高利率。櫻井誠於 2021 年離開了該央行。

櫻井誠表示,日本央行的政策走向存在一個不確定因素,那就是 10 月 4 日舉行的執政黨自民黨領導層選舉的結果。如果熱門候選人高市早苗獲勝,當局可能不得不推遲加息。他稱,高市早苗被視為支持貨幣寬鬆政策的人士,不過與去年競選首相時的言論相比,她今年的鴿派言論有所緩和。

在週三與其他四位競爭者進行的辯論中,高市早苗表示她對政策立場有所軟化,她稱貨幣政策的實施手段應由日本央行負責,而政府則應決定財政和貨幣政策的方向。一年前,她曾表示加息是荒謬之舉。

最終,櫻井誠認為,在植田和男任期於 2028 年 4 月結束之前,日本央行的政策利率在未來兩年半的時間裏有可能從目前的 0.5% 上調 100 個基點。根據一項調查,這一預期略高於市場普遍預期的當前週期最高利率 1.25% 的水平。

櫻井誠説道:“日本央行或許希望將其利率穩定在約 1.5% 的水平,看起來必定會達到 1.25% 的水平。”