Bullish bets increase! AI is ambitious, Alibaba occupies the "C position" of Chinese concept technology stocks

阿里巴巴因其在人工智能領域的雄心而成為中國科技股的領軍者。該公司股價在美股上漲 8%,港股上漲 50%。阿里巴巴計劃增加 AI 投資並與英偉達合作,吸引投資者重返市場。期權交易顯示對其股價進一步上漲的押注增加,標誌着公司股價在經歷低迷後出現轉機。分析師指出,阿里巴巴的估值偏低,投資者對其 AI 潛力的關注日益增加。

由於對人工智能項目的支出,阿里巴巴再次成為中國最熱門的科技股。投資者紛紛重返這家價值 4200 億美元的互聯網巨頭的股票市場。週三,阿里巴巴 (BABA.US) 美股大幅上漲,漲幅一度高達 10%,最終收漲 8%。港股在 9 月份迄今更是上漲了 50%,成為恒生科技指數中表現最佳的股票。

週三,該公司宣佈計劃增加在人工智能領域的投入,並與英偉達 (NVDA.US) 建立新的合作關係,這些消息成為了其股價上漲的最新推動力,並且也對同行和供應商的情緒起到了提振作用。期權交易數據顯示,投資者對阿里巴巴股票進一步上漲的押注不斷增加,而與全球其他公司相比,阿里巴巴的股價仍處於較低水平。這標誌着在外賣價格戰持續數月導致低迷之後,該公司股價出現了轉機。

GAM Investment Management 基金經理 Jian Shi Cortesi 説道:“很明顯,在 2022 至 2023 年期間,阿里巴巴的估值偏低,但投資者需要一個誘因來買入它——這個誘因已經出現,那就是其在人工智能領域的潛力,如今,人們越來越將阿里巴巴視為一家集人工智能和雲基礎設施於一體的公司,而非僅僅是一家電子商務企業。”

最近美股出現一個新現象,大規模 AI 投資的計劃使得科技股股價大幅上漲,因為投資者們正在押注下一家 AI 行業領導者出現。在中國,人們的關注焦點正更加集中於阿里巴巴,該公司在今年早些時候成為了推動亞洲國家發展本土人工智能技術這一進程的關鍵推動者。

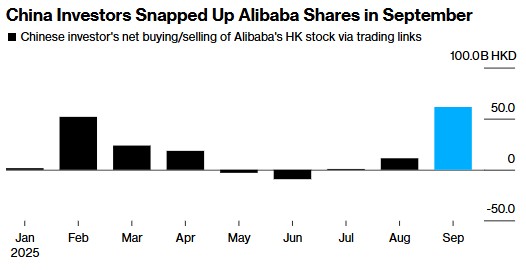

今年截至目前,中國內地投資者在 9 月份共購入了價值 610 億港元 (約合 78 億美元) 的阿里巴巴港股 (以淨買入計算),這是今年以來單月買入量最大的一次。

摩根士丹利的分析師們在週三參加完阿里巴巴在杭州舉行的 AI 會議後發佈了一份報告,稱阿里巴巴是 “中國最出色的 AI 引領者”。他們表示,其主打產品 Qwen3-Max 模型據稱已超越 GPT-5 和 Claude Opus 4,使其在全球範圍內躋身 “前三名”。

期權交易者正在增加看漲倉位,相對於恒生科技指數而言,阿里巴巴港股相關合約的成本已攀升至自 2022 年以來的最高水平。不過,謹慎情緒正在悄然蔓延,根據標普全球的數據,阿里巴巴美國存託憑證的空頭頭寸本週已升至已發行股票的 6.8%,為五年多來的最高水平。

不過,估值方面也為該股票增添了更多吸引力,其當前的市盈率約為預期未來收益的 20 倍,而亞馬遜 (AMZN.US) 的這一數值接近 25 倍,微軟 (MSFT.US) 的則超過 30 倍。

Aberdeen Investments 基金經理 Xin-Yao Ng 表示:“我不會説存在 ‘最佳的人工智能概念股’,但阿里巴巴是與美國超大規模企業最為相似的公司。在中國的大型雲服務企業中,它們也是最為激進的,其投資規模甚至超過了騰訊等。”