The state of the American economy now depends on NVIDIA!

Deutsche Bank stated that if technology-related spending is excluded, the U.S. economy may have been close to recession earlier this year. As long as the potential profitability of AI is not fundamentally questioned, this wave of investment will not stop and will continue to be an important macroeconomic theme in 2026, with NVIDIA playing a key role

NVIDIA, a chip giant with only 36,000 employees, is becoming a key force in determining the direction of the global macroeconomy in 2026.

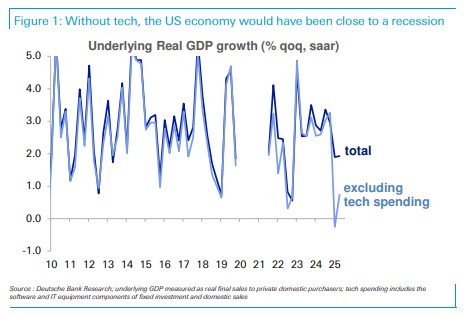

According to news from the Wind Trading Desk, Jim Reid, the head of Deutsche Bank's Global Macro Research, and his team emphasized in a recent research report that technology spending, especially AI-related capital expenditures, is key to understanding the current resilience of the U.S. economy. Without the impetus of technology-related spending, the U.S. economy would be close to recession or already in recession.

Chart data shows that after excluding technology spending such as software and IT equipment, the core indicator viewed as measuring potential economic momentum—real final sales to domestic private purchasers—had already slipped into recession territory earlier in 2025.

The report further emphasizes that the core driver of technology spending is the "massive AI capital expenditures." The market generally expects that as long as the potential profitability of AI is not fundamentally questioned, this wave of investment will not stop and will continue to be an important macroeconomic theme in 2026.

The report argues that it is this massive capital expenditure that explains why weak employment data has not dragged down economic growth, and it also explains why global trade remains resilient despite generally weak global demand.

Deutsche Bank ultimately narrowed its focus to the core company of this AI wave—NVIDIA. The report bluntly states that from a simplified perspective, NVIDIA may hold the key to the global macroeconomy in 2026.