Is the US stock market "stuck"?

On Wednesday, the three major U.S. stock indices continued to decline, with the Dow Jones Industrial Average having retraced all gains since the Federal Reserve meeting. Wall Street strategists believe the stock market has entered a "pause period" and is looking for catalysts for an upward movement. Bank of America data shows that U.S. stock valuations are expensive based on 19 indicators. However, optimists believe the pullback will be brief, and a JPMorgan strategist even stated that the "most likely factor to disrupt this bull market" he has heard from clients is "a small asteroid hitting the Earth."

After experiencing a rapid surge, the U.S. stock market is showing signs of fatigue, with investors becoming hesitant as they weigh high valuations against potential macro risks.

On Wednesday, the three major U.S. stock indices fell again, continuing the downward trend from Tuesday, with the Dow Jones Industrial Average nearly erasing all gains made after the Federal Reserve meeting. Although the S&P 500 index has set nearly 30 historical highs this year, surpassing analysts' average year-end expectations, several Wall Street strategists believe the stock market has entered a "pause period" and is looking for new catalysts for upward movement.

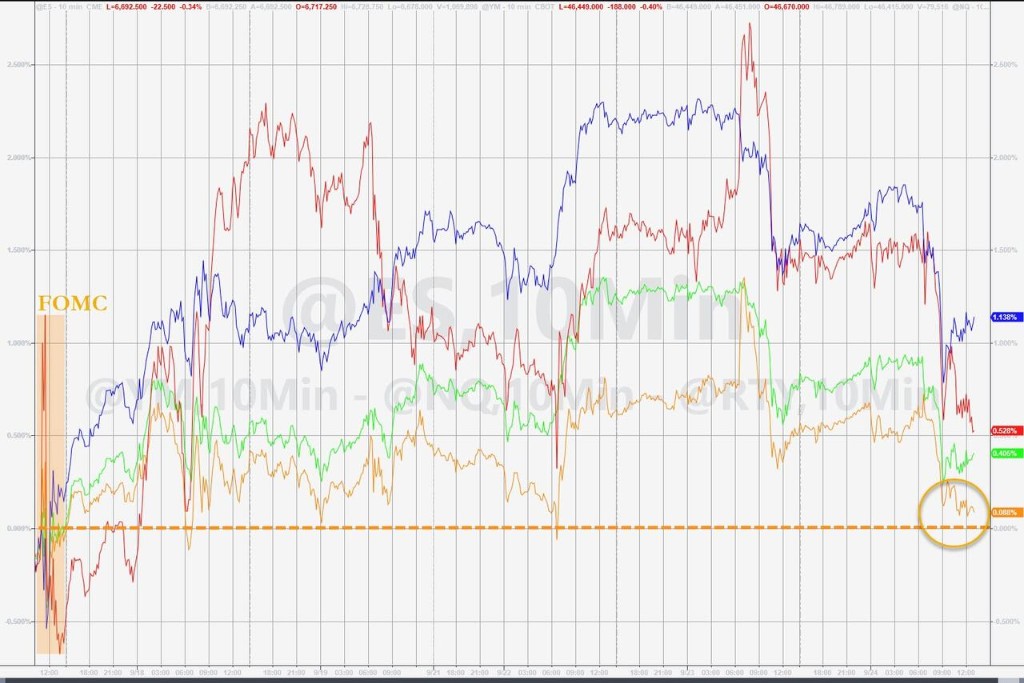

(The benchmark U.S. stock index fell during the day, with the Dow Jones Industrial Average nearly wiping out gains made after the Federal Reserve meeting)

(The benchmark U.S. stock index fell during the day, with the Dow Jones Industrial Average nearly wiping out gains made after the Federal Reserve meeting)

Bank of America strategist Savita Subramanian pointed out that, based on 19 out of 20 indicators, the benchmark index of the U.S. stock market is trading at an expensive level. The 12-month forward price-to-earnings ratio of the S&P 500 index reached a high of 22.9 times this week, a level that has only been surpassed twice this century during the dot-com bubble burst and the summer pandemic rebound in 2020.

On the other hand, some of Wall Street's most optimistic voices believe that any pullback will be short-lived. JPMorgan's Andrew Tyler even stated that the "most likely factor to disrupt this bull market" he hears from clients is "an asteroid hitting the Earth."

Ulrike Hoffmann-Burchardi from UBS Global Wealth Management expects that the ongoing weakness in the U.S. labor market will prompt the Federal Reserve to cut interest rates further, predicting a 25 basis point cut at each meeting until January 2026. In her baseline scenario, she forecasts that the S&P 500 index will trade around 6,800 points by June 2026.

"Technical Pause" or "Loss of Momentum"?

Wall Street strategists believe the market may enter a consolidation phase in the short term.

Craig Johnson from Piper Sandler described the current market situation as "calling for a pause," noting:

Although the strong upward trend has not ended, the risk-reward situation is becoming increasingly tight as stock prices continue to rise while potential momentum weakens.

This view is echoed by Charlie McElligott from Nomura Securities. He believes that as more investors chase this year's gains, bullish investors should continue to hedge their portfolios. McElligott pointed out:

The frenzy brought about by the artificial intelligence boom has led some skeptics to buy stocks at high levels, and this behavior, combined with many participants being close to or at maximum risk exposure, has collectively built up the downside risk in the stock market The S&P 500 Index has rebounded nearly 35% since its low in April, continuing to rise during the traditionally weak seasonal period, seemingly fueling "bubble" talk, especially regarding technology stocks.

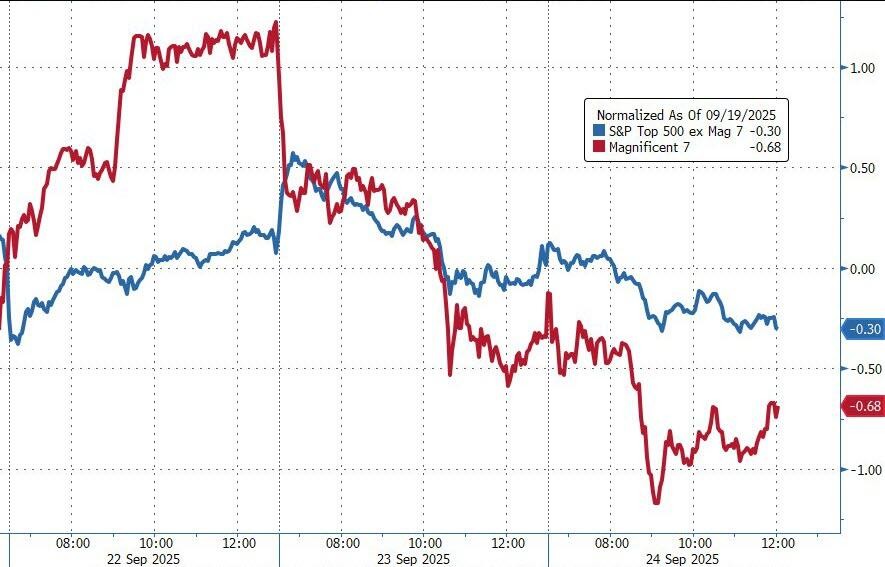

(The performance of the seven tech giants' stocks was weak this week)

(The performance of the seven tech giants' stocks was weak this week)

Valuation Alerts and the Debate on "New Normal"

High valuations are one of the core factors triggering market concerns.

Savita Subramanian from Bank of America pointed out that based on 19 of its 20 metrics, the benchmark index of the U.S. stock market is statistically at an expensive level.

This week, the S&P 500 Index's 12-month forward price-to-earnings ratio reached a high of 22.9 times, a level that has only been surpassed twice this century: once during the burst of the internet bubble and once during the summer of 2020 when the Federal Reserve lowered interest rates to near zero due to the pandemic.

However, there are differing views in the market regarding whether high valuations are justified.

Subramanian further proposed another possibility, suggesting that given the increased visibility and predictability of corporate earnings, the current high P/E ratio of the S&P 500 Index may be reasonable. She stated:

Theoretically, investors are willing to pay a premium for predictable assets, and perhaps the market should view the current valuation level as a "new normal" rather than expecting a return to past averages.

Andrew Tyler from JPMorgan stated:

Several conversations yesterday focused on what could disrupt this bullish trend. My favorite answer is an asteroid hitting the Earth.

Mark Hackett from Nationwide Mutual Insurance also believes that Powell's comments on valuations are more "observational than cautionary."

Wall Street Insight previously mentioned that Powell spoke at an event on Tuesday, indicating that monetary policy faces "dual challenges," and that current U.S. stock market valuations are "quite high," which subsequently led to a decline in the U.S. stock market.

Macroeconomic Risks and Historical Patterns

Beyond valuations, some macroeconomic risks are also beginning to emerge.

From sticky inflation to a slowdown in the expansion of the labor market, these could become obstacles for the market's progress. Matt Maley from Miller Tabak stated:

Stagflation issues tend to pop up every few months, so Friday's key price data will be crucial in either alleviating or exacerbating stagflation concerns.

However, from a historical and positioning perspective, bulls still have reasons to remain optimistic.

Daniel Skelly, head of market research and strategy at Morgan Stanley Wealth Management, pointed out that although the ongoing market rise is fueling "bubble" talk, there is ample reason to believe that this assertion is incorrect In the past 50 years, there have been five bull markets lasting more than two years, with an average length of eight years. Currently, the bull market that began in October 2022 has lasted less than three years.

Hackett from Nationwide also added that sentiment and positioning indicators show that the foundation of this rally is "cautious optimism rather than speculative excess." He believes that this positioning and sentiment backdrop supports a constructive outlook for the stock market.

Sam Stovall from CFRA found comfort in historical data. He pointed out that since World War II, any year that started with a decline of more than 11% has never experienced a second decline of over 10% within the same year.

Nevertheless, he cautioned investors to be prepared for volatility in October, as historically, the standard deviation of monthly returns in October is 33% higher than the average of the other 11 months