Federal Reserve officials make ambiguous statements on interest rate cuts, emerging market currencies decline

美聯儲官員對降息的模糊表態導致市場不確定性,美元上漲,新興市場貨幣匯率普遍下跌。MSCI 國際指數下跌 0.2%,匈牙利福林、捷克克朗、巴西雷亞爾和波蘭茲羅提跌幅均超過 0.8%。市場情緒主導,投資者對美聯儲未來政策走向的期待加劇。美聯儲主席鮑威爾和其他官員的講話引發了對降息的不同看法,財政部長對未明確降息計劃表示失望。

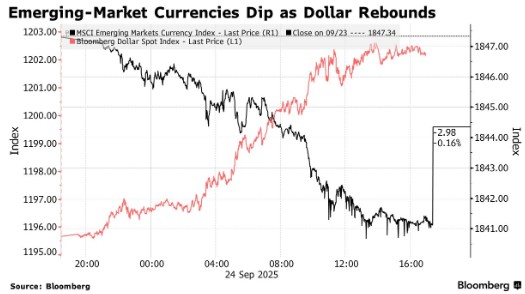

智通財經 APP 獲悉,週三,由於美聯儲官員釋放出的降息信號存在不確定性,美元走強,新興市場貨幣紛紛下跌。。追蹤新興市場貨幣的 MSCI 國際指數下跌了 0.2%,其中匈牙利福林、捷克克朗、巴西雷亞爾和波蘭茲羅提的跌幅均達到了至少 0.8%。彭博美元指數上漲了 0.6%,而美國國債收益率則有所上升,因為舊金山聯儲主席戴利週三表示,可能還需要進一步降息,但美聯儲在採取此類措施時應謹慎行事。

XP 投資公司的高級策略師 Marco Oviedo 表示:“鑑於官員們的表態,市場對美聯儲的預期已經有所調整。成員們之間可能會存在分歧,因此市場不確定這種情況未來會如何發展,而目前的數據也仍缺乏説服力。”

Oviedo 認為,這是一次典型的 “避險” 日。不過他表示,鑑於世界最大經濟體尚未公佈相關經濟數據,此次 “避險” 現象似乎 “有所剋制”。他補充道:“目前主要是由市場情緒所驅動的。”

在美聯儲主席鮑威爾週二發表講話之後,市場一直在期待有關美聯儲未來政策走向的更多明確信息。在此次演講中,鮑威爾重申了他的觀點,即政策制定者在權衡進一步降息的過程中可能面臨艱難的抉擇。

市場還權衡了其他美聯儲官員的講話。美聯儲理事鮑曼的講話較為温和——政策制定者有可能落後於形勢,需要果斷採取行動以降低利率,因為勞動力市場正在走弱。相比之下,亞特蘭大聯儲主席博斯蒂克和芝加哥聯儲主席古爾斯比都對通脹發出了警告。

在週三接受的採訪中,美國財政部長貝森特表示,他對於鮑威爾尚未明確制定出降低利率的計劃感到失望。

Natixis 美洲區首席經濟學家 Benito Berber 表示:“新興市場外匯市場的當前價格走勢似乎完全符合風險規避行情的所有特徵。”

此外,在北約東翼因俄烏戰爭而局勢緊張加劇的情況下,東歐貨幣普遍貶值。泰國泰銖也出現貶值,原因是該國出口增速創下近一年來的新低,原因是受到了美國關税的影響。

在拉丁美洲,阿根廷因貝森特的言論而備受關注。貝森特稱,美國正在與這個南美國家商討一項 200 億美元的貨幣互換協議,並準備購買該國的美元債券。此言論發佈後,阿根廷比索匯率上漲,美元債券價格也大幅攀升。阿根廷當局隨後降低了回購利率,從而遏制了比索的上漲勢頭。

與此同時,新興市場股票指數在週三上漲了 0.4%。其中,科技類藍籌股阿里巴巴和騰訊,以及沙特的銀行股領漲。在媒體報道稱沙特將放寬外資持股限制後,沙特股市創下自 2020 年以來最大漲幅。

在央行的決策中,捷克央行在連續第三次會議上維持利率不變。此前,政策制定者曾對持續存在的通脹風險表示擔憂。