After Goldman Sachs, UBS follows suit, and Wall Street competes to raise Tesla's third-quarter delivery expectations

UBS raised its third-quarter delivery forecast for Tesla to 475,000 units, higher than market consensus, driven by strong deliveries in the U.S. market due to the expiration of tax incentives under the Inflation Reduction Act, as well as decent performance in the European and Chinese markets. Nevertheless, UBS maintains a "Sell" rating, expecting a quarter-on-quarter decline in deliveries for the fourth quarter, and notes that Tesla's stock price is currently more driven by AI themes rather than the fundamentals of its automotive business

Tesla is expected to release its delivery report for the third quarter of 2025 in early October, and several investment banks have raised their delivery expectations in advance. Goldman Sachs analysts have previously increased their delivery volume forecast and raised their target price, while UBS analysts have also raised their delivery estimates this week to levels exceeding the general market consensus, but still maintain a "Sell" rating on Tesla stock.

UBS's latest forecast for Tesla's third-quarter delivery volume is 475,000 units, a 3% increase from the same period last year and a 24% increase from the previous quarter, significantly higher than the earlier estimate of 431,000 units. This figure is about 8% higher than the consensus from market data platform Visible Alpha, but is closer to the expectations of buy-side investment institutions, which generally estimate delivery volumes between 470,000 and 475,000 units.

UBS analyst Joseph Spak stated in a report released on Monday:

“We believe our new forecast is more aligned with the buy-side expectations of 470,000 to 475,000 units.”

However, he also pointed out:

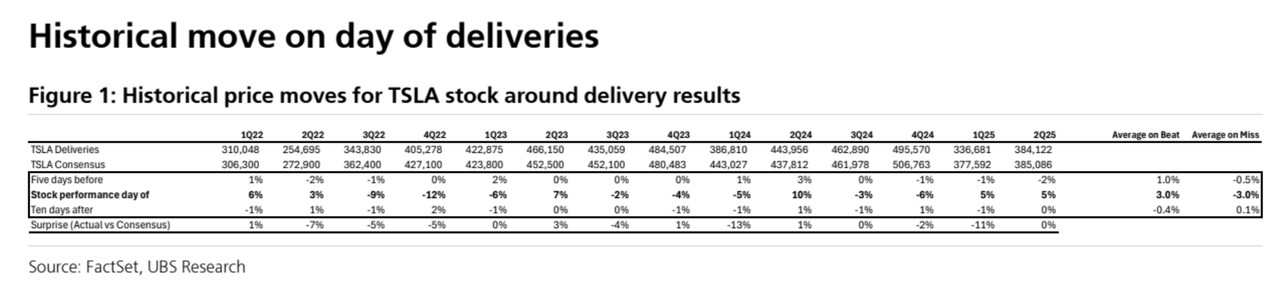

“Although the final data may meet buy-side expectations, we generally find that stock prices still react based on whether they exceed or fall short of the media's 'headline number.'”

Tesla's stock price rose 4.16% during intraday trading on Wednesday, with a year-to-date increase of nearly 17%.

Spak noted in the report that UBS raised its forecast because delivery performance in multiple markets exceeded expectations in the third quarter.

First, in the U.S. market, consumers rushed to take advantage of the $7,500 electric vehicle tax credit under the Inflation Reduction Act (IRA), which is set to expire at the end of September 2025, driving a significant increase in Tesla's sales. UBS believes that this quarter may set a record for the highest quarterly delivery volume in the U.S. since mid-2023, and could even be the highest level ever. However, analysts also warned that the current strong demand is likely to be "pulled forward," meaning that even if Tesla launches a "low-cost version" of the Model Y in the fourth quarter, delivery volumes may still decline quarter-over-quarter.

The European market is also showing signs of recovery. Data shows that in the first two months of the third quarter, Tesla's delivery volume in the top eight European markets increased by about 22% quarter-over-quarter. In the Chinese market, retail delivery volumes (i.e., wholesale minus exports) increased by about 45% quarter-over-quarter, showing similarly robust performance. Additionally, UBS pointed out that delivery growth in the Turkish and South Korean markets is also noteworthy.

In terms of inventory, UBS expects that this quarter's delivery volume will exceed production, potentially by 7%, which will help Tesla reduce inventory levels. In contrast, in the second quarter of 2025, production exceeded delivery volume by about 26,000 units, accounting for 6% UBS also expects that Tesla will disclose the deployment status of its energy storage systems in its financial report for this quarter. Although the data is difficult to verify immediately due to accounting confirmation rules, UBS predicts a deployment volume of 10.4 GWh, an 8% increase quarter-on-quarter, which is basically in line with the Visible Alpha market consensus of 10.9 GWh and higher than the previous quarter's 9.6 GWh. Spak reminds investors that the energy storage business has cyclical fluctuations, and single-quarter data should not be over-interpreted.

Looking ahead, UBS expects the delivery volume in the fourth quarter of 2025 to be 428,000 units, a 10% decrease quarter-on-quarter and a 14% decrease year-on-year. This estimate has already taken into account the launch of the Model Y L in the Chinese market, as well as the potential introduction of a "low-priced version" of the Model Y in the U.S. market.

For the full year, UBS has raised its total delivery forecast for 2025 from 1.51 million to 1.62 million units. Although this still represents a 9% year-on-year decline, it is in line with market consensus. The delivery forecast for 2026 has been slightly lowered to 1.6 million units, which is 14% lower than market consensus. UBS stated that it will update its financial model after Tesla announces the actual delivery data on October 2.

Despite the short-term improvement in delivery data, Spak emphasized at the end of the report:

“The main driver of Tesla's stock price is more related to the market narrative around artificial intelligence rather than its core automotive business.”