U.S. Stock Market Outlook | Three major index futures rise together, S&P 500 achieves the longest stable period in over a year, Alibaba's stock price hits a four-year high

U.S. stock index futures all rose, with the S&P 500 Index achieving its longest stable period of 107 days without a decline of over 2%, accumulating a gain of 34%. Despite facing risks such as inflation and economic slowdown, market performance remains strong. Federal Reserve officials discussed the possibility of setting an inflation target range, suggesting potential policy adjustments

- On September 24th (Wednesday) before the US stock market opened, the three major US stock index futures all rose. As of the time of writing, Dow futures were up 0.17%, S&P 500 futures were up 0.23%, and Nasdaq futures were up 0.34%.

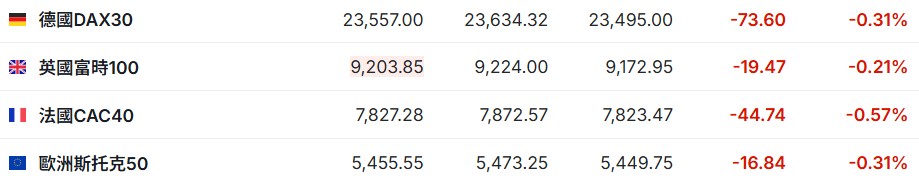

- As of the time of writing, the German DAX index was down 0.31%, the UK FTSE 100 index was down 0.21%, the French CAC40 index was down 0.57%, and the Euro Stoxx 50 index was down 0.31%.

- As of the time of writing, WTI crude oil was up 1.10%, priced at $64.11 per barrel. Brent crude oil was up 1.08%, priced at $68.36 per barrel.

Market News

US stocks stage a "calm bull"! The S&P 500 has not fallen more than 2% for 107 consecutive days, creating the longest stable period in over a year. Currently, US stock investors continue to show remarkable calmness. Trade tensions, slowing economic growth, and even high valuations—none have been able to stop the S&P 500 index from continuously setting new historical highs. As the core benchmark index of US stocks, the S&P 500 has not experienced a single-day drop of at least 2% for 107 trading days, marking the longest stable cycle since July 2024. Compilation data shows that even after a brief fluctuation caused by tariff disputes in early April, the index has since climbed, with a cumulative increase of 34% and a market capitalization growth of nearly $16 trillion. Despite risks being omnipresent, from stubborn inflation to the gradually slowing expansion of the US job market, it seems nothing can shake the market.

Is the inflation target no longer strictly 2%? The Federal Reserve sends disruptive signals, with three high-ranking officials supporting a range-based approach. Three Federal Reserve officials support the idea of setting an inflation target range instead of maintaining the current fixed target of 2%. Federal Reserve Governor Stephen Moore, Michelle Bowman, and Atlanta Fed President Raphael Bostic discussed this idea in different forums this week. Their comments came after the Federal Reserve completed its five-year policy framework review in August, which had already clearly ruled out the possibility of adjusting the inflation target. This year, US President Donald Trump has exerted tremendous pressure on the Federal Reserve to lower interest rates. Federal Reserve Chairman Jerome Powell's term will expire in May next year, giving Trump the opportunity to appoint a new Federal Reserve chairman, raising speculation about potential structural reforms under new leadership The wind has changed! Disagreements within the Federal Reserve intensify, traders urgently reduce interest rate cut bets. Traders are lowering their expectations for the Federal Reserve's interest rate cuts in the coming months, a shift that indicates the mixed messages from Fed officials have affected expectations for monetary policy. Options linked to the secured overnight financing rate show that market participants are betting the Fed will only cut rates by 25 basis points in 2025, and the so-called neutral rate (the interest rate level that neither stimulates nor suppresses economic growth) is higher than current market expectations. This stands in stark contrast to last week when market expectations for a 50 basis point cut by the end of the year were heating up. The broader monetary policy views expressed by Fed officials in recent weeks have driven this shift, with traders hedging against scenarios of significant rate cuts and smaller cuts.

OpenAI advances the Stargate project: officially announces the development of five new data center sites in Texas and elsewhere. OpenAI plans to invest approximately $400 billion in collaboration with Oracle (ORCL.US) and SoftBank to develop five new data center sites in the United States, marking its largest effort to fulfill its previous commitment to invest $500 billion in AI infrastructure in the U.S. Executives from the three tech companies announced at a press conference in Abilene, Texas, that these new data centers will be located in Texas, New Mexico, and Ohio, ultimately boasting a power generation capacity of 7 GW, equivalent to the power output of some cities. OpenAI and Oracle have been developing a joint AI infrastructure project called "Stargate" for months, which will be the first data center to carry that name.

Individual Stock News

Alibaba (BABA.US) stock price surges as "Cathie Wood" re-establishes position betting on AI transformation after four years. As Alibaba's stock price soared to a four-year high due to market optimism about its prospects in the AI sector, Cathie Wood's fund re-established its position in the Chinese tech company after four years. Ark Investment Management's daily trading report shows that the company's two exchange-traded funds bought American Depositary Receipts (ADRs) of Alibaba on Monday. According to the holdings report of these funds, the total value of these shares is approximately $16.3 million. Alibaba's ADR reached its highest level since November 2021 on Tuesday, with its stock price nearly doubling this year. As its core e-commerce business faces competition, investors are increasingly betting that the internet giant's AI business will help revive its growth momentum.

AI demand drives strong growth in memory chips, Micron Technology (MU.US) Q1 performance outlook far exceeds expectations. Benefiting from the demand for AI devices, Micron Technology has made an optimistic outlook for its quarterly performance. Micron expects revenue for the first quarter of fiscal year 2026 to be approximately $12.5 billion, exceeding analysts' previous average expectation of $11.9 billion. Excluding certain special items, earnings per share are expected to be around $3.75, surpassing analysts' earlier forecast of $3.05. Data shows that Micron's Q4 sales grew by 46%, reaching $11.3 billion, while analysts had previously estimated around $11.2 billion Excluding certain special items, the earnings per share is $3.03, while the average analyst forecast is $2.84.

Nvidia (NVDA.US) two directors collectively reduced their holdings by 390,000 shares, cashing out nearly $70 million. Public documents show that Nvidia director Mark A. Stevens reduced his holdings by 350,000 shares through his trust, with an average selling price of approximately $176.39 per share. This transaction, completed on September 19 (Friday), had a total value of about $61.7 million. After this reduction, his total shares held directly and through the trust amount to approximately 35 million shares, with a total value of about $6.23 billion. Another director, Persis Drell, reduced his holdings by 40,000 shares at an average price of about $177.65 per share on the same day, valued at approximately $7 million. After the reduction, his total holdings amount to about 142,000 shares, with a total value of about $25.3 million.

Boeing (BA.US) partners with Palantir (PLTR.US) to bring AI into defense and aerospace manufacturing. Boeing will collaborate with Palantir to integrate artificial intelligence (AI) into existing and future defense projects as well as its factories. The defense division of the American aircraft manufacturer will deploy Palantir's Foundry platform to standardize data analysis and insights in factories producing fighter jets, helicopters, missiles, and satellites. According to the statement, Palantir will also provide AI expertise for Boeing on "a range of undisclosed classified and proprietary projects" aimed at supporting the most sensitive missions of military clients. As geopolitical tensions escalate, artificial intelligence has become a focus for defense companies. Palantir was co-founded in 2003 by Alex Karp and billionaire Peter Thiel, and received early support from the CIA.

Important Economic Data and Event Forecast

Beijing time 20:00: Revision of the U.S. August building permits month-on-month rate (%).

Beijing time 22:00: U.S. August seasonally adjusted new home sales annualized total (10,000 units).

Beijing time 22:30: U.S. EIA crude oil inventory change for the week ending September 19 (10,000 barrels).

Next day Beijing time 04:10: 2027 FOMC voting member and San Francisco Fed President Mary Daly will speak.

Earnings Forecast

Thursday pre-market: Accenture (ACN.US)