The "new regulations" for food delivery have arrived! Standardizing platform fees, merchant onboarding... Meituan and JD.com stocks both rise

市場監管總局發佈《外賣平台服務管理基本要求 (徵求意見稿)》,徵求意見稿明確限定外賣平台向商户的收費項目,不得隨意新設收費項目。新規從公示方式、公示內容、結算明細、推廣效果等方面對平台收費作出細化規定,防止不透明收費現象。

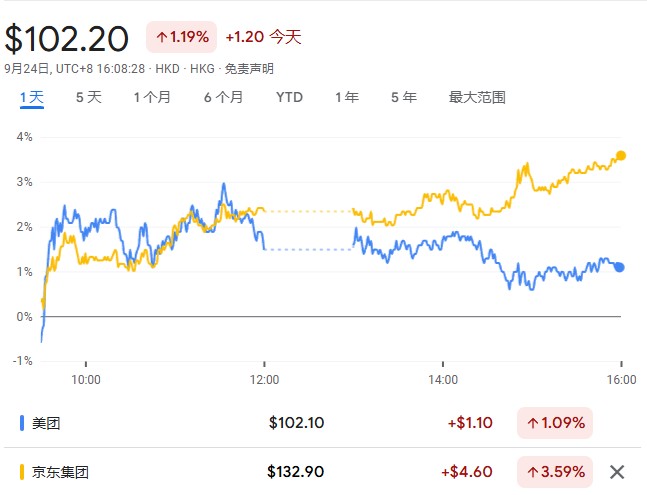

監管部門推出外賣平台新規,美團和京東股價應聲上漲。

9 月 24 日,市場監管總局發佈《外賣平台服務管理基本要求 (徵求意見稿)》,旨在規範平台收費、促銷行為等關鍵問題,引導平台企業公開有序競爭。

據央視新聞報道,專家介紹,新規限定平台向商户的收費項目,禁止平台強制商户分攤促銷成本,並要求建立技術服務費下調機制。這一監管舉措直指今年夏季以來愈演愈烈的外賣行業價格戰,京東進入外賣市場後,美團和阿里旗下餓了麼加大補貼力度。

受此消息推動,週三美團港股股價一度上漲 3%,京東收漲 3.6%。

新規的出台標誌着監管層對外賣行業無序競爭的正式回應,今年 8 月,三大互聯網巨頭曾達成停戰協議,但缺乏具體細則,而商户在激烈競爭中承受的負擔已引發監管關注。

收費透明化成監管重點

徵求意見稿明確限定外賣平台向商户的收費項目,不得隨意新設收費項目。新規從公示方式、公示內容、結算明細、推廣效果等方面對平台收費作出細化規定,防止不透明收費現象。

中國信息通信研究院政策與經濟研究所副所長李強治表示,近年來平台收費規則、計費方式、包括補貼要求等越來越複雜,常常導致商户出現"看不懂、弄不明、算不清"的情況,甚至出現"賣得越多、虧得越多"的局面。

新規要求平台按照合理匹配原則,科學設定技術服務費、配送服務費和推廣服務費。平台需建立技術服務費下調機制,逐步降低基礎佣金,特別是對中小微商户要制定費用減免等扶持措施。

遏制"裹挾式"競爭亂象

據央視新聞援引專家分析,今年以來,外賣平台圍繞搶奪用户流量、夯實配送能力開展"補貼大戰",很多商户被迫捲入其中,出現轉嫁補貼成本、擠壓商户合理利潤空間等現象。

徵求意見稿重點規範平台和商户價格促銷行為,明確要求平台價格促銷成本不應變相或直接要求商户進行分攤。新規明確禁止平台強制或變相強制商户開展價格促銷,或干預商户促銷力度。

有分析表示,中國針對外賣平台運營的新規將可能將美團、阿里巴巴和京東在過去幾個月與監管機構達成的協議正式化。新規對拼多多、抖音和快手等計劃更積極擴張快速商務服務的公司影響可能更為顯著。

嚴打 “幽靈外賣” 保障食品安全

針對"幽靈外賣"、商户"爆單"等亂象,徵求意見稿從商户入駐、信息審核等方面提出系統要求。所謂"幽靈外賣"是指沒有營業執照、食品經營許可證等證照的商户,通過假證、套證、借證等違法違規手段在外賣平台提供違規餐飲服務。

對外經濟貿易大學法學院教授張欣表示,徵求意見稿要求商户提供真實證照、門店場景信息,甚至是"一鏡到底"的定位視頻,由平台執行商户准入與動態審核,輔以"網上亮證"的社會監督。

為化解"爆單"風險,徵求意見稿引入"接單控制提示"機制。平台可利用算法監測商户的訂單負荷,在出現積壓趨勢時主動預警,同時鼓勵平台同步提示消費者"商家繁忙"等信息。

保障配送員權益成新亮點

徵求意見稿聚焦配送員勞動報酬、工作時間和社會保障等方面,要求平台完善與配送員工作任務、勞動強度相匹配的勞動報酬分配機制。

新規明確,平台應合理限定配送員的接單時長,避免配送員超時勞動、過度勞累引發健康和安全風險。對於連續接單時間超過 4 小時的配送員,平台應發出疲勞提示。此外,平台需合理設置同時接單量和單日接單量上限。

市場監管總局從 24 日起正式面向社會公開徵求意見。新規的推出旨在幫助外賣平台企業規範服務管理、提升服務質量,減輕商户經營負擔,引導平台企業公開有序競爭。