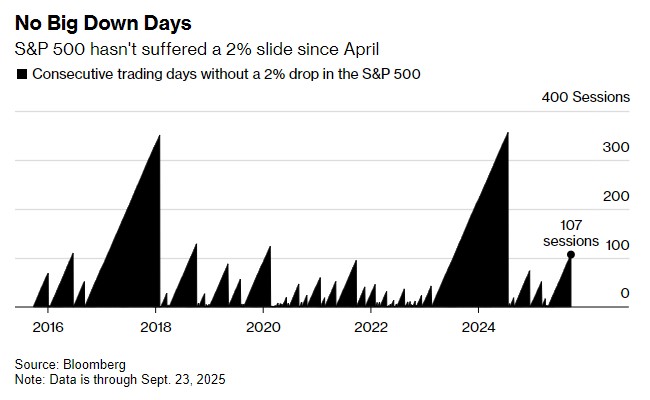

美股上演 “淡定牛”!标普 500 连续 107 天跌幅不超 2% 创逾一年最长平稳期

美股投資者展現出驚人的鎮定,標普 500 指數已連續 107 個交易日未出現至少 2% 的單日跌幅,創下自 2024 年 7 月以來最長平穩期。儘管面臨貿易緊張、經濟放緩和高估值等風險,該指數仍持續創下歷史新高,累計漲幅達 34%。投資者對降息持樂觀態度,但需警惕通脹超預期可能帶來的風險。

智通財經 APP 獲悉,當前,美股投資者持續展現出驚人的鎮定。貿易緊張局勢、經濟增長放緩乃至過高的估值——無一能阻擋標普 500 指數如火如荼地接連創下歷史新高。

作為美股的核心基準指數,標普 500 指數已連續 107 個交易日未出現至少 2% 的單日跌幅,這是自 2024 年 7 月以來持續時間最長的平穩週期。彙編數據顯示,即便 4 月初關税風波引發短暫波動,該指數仍在此後一路攀升,累計漲幅達 34%,市值增長近 16 萬億美元。

儘管風險無處不在,從頑固的通脹到逐漸放緩的美國就業市場擴張,但似乎沒有什麼能撼動市場。週二,美聯儲主席鮑威爾重申政策制定者在權衡進一步降息時可能面臨艱鉅挑戰,此話一度令標普 500 指數承壓回落。然而,交易員近來似乎處變不驚,該指數已超過五個月未出現連續至少 1% 的下跌。

“投資者目前非常願意忽略任何壞消息——但自滿情緒是股市上漲的一個風險,” Kayne Anderson Rudnick 投資組合經理 Julie Biel 表示,“如果未來幾個月通脹漲幅超出交易員預期,可能迫使美聯儲的降息幅度不及投資者所望。”

即便是 2021 年以來的最高失業率也未能動搖市場,截至週一,標普 500 指數今年已創下 28 次歷史新高。

儘管鮑威爾措辭謹慎,交易員對降息仍持樂觀態度——目前市場已基本消化 2025 年累計降息 50 個基點的預期。股市韌性的背後,還源於市場對經濟基本面的信心:投資者認為美國經濟已扛過特朗普關税政策的最嚴峻衝擊,且企業盈利改善與人工智能熱潮將進一步提振經濟增長。

風險在於政策制定者可能收斂其對進一步降息的預測,從而令華爾街大失所望。

截至目前,股市上漲動能尚未顯現減弱跡象。EPFR Global 和美國銀行的數據顯示,在截至 9 月 17 日的一週內,基金經理向美股投入了近 580 億美元,創下年內最大單週資金流入規模。

空頭回補:支撐市場的重要推手

標普 500 指數甚至打破了 9 月作為股市回報最差月份的 “魔咒”。儘管股市走勢的驅動因素往往復雜難辨,但此次平穩行情背後,一個關鍵推手逐漸清晰:空頭回補。

根據追溯至 2008 年的數據,高盛編制的一籃子被做空最嚴重的股票本月至今飆升 14%,遠超標普 500 指數 3% 的同期漲幅,有望創下 2010 年以來該籃子指數表現最佳的 9 月。這一現象暗示,部分投資者在美聯儲利率決議公佈前選擇回補空頭頭寸。

目前,該籃子指數的 14 天相對強弱指數 (RSI) 已升至 2021 年初 “meme 股熱潮” 高峰以來最嚴重的超買水平。當時散户交易員曾推動多隻股票出現無明顯邏輯支撐的劇烈波動。通常而言,此類超買水平意味着股價短期回調風險已臨近。

此外,在消費者支出強勁、企業盈利穩健的樂觀預期下,市場還顯現出其他 “投資者自滿” 的信號。華爾街主要恐慌指標——Cboe 波動率指數 (VIX) 目前遠低於 10 年平均水平,且持續處於 20 點關鍵關口下方 (20 點通常被視為交易員開始警惕風險的閾值)。

隨着股市不斷刷新紀錄,對沖基金與大型投機機構進一步押注 “低波動行情將持續”。美國商品期貨交易委員會數據顯示,截至 9 月 16 日的一週內,VIX 指數淨空頭頭寸達到 10.2 萬份合約,接近 2022 年 8 月以來的最高水平。

Susquehanna 衍生品策略聯席主管 Chris Murphy 認為,對 VIX 指數的大舉做空以及被嚴重做空股票的大幅上漲,暗示股市本輪漲勢可能即將停滯,即便只是短暫停頓。

“儘管種種跡象表明大盤需要很快休整一下,但這很可能是暫時的,” Murphy 表示,“因為標普 500 指數仍有很大空間繼續震盪上行,畢竟市場狂熱情緒遠未達到極端水平,而懷疑論仍普遍存在。對股市多頭而言,這無疑是個積極信號。”