"Mechanical Deification"! Can AI save America?

德銀認為,當前美國經濟增長主要依賴於 AI 基礎設施建設帶來的資本支出,這股熱潮抵消了其他負面影響。這種由 AI 基建驅動的增長模式不可持續,其資本支出高峰期預計在 2025 年見頂。未來的不確定性在於,一旦基建完成,AI 帶來的生產力提升能否及時接棒,成為新的經濟增長引擎。

人工智能正以前所未有的方式扮演着美國經濟的 “機械降神”(Deus ex Machina)。

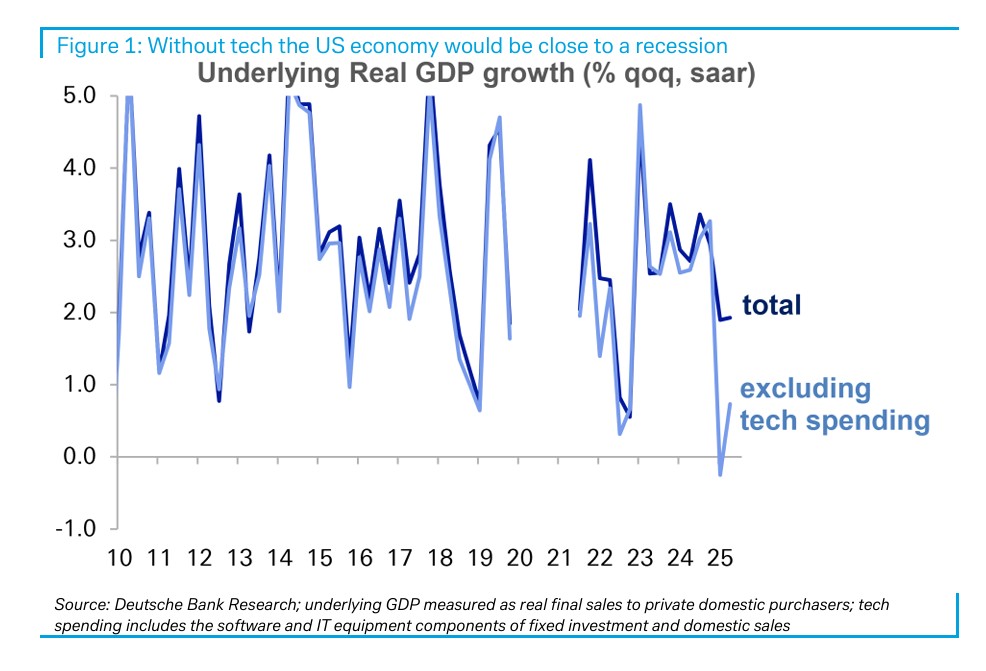

據德意志銀行 9 月 23 日發佈的報告顯示,這一由 AI 基礎設施建設引發的資本支出熱潮,正在抵消關税等需求衝擊和移民政策等供應衝擊帶來的負面影響。該行數據分析表明,如果沒有科技領域的支出,美國經濟的真實狀況將遠比表面看起來疲弱。

這解釋了為何科技股(尤其是 “科技七巨頭”)表現一騎絕塵,而經濟其他領域卻感受不到暖意。就像古希臘戲劇中的 “機械降神”,在劇情陷入僵局時,用舞台機關突然降下一位 “神” 來解決矛盾,強行推動結局。換言之,德銀認為,AI 是靠一場史無前例的資本支出熱潮 “天降神力”,直接把總需求曲線撐起來,抵消了多重負面衝擊。

同時,這種依賴單一引擎的增長模式也帶來了巨大的不確定性。報告明確指出,當前的增長主要來自建設 AI 能力的 “工廠”,而非 AI 本身帶來的生產力提升。更關鍵的是,這種 “拋物線式” 的資本投資增長被認為是 “極不可能” 持續的。報告明確指出,超級計算機(hyperscalers)的資本支出增長正於今年(2025 年)見頂。

AI 投資:美國經濟的引擎

德意志銀行策略師 George Saravelos 在報告中寫道,英偉達作為 AI 投資週期的關鍵資本品供應商,“目前正肩負着美國經濟增長的重擔”。

若將軟件和 IT 設備等科技支出從美國經濟指標 “對國內私人購買者的實際最終銷售額” 中剔除,其增長將趨近於零或陷入負值。

報告認為,AI 基建的爆發式投資,為以下五個宏觀經濟謎題提供了 “缺失的環節”:

- 就業放緩與衰退脱鈎: 歷史上,就業增長的大幅放緩通常伴隨着經濟衰退。但這一次,由 AI 驅動的資本深化並不需要大量勞動力,從而在就業市場疲軟的同時,維持了經濟的表面增長。

- 全球貿易的意外韌性: 儘管關税陰雲密佈,但全球貿易,尤其是以科技為主的北亞地區的貿易表現出驚人的韌性。報告認為,一個有些諷刺的原因是,芯片被豁免於關税之外,這反而鼓勵了企業進行大規模的 “提前囤貨”。

- “雙速”的投資週期: 覆蓋廣泛經濟領域的資本支出情緒指標持續疲軟,但這與高度集中的數據中心投資形成了鮮明對比。這造成了一個 “雙速” 的投資週期:一邊是熱火朝天的 AI 基建,另一邊是普遍低迷的傳統行業投資。

- 科技股的超級表現: 標普 500 指數中科技公司的盈利能力大幅跑贏其他板塊,市場表現也持續向 “科技七巨頭”(mag-7)集中。這正是 AI 資本支出熱潮在資本市場的直接映射。

- 通脹持續温和: 由於更廣泛的經濟需求仍然疲軟,通貨膨脹得以保持在較低水平,並未因少數領域的火熱投資而全面升温。

從基建到應用:增長能否持續?

儘管 AI 投資目前扮演了 “救世主” 的角色,但其可持續性正受到嚴重質疑。德意志銀行警告稱,為了讓科技週期繼續為 GDP 增長做出貢獻,資本投資需要保持 “拋物線式” 的增長,而這 “極不可能” 實現。報告援引其股票研究同事的觀點稱,超級計算機(hyperscalers)領域的資本支出增長將在今年(2025 年)達到頂峯。

報告為投資者提出了關乎中期前景的兩個核心問題,這也將直接影響對美元的展望:

- 增長動力能否順利切換? 今天的增長並非來自 AI 本身,而是來自建造工廠以產生 AI 能力。一旦工廠建成,由 AI 帶來的生產力收益能否及時接管,成為新的增長引擎?

- 全球利益如何分配? AI 帶來的生產力紅利,其分佈範圍會有多廣?這些好處是會像工廠的地理位置一樣高度集中,還是會廣泛傳播到全球各地?

報告總結道,這些都是我們思考明年經濟前景時,必須越來越多地納入考量的 “不尋常且困難的問題”。對於投資者而言,看清這一輪由資本支出驅動的增長何時退潮,以及真正的 AI 生產力革命何時到來,將是穿越未來市場迷霧的關鍵。