The Fate of the "Capital Expenditure Bull Market" – The Rise and Fall of the Stock Market in the Canal, Railway, and Telecommunications Technology Revolutions

微軟、谷歌等科技巨頭正在進行一場前所未有的 AI 資本支出競賽。德意志銀行警示,歷史上由技術革命驅動的資本開支熱潮,如 18 世紀的運河、19 世紀的鐵路和 2000 年的電信,最終都演變成了 “繁榮 - 蕭條” 的週期,導致相關股票泡沫破裂,投資者損失慘重。“2000 年電信泡沫破裂後,至今沒回到當年高點。”

歷史的車輪滾滾向前,但資本市場的劇本似乎總在驚人地重演。

當前,由人工智能(AI)點燃的資本市場狂熱,正將科技巨頭推向一場史無前例的資本開支競賽。據追風交易台消息,德意志銀行 9 月 24 日發佈的報告顯示,微軟、Meta、谷歌和亞馬遜等科技巨頭正以前所未有的力度加碼 AI 基礎設施建設,這無疑是一場高風險、高回報的豪賭。

該行警示,歷史上由技術革命驅動的資本開支熱潮,如 18 世紀的運河、19 世紀的鐵路和 2000 年的電信,最終都演變成了 “繁榮 - 蕭條”(Boom-Bust)的週期,導致相關股票泡沫破裂,投資者損失慘重。

這份報告的核心觀點是,儘管新技術本身能夠永久性地提升生產力並改變世界,但與之相關的金融市場狂熱往往以 “一地雞毛” 告終。而理解過去運河、鐵路和電信革命中的股市沉浮,為判斷當前 AI 投資熱潮未來走向的提供了前車之鑑。

AI 軍備競賽:科技巨頭的千億豪賭

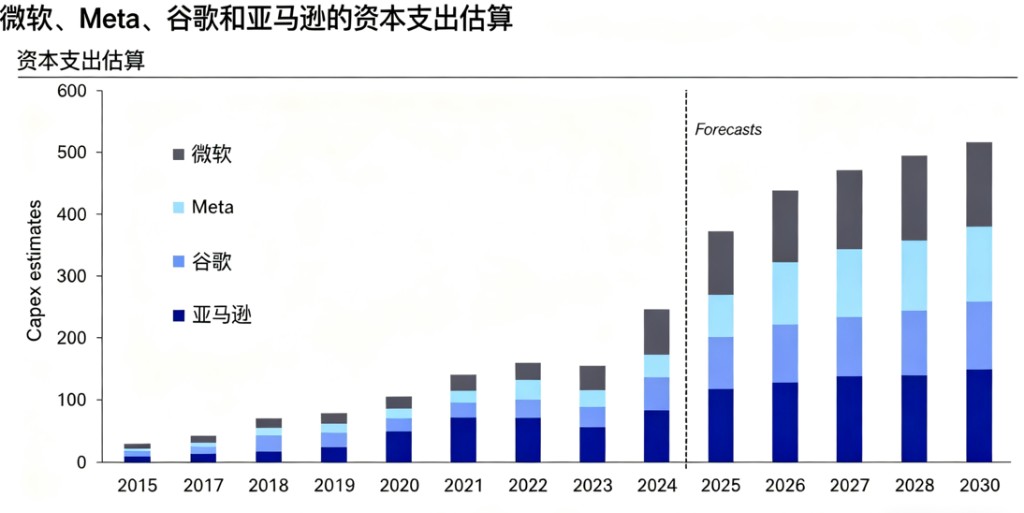

根據報告,“四大科技巨頭”——微軟、Meta、谷歌、亞馬遜的資本支出自 2015 年以來持續攀升,並在近期呈現爆炸式增長。具體來看,2024 年其資本支出超過 2000 億美元,預計 2025 年接近 4000 億美元。

報告預測,這一增長趨勢將至少持續到 2030 年,屆時四家公司的年度總資本支出或將突破 5000 億美元大關。

來源:德意志銀行、Bloomberg Finance LP

來源:德意志銀行、Bloomberg Finance LP

這四家科技巨頭正在進行一場 “巨大的高風險賭注”。這場豪賭的核心問題在於,當所有巨頭都投入巨資時,誰能最終成功地將這些投資變現?

報告提出了一個尖鋭的觀點:AI 革命的最終受益者,可能更多的是技術的使用者,而非其生產者。

歷史的回聲:運河與鐵路狂熱的泡沫與破滅

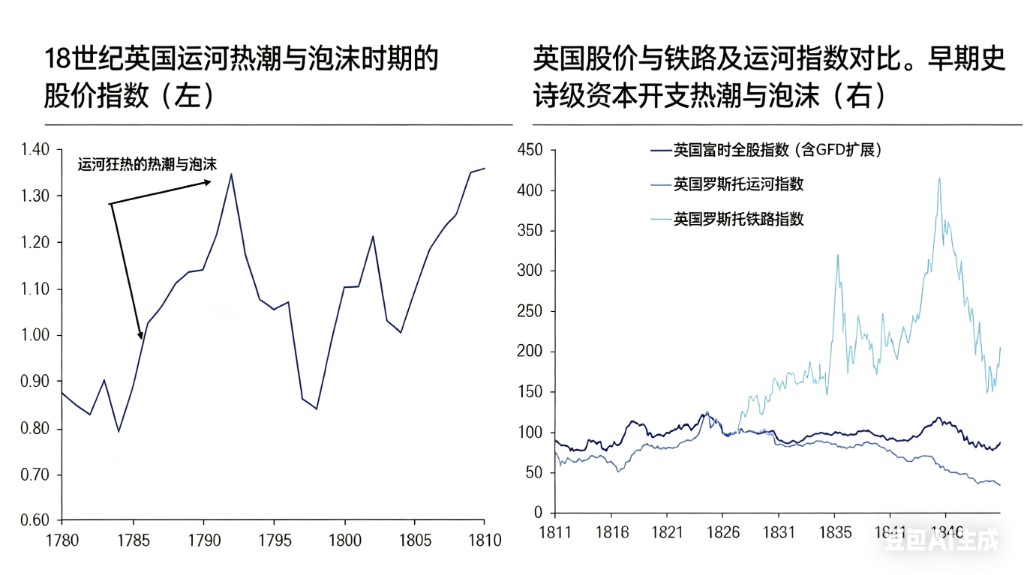

歷史是最好的老師。報告回顧了英國曆史上兩次著名的資本開支泡沫。

- 18 世紀末的 “運河狂熱”(Canal Mania): 報告圖表顯示,在 1790 年代,投資於新興運河技術的股票價格指數在短期內急劇飆升,隨後迅速崩潰。

- 19 世紀的 “鐵路狂熱”(Railway Mania): 同樣,在 1830 至 1840 年代,鐵路作為顛覆性技術吸引了巨量資本,其股票指數經歷了更為壯觀的泡沫與破裂,其崩盤幅度遠超當時的大盤指數。

來源:德意志銀行、英格蘭銀行、Finaeon

德意志銀行指出,這兩次事件的共同點是:運河和鐵路確實永久性地改變了經濟格局,但那些在狂熱頂點買入的投資者,卻承受了巨大的財務損失。這證明了 “一個罕有繁榮 - 蕭條週期的金融市場,幾乎從未在巨大的資本開支熱潮中出現過”。

更近的教訓:2000 年電信泡沫的警示

如果説 19 世紀的鐵路過於遙遠,那麼 2000 年的電信行業泡沫則提供了更為切近的警示。

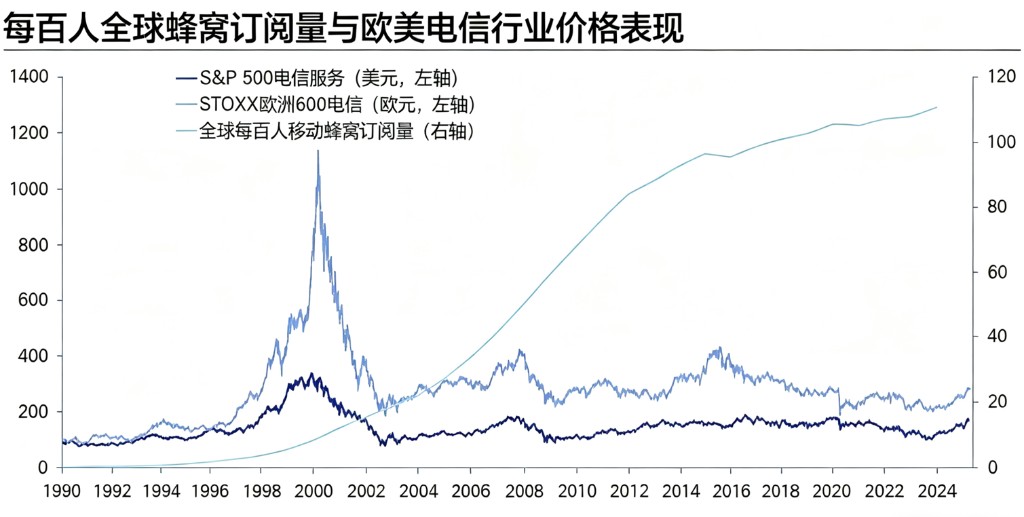

報告展示的圖表清晰地對比了兩條曲線:一方面,全球移動蜂窩網絡用户數(每百人)從 1990 年代的幾乎為零,爆炸式增長到如今的全面普及。

另一方面,美國(S&P 500 電信服務)和歐洲(STOXX 600 電信)的電信板塊股價指數,在 2000 年達到頂峯後便一路下跌。

圖:全球移動用户普及率 vs. 美歐電信股表現 來源:德意志銀行、Bloomberg Finance LP、世界銀行

驚人的事實是,“25 年過去了,儘管這項技術已經普及並改變了世界,但電信股的價格仍未超過其 2000 年的峯值”。這再次印證了報告的核心論點:技術的成功推廣與早期投資者的回報是兩個完全不同的故事。為建設信息高速公路而投入的鉅額資本,並未給二級市場的股東帶來相應的長期回報。

降息能否讓泡沫飛得更高?

那麼,當前的 AI 泡沫是否會繼續膨脹?

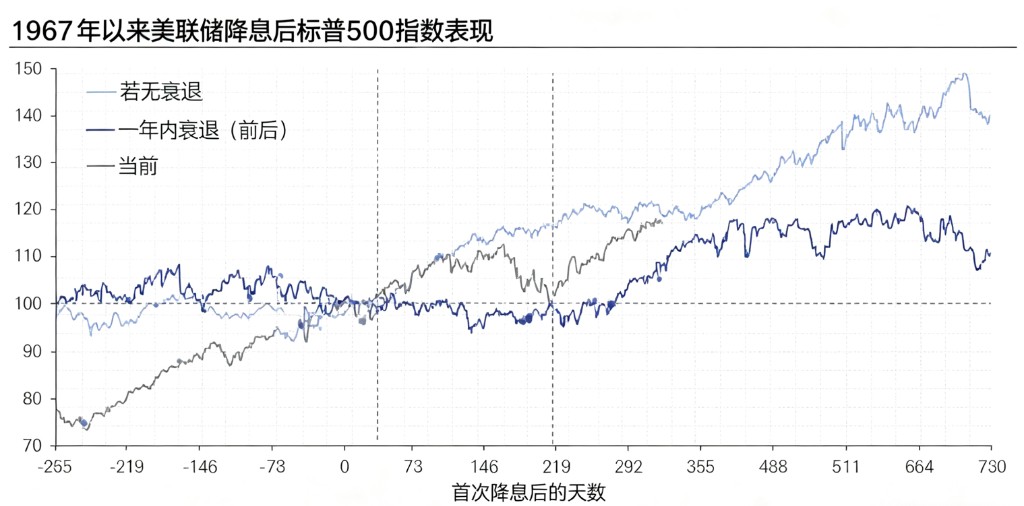

報告還提供了一個宏觀視角。數據顯示,自 1957 年以來,如果美聯儲在沒有經濟衰退的背景下啓動降息週期,標普 500 指數在首次降息後的兩年內通常會錄得非常強勁的漲幅。這一歷史規律為當前的市場增添了更多不確定性。倘若宏觀環境配合,AI 領域的投資狂熱或許還能持續更長時間,將泡沫推向新的高度,然後再重演歷史的宿命。

美股估值與集中的雙重警報

這場 AI 驅動的牛市,已經將市場推向了兩個歷史性的極端。

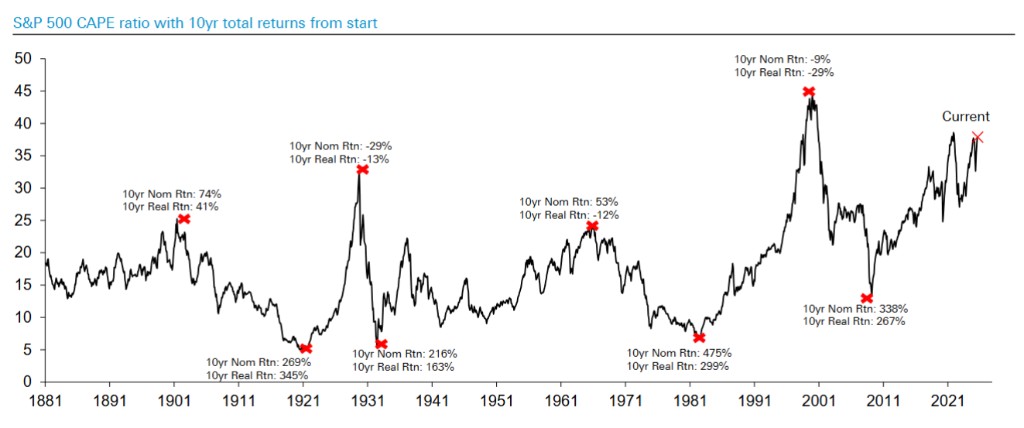

首先是估值。報告圖表顯示,當前美股的市盈率(CAPE ratio)比例已攀升至歷史高位,僅次於 2000 年科網泡沫的頂峯。歷史數據無情地揭示了一個規律:每當估值達到如此高點時(如 1929 年、2000 年),隨後十年的市場回報,尤其是剔除通脹後的真實回報,往往是負值。

標普 500 指數 CAPE 市盈率與未來 10 年總回報 來源:德意志銀行

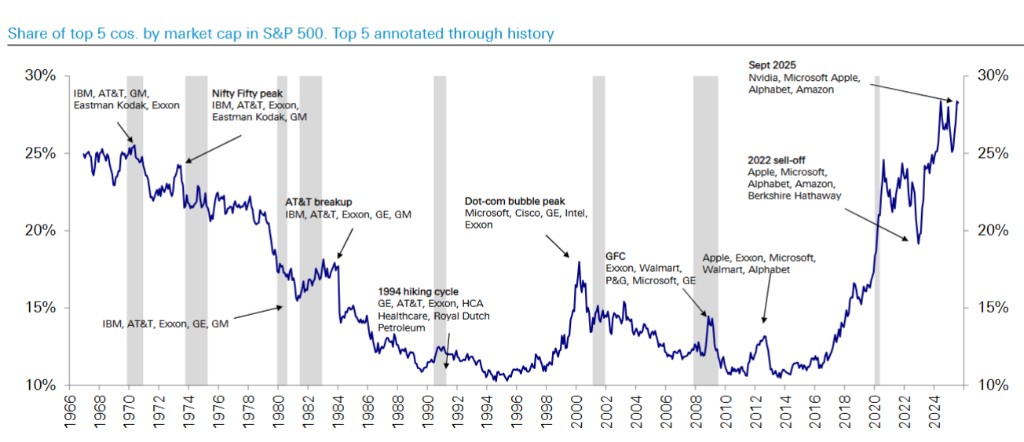

其次是市場集中度。AI 熱潮的另一個顯著特徵是贏家通吃。圖表顯示,標普 500 指數中市值排名前五的公司(英偉達、微軟、蘋果、Alphabet、亞馬遜)的權重總和已逼近 30%。

這一集中度不僅遠高於 2000 年科網泡沫時期的水平,甚至超越了上世紀 70 年代初 “漂亮 50” 行情最火熱的時刻。報告指出,這並不必然意味着泡沫,但它確鑿無疑地表明市場已進入 “未知領域”,整體表現過度依賴於少數幾家公司的命運。

標普 500 指數前五大公司市值佔比歷史走勢 來源:德意志銀行

對於今天的投資者而言,這份歷史覆盤無疑是一劑清醒劑。AI 革命浪潮勢不可擋,但資本市場的狂熱是否已脱離基本面?歷史的教訓提醒我們,在追逐下一個 “時代機遇” 時,必須對資本開支驅動的股價飆升保持高度警惕,因為狂熱的終點,往往是價值的殘酷迴歸。

~~~~~~~~~~~~~~~~~~~~~~~~

以上精彩內容來自追風交易台。

更詳細的解讀,包括實時解讀、一線研究等內容,請加入【追風交易台▪年度會員】