A Detailed Explanation of Oracle's "Growth Model"

Morgan Stanley stated that Oracle is transforming from a traditional software giant into a GPU data center operator, expecting that by fiscal year 2030, its AI-related business will contribute 60% of total revenue, with OCI revenue increasing from approximately $18 billion to $144 billion. However, this high growth model comes with capital expenditures of up to $405 billion and rising debt, while also being eroded by the low profit margins of the AI business, impacting the company's overall profit margins

Oracle is transforming from a traditional software vendor to a GPU data center operator, dominating the market with large contract orders from clients such as OpenAI, Meta, and xAI.

According to news from the Chasing Wind Trading Desk, a report released on September 23 by Morgan Stanley analysts Keith Weiss and Jamie Reynolds indicates that this transformation will reshape the company's revenue structure, profit margins, and risk dynamics. It is expected that by fiscal year 2030, AI-related businesses will contribute 60% of its total revenue.

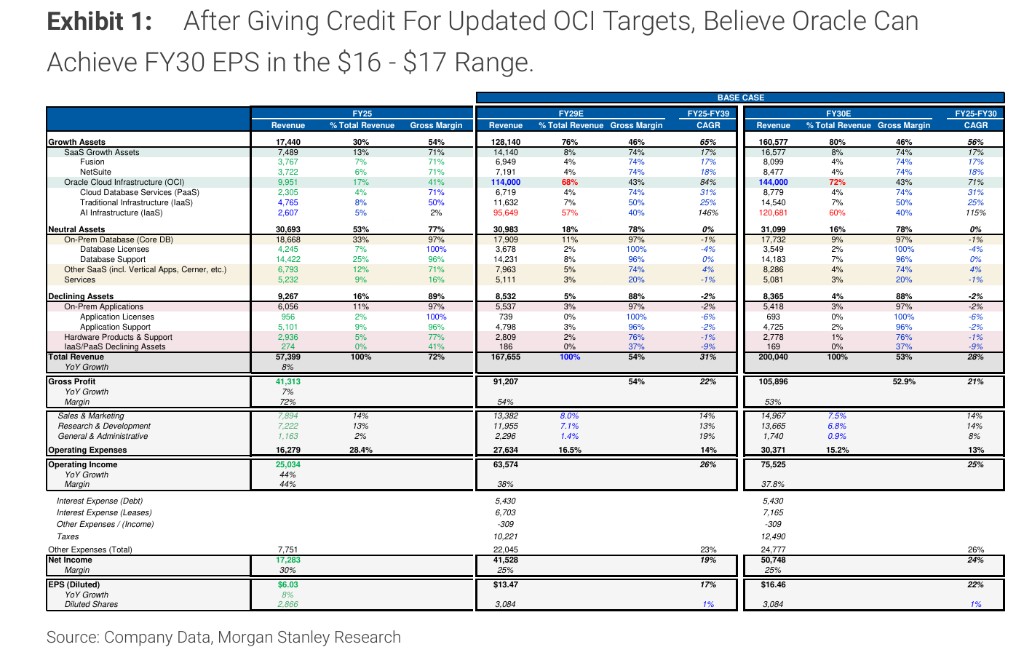

This assessment is based on Oracle's recently announced impressive performance guidance. According to Morgan Stanley's analysis, Oracle expects its cloud infrastructure (OCI) business revenue to expand from approximately $18 billion in fiscal year 2026 to $144 billion in fiscal year 2030. Based on Morgan Stanley's growth framework analysis, achieving these goals means OCI will account for 72% of fiscal year 2030 revenue, a significant increase from 17% in fiscal year 2025.

Although revenue is expected to achieve a compound annual growth rate of 28%, this GPU-centric AI as a Service (GPUaaS) model also brings unprecedented capital expenditure pressure and profit margin erosion risks for Oracle. Analysts maintained a "Equal Weight" rating on the stock, with the core view that despite the extremely promising growth prospects, this expectation has largely been priced in by the current stock price.

AI Business Dominates, Reshaping Revenue Structure

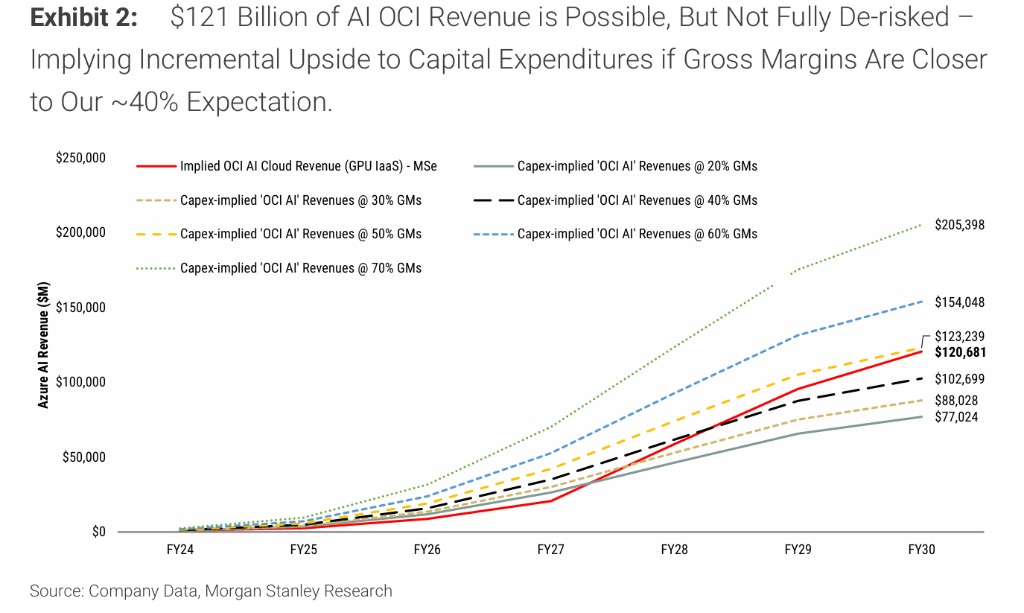

Oracle's new growth model is centered on the explosive growth of AI Infrastructure as a Service (IaaS) within its OCI business. According to Morgan Stanley's estimates, to achieve the OCI total revenue target of $144 billion for fiscal year 2030, the revenue from AI IaaS needs to reach approximately $121 billion.

This means that the share of AI IaaS in Oracle's total revenue will jump from about 5% (approximately $2.6 billion) in fiscal year 2025 to 60% in fiscal year 2030. This marks Oracle's transformation from a database and enterprise application software giant to a GPU data center operator.

The key driver behind this ambitious blueprint is the large-scale contracts that Oracle has already secured. The report notes that this expectation is supported by a total contract value agreement with OpenAI worth up to $300 billion. Additionally, Oracle's management expects that new bookings in the coming months will drive the company's total remaining performance obligations (RPO) to exceed $500 billion, providing high visibility for short- to medium-term revenue growth.

High Capital Expenditures and Financial Pressure

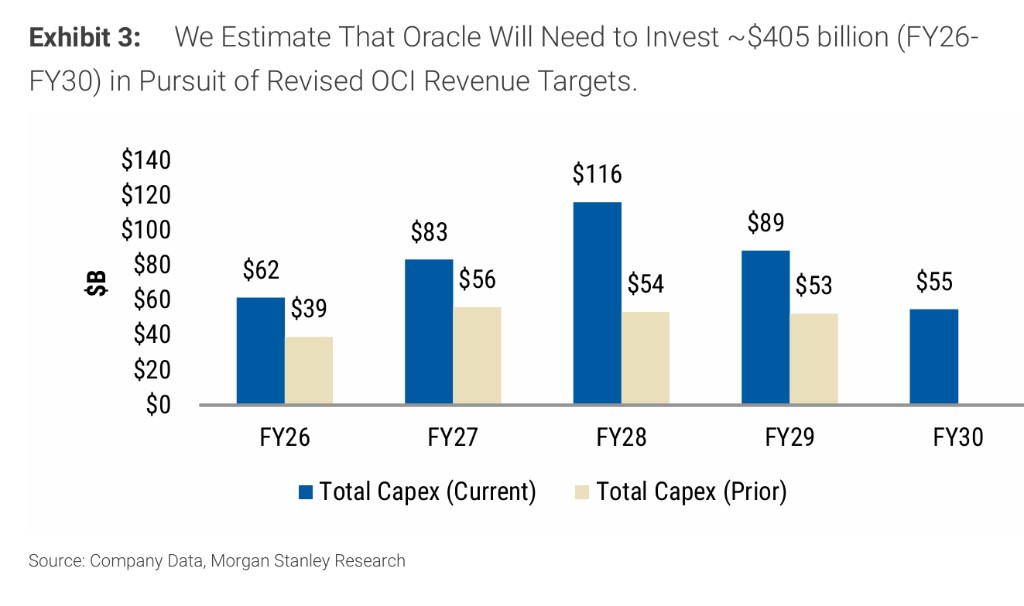

To meet AI clients' demand for large-scale GPU clusters, Oracle must make substantial and ongoing capital investments. According to Morgan Stanley's estimates, over the five years from fiscal year 2026 to fiscal year 2030, Oracle's total capital expenditures (including financing leases) will reach approximately $405 billion, far exceeding previous expectations. **

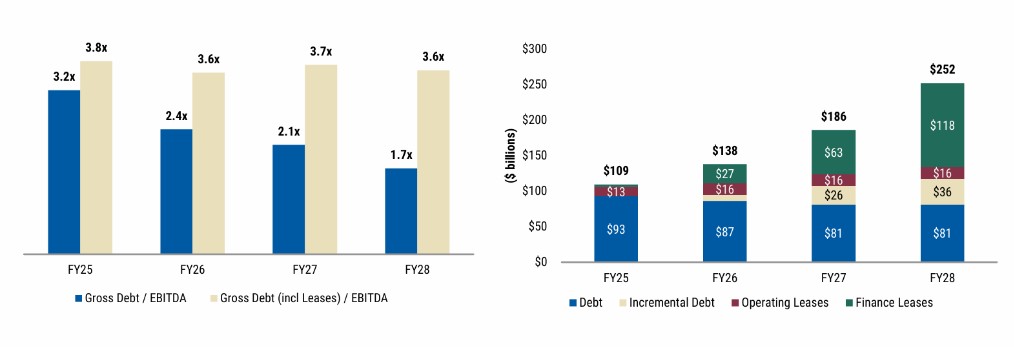

Such a large investment scale will put significant pressure on the company's financial situation. The report predicts that Oracle's total debt and lease obligations will rise from approximately $109 billion at the end of fiscal year 2025 to about $252 billion by fiscal year 2028. Its leverage ratio (total debt and lease/EBITDA) is expected to remain above 3 times before fiscal year 2028.

Although Oracle's management is expected to disclose more details about the financing plan on Analyst Day on October 16, Morgan Stanley has already preliminarily accounted for the interest cost burden from the issuance of additional debt and financing leases in its earnings forecast.

Profit Margin Under Pressure: The Cost of Growth

The transformation to AI IaaS business has led to a surge in revenue but also caused structural changes in profit margins. Compared to the over 90% gross margin of Oracle's traditional software business, the capital-intensive GPUaaS business has much lower profit margins.

Morgan Stanley's model assumes that Oracle's AI IaaS business can achieve a 40% gross margin once scaled. Even so, as this low-margin business rapidly increases its share of the revenue structure, the company's overall operating profit margin will face erosion. The report predicts that Oracle's non-GAAP operating profit margin will decline from about 44% in fiscal year 2025 to about 38% in fiscal year 2030.

This means that investors need to accept a new profit model: sacrificing some profit margin for ultra-fast revenue growth. The success or failure of this model will heavily depend on Oracle's ability to achieve significant operational efficiency improvements while scaling up.

Valuation Full? Analysts' Cautious Judgment

Considering high growth and high investment, Morgan Stanley predicts that Oracle is expected to achieve approximately $16.50 in non-GAAP earnings per share (EPS) by fiscal year 2030, representing a compound annual growth rate of over 20% from fiscal year 2025 to fiscal year 2030.

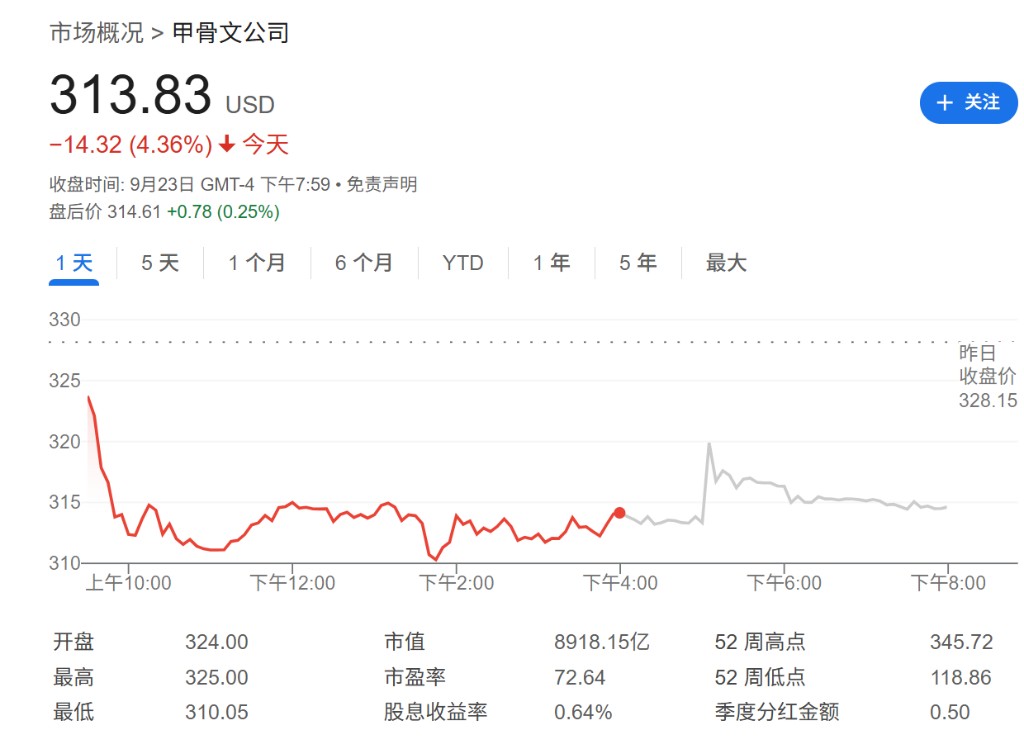

However, analysts believe the market has already reacted in advance. As of the time of writing, Oracle's stock price is trading around $313. Morgan Stanley values Oracle's EPS for fiscal year 2030 using a similar 25 times price-to-earnings ratio as Microsoft and discounts it back to 2027 using an 8.7% weighted average cost of capital (WACC), arriving at a target price of $320, which is basically in line with the current stock price

The conclusion of the report is that Oracle's AI-driven growth story is highly attractive, but its stock price has already reflected most of the optimistic expectations. The future upside potential of the stock price will mainly depend on two key variables: whether the gross margin of the AI IaaS business can exceed the expected 40%, and the degree of improvement in operational leverage as the company pursues revenue growth. Any performance that exceeds or falls short of expectations in these two factors could lead to significant stock price fluctuations