The first "H first, then A" company to be reviewed this year has arrived: BIOCYTOGEN's performance surge and "negative disclosure" growth rate attract attention

“國內模式動物三巨頭” 將齊聚 A 股

今年以來隨着 “A+H” 熱度持續攀升,不少 A 股公司都在向港股市場發起衝刺。

但也有公司 “反其道而行之”。

日前即將上會的港股公司百奧賽圖(北京)醫藥科技股份有限公司(下稱 “百奧賽圖”)便採取 “先 H 後 A” 的上市路徑。

早在 2022 年 9 月,百奧賽圖就已經登陸港股市場,不到 1 年後便在中金公司的保薦下向科創板遞交上市申請,迄今審核時長已超過 2 年,終於迎來關鍵進展。

9 月 24 日,科創板上市委將對百奧賽圖的上市做出審核。

百奧賽圖不僅是年內首家科創板上會的港股上市公司,也是年內首單 “先 H 後 A” 的上會公司。

作為一家臨牀前 CRO 企業,百奧賽圖主營實驗鼠銷售等,與藥康生物(688046.SH)、南模生物(688265.SH)被並稱為 “模式動物三巨頭”。

百奧賽圖已實現盈利,2025 年上半年收入為 6.21 億元,同比增長了超 5 成;同期淨利潤則達到 0.48 億元,較 2024 年同期-0.51 億元已大幅扭虧。

儘管淨利潤大幅增長,但百奧賽圖的上會稿中將 2025 年上半年及 2025 年前 9 個月的淨利潤同比變動比例分別表述為 “-194.72%”、“-162.18%”。

如此表述在市場間引發了爭議。

不少業內人士對此告訴信風,一般對於扭虧為盈的情況,可以不寫變動比例,實務中並未對此進行統一。

實操中應該如何在業績扭虧為盈之際對業績增長做出合理表述,為投資者提供清晰的標識,仍需要更多規則的明示。

百奧賽圖此番 IPO 計劃募資 11.85 億元,投向 “藥物早期研發服務平台建設”、“抗體藥物研發及評價” 及臨牀前研發等項目的建設,這一募資金額較其首次申報已下調超 3 成。

扭虧為盈的披露爭議

百奧賽圖此次獲得上會機會或許在市場預料之中。

隨着 IPO 審核進程加快,不少等待良久的生物醫藥企業都迎來了關鍵進展,例如未盈利創新藥企禾元生物(688765.SH)已於近期啓動招股。

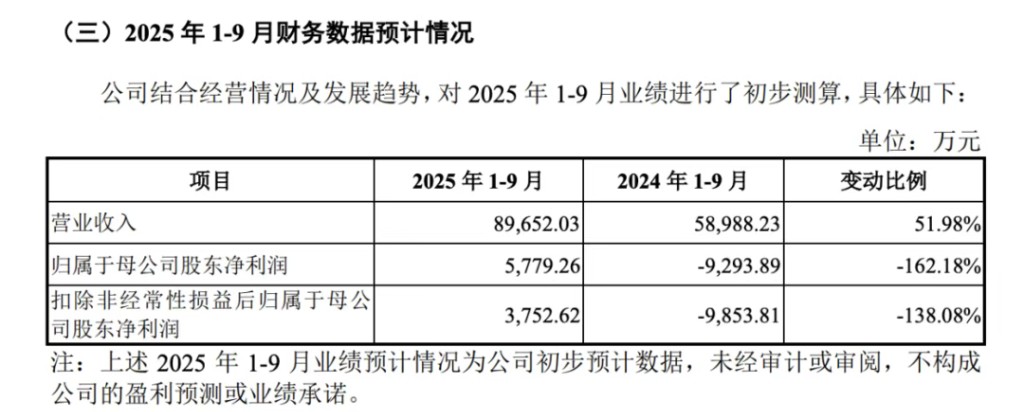

更為關鍵的因素是,百奧賽圖的基本面確實有較大程度改善,今年前 9 個月預計收入為 8.97 億元,同比增長了超 5 成;同期歸母淨利潤為 0.58 億元,較 2024 年同期 0.93 億元的淨虧損已大幅改善。

此次引發爭議之處在於,百奧賽圖在上會稿中將扭虧為盈的利潤增長率標示為負值——2025 年前 9 個月淨利潤同比增長表述為 “-162.18%”。

僅從這一數值來看,百奧賽圖今年以來增長的歸母淨利潤易被誤解為出現大幅下滑,但事實上這是數學計算方法造成的結果,即直接以 “(0.58+0.93)/(-0.93)=-1.62” 計算業績變動比例。

接近百奧賽圖的人士對此告訴信風:“對於負數轉正數,可以不寫變動比例,但如果寫的話一般就是這種寫法。”

據信風和業內人士溝通,目前相關規則尚未明確 “扭虧為盈” 的變動比例計算方式。

“一般來説,基期是負數就不該有變動比例。如果一定要計算變動比例,實務中確實沒有統一寫法。” 北京一家審計機構人士告訴信風。

實操方面確實如此,即便是同一家保薦機構的項目,其標識方式亦有差異。

信風注意到,同是中金公司保薦並已進入註冊環節的科創板 IPO 項目深圳北芯生命科技股份有限公司(下稱 “北芯生命”)便採取了不同的計算方式。

2025 年一季度,北芯生命的歸母淨利潤為 0.21 億元,較 2024 年同期 0.19 億元的虧損實現大幅扭虧,其變動比例表述為 “207.85%”。

其中,北芯生命的具體計算方式為 “(2060.61+1910.55)/|-1910.55|=2.08”。

據上交所《股票上市規則》,上市公司及相關信息披露義務人應保證所披露簡明清晰、通俗易懂等。

“從通俗易懂的原則出發的話,一般還是會建議扭虧為盈的公司用正值表示變動比例,便於投資者理解企業業績變動的情況。” 北京一位投行人士指出。

據信風觀察,Wind 等第三方金融終端數據庫對扭虧為盈的變動比例標識亦是採取正值方式記載。

究竟如何標識更為合理,仍待各方討論。

“開源節流” 兩手抓

百奧賽圖能夠實現扭虧,兩大助力源自收入的增長和 “節流”。

百奧賽圖的業務主要分成臨牀前藥理藥效評價、模式動物銷售、抗體開發和基因編輯四大板塊。

模式動物銷售、抗體開發構成主要收入來源。

2024 年,模式動物銷售業務創收 3.89 億元,同比增長了超 4 成,這主要是受益於近年來中國創新藥企對 PD-1 等熱門靶點的角逐,百奧賽圖模式動物中涵蓋這些靶點的人源化鼠銷售可觀。

2024 年,百奧賽圖共銷售 11.97 萬隻靶點人源化鼠,銷售金額達到 2.98 億元,折算靶點人源化鼠單價為 2487.04 元,同比增長了 4.5%。

抗體開發業務的增長則更為強勁,2024 年創收 3.18 億元,同比增長超 8 成。

百奧賽圖主要是根據開發的成果或服務的工作量確認抗體業務的收入,其所獲取的首付款及授權款項等主要取決於與客户之間的談判情況。

這意味着,抗體開發的進程快慢以及藥企對外獲取抗體使用權的傾向,都有可能影響百奧賽圖的業績變動,在不同年份間可能存在差異。

2024 年,百奧賽圖先後完成與 Neurocrine Biosciences、多瑪醫藥、IDEAYA Biosciences、ABL BioInc 等主要客户達成交易,推動了抗體授權收入的激增。

例如 2024 年 7 月百奧賽圖與 IDEAYA Biosciences 簽署了 OPTION AND LICENSE AGREEMENT(選擇權與許可協議),交易分成 50 萬美元預付款、600 萬美元的期權行使費和里程碑付款三大部分。

同年,百奧賽圖向 IDEAYA Biosciences 轉讓雙抗 ADC 分子後,拿到了首付款和期權行使費等合計 0.47 億元的收入。

不僅如此,百奧賽圖似乎也在壓縮管理費用和研發費用的支出。

2024 年,百奧賽圖的管理費用為 1.87 億元,同比下滑了近 3 成;研發費用則從 2023 年的 4.74 億元大幅削減至 2024 年的 3.24 億元,同比縮水了近 1/3,2024 年佔收入比重同比下滑了超 30 個百分點。

正是 “開源節流” 兩手抓推動了百奧賽圖在 2024 年快速扭虧,淨利潤達到 0.34 億元。

百奧賽圖能否持續保持增長,或許值得關注。