NIO's "self-redemption": After sales improvement, the next step is finance

Nomura Securities believes that Nio has successfully reversed its sales decline with strong sales of new models; however, its financial situation remains weak. Nio is expected to achieve full-year breakeven by 2027, which is earlier than market expectations, but the premise is that the company needs to make more efforts in cost control and operational efficiency to cope with the profit pressure brought by the "price-for-volume" strategy

For investors focused on Nio, the latest research report from Nomura conveys a complex but clear signal: Nio's "self-redemption" has begun, but is far from complete.

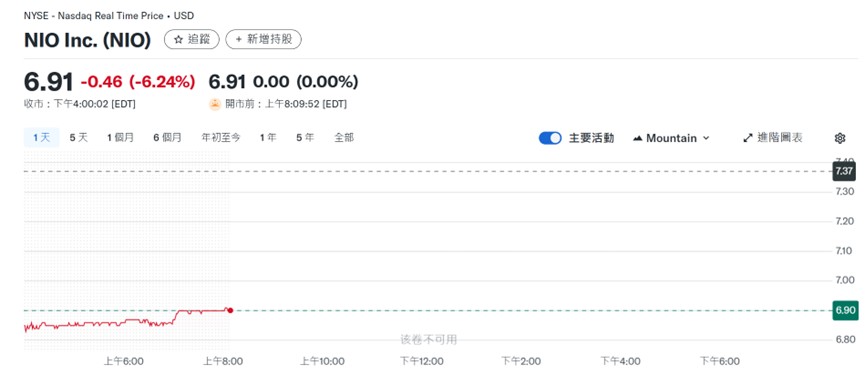

According to news from the Wind Trading Desk, Nomura stated in its report on the 22nd that Nio has reversed its sales decline thanks to its successful pricing strategy and strong orders for new products (the Aito L90 and the new ES8), addressing current demand challenges. Based on this assessment, Nomura has significantly raised Nio's target price from $5.00 to $8.40, while maintaining a "neutral" rating, indicating about a 22% upside potential from the current stock price.

However, analysts also pointed out that despite the temporary alleviation of sales challenges, Nio's financial situation, especially compared to its peers, still appears somewhat fragile. Analysts believe that investors need to remain patient, as the company requires time to achieve a "meaningful improvement" in its financial condition.

Regarding Nio's future, Nomura's forecast is mixed. On one hand, the firm expects Nio's market share to continue to rise and may achieve breakeven for the full year by 2027, which is earlier than the market's general expectations. On the other hand, achieving this goal requires the company to make more efforts in operational efficiency and cost control to cope with the pressure on profit margins from the "price-for-volume" strategy.

Strong New Car Orders, Sales Decline Reversed

Earlier this year, Nio faced challenges in sales growth, but the market performance of its latest two models has successfully pulled it out of the slump. Nomura's report noted that the newly launched Aito L90 and the new ES8 are enjoying solid demand.

According to Nomura's market survey, the Aito L90 model has maintained an order volume of 2,000 to 3,000 units per week. Meanwhile, the confirmed orders for the new ES8 are nearing 50,000 units, a figure that has already exceeded the production capacity limit for this model for the remainder of 2025. Strong orders provide a solid guarantee for Nio's delivery volume growth in the second half of 2025.

Analysts believe that if Nio continues a similar strategy with its new models next year, its growth prospects will be optimistic.

Financial Situation Remains the Next Challenge

After temporarily addressing the demand-side challenges, Nio's focus is now shifting to the more challenging financial issues. The Nomura report emphasizes that compared to its competitors, Nio's balance sheet still appears "somewhat fragile." A key detail is that the company's shareholders' equity has only just turned positive after the recent placement and issuance, indicating that its financial foundation is still not solid.

Analysts believe that considering that car sales typically enter a low season in the first half of the year (such as the first half of 2026), Nio may require further investment to maintain operations. Therefore, even if Nio can sustain its current business momentum, achieving a "meaningful improvement" in its financial situation will still require more patience and time

Earnings Forecast Adjustment: Short-term Pressure, Long-term Improvement

Based on the latest sales momentum, Nomura has adjusted its financial forecasts for Nio, showing a trend of short-term pressure and long-term improvement.

The firm has lowered its delivery forecast for Nio in the 2025 fiscal year by 9.5% to 352,000 units, and reduced the revenue forecast for the same year by 11.7%, mainly reflecting the impact of the business transition period. However, thanks to the strong momentum of new models, Nomura has raised its delivery forecasts for the 2026 and 2027 fiscal years by 0.9% and 12.7%, respectively. The report predicts that Nio's revenue compound annual growth rate from 2024 to 2027 will reach 32%.

In terms of profitability, due to the "price-for-volume" strategy, Nomura has slightly lowered its gross margin forecasts for the 2025 to 2027 fiscal years by 0.2 to 1.2 percentage points. However, thanks to better control of R&D and sales management expenses, the firm has raised its operating profit margin expectations for the 2026 and 2027 fiscal years, and expects Nio to achieve breakeven for the entire year in the 2027 fiscal year.

In summary, Nomura maintains a "neutral" rating on Nio, and has raised its target price for Nio from $5.00 to $8.40, indicating a 22% upside from the current closing price of $6.91