The rebound of U.S. Treasury bonds is in sight, but whether it can materialize depends on Powell's "guidance."

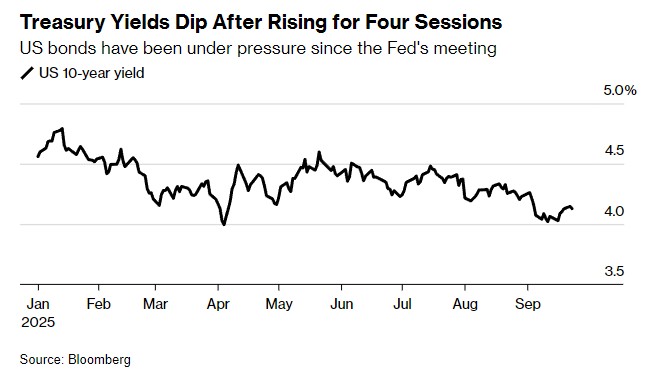

U.S. Treasury bonds are on track for their first increase in five trading days, as traders anticipate that upcoming remarks from Federal Reserve officials may signal a potential interest rate cut. Currently, yields on U.S. Treasuries across various maturities are generally declining, with the 10-year Treasury yield falling to 4.13%. There is a high level of uncertainty regarding the Federal Reserve's future policy path, and investors are seeking clearer directional signals. Attention is turning to the upcoming PMI, GDP, and PCE data for evidence of a weakening U.S. economy

According to Zhitong Finance APP, U.S. Treasury bonds are on track for their first increase in five trading days. Traders expect that speeches from several Federal Reserve officials soon may signal more interest rate cuts.

Currently, yields on U.S. Treasuries across various maturities are generally declining, with the 10-year Treasury yield falling 2 basis points to 4.13%. Previously, the Treasury market had been under pressure due to signals from Federal Reserve officials last week indicating a cautious stance on further easing policies, and related statements on Monday continued this tone.

With several Federal Reserve officials, including Chairman Jerome Powell and policymakers Goolsbee, Bowman, and Bostic, set to speak on Tuesday, investors are seeking clearer directional signals. There is currently high uncertainty in the market regarding the Federal Reserve's future policy path, leading investors to prefer targets that are likely to yield returns even if unexpected economic fluctuations hinder rate cut plans.

Michael Brown, senior research strategist at Pepperstone, stated, "The market hopes Powell can clarify some of the confusion caused by last week's rate cut being characterized as a 'risk management' measure." He also added that the auction of two-year Treasuries in the early session may be well absorbed by the market.

When Powell implemented the highly anticipated rate cut last week, he described it as a "risk management" measure and emphasized the need to balance signs of weakness in the labor market with inflationary risks.

Since the announcement, Federal Reserve officials have sent mixed signals regarding the timing and possibility of further easing. Fed official Musalem indicated that there is limited room for further rate cuts; meanwhile, Milan—speaking for the first time since being appointed by Trump—believes that current monetary policy remains overly tight.

Market focus has now shifted to the Purchasing Managers' Index (PMI) and the Richmond Fed Manufacturing Index to be released on Tuesday, as investors hope to find evidence of a weakening U.S. economy. Additionally, GDP data and Personal Consumption Expenditures (PCE) data to be released later this week are also closely watched by investors.

Bruce Richards, Chief Investment Officer at Marathon Asset Management, stated in an interview, "The current pace of job market growth is slowing, and more importantly, the neutral interest rate level is far below the current actual rate." He anticipates an additional 125 basis points of rate cut potential and noted, "The Federal Reserve still has a long way to go on the path of rate cuts."