Massive capital shift! Investors are frantically buying U.S. municipal bonds, while U.S. stocks "bled" $20 billion in a single week

投資者向美國市政債券基金投入的現金達到 2007 年以來的最高水平,市政債券共同基金吸引了約 24 億美元資金,ETF 錄得 20 億美元流入。與此同時,投資者從美國股票基金撤出約 200 億美元。美聯儲降息預期推動市政債券上漲,9 月份回報率為 2.6%。儘管市政債券表現強勁,但隨着債券發行量增加,未來表現可能放緩。

智通財經 APP 獲悉,CreditSights 表示,本月初投資者向美國市政債券基金投入的現金達到至少 2007 年以來的最高水平。CreditSights 的數據顯示,截至 9 月 10 日當週,市政債券共同基金吸引了約 24 億美元的資金,創下 137 周以來的最高水平;而交易所交易基金 (ETF) 則錄得 20 億美元的資金流入,為四周以來的最高水平。根據美國投資公司協會 (ICI) 的數據,同一周投資者從美國股票基金中撤出了約 200 億美元。

受美聯儲重啓降息的預期推動,投資者追逐美國州和地方政府債券的漲勢,並且隨着股價上漲至歷史最高水平,他們重新平衡了投資組合。

CreditSights 高級市政策略師 Patrick Luby 表示:“在我看來,這表明資產配置正在發生調整。我認為並沒有太多新的資金自發流入共同基金。”

標普 500 指數已創下歷史新高,科技股因利率下調而上漲。通常情況下,降息會刺激消費者支出並提高企業利潤。

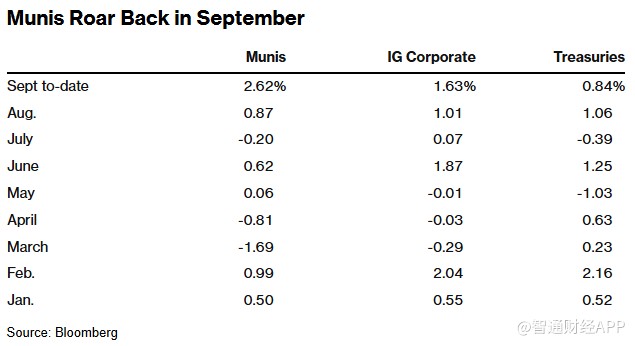

美國市政債券在 9 月強勢上漲

9 月份市政債券回報率為 2.6% ,超過了美國投資級債券和美國國債。而今年大部分時間裏,市政債券的表現都遜於這兩類資產。創紀錄的州和地方政府債券發行,以及美國總統唐納德·特朗普税收和支出法案中免税債券的狀況存在不確定性,導致市政債券表現不佳。

受疲軟的勞動力市場報告影響,本月市政債券強勢反彈。但隨着債券發行量增加以及 10 月份可用於再投資的現金減少 (這是季節性週期的一部分),市政債券的表現可能會有所放緩。根據彭博彙編的數據,未來 30 天內預計將有約 163 億美元的新債券發行。

巴克萊銀行市政策略師 Mikhail Foux 在上週五的研究報告中寫道:“戰術投資者可能傾向於在此稍作停頓,甚至考慮獲利了結,但我們預計,如果債券發行量沒有太大的意外上升,市場將在 10 月份繼續表現良好。”