A comprehensive understanding of the "future Prime Minister of Japan" contest: For the market, Sanae Takaichi is the biggest variable

Bank of America Merrill Lynch believes that there are significant differences among the five candidates regarding tax, monetary, and fiscal policies. Takashi Shimizu insists on prioritizing the debt-to-GDP ratio over strict fiscal discipline and favors loose monetary policy, which, if elected, would lead to a weaker yen and a steepening of the government bond yield curve. In contrast, Shinjiro Koizumi and Yoshihisa Hayakawa continue a prudent approach, and the market reaction may be relatively mild

As the Liberal Democratic Party presidential election approaches on October 4, the policy positions and market impacts of the five candidates are becoming the focus of investors. Bank of America Merrill Lynch stated that among the candidates, Sanae Takaichi is the biggest variable for the market.

On September 23, according to news from the Wind Trading Desk, Bank of America Merrill Lynch mentioned in its latest research report that there are significant differences among the candidates regarding tax policy, monetary policy stance, and fiscal policy direction, with Sanae Takaichi seen as the candidate most likely to trigger severe market fluctuations.

Bank of America Merrill Lynch strategists analyzed that Takaichi's victory would have the greatest impact on the yen and the Japanese government bond market. Although she no longer explicitly advocates for a reduction in the consumption tax, she still insists on prioritizing the debt-to-GDP ratio over strict fiscal discipline, which may lead to market expectations for fiscal expansion. At the same time, the market still believes she leans towards a loose monetary policy stance.

In contrast, the victories of Shinjiro Koizumi and Yoshihiro Kawai may maintain the continuity of Shigeru Ishiba's policies, while Eagle Kobayashi is the only candidate who has not ruled out a reduction in the consumption tax, and his victory could strengthen the yen.

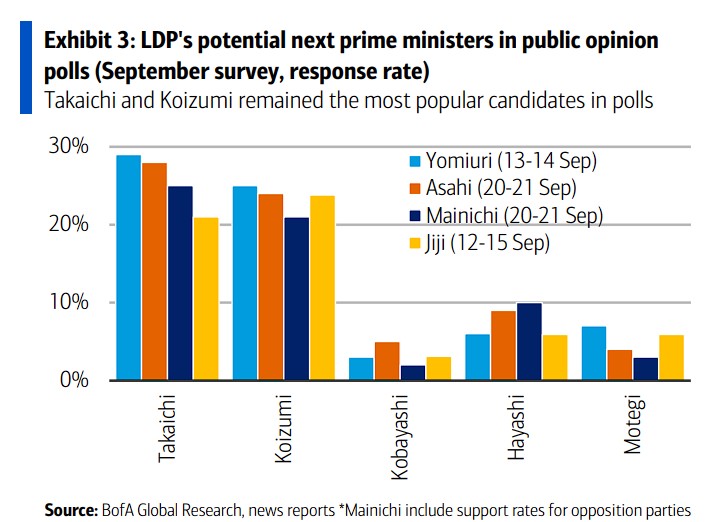

Polls show that Sanae Takaichi and Shinjiro Koizumi remain the most popular candidates. The five candidates—Toshimitsu Motegi, Eagle Kobayashi, Yoshihiro Kawai, Sanae Takaichi, and Shinjiro Koizumi—will participate in public debates and policy speeches over the next two weeks, with the final vote conducted according to the normal procedures allowing party member participation.

Clear Divergence in Candidates' Policy Positions

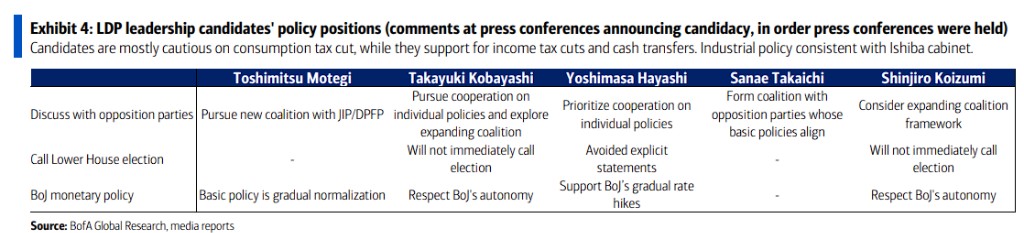

According to the candidate policy comparison compiled by Bank of America Merrill Lynch, the five candidates generally hold a cautious attitude towards the issue of reducing the consumption tax.

Eagle Kobayashi is the only candidate who views a reduction in the consumption tax as an option, while Sanae Takaichi, who previously advocated for the elimination of the food consumption tax, now states that reducing the consumption tax will not bring immediate benefits.

In terms of income tax and cash transfer payments, the candidates' positions have diverged. Eagle Kobayashi, Sanae Takaichi, and Shinjiro Koizumi proposed lowering income tax, Toshimitsu Motegi called for the establishment of special local subsidies, and Yoshihiro Kawai suggested creating a universal credit program. All candidates support the abolition of the temporary gasoline tax, which is consistent with the agreement reached by the ruling and opposition parties.

In terms of industrial and energy policy, the candidates are largely in agreement, supporting industrial investment in growth areas such as artificial intelligence and semiconductors, restarting nuclear power plant energy policies, and strengthening Japan's defense capabilities. These policies are generally consistent with the "Basic Policy on Economic and Fiscal Management and Reform 2025" approved by the Ishiba Cabinet in June.

Regarding the Bank of Japan's monetary policy, Toshimitsu Motegi, Eagle Kobayashi, Yoshihiro Kawai, and Shinjiro Koizumi have all indirectly expressed support for gradual interest rate hikes. Notably, Sanae Takaichi, who opposed interest rate hikes in the 2024 presidential election, has not made a clear comment this time.

In terms of congressional operations, Bank of America Merrill Lynch pointed out that all candidates have indicated they will seek cooperation with opposition parties or expand the ruling coalition. Currently, no candidates have mentioned the possibility of dissolving the House of Representatives for an election in the near future.

In terms of congressional operations, Bank of America Merrill Lynch pointed out that all candidates have indicated they will seek cooperation with opposition parties or expand the ruling coalition. Currently, no candidates have mentioned the possibility of dissolving the House of Representatives for an election in the near future.

According to the Liberal Democratic Party's arrangements, multiple public debates and policy speeches will be held over the next two weeks. A joint press conference and a public debate hosted by the Liberal Democratic Party will take place on September 23, followed by a public debate hosted by the Japan National Press Club on September 24, and then policy speeches will be held in Tokyo, Nagoya, Osaka, and other locations. Voting by party members will end on October 3, with the official election taking place on October 4.

Market Impact: The Biggest Shock from a High City Sawa Win

Bank of America Merrill Lynch foreign exchange/rate strategist Shusuke Yamada analyzed that fixed income market participants are currently in a wait-and-see mode. The dollar-yen options market shows that the two-week ATM volatility, including the election, is below 9, lower than the three-month volatility. The strategist believes that the relatively calm market reaction is due to several reasons:

The lessons learned from last year's Liberal Democratic Party presidential election—after High City Sawa won the first round of voting, the yen weakened significantly, but after losing to Shigeru Ishiba in the decisive round, there was a correction; overseas investors realize that it is difficult to accurately predict election results due to the lack of information on the voting intentions of Liberal Democratic Party members; the degree of differentiation among candidates has decreased.

If High City Sawa wins, Bank of America Merrill Lynch expects it to trigger the largest market volatility. In terms of fiscal policy, although she may abandon her long-standing advocacy for a consumption tax cut, she continues to advocate prioritizing the debt-to-GDP ratio, believing that ignoring the fiscal discipline needed for economic growth is misguided. The market may be preparing for fiscal expansion.

Although she has not mentioned the Bank of Japan in this presidential election, the market still believes she leans towards an accommodative monetary policy. Bank of America Merrill Lynch believes that the potential market reaction to a High City Sawa victory would be a weaker yen and a steepening of the Japanese government bond yield curve.

Regarding the market impact of other candidates winning, Bank of America Merrill Lynch believes that Shinjiro Koizumi and Yoshifuru Hayashi may continue the continuity of Shigeru Ishiba's policies. While their victory may lead to a slight strengthening of the yen and a flattening of the yield curve, the lack of a change in outlook will result in a relatively mild market reaction.

Higashi Kobayashi is the only candidate who has not ruled out a consumption tax cut, and he has also expressed respect for the autonomy of the Bank of Japan. If he wins, Bank of America Merrill Lynch believes that the market's potential perception of a combination of aggressive fiscal policy and normalization of monetary policy could lead to a stronger yen and a bear steepening of the yield curve