Goldman Sachs urges investors: Don't fight the bull market amid the AI boom and the backdrop of Federal Reserve rate cuts

Goldman Sachs told investors that there is strong bullish momentum in the market against the backdrop of Federal Reserve rate cuts and the AI boom, recommending a prudent bullish strategy. With the S&P 500 Index and MSCI Global Index repeatedly hitting new highs, Wall Street analysts are generally optimistic, expecting the S&P 500 Index to rise to 7,000 points by the end of the year or early next year. Goldman Sachs believes that market performance during the rate-cutting cycle is favorable, with corporate profit growth and enthusiasm for AI driving a strong rise in U.S. stocks

According to the Zhitong Finance APP, Tony Pasquariello, head of the hedge fund business at Wall Street financial giant Goldman Sachs, recently released a research report stating that as the benchmark U.S. stock index—the S&P 500 index—and the global index benchmark—the MSCI global index—continue to soar to historical highs driven by large technology giants and AI leaders with significant weight, investors should not resist the unprecedented AI investment boom that dominates the hot global bull market. The market has stronger bullish momentum and should adopt a "responsible and prudent bullish strategy."

Goldman Sachs, known as the "flag bearer of the stock market bull market," has an investment attitude towards the U.S. stock market and global stock markets that is completely consistent with the recent shift to a "bullish stance" among Wall Street peers. With strong corporate earnings growth data and the market's renewed enthusiasm for artificial intelligence driving the U.S. stock market's strong rise since April, which has recently set multiple historical highs, top analysts from Wall Street are rushing to raise their year-end and next-year outlooks for the S&P 500 index.

Not only are bullish analysts continuously "tearing up research reports" to raise targets, but especially those analysts who have been bearish on U.S. stocks for a long time this year are also constantly "tearing up research reports"—that is, updating and raising their S&P 500 index target levels multiple times this year to keep pace with their peers' bullish expectations and the epic bull market of U.S. stocks.

Overall, these top analysts on Wall Street generally expect the overall earnings of S&P 500 index constituents and the investment returns of this benchmark index to expand in 2025 and 2026, with 7,000 points already becoming the "new anchor" for the S&P 500 index—most analysts predict that this index may significantly rise to around 7,000 points by the end of this year or early next year.

Goldman Sachs: The tone of the stock market remains bullish

Goldman Sachs hedge fund chief Pasquariello wrote that from a historical data perspective, when the Federal Reserve shifts to a rate-cutting cycle while economic growth remains resilient and the stock market is near record highs, market performance is very favorable. In a report to clients, Pasquariello wrote that under the catalysis of artificial intelligence, the main trend and tone of the global stock market remain upward.

"So, every investor should firmly hold onto the stocks you want to hold," he wrote, noting that he personally prefers the Nasdaq 100 index over the Russell 2000 index. He also advised investors to use the options market to manage tail risks.

The U.S. stock market has risen for three consecutive weeks, breaking the pessimistic view of seasonal weakness in September and ignoring growing concerns about U.S. macroeconomic indicators. A strategist from another Wall Street giant, Bank of America, stated last week that the unparalleled rise of large technology stocks over the past two years still has room for further strengthening, and investors should position themselves for more gains.

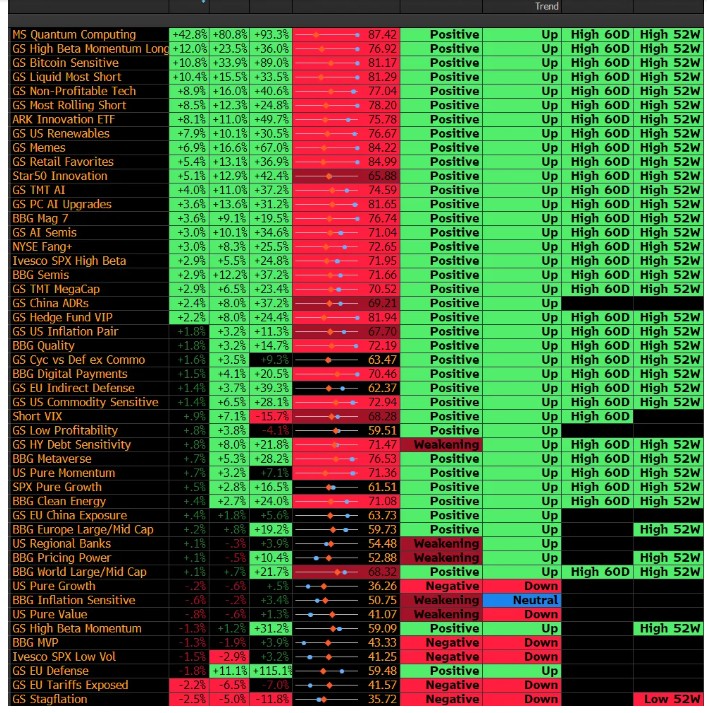

Although bullish sentiment pushed several global stock benchmark indices into overbought territory last week, as shown in the chart below, some of the riskiest investment corners in the market continue to show sustained strong upward momentum

Pasquariello stated that investors should neither fight against the current market bull market dominated by the AI investment craze nor become overly obsessed with chasing gains. "Investors are currently facing a relatively positive situation: on one hand, positions seem to be on the high side, while on the other hand, the upward momentum of tech stocks shows no signs of slowing down," said Pasquariello from Goldman Sachs.

"Do I like the current position setup and the tactical risk/reward? Honestly, I do not." He wrote. "That said, do I think you should stand in front of the 'super bull market freight train' of the U.S. mega-cap tech giants? I do not think so. Investors should not go against the trend of the large tech bull market."

Goldman Sachs' own major brokerage business data shows that while the total exposure of fundamental investors has increased, net exposure remains limited. This indicates that although hedge funds are actively trading for beta and alpha returns, they still show hesitation in chasing highs. Analysts believe that the main theme of the market in September is that investors have gradually accepted the "Goldilocks" economic narrative. The conclusion is that while bullish positions in the market have increased compared to a few weeks ago, "few are taking excessive risks," which means the market still has the capacity to absorb new funds.

Undoubtedly, the recent surge in global DRAM and NAND series storage product prices, along with Oracle's contract reserves of $455 billion that far exceeded market expectations, and the strong performance and future outlook announced by global AI ASIC chip "superpower" Broadcom last week have significantly reinforced the "long-term bull market narrative" for AI GPU, ASIC, and HBM and other AI computing infrastructure sectors. The AI computing demand driven by generative AI applications and AI agents at the inference end can be described as "starry seas," expected to drive the artificial intelligence computing infrastructure market to continue showing exponential growth. The "AI inference system" is also considered by Jensen Huang to be the largest source of future revenue for Nvidia.

It is under the epic stock price surge of large tech giants such as Nvidia, Meta, Google, Oracle, TSMC, and Broadcom, along with the continuously strong performance since the beginning of this year, that an unprecedented AI investment craze has swept through the U.S. stock market and global stock markets, driving the S&P 500 index and the global stock index benchmark—MSCI Global Index to significantly rise since April, recently setting new historical highs.

Wall Street shouts that the AI-driven bull market is far from over

Since the beginning of this year, the S&P 500 index has set more than 20 historical highs, rebounding over 30% since the April low. Driven by the unprecedented AI craze, U.S. stock investors have undoubtedly shown strong bullish resilience, but top analysts on Wall Street believe that this wave of gains is far from over In Goldman Sachs' latest market strategy report, the institution raised its expected return rates for the S&P 500 index over the next 6 and 12 months to 5% and 8%, respectively, which implies corresponding target levels of 7000 and 7200 points.

Binky Chadha, a stock market analyst from Deutsche Bank, recently raised his year-end target for the U.S. stock market benchmark index—the S&P 500—to 7,000 points, indicating an increase of over 7% from current levels. Analysts from Barclays also upgraded their forecasts, while a team of analysts from Wells Fargo, a major Wall Street firm, expects the U.S. stock market to continue its bullish momentum next year, predicting an 11% rise in the S&P 500 by the end of next year.

"There is a bubble, but as long as the tech giants' AI capital expenditures continue to expand, the bull market should persist," said Ohsung Kwon, the analyst who succeeded Christopher Harvey as the chief equity analyst at Wells Fargo after Harvey's departure in August.

Julian Emanuel, an analyst from the well-known Wall Street firm Evercore ISI, predicts that driven by the "once-in-a-generation" transformative change of artificial intelligence (AI) technology, the S&P 500 index will climb to 7750 points by the end of 2026, with an expected potential increase of about 20%.

Overall, Emanuel's long-term outlook is more optimistic, emphasizing that the proliferation of AI will drive both corporate earnings and valuations higher. Emanuel stated that during this process, a 10% or greater pullback in the S&P 500 index is possible, but he believes that such pullbacks represent good buying opportunities in the context of a structural bull market. This analyst's forecast for the bullish scenario in the U.S. stock market is even more aggressive: Emanuel predicts that if an "AI-driven asset bubble" occurs, the S&P 500 index could even rise to 9000 points