FOMO sweeps the entire market, and the speculative frenzy rolls towards traditional safe-haven assets!

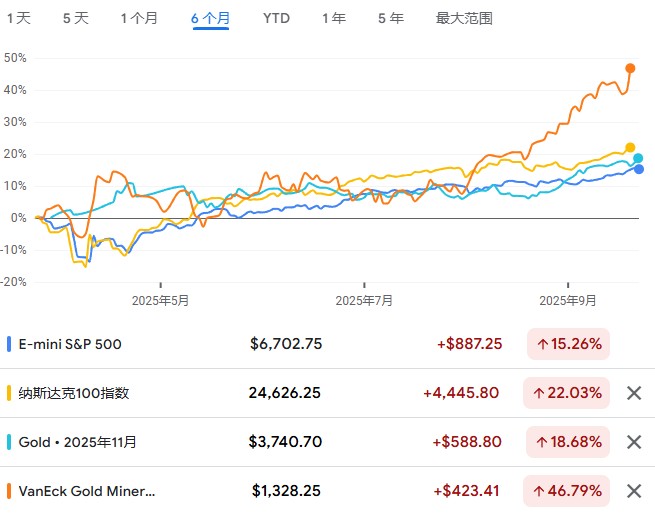

FOMO sentiment sweeps the market, and the speculative frenzy extends to traditional safe-haven assets like gold. The S&P 500, Nasdaq, gold, and gold mining stocks all surged simultaneously, indicating an unusual asset correlation and releasing dangerous signals. The Federal Reserve cut interest rates by 25 basis points to a range of 4.00%-4.25%, and the market's reaction was complex, with stock market volatility, a stronger dollar, and the 10-year U.S. Treasury yield rising to 4.07%. Gold reached an all-time high, and the gold mining ETF (GDX) soared nearly 100%, showing that speculative sentiment is permeating traditional defensive assets

When FOMO (fear of missing out) sentiment sweeps the market, the speculative frenzy is no longer limited to risk assets like tech stocks but has spread to traditional safe-haven assets such as gold and gold ETFs. The S&P 500, Nasdaq, gold, and gold mining stocks have surged simultaneously, and this unusual asset correlation is releasing dangerous signals.

Last week, the Federal Reserve cut interest rates by 25 basis points to a range of 4.00%-4.25%. This "risk management" measure aims to guard against a deterioration in the labor market, but the market's reaction has been complex. After sharp fluctuations during the trading session, the stock market closed mixed, the dollar strengthened, and the 10-year U.S. Treasury yield rose to around 4.07%.

What is most concerning is that historically, gold has served as a market pressure hedge, but now it is rising in tandem with stocks, tech stocks, and even Bitcoin. Gold has reached a historic high, and the gold mining ETF (GDX) has surged nearly 100% from its low. This "parabolic" rise pattern indicates that speculative sentiment has permeated traditional defensive assets.

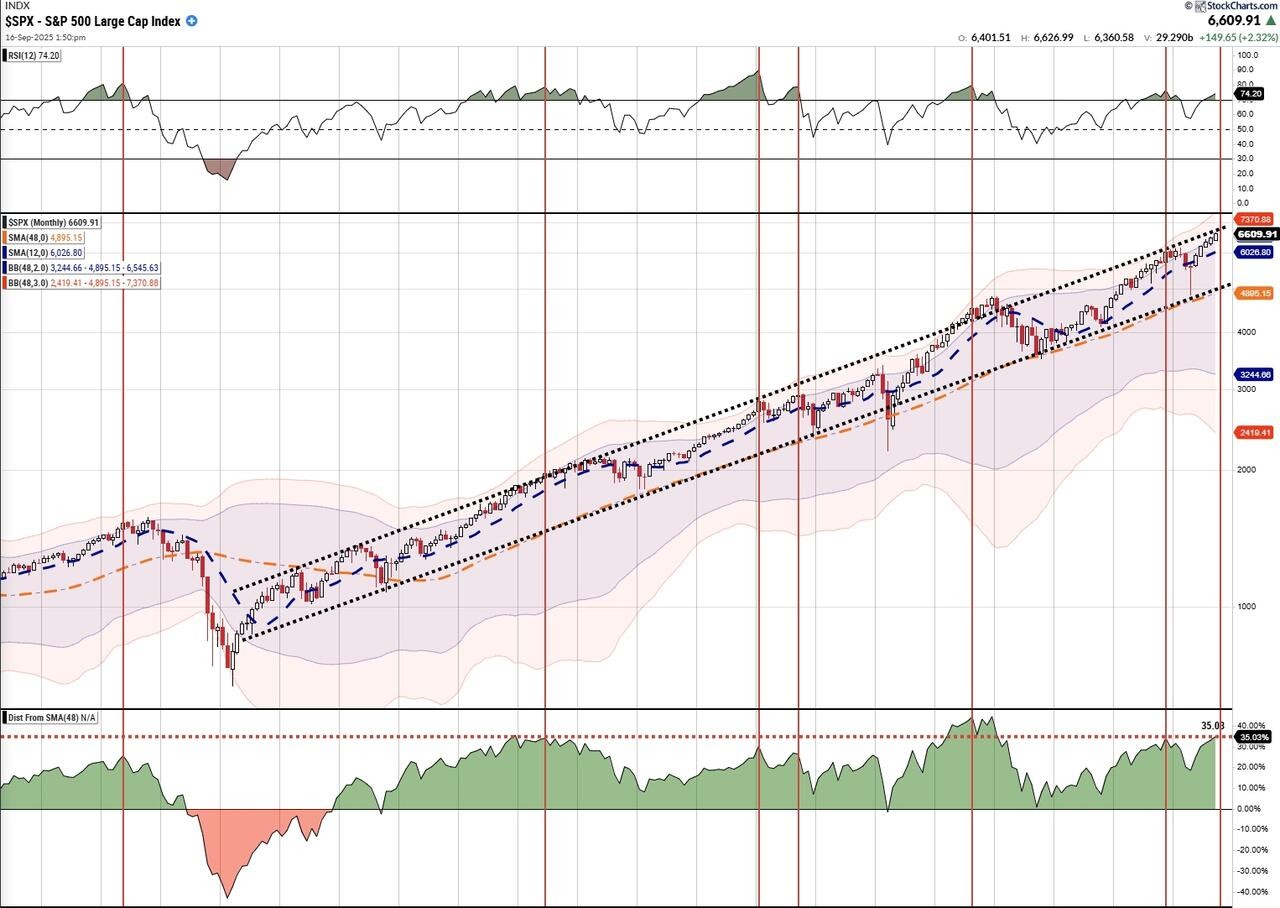

From a technical perspective, the S&P 500 index closed at 6,652 points, two standard deviations above the 50-day moving average, with market breadth continuing to deteriorate. When all assets are rising in a frenzied manner, it often signifies that risks are accumulating, and ultimately, some segment will collapse, leading to a significant drop.

Federal Reserve Rate Cut Sparks Market Divergence

The Federal Reserve delivered its first rate cut in 2025, lowering the federal funds rate target range by 25 basis points to 4.00%-4.25%. Unlike the previous two years focused on inflation, this statement emphasized that "the downside risks to employment have increased," marking a shift in policy focus towards employment objectives.

The market's reaction has been complex. Following the rate cut announcement, the stock market experienced sharp fluctuations, ultimately closing mixed. Bond yields initially fell and then rose, with the 10-year U.S. Treasury yield closing around 4.07%, and the dollar strengthening slightly. On Thursday, the stock market rebounded, buoyed by news that Nvidia would invest $5 billion in Intel to produce AI chips.

Principal analyst Seema Shah believes this move helps "lead the economy into a slowdown without overreacting," while AmeriVet analyst Gregory Faranello described it as "an orderly path to a neutral interest rate." However, the risk lies in cutting rates in an environment where inflation remains elevated, especially if tariff-related costs eventually materialize, which could push the Federal Reserve into a dilemma.

The market's cautious reaction and the strengthening dollar indicate that investors do not fully believe the Federal Reserve has found the right balance.

Technical Warning: FOMO Sentiment Drives Market to Extreme Overbought

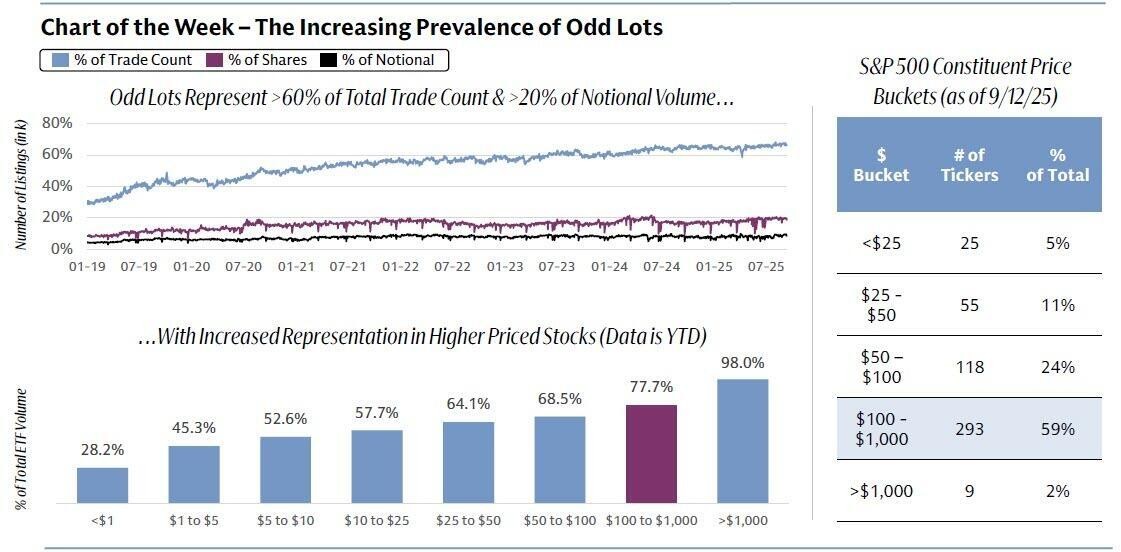

Technical indicators show clear signs of FOMO chasing, with the S&P 500 index continuously hitting historic highs, two standard deviations above the 50-day moving average. This extreme deviation usually signals short-term adjustment risks. According to the latest report from Goldman Sachs, the retail trading proxy indicator—trades of less than 100 shares—accounted for 66% of total U.S. stock trading volume in the third quarter, a significant increase from 31% in January 2019, representing over 20% of nominal trading volume. This phenomenon of retail investors flooding in precisely confirms the rising FOMO sentiment.

Volatility remains unusually low, with the VIX index trading around 15.6, at the bottom decile of recent history. Such low volatility supports a "buy the dip" mentality, but leaves very little room for error ahead of a large number of options expirations.

The continuous deterioration of market breadth has become a key concern. Although large tech stocks have driven the index higher, the negative divergence remains worrying. Historically, such divergences often signal the arrival of a short-term correction period.

AI Boom Fuels Valuation Bubble in Tech Stocks

The concept of artificial intelligence has once again become the market focus, with large tech stocks continuing to attract capital inflows. Leading AI companies like Nvidia and Microsoft reported strong performance in the second quarter, with market expectations being continuously revised upward. According to DataTrek data, Wall Street analysts have raised their earnings forecasts for the S&P 500 index to record levels for each quarter over the next year.

However, the valuations in the AI sector have been severely stretched, with the forward price-to-earnings ratios of related companies reaching extreme levels. Many companies are priced for perfection, and economic weakness, overstated demand, or margin compression could trigger a sharp repricing. The Global X Artificial Intelligence ETF (AIQ) shows signs of being overbought, comparable to levels before the sell-off in April.

From hedge funds and institutions to retail investors, everyone has increased their exposure to the same stocks, creating a "crowded trade" that leads to vulnerability. Once the story breaks, unwinding positions could happen very quickly. Additionally, governments around the world are beginning to address ethical, privacy, and security issues related to AI development, with regulatory risks rising but not yet priced in.

Gold's "Parabolic" Rise Sounds the Alarm for Speculation

The most striking speculative signal comes from the "parabolic" rise of gold and gold mining stocks. Historically, gold has been a tool for hedging market pressures, inflation, or currency devaluation, but this year it has risen in sync with stocks, tech stocks, and Bitcoin, a highly unusual correlation.

Gold has reached an all-time high, driven by central bank demand, geopolitical uncertainty, and a weakening dollar. Falling real yields and high inflation expectations support the gold trend. There is a high negative correlation between the dollar and gold prices; when the dollar falls, foreign central banks holding dollar reserves turn to gold to hedge currency risks The gains in gold mining stocks are even more aggressive. The VanEck Gold Miners ETF (GDX), which serves as a proxy for gold mining stocks, has surged nearly 100% from its lows, which is not typical behavior for a sector known for its volatility and operational risks. Historically, such extreme overbought conditions have often been closer to peaks in price increases.

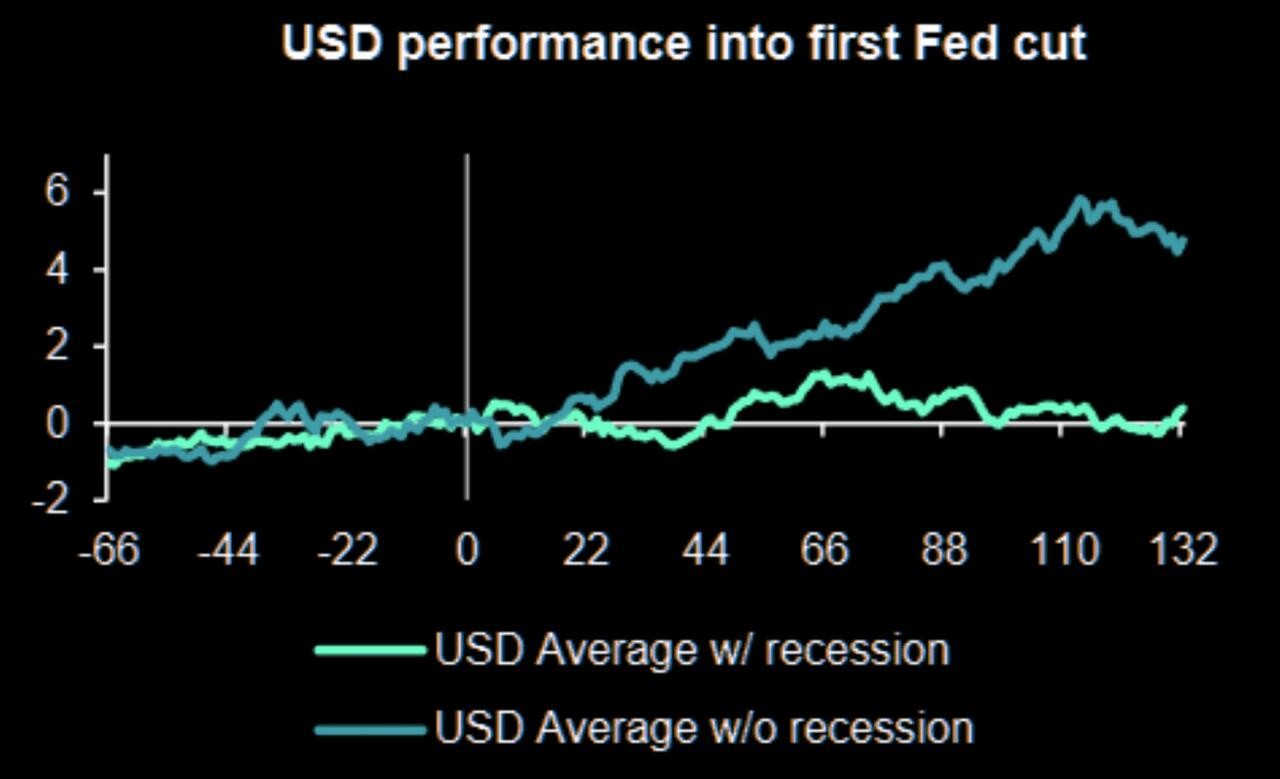

A broader concern is that gold and mining stocks are now behaving like momentum stocks. A reversal in the dollar could quickly dampen bullish sentiment, and given that the dollar is currently trading near fair value, this risk is rising. Historically, the dollar tends to rise after the Federal Reserve enters a rate-cutting cycle.

If risk appetite wanes, these assets may be sold off alongside stocks, leaving investors with almost no traditional portfolio hedging tools. The lesson the market provides is quite simple: when all assets are surging in sync and the market is euphoric, it often indicates that risks are accumulating, and eventually, some link may collapse, leading to a significant drop.

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk