Gold and silver are racing together! Gold prices hit a new record, and silver reaches a 14-year high

Driven by investors' rising expectations for interest rate cuts, gold and silver prices have surged significantly. The spot gold price reached a historic high of $3,728.26, while silver prices rose to $43.78, marking a 14-year high. The market is paying attention to speeches from Federal Reserve officials and key inflation data for policy clues. Major banks like Goldman Sachs are optimistic about the further upside potential for gold and silver, expecting gold prices to set new historical highs this week

According to Zhitong Finance APP, driven by investors' rising expectations for interest rate cuts, gold surged significantly on Monday, setting a new historical record. At the same time, silver also rose, with its year-to-date increase surpassing 50%. Currently, the market is closely watching the speeches of several Federal Reserve officials and key inflation data this week for policy clues.

Data shows that the spot gold price briefly reached a historical high of $3,728.26 during the trading session. As of the time of writing, the gold price rose by 1.10% to $3,726.66 per ounce. The price of U.S. gold futures for December delivery increased by 1.4% to $3,758.40.

On Monday, silver's rise was even more rapid than gold's, with the spot silver price increasing by 1.5% to $43.78 per ounce, marking a new high in over 14 years. In other precious metals, platinum prices rose by 0.8% to $1,415.09 per ounce, while palladium prices increased by 1.9% to $1,170.63 per ounce.

With the Federal Reserve easing its policies, major central banks increasing their reserves, and ongoing geopolitical tensions boosting safe-haven demand, gold and silver have become one of the best-performing commodities this year, supported by multiple favorable factors. Major banks like Goldman Sachs have clearly expressed optimism about their further upside potential.

Soni Kumari, a commodity strategist at ANZ Bank, pointed out: "The technical performance is strong, and market expectations for larger interest rate cuts are also rising. Silver has broken through the resistance level of $43 per ounce, and gold has strongly breached the $3,708 per ounce mark—this suggests that prices are likely to continue rising."

UBS analyst Giovanni Staunovo stated: "I expect gold prices to reach new historical highs this week, as Federal Reserve officials are likely to hint at further interest rate cuts; however, the pace and extent of the cuts will still depend on economic data."

Several Federal Reserve officials will speak this week, with Fed Chairman Jerome Powell scheduled to speak on Tuesday. Investors are closely monitoring these remarks for clues about the future direction of monetary policy. The market is also focused on the U.S. core Personal Consumption Expenditures (PCE) price data to be released on Friday, which will provide a basis for assessing the pace of further interest rate cuts.

Last Wednesday, the Federal Reserve implemented its first interest rate cut since December of last year, lowering rates by 25 basis points and signaling an openness to further easing policies.

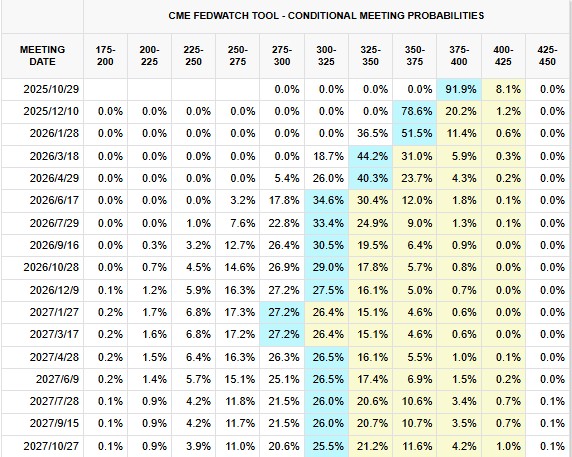

According to the CME FedWatch Tool, investors currently expect two more 25 basis point rate cuts this year, one in October and one in December, with probabilities of 92% and 79%, respectively.

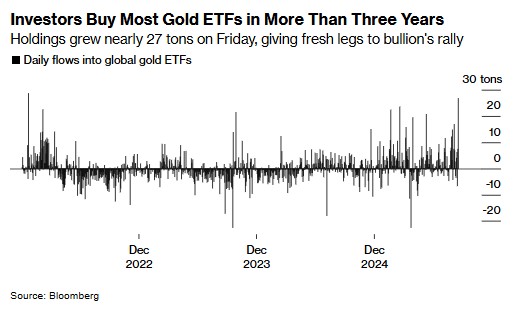

Staunovo noted: "The factors supporting gold prices are changing. Previously, it was mainly driven by central bank purchases and demand from Asian markets, but now, driven by expectations of declining U.S. interest rates, we are also starting to see Western investors intending to increase their gold holdings, which is evident from the changes in gold ETF holdings." Data from the compilation shows that last Friday, the inflow of funds into gold ETFs reached a three-year high, with prices rising by 0.9%, marking the largest single-day percentage increase since 2022. Since the beginning of this year, gold prices have risen by more than 40%.

Staunovo added: "We remain optimistic about the further upside potential for gold, expecting prices to reach $3,900 per ounce by mid-2026."