The market has underestimated the possibility of rising earnings in the U.S. stock market? Morgan Stanley: The Federal Reserve will have a "higher tolerance for inflation" next year

Morgan Stanley stated that positive operating leverage, declining compensation costs, and pent-up demand are driving earnings per share revisions to a positive outlook, indicating that concerns about an economic recession have passed. If the U.S. economy shifts to recovery next year, along with interest rate cuts by the Federal Reserve, U.S. stock corporate revenues and profit growth may exceed expectations

Morgan Stanley strategists believe that the market may have severely underestimated the prospects for earnings growth in U.S. stocks.

According to Wind Trading Desk, the latest strategy report from this investment bank points out that positive operating leverage, continuously declining wage costs, and pent-up demand are driving earnings per share revisions towards positivity, indicating that some concerns about an economic recession have passed. The current key issue is whether the Federal Reserve can shift its policy stance quickly enough to meet the market's expectations and needs for a new round of bull market continuation.

Morgan Stanley stated that the rolling recession (where some sectors are in recession while the overall economy maintains positive growth) has ended, and the U.S. economy is transitioning to an early cycle backdrop, with expected earnings growth to be stronger than anticipated. The historic re-acceleration of the breadth of earnings revisions (reaching +35% on a three-month change basis, occurring only in the early cycle context after a recession) confirms this shift.

The investment bank believes that the key investment logic is: the Federal Reserve will show a higher tolerance for inflation in 2026 while continuing to cut interest rates, and this "high-temperature operation" strategy will drive income and earnings growth far exceeding market expectations.

The report emphasizes that the rolling correlation between stock earnings and real yields has deeply turned negative, indicating that the stock market hopes for interest rate cuts to drive the yield curve downward. Investors should pay attention to bond volatility and the spread between SOFR and the federal funds rate as potential early warning signals for stock market adjustments.

The rolling recession has ended, and earnings revisions show signs of recovery

Morgan Stanley maintains its core view that weak macro and earnings data are a thing of the past, and the rolling recession has ended.

The bank points out several key indicators confirming the transition to an early cycle backdrop:

The breadth of earnings revisions has seen a historic re-acceleration, reaching +35% on a three-month change basis, a situation that only occurs in the early cycle context after a recession. The turning point in the breadth of earnings revisions and the recent strength of the Philadelphia Fed survey both point to upward potential for the ISM manufacturing PMI.

The return of positive operating leverage is driving the bank's non-PMI earnings model sharply upward. The median earnings growth per share of Russell 3000 index constituents has turned positive after experiencing long-term negative growth or stagnation, currently reaching +6%. The correlation between stocks and inflation expectations is significantly positive, which is a typical characteristic of the early cycle.

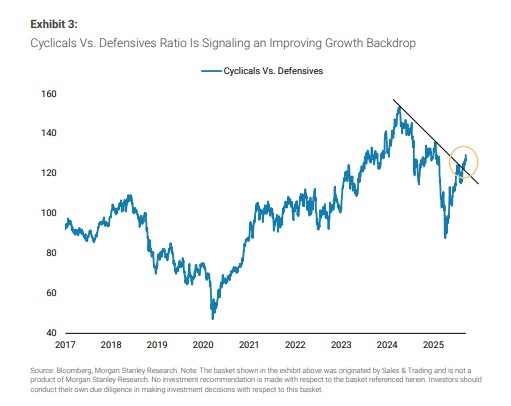

The ratio of cyclical stocks to defensive stocks has risen about 50% from the April low, breaking the downtrend that began in April 2024, and the internal structure of the market clearly signals a better growth backdrop ahead.

Key pillars of the early cycle: declining wage costs and pent-up demand

Morgan Stanley believes that the main variables of a typical early cycle setup include a general slowdown in operating expenses (especially wages), pent-up demand, and interest rate cuts by the Federal Reserve. Although this cycle is quite unique due to the post-pandemic economic nature and the return of inflation, it indeed possesses the elements of these variables The slowdown in wage costs or wage growth is crucial, as it is a major component of the cost structure for ordinary companies. Therefore, a more streamlined cost structure has led to positive operating leverage in the early cycle context. What is unique about this cycle is that the decline in the second derivative of wage growth has not been accompanied by a nonlinear rise in the unemployment rate.

On the contrary, the slowdown in wage growth has occurred alongside a sustained but more gradual weakening of other labor market indicators over the past few years, including the U.S. Chamber of Commerce employment ample/difficult-to-find job spread, temporary hiring, job vacancies and the Job Openings and Labor Turnover Survey (JOLTS), and the University of Michigan labor market sentiment.

The decline in the second derivative of wage growth began in 2023 and is now comparable to previous recessionary periods/early cycle transitions, laying the groundwork for a full return of positive operating leverage by 2026.

Additionally, Morgan Stanley noted that suppressed demand has become increasingly evident in the economic/market sectors that have struggled for growth over the past 3-4 years, including real estate, short-cycle industrial goods, consumer goods, transportation, and commodities. The Federal Reserve's decision to cut rates by 25 basis points at the September FOMC meeting also provides a key element of rate reduction for early cycle setup.

The Federal Reserve Will Increase Inflation Tolerance in 2026

As we enter the fourth quarter, market focus may shift from the tensions of the Federal Reserve's reaction function to expectations of the Federal Reserve being more tolerant of stubborn inflation in 2026. This is crucial, as inflation is often closely related to income growth.

Morgan Stanley pointed out that one reason for the recent weakness in income growth is the decline in inflation/pricing power. If the U.S. economy turns to recovery next year while the Federal Reserve cuts rates, corporate income and profit growth in the U.S. stock market could far exceed expectations.

The key is that the Federal Reserve will cut rates amid cyclical impulses, which is a typical early cycle characteristic— the Federal Reserve usually focuses on the lagging weakness in labor market data, while the stock market focuses on future improvements in profit revisions/pricing power.

Data shows a close correlation between the Producer Price Index and S&P 500 sales growth, with PPI leading by 4 months. This indicates that if inflation rises again but the Federal Reserve maintains an accommodative stance, corporate profits will receive a significant boost.

Historically, small-cap stocks have only outperformed the market after a recession when the Federal Reserve is ahead of the curve (defined as the federal funds rate being below the 2-year U.S. Treasury yield). Currently, there is still a gap of 65 basis points to achieve this goal. Small-cap stocks also tend to outperform when their relative earnings revision breadth is strong, but this condition has not yet emerged