Asian stock markets generally closed higher, gold and silver surged, while the cryptocurrency market plummeted

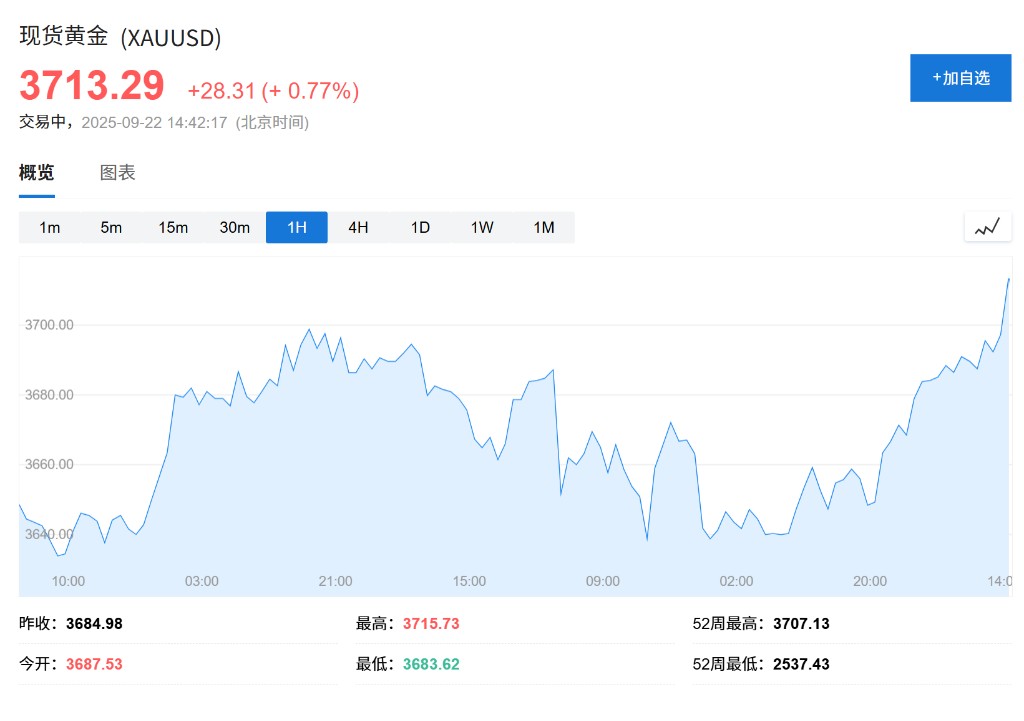

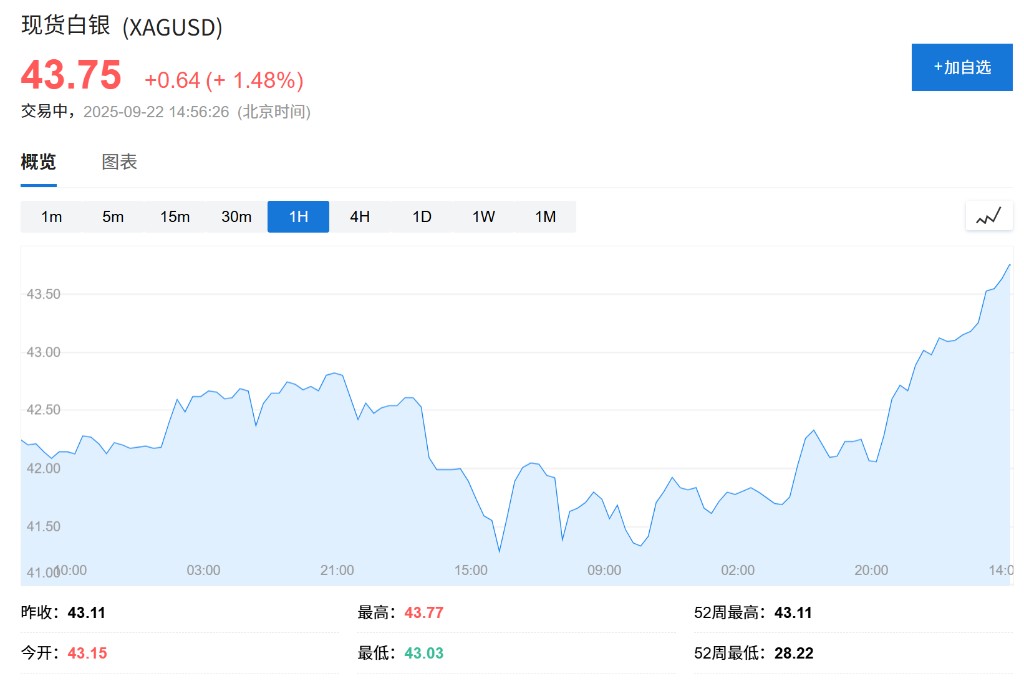

On Monday, spot gold continued its strong performance, rising by $5.96 per ounce within 5 minutes, reporting at $3,714.37 per ounce, reaching a new high. Spot silver increased by 1.48% to $43.75. Cryptocurrencies declined, with Bitcoin dropping over 2% in 24 hours. Asian stocks generally closed higher, and the yen weakened against the dollar, benefiting exporters who typically gain from this. The U.S. dollar index rose slightly by 0.1%, continuing its upward trend for the fourth consecutive day

Boosted by the rise in U.S. stocks and easing concerns over the Bank of Japan's policies, Asian stock markets generally rose on Monday. However, Trump's announcement of plans for a comprehensive reform of the H-1B visa program is bringing new uncertainties to the global tech industry and companies that rely on overseas talent.

On Monday, the 22nd, Asian stocks generally closed higher, mainly due to easing market concerns over the Bank of Japan selling off its massive ETF holdings. The yen weakened against the dollar. The dollar index rose slightly by 0.1%, continuing its upward trend for the fourth consecutive day. Spot gold maintained its strength, rising by $5.96 per ounce within 5 minutes, reporting $3,714.37 per ounce, reaching a new high.

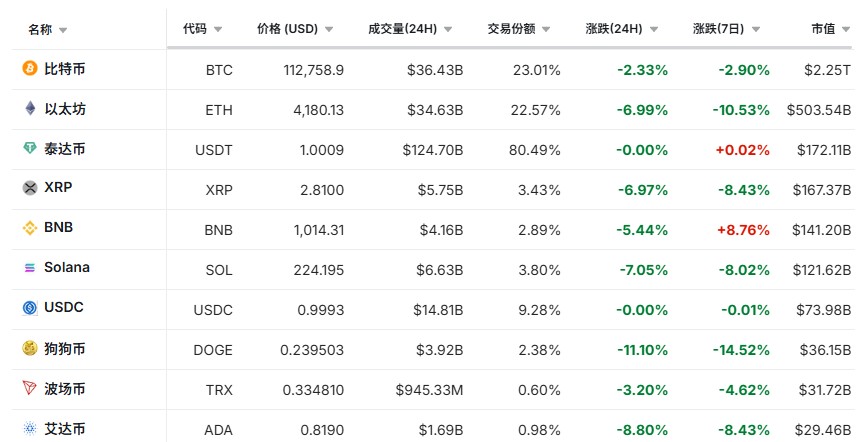

Cryptocurrencies declined, with Bitcoin falling over 2% in 24 hours, Ethereum dropping nearly 7%, Dogecoin down nearly 11%, and Cardano falling over 8% in 24 hours.

- The Nikkei 225 index closed up 1%, at 45,493.66 points. The Tokyo Stock Exchange index rose 0.5%, at 3,163.17 points. The Seoul Composite Index closed up 0.7%, at 3,468.65 points.

- The dollar spot index changed little. The euro exchange rate remained stable at $1.1736.

- The yen fell 0.2% against the dollar to 148.25.

- The yield on the 10-year U.S. Treasury bond rose by 1 basis point to 4.14%.

- Spot gold maintained its strength, rising by $5.96 per ounce within 5 minutes, reporting $3,714.37 per ounce, reaching a new high.

- Spot silver rose 1.48% to $43.75.

- West Texas Intermediate crude oil rose 0.8% to $63.16 per barrel.

- Cryptocurrencies declined, with Bitcoin falling over 2% in 24 hours, Ethereum dropping nearly 7%, Dogecoin down nearly 11%, and Cardano falling over 8% in 24 hours.

U.S. Stocks Reach New Highs Amid "Bubble" Discussion

On Monday, spot gold maintained its strength, rising by $5.96 per ounce within 5 minutes, reporting $3,714.37 per ounce, reaching a new high.

Spot silver rose 1.48% to $43.75.

Cryptocurrencies declined, with Bitcoin falling over 2% in 24 hours, Ethereum dropping nearly 7%, Dogecoin down nearly 11%, and Cardano falling over 8% in 24 hours.

Trump's domestic policy proposal has brought new turbulence to the market. Last Friday, he called for a comprehensive reform of the H-1B visa program, proposing to set the application fee at $100,000 This move may inject new uncertainty into the global market, particularly for U.S. companies that have long relied on the program to recruit skilled technical talent such as computer programmers, data analysts, and engineers, especially tech firms in California. The pressure is particularly evident in India and its $280 billion IT industry.

Despite the policy uncertainty, global stock markets are currently at record levels. Evercore ISI strategist Julian Emanuel stated in a report that "the discussion about 'bubbles' has officially entered the market dialogue," but "there is still a long way to go for a bubble." Evercore estimates the probability of a bubble scenario (i.e., the S&P 500 reaching 9,000 points by the end of 2026) at 25%, while its baseline scenario forecasts 7,750 points.

Bloomberg strategist Garfield Reynolds believes that, with market volatility remaining low and the Federal Reserve cutting interest rates, the clouds raised by visa issues are unlikely to hinder the U.S. stock market's march toward new highs. He analyzed that the profitability of tech companies appears sufficient to absorb any sudden spike in visa costs.

Market Focus on Japanese Political Situation and Federal Reserve Movements

This week, investors will also focus on key dynamics in Japan and the United States. On Monday, the election of leaders in Japan's ruling party officially kicked off, and the market is closely watching the results.

In the U.S., traders will analyze a series of economic data, including the inflation indicators favored by the Federal Reserve. Federal Reserve Chairman Jerome Powell is scheduled to speak on the economic outlook on Tuesday, having previously refuted market expectations for rapid interest rate cuts last week. In other markets, U.S. Treasury prices dipped slightly, with the 10-year Treasury yield rising by 1 basis point to 4.14%. Following a slight decline last week, oil prices rose by 0.6%, while silver climbed to its highest level since 2011.

Updating