This year's financing has exceeded 20 billion USD, the model has become a "red ocean," how much ammunition does the "digital currency treasury company" still have?

With the compression of premiums, liquidity pressure, and valuations falling below net asset value, the industry is shifting from explosive growth to internal competition. Most companies' stock prices have fallen below their net asset value, highlighting liquidity pressure, and the industry is facing consolidation. Leading enterprises are seeking survival through differentiated strategies, including locking up token investments and enhancing liquidity. Funds are beginning to shift towards new tracks such as DeFi, real-world assets, and stablecoins

Digital asset treasury companies are experiencing an unprecedented wave of financing this year. After attracting over $20 billion in massive funding, the industry is rapidly shifting from a "blue ocean" to a highly competitive "red ocean." As the stock prices of most treasury companies fall below their net asset values, liquidity pressures are emerging, and the curtain on industry consolidation may have already been raised.

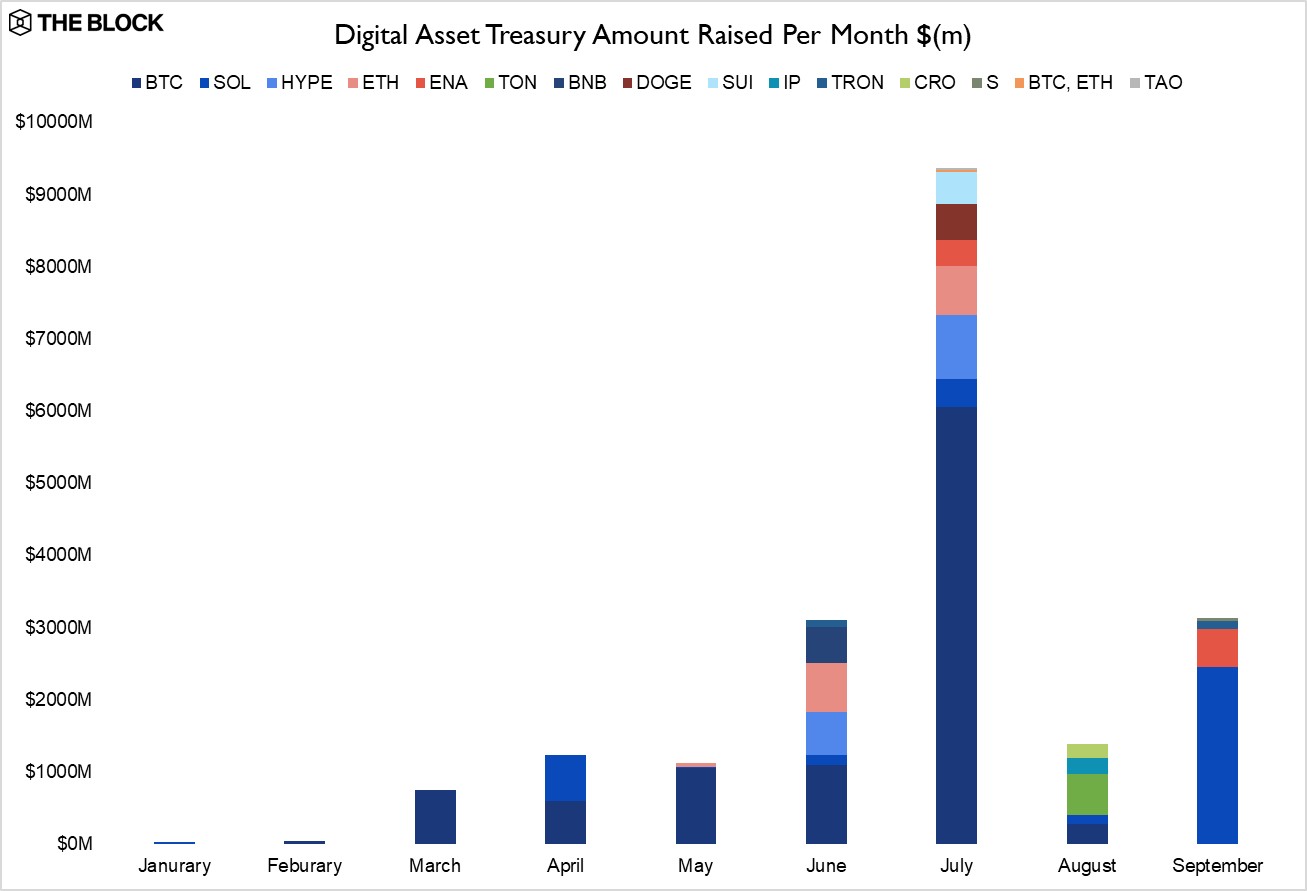

As the hottest sector in the cryptocurrency market this year, digital asset treasury companies (DAT) are witnessing an unprecedented wave of financing: According to the latest data released by The Block, DAT companies have raised over $20 billion so far in 2025, setting a historical record, with nearly $10 billion raised in just the month of July.

However, the latest market dynamics and signals indicate that the financing boom for DAT may have peaked, and premiums are being compressed. According to The Block's data, many DATs are trading at or even below their net asset value levels. Additionally, liquidity has become a pressure point for DATs.

As previously pointed out in an article by Jianwen: Coinbase's latest research report clearly states that the era of easy profits and guaranteed net asset value (NAV) premiums is over. The significant premiums enjoyed by pioneers like MicroStrategy are disappearing, as intensified competition, increased execution risks, and tightening regulatory constraints have led to a compression of net asset value multiples.

In the face of challenges, leading DAT companies are actively seeking differentiated strategies for survival, including enhancing liquidity, and funds are shifting towards new sectors. Analysts point out that as the DAT sector becomes saturated, capital is looking for the next opportunity, with renewed attention on decentralized finance (DeFi), real-world assets (RWA), and stablecoins.

Financing Boom Peaks, Premium Era Ends

The digital asset treasury model has seen explosive growth in 2025. According to data, the total financing amount for DAT companies has surpassed $20 billion this year. In just the month of July, the financing amount approached $10 billion, accounting for half of the total.

Additionally, as previously reported by Jianwen, data shows that 154 publicly listed companies in the United States have raised approximately $9.84 billion this year to purchase cryptocurrencies. However, the influx of capital has quickly led to intense competition. Coinbase's research director David Duong previously pointed out:

The market has entered a "player versus player" competition phase, and merely replicating MicroStrategy's script is no longer sufficient to guarantee success. The valuation premiums enjoyed by early entrants have been significantly compressed due to intensified competition, increased execution risks, and tightening regulatory constraints Cosmo Jiang, a general partner at Pantera Capital, stated, "The market will soon exit the initial formation phase of DAT and enter the execution, expansion, and possible integration phases."

For financing rounds of over $500 million to $1 billion, only a few companies with large market capitalizations and volatility characteristics can realistically raise such funds.

Michael Anderson, co-founder of Framework Ventures, pointed out, "For example, the Ethereum treasury company Bitmine may be able to do this, but for most companies, the pace of large financing may be difficult to sustain."

Net Asset Value Discount Becomes Common Phenomenon, Liquidity in Dilemma

As competition intensifies, two core issues are becoming severe tests for DAT companies: net asset value (NAV) discount and liquidity.

According to data from The Block's dashboard, many DATs are currently trading below their net asset value. Ray Hindi, co-founder of L1D AG, stated that the emergence of discounts is "inevitable" and predicted that the market will see consolidation by 2026.

Richard Galvin, executive chairman of Digital Asset Capital Management, agreed, believing that well-managed but undervalued DATs may become acquisition targets.

Michael Bucella, co-founder of Neoclassic Capital, noted that if stocks can be issued at a valuation of 1.25 times NAV while acquiring at 0.7 times NAV, it would immediately create a value-added effect. However, he warned that this strategy's premise is that the target tokens have high liquidity; otherwise, attempts to bridge the discount may trigger a "death spiral" of the assets.

Liquidity has also become a pressure point for treasury companies. Low trading volumes limit their ability to raise funds through at-the-market offerings or equity issuance, resulting in persistent discounts that make vulnerable companies easy targets for acquisition. Brian Rudick, chief strategy officer of Solana ecosystem DAT company Upexi, pointed out:

Low trading volumes limit the company's ability to raise funds through methods like "at-the-market offerings," otherwise it would impact its stock price.

He added that a DAT can only release 1% to 3% of its daily trading volume to the market without harming its stock price.

Differentiation for Survival: Seeking New Strategies in the "Red Ocean"

In the face of challenges, leading DAT companies are actively seeking differentiation strategies for survival.

Brian Rudick revealed that most of Upexi's portfolio consists of Solana tokens with lock-up periods, which were acquired at about a 15% discount, mainly from over-the-counter trading platforms like BitGo and some investors who purchased assets during the FTX bankruptcy process. These assets will unlock monthly until 2028 while still generating about 8% staking yield He explained, "Over time, a 15% discount will approach zero. If we convert this 15% discount into an equivalent yield, we can roughly double the staking yield."

Enhancing liquidity is another major direction. Samantha Bohbot, a partner at RockawayX, stated that establishing liquidity for DAT stocks requires the continuous development of the options market for their underlying assets.

As the options market deepens, market makers can perform delta hedging, creating a "virtuous cycle" where options and spot liquidity mutually promote each other.

However, investors like Richard Galvin believe that the long-term success of DAT depends more on the long-term development trajectory of its underlying tokens rather than short-term trading volume. Additionally, regulatory bodies such as Nasdaq are reportedly intensifying scrutiny of DAT, adding new variables to the field.

Funds shifting to new tracks, DeFi and stablecoins in focus

As the DAT space becomes increasingly crowded, the focus of venture capital has begun to shift.

Several investors have indicated that as the expectation of the Federal Reserve's interest rate cut cycle approaches, decentralized finance (DeFi) will regain momentum. Quynh Ho, head of venture capital at GSR, stated:

"The Federal Reserve's interest rate cuts will make DeFi yields look increasingly attractive, which should drive demand for high-yield RWA (real-world asset) products."

Stablecoins are another common theme. Other investors are also focusing on consumer applications within the ecosystem, late-stage financing for mature crypto businesses, and selective investments around tokens with strong fundamentals.

Overall, this paints a picture of a more rigorous venture capital market, emphasizing use cases with clear product-market fit and large addressable markets