Berkshire continues to increase its holdings in Japan's "five major trading companies," with Buffett becoming a "major shareholder."

Berkshire Hathaway, led by Warren Buffett, has increased its stake in Japan's Mitsui & Co. to over 10%, becoming a major shareholder. Previously, the company had also raised its holdings in another Japanese trading company, Mitsubishi Corporation, to the same level. Following the announcement, Mitsui & Co.'s stock price rose by 2.2% at one point, and the stock prices of several other large trading companies also generally increased

Warren Buffett is deepening his bet on Japan's major trading companies by increasing his stake in Mitsui & Co. to a "major shareholder" level.

According to a statement released by Mitsui & Co. on Monday, Berkshire Hathaway, led by Buffett, has raised its stake in the company (based on voting rights) to over 10%. The statement also noted that Berkshire may consider further increasing its holdings.

This move is seen as the latest signal of Buffett's confidence in the Japanese market. Previously, Berkshire had raised its stake in another major trading company, Mitsubishi Corporation, to above the 10% threshold.

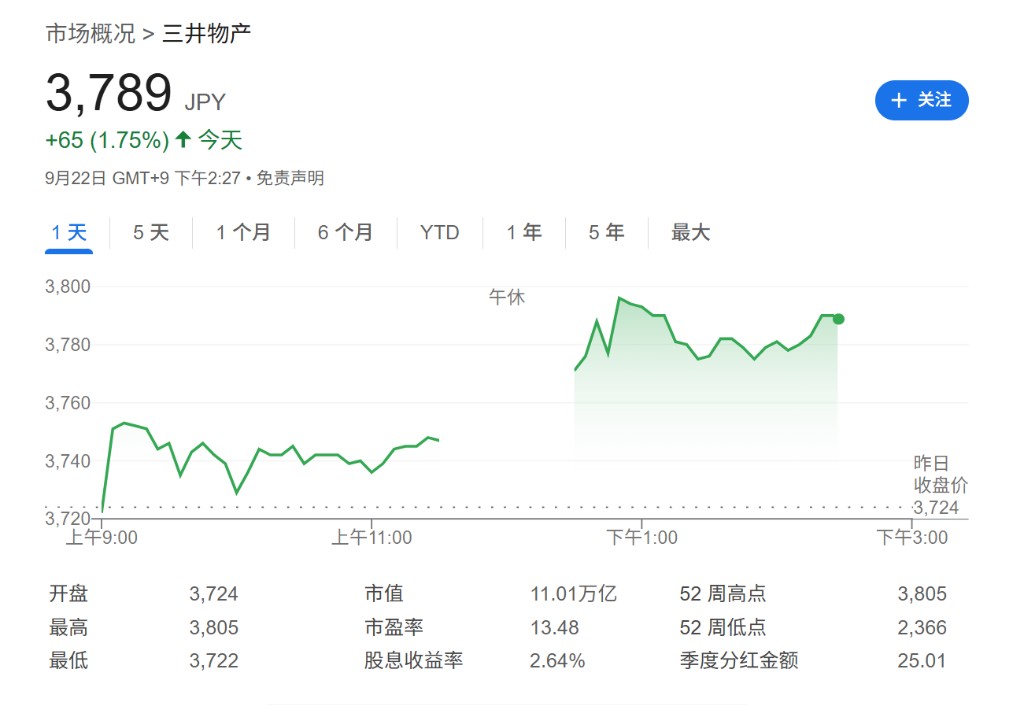

Following the announcement, the market reacted positively. Mitsui & Co.'s stock price further expanded its gains from the morning session, rising by as much as 2.2%, and has now retreated to 1.75%. The stock prices of several other major trading companies, including Mitsubishi Corporation, Itochu Corporation, Marubeni Corporation, and Sumitomo Corporation, also generally rose on Monday.

Investment Strategy Shift: Increase in Shareholding Limit

This increase in holdings marks a subtle shift in Berkshire's investment strategy. Buffett first disclosed his investments in Japan's top five trading companies (known as "sogo shosha") in 2020. According to Buffett's annual letter to investors released in February this year, Berkshire initially planned to keep its stake in these companies below 10%.

However, the letter mentioned that these Japanese companies have agreed to "moderately" relax this shareholding limit. This change has paved the way for Berkshire to now surpass the 10% threshold and become a "major shareholder," allowing it to participate more deeply in the future development of these Japanese business giants.

"The 'Oracle of Omaha' is buying more, which is a positive for Japanese trading company stocks," said Ryunosuke Shibata, an analyst at SBI Securities Co. Since Buffett's initial endorsement in 2020, the stock prices of these diversified companies (ranging from liquefied natural gas to salmon farming) have consistently outperformed the Tokyo Stock Exchange index.

Analysts believe that Buffett's continued investment highlights the unique business value of Japan's trading companies. The highly diversified business structures of these companies have shown greater resilience compared to their overseas counterparts during periods of significant commodity price fluctuations. Additionally, these companies have increasingly focused on shareholder returns in recent years, further enhancing their investment appeal