Goldman Sachs: As long as the U.S. economy does not go into recession, interest rate cuts will be beneficial for U.S. stocks

高盛認為,若美國經濟能避免衰退,美聯儲的降息週期將支撐股市。未來美股上漲動力將由盈利增長接替估值擴張。儘管股市已在高位,但投資者倉位偏低,提供了戰術性上漲空間。高盛上調標普 500 指數未來 12 個月目標至 7200 點,預計仍有約 8% 上漲潛力。

根據高盛的最新分析,美聯儲開啓的降息週期將為美國股市提供支撐,前提是美國經濟能夠成功規避衰退。

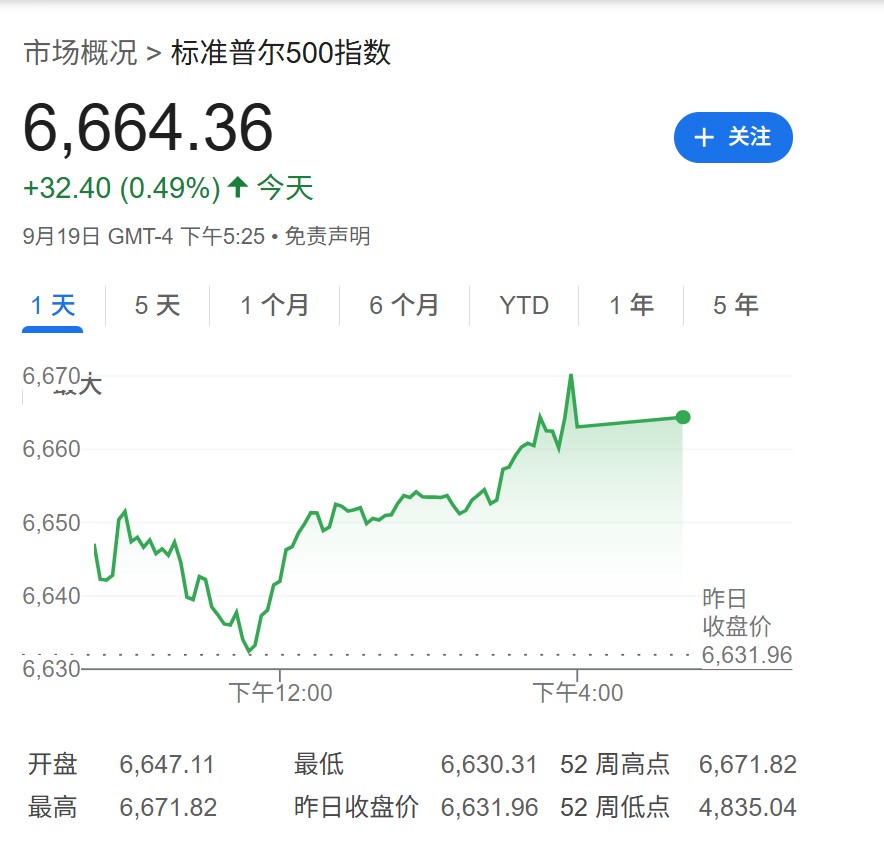

據追風交易台消息,本週,美聯儲實施了自 2024 年 12 月以來的首次降息,推動標普 500 指數週內上漲 1%,並創下年內第 27 個歷史新高。高盛經濟學家在最新研報中預計,美聯儲今年還將有兩次 25 個基點的降息,並在 2026 年再降息兩次,這一路徑與當前市場預期基本一致。

隨着市場已基本消化降息預期,高盛指出,利率對估值的提振作用或將減弱。今年以來,標普 500 指數 14% 的總回報中,盈利增長貢獻了 55%,而估值擴張貢獻了 37%。策略師預計,長期利率在明年將保持在當前水平附近,除非經濟前景惡化,否則進一步大幅下行的空間有限。

高盛認為,企業盈利將接替利率,成為驅動美股未來上漲的核心動力。同時,儘管股市屢創新高,但投資者倉位普遍偏低,這為市場在宏觀環境友好的情況下,提供了戰術性的上行空間。

盈利將接替估值,成為股市上漲主動力

高盛首席美股策略師 David J. Kostin 在一份報告中指出,隨着美聯儲的政策路徑基本被市場定價,股市的驅動邏輯正在發生轉變。他們預計,企業盈利將繼續成為股價的主要驅動因素。

報告數據顯示,標普 500 指數的遠期市盈率已從年初的 21.5 倍升至目前的 22.6 倍。高盛認為,雖然這一估值水平相對於歷史較高,但考慮到當前的宏觀經濟和企業基本面背景,其估值接近公允價值。

策略師判斷,寬鬆的美聯儲政策和預計在 2026 年加速的經濟增長,將支撐市場維持現有估值水平,從而讓盈利增長來推動美股的持續收益。高盛預測,標普 500 指數的每股收益(EPS)在 2025 年和 2026 年將分別增長 7%。

從歷史經驗看,一個避免了衰退的降息週期對股市而言是積極的。高盛回顧了過去 40 年的數據,發現在美聯儲暫停加息六個月以上後啓動降息的 8 次週期中,有一半最終經濟陷入衰退。

但在另外四次經濟持續增長的 “非衰退式降息” 週期中,標普 500 指數在降息後的 6 個月和 12 個月內,取得了 8% 和 15% 的中位數回報。從行業來看,在這些時期,信息技術和非必需消費品板塊表現最佳。從投資風格來看,高增長型股票的表現最為出色。

投資者倉位偏低,提供戰術性上行空間

儘管股市處於歷史高位,但高盛認為,投資者倉位仍是支撐股市短期上行的最有力論據。該行的情緒指標(Sentiment Indicator)目前讀數為-0.3,顯示股票投資者倉位仍然 “偏低”。

報告指出,在情緒指標的九個組成部分中,只有一個偏離了其 12 個月均值一個標準差以上。這種並不擁擠的倉位狀況意味着,如果宏觀背景保持穩定向好,仍有大量資金可能流入股市,從而帶來 “戰術性上行” 機會。

基於對市場的判斷,高盛調整了其投資建議。策略師們繼續推薦持有高比例浮動利率債務的公司。這類公司能從短期利率下降中獲得切實的盈利提振。據估算,債務成本每下降 100 個基點,這些公司的盈利將提升超過 5%。

與此同時,高盛提醒,近期部分利率敏感型股票的優異表現可能會減弱。例如,住宅建築商和生物科技等板塊,其近期漲勢主要受益於長期利率的下行。由於高盛預計長期利率下行空間有限,這些板塊的增長動能可能面臨消退。策略師認為,在對利率敏感的股票中,應優先選擇那些同時對經濟增長前景也較為敏感的類別,如中小型市值股票。

綜合以上分析,高盛策略師團隊更新了其對標普 500 指數的預測。他們將 3 個月、6 個月和 12 個月的目標點位分別上調至 6800 點、7000 點和 7200 點。這意味自當前水平,未來一年該指數仍有約 8% 的上漲潛力。