If You'd Invested $1,000 in Amazon 5 Years Ago, Here's How Much You'd Have Today

I'm PortAI, I can summarize articles.

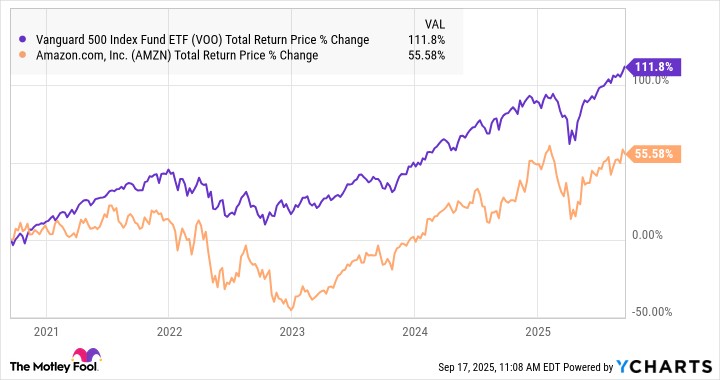

亞馬遜的股票在過去五年中上漲了約 56%,這意味着在 2020 年 9 月 17 日投資 1000 美元,現在的價值為 1560 美元。這一表現落後於標準普爾 500 指數,該指數在同一時期回報率為 112%。儘管如此,亞馬遜在 COVID-19 大流行期間的早期強勁表現為其整體收益做出了貢獻,自 2020 年初以來,其表現超過標準普爾 500 指數 26 個百分點

我不會粉飾事實:亞馬遜(AMZN 0.23%)在過去五年中的表現並不算最佳,這段時間的漲幅約為 56%。換句話説,五年前在亞馬遜投資 1000 美元——在 2020 年 9 月 17 日——今天的價值為 1560 美元。

這遠低於 標準普爾 500 指數(^GSPC 0.49%),後者在過去五年中實現了 112% 的總回報。那麼,為什麼亞馬遜的收益不到簡單的標準普爾 500 指數基金的一半呢?

圖片來源:Getty Images。

為什麼亞馬遜表現不佳?

讓我們明確一點:並不是説亞馬遜的表現很差。在你評判過去五年的表現之前,重要的是要將這個時間框架放在上下文中考慮。

VOO 總回報價格數據來自 YCharts

具體來説,五年前的 2020 年 9 月中旬,世界基本上仍因 COVID-19 疫情而處於封鎖狀態。因此,電子商務需求極其強勁。事實上,從 2020 年初到 9 月中旬,亞馬遜的漲幅已經達到 63%,而標準普爾 500 指數的總回報僅為 5%。換句話説,在過去五年中,亞馬遜的起點已經是強勁的表現。

實際上,如果我們從 2020 年初到今天來看亞馬遜與標準普爾 500 指數的表現,亞馬遜實際上領先約 26 個百分點。