The historical high point is "stepped on," and all assets are rising!

Under the dual catalysts of the Federal Reserve's policy shift and the AI investment narrative, a comprehensive bull market sweeping across major asset classes such as global stocks and credit bonds is unfolding. Its breadth is the widest since 2021: major global stock indices are hitting new highs, and U.S. credit spreads have narrowed to their lowest level since 1998, with the market almost pricing in a "perfect" scenario

With the strong push from the Federal Reserve's interest rate cuts and the AI boom, the global financial markets are experiencing the broadest cross-asset surge since the speculative frenzy of 2021.

From stocks to credit, prices of various risk assets are being pushed to historical highs, with market optimism almost without any blind spots.

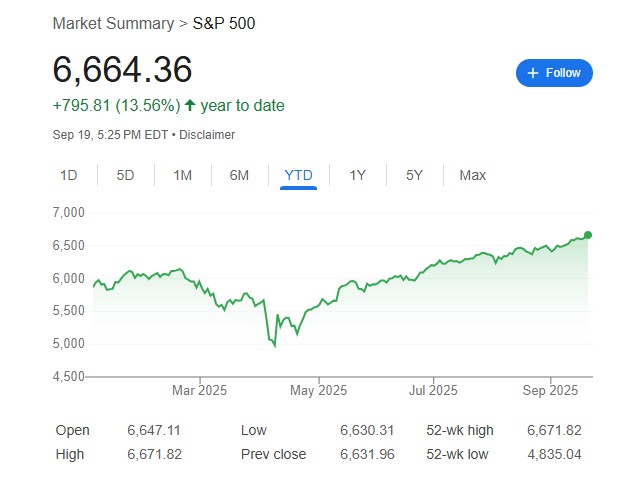

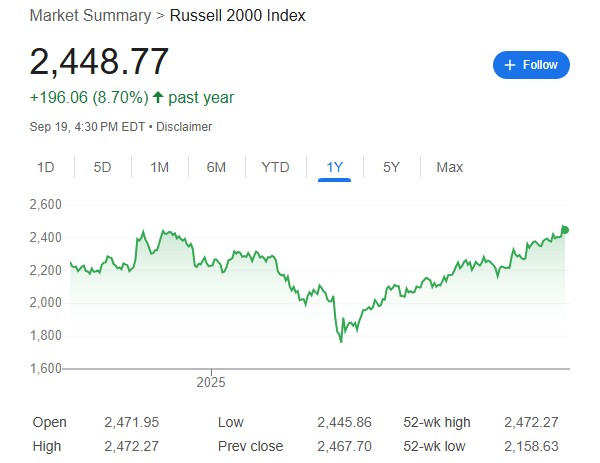

In the U.S. market, the blue-chip S&P 500 index and the tech-dominated NASDAQ Composite Index both hit historical highs this week, with year-to-date gains of 14% and 17%, respectively. After the Federal Reserve's interest rate cuts, the Russell 2000 index, which is primarily composed of small-cap stocks, also broke through the high point of November 2024.

This wave has already globalized, with the MSCI All Country World Index, which tracks developed and emerging markets worldwide, also reaching historical highs. Emerging market stocks have even outperformed global stock indices this year, becoming a clear signal of investors' sharply increasing risk appetite.

The credit bond market is also playing out an optimistic trend simultaneously. The credit spread, which measures the borrowing costs of high-rated U.S. companies relative to government bonds, has narrowed to below 0.8 percentage points, marking the lowest level since 1998.

Jamie Patton, co-head of global rates at asset management firm TCW, commented on this:

“It can be said that the return you get for taking on risk has never been so low.”

This phenomenon has even spread to Europe, where the borrowing costs of some French companies are now lower than those of their sovereign government, indicating that investors no longer require extra compensation for corporate credit risk.

Ben Inker, co-head of asset allocation at asset management firm GMO, attributes this to the "fear of missing out" (FOMO) sentiment, believing that the extremely narrowed credit spreads are the "most perplexing" part of this rebound:

“I just don’t understand why (investors) are unwilling to believe that the direction of the economy is actually going to be very unstable.”

The Dual Narrative of AI Frenzy and the Federal Reserve's "Liquidity"

Wall Street has constructed a powerful narrative for this seemingly fundamentals-detached surge—“The Great Resilience Trade.”

Its logical pillars are: resilient consumers, the real occurrence of the AI revolution, and the White House's easing stance on tariff issues. This narrative is simultaneously rewarding bold speculators and benefiting balanced investment portfolios. Among them, the fervent bet on artificial intelligence is the core engine.

This wave has been described by investment firm GQG Partners as a "steroid-fueled internet bubble," warning investors that they seem to be making a one-way bet while ignoring fundamental issues such as high price-to-earnings ratios, slowing revenue growth, and the enormous investment needs of AI giants themselves.

However, bulls believe that unlike the internet bubble of the 1990s, today's tech giants can use their free cash flow to support massive AI expenditures.

Ellen Hazen, Chief Market Strategist at F.L. Putnam Investment Management, believes:

"This trend has strong momentum, and when we see accelerated earnings next year, it will be very convincing."

If AI is a long-term belief, then the Federal Reserve's policy shift is the most direct fuel.

This week's interest rate cut aims to cushion the weak labor market, but the market interprets it as the beginning of a new round of easing, with the temptation of lower funding costs completely overshadowing concerns about the reasons for economic downturn.

Following the announcement of the rate cut, global stock markets recorded the largest single-week capital inflow since 2025. The futures market has even priced in expectations of at least four rate cuts next year.

Matt Miskin, a strategist at Manulife John Hancock Investments, summarized:

"When economic growth is good enough and the Federal Reserve intends to cut rates, the stock market reaches its ideal state."

Ignored Risks and Defensive Moves by the Minority

Amid the revelry, some investors see risks.

Kasper Elmgreen, Chief Investment Officer at Nordea Asset Management, warned that the market is simultaneously facing "extremely high geopolitical risks, a slowdown in the U.S. job market, inflation that is not fully under control, and extreme and historic market concentration," emphasizing that "current valuations leave little room for error."

Neel Kashkari, President of the Minneapolis Federal Reserve, also publicly stated that while the labor market is slowing, risk markets appear "overly prosperous," warning that "any new signs of economic weakness could burst this prosperity."

Against this backdrop, a minority of teams have begun defensive positioning.

Brij Khurana, a portfolio manager at Wellington Management, clearly stated that the market's expectations for Federal Reserve rate cuts are overly optimistic, and there is little value left in the credit market, with his team's positions being "more defensive than in recent times."

Khurana is not the only one with doubts. Beneath the surface of market prosperity, cautious signs have emerged: short positions in the iShares Russell 2000 Index ETF have climbed to nearly a two-year high, and so-called "safe-haven tools" linked to gold and cash have attracted inflows for four consecutive weeks.

Nevertheless, bulls still seem to hold the upper hand.

A popular view is that the lingering skepticism in the market itself is precisely the "unburned fuel" reserved for the next stage of the rally Raphael Thuin, the Head of Capital Markets Strategy at Tikehau Capital, has a representative viewpoint:

"I would say people are buyers, but they are reluctant buyers. There will be more rate cuts in the future, and the general consensus is to not go against the Federal Reserve."