After the Federal Reserve cuts interest rates, investors' next focus: Can a recession be avoided?

After the Federal Reserve cut interest rates, investors are focused on whether the U.S. economy can avoid a recession. The market expects more rate cuts in the future, although the impact of rate cuts on the stock market remains to be seen. A Bank of America survey shows that 67% of fund managers expect an economic "soft landing," while historical data indicates that the stock market performs better when rate cuts are not immediately followed by a recession. Analysts believe that the current interest rate cut cycle is different from previous ones, and the overall economy is still "basically acceptable."

With the Federal Reserve's anticipated interest rate cut, investors' focus has shifted, and the next core question is: Is the U.S. economy resilient enough to support the stock market's continued rise after reaching record highs?

Powell has successfully united a deeply divided policy-making committee, leading to Wednesday's rate cut decision. The market expects that the Federal Reserve may not be finished with its rate-cutting cycle, with three more cuts anticipated before March next year. Nevertheless, a decrease in borrowing costs does not always immediately boost stock prices, and its positive effects in the coming months remain to be seen.

Analysts believe that the sustainability of the positive effects of rate cuts hinges on whether investors believe the economy can avoid a recession.

A Bank of America fund manager survey released this week showed that 67% of respondents expect an economic "soft landing," 18% expect "no landing," and only 10% anticipate a recession. This optimistic sentiment supports the stock market but also means that any unexpected deterioration in economic data could trigger a market adjustment.

Historical Experience: Stock Market Performs Better Without Recession

A report led by Beata Manthey from Citigroup's strategist team pointed out:

"Historically, Federal Reserve rate cuts have been a tailwind for global/European stock markets and a catalyst for 'broadening' market performance. Stocks have averaged even better performance when rate cuts are not followed closely by economic recessions."

Research by Barclays strategist Emmanuel Cau shows that in the past seven instances where the Federal Reserve restarted rate cuts after a long pause, four were closely followed by economic recessions and stock market declines, while three were accompanied by continued economic expansion and further stock market gains. "We believe a recession will not occur, and the stock market clearly shares the same view," Cau stated.

The strategist expects European stocks to outperform the market as investors broaden their investment scope. In cases like those in 1984, 1995, and 1998, where Federal Reserve rate cuts were not followed by U.S. economic recessions, European stocks typically performed better both absolutely and relative to the U.S.

The context of this rate-cutting cycle is different from previous ones. Over the past two decades, aggressive rate cuts have often been emergency measures taken in response to economic weakness. This time, although the U.S. labor market has begun to weaken, the overall economy is "basically okay."

The Bank of America fund manager survey released this week shows that as many as 67% of respondents expect the economy to achieve a "soft landing," 18% expect "no landing," and only 10% are prepared for an economic recession. This optimistic sentiment is also a significant reason driving the stock market to record highs.

Short-Term Outlook in Doubt, Market Breadth Raises Concerns

However, some market participants are cautious about the short-term outlook and have raised questions about the health of the market's rise.

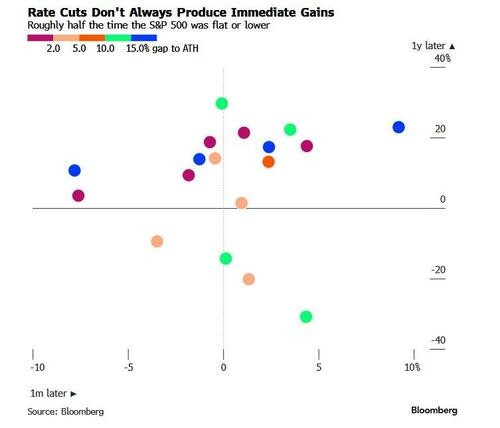

First, the short-term effects of rate cuts are debatable. Historical data from the S&P 500 index shows that one month after the first rate cut following a long pause, the benchmark index has performed flat or declined in about half of the cases. However, from a one-year perspective, the situation appears more optimistic Goldman Sachs trader Bobby Molavi expressed concerns about this. He pointed out that the benefits of the Federal Reserve's easing policy have actually been digested by the stock market since August:

"What is driving the next round of increases? Investors are already long, CTA funds are long, and retail investors are also long, but stock buybacks are slowing down, and valuations are no longer cheap."

Molavi also warned that investors are continuously focused on a few "winners," such as the "Seven Tech Giants," mega-cap stocks, and leaders in the artificial intelligence sector, while other parts of the market seem to be stagnating or even losing attention.

Strategists Call for "Expansion" of Investment Landscape

In the face of uncertainty in the U.S. market outlook and highly concentrated risks, some strategists suggest that investors look towards broader areas.

The strategist team at Société Générale, led by Alain Bokobza, stated, "History shows that a more dovish Federal Reserve will clearly boost global stock markets, not just the U.S. market." They continue to advocate for "expansion" in investments and point out that the market performance in 2025 has already proven that, when measured in common currency, non-U.S. stocks can perform comparably to U.S. stocks, or even better.

Citigroup's strategists also expect that as investors expand their risk exposure, European stock markets will outperform the U.S. This view aligns with historical patterns, where European stock markets often outperform in absolute and relative terms during periods when the Federal Reserve cuts interest rates without an economic recession.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk