Is the logic of the U.S. stock market bull market still solid? Earnings guidance is steadily being raised, and the earnings season is expected to continue to capitalize on the "expectation gap."

The logic of the bull market in the U.S. stock market remains solid. With the increase in earnings expectations, the market performance has already absorbed tariff risks. Among the S&P 500 constituent companies, 22% are expected to exceed analyst expectations, reaching a one-year high. The outlook for corporate earnings has improved, with analysts forecasting a 6.9% growth in earnings for the third quarter. Companies like 3M and Expedia have raised their earnings expectations, indicating an increased market confidence in companies' ability to withstand the impact of tariffs

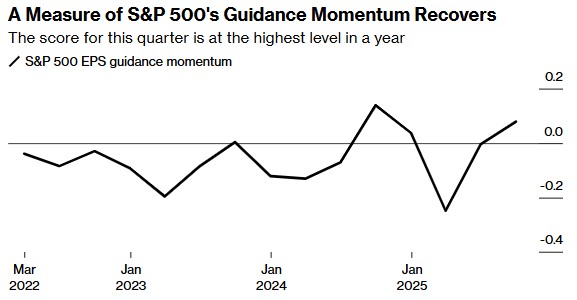

According to the Zhitong Finance APP, the U.S. stock market is currently at historical highs, with a new earnings season approaching, and the improvement in expectations for U.S. corporate profit growth suggests that the stock market rally is likely to continue. Among the S&P 500 index constituent companies that provided guidance for third-quarter performance, more than 22% expect to exceed analysts' expectations, the highest level in a year. Additionally, the proportion of companies issuing profit guidance below expectations is also at its lowest in four years.

The improvement in corporate earnings prospects is in stark contrast to the previous expectations of many Wall Street professionals, who anticipated that conditions would worsen as the first round of tariffs implemented by Trump began to take effect.

Sam Stovall, Chief Investment Strategist at CFRA, stated, "People have been making a fuss about tariffs, but that 'wolf' has yet to appear. The real question is whether this 'wolf' is delayed or has already been eliminated? It seems that companies have absorbed most of the tariff costs."

Wall Street analysts expect that the earnings of S&P 500 index constituent companies will grow by 6.9% in the third quarter, up from 6.7% at the end of May. Data indicates that this increase in optimism reflects growing confidence in the ability of these companies to withstand the impact of Trump's tariffs.

Among the most optimistic companies, 3M (MMM.US) raised its earnings expectations and stated that it has taken measures to reduce tariff-related costs, including production relocation and price adjustments. Meanwhile, Expedia (EXPE.US) raised its full-year expectations based on strong consumer demand growth. Just last week, Oracle (ORCL.US) made a strong forecast for its cloud infrastructure business, causing its stock price to soar to its best performance in the market since 1992.

Corporate Earnings Guidance is Cautious

Investors will make judgments based on this data in advance, as corporate earnings expectations are often conservative, even when profits are rising. CFRA data shows that in the past 65 quarters, actual performance exceeded expectations in 63 quarters. According to CFRA, the gap between actual performance and expectations in the last quarter was 7.1 percentage points, while the median of the average beat over the past 65 quarters was 4.8 percentage points.

There are also other favorable factors driving profit growth, such as the Federal Reserve's impending new round of interest rate cuts. With the economy remaining strong, lower borrowing costs are expected to help improve U.S. corporate profit margins, thereby impacting their performance.

Stovall stated, "Although U.S. Treasury yields have declined, the U.S. GDP remains relatively stable, so we can still see continued growth in corporate earnings." The impact of lower interest rates typically becomes apparent gradually, with stock prices rising more in the second year of an interest rate cut cycle than in the first year. Assuming no economic recession occurs, according to data from JP Morgan's U.S. Equity Research team, the S&P 500 index averages an increase of nearly 27% in the second year of rate cuts, compared to a 14% increase in the first year.

A team led by JP Morgan analyst Ken Goldman wrote in a report to clients on Thursday that lower interest rates have historically provided significant support for earnings, as they promote activities such as consumer spending, capital investment, mergers and acquisitions, and stock buybacks.

Historically, in the second year of an interest rate cut cycle, 10 out of the 11 sectors of the S&P 500 have seen gains, with the technology and financial sectors performing the best. According to CFRA data. This time, capital equipment, transportation, and building materials companies are seen as the biggest beneficiaries. Additionally, JP Morgan states that the automotive, clean energy, utilities, real estate, and technology sectors also have further room for growth.

Analysts wrote, "Most industries are expected to receive broad support for stock valuations, especially those with high debt leverage, sensitivity to interest rates, or capital-intensive business models."