Bank of America: The "Seven Giants" of the U.S. stock market are still in a bubble! The upside potential has not yet been exhausted

美国银行策略师表示,美国大型科技股泡沫仍有扩张空间,投资者应为更多上涨做好准备。研究显示,过去股市泡沫从低点到峰值的平均涨幅为 244%。目前 “七巨头” 股票组合的市盈率为 39 倍,较 200 日移动均线高出 20%,显示出进一步上涨的潜力。积极的宏观经济背景和对美联储降息的预期也为科技板块提供支持。

智通财经 APP 获悉,美国银行策略师表示,美国大型科技股在过去两年中形成的泡沫仍有进一步扩张空间,投资者应当为更多上涨做好准备。以 Michael Hartnett 为首的美国银行策略师团队研究了上世纪以来的 10 次股市泡沫,发现这些极端高估值时期从低点到峰值的平均涨幅为 244%。这意味着,自 2023 年 3 月低点以来上涨了 223% 的所谓 “七巨头”(Magnificent Seven) 股票组合 “还有进一步上行空间”。

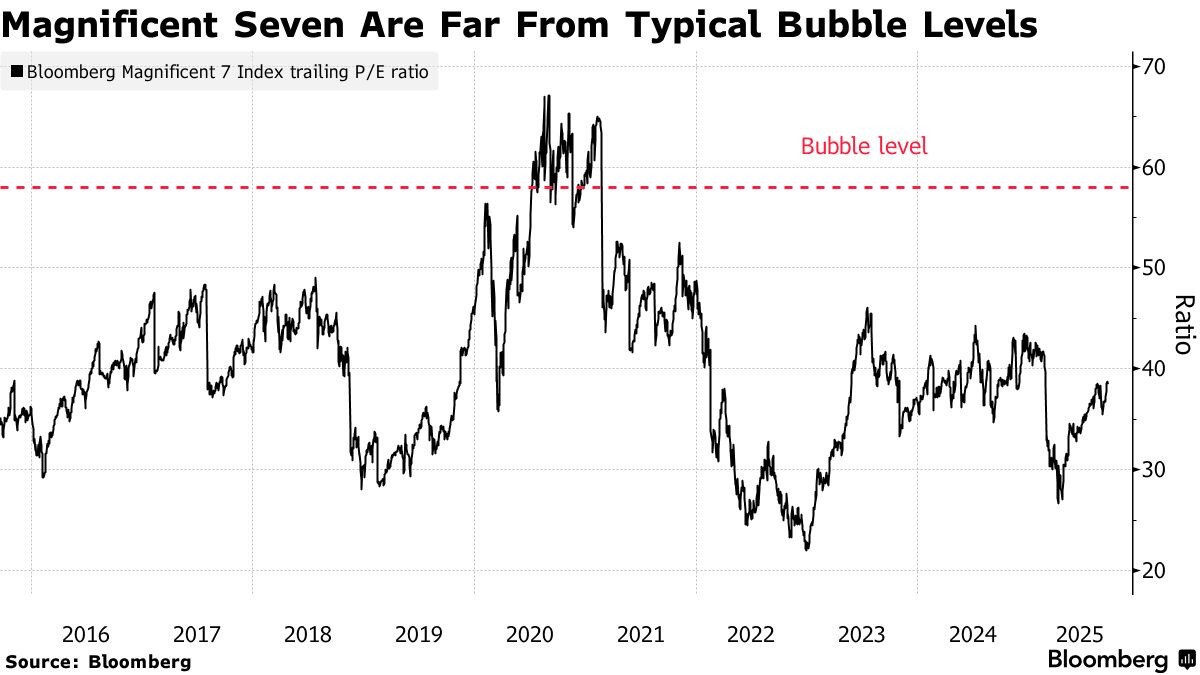

美银策略师表示,目前的估值也支持该股票组合进一步上涨的观点。过去的股市泡沫通常在市盈率达到 58 倍时结束,当时这些股票的基准水平较其 200 日移动均线高出 29%。而目前这七只股票——特斯拉 (TSLA.US)、Alphabet(GOOGL.US)、苹果 (AAPL.US)、Meta Platforms(META.US)、亚马逊 (AMZN.US)、微软 (MSFT.US) 以及英伟达 (NVDA.US)——的市盈率为 39 倍,且仅较 200 日移动均线高出 20%。策略师们表示,这使得它们成为当今 “最佳泡沫代表”。

投资者对美国科技巨头的热情已推动美股今年屡创新高,且没有减退迹象。在经历了年初中国人工智能初创企业 DeepSeek 带来的冲击、以及特朗普政府关税政策引发的动荡后,“七巨头” 迅速反弹——标普 500 信息技术指数自 4 月低点以来已飙升 56%,投资者也选择在此期间不断逢低买入。

积极的宏观经济背景、围绕人工智能的持续狂热、以及对美联储进一步降息的预期,正为科技板块提供助力。事实上,美国银行本周发布的基金经理调查显示,“做多七巨头” 已连续第二个月被 42% 的受访者认为是 “最拥挤的交易”。

美银策略师指出,泡沫往往时间短暂且高度集中。回顾 2000 年,当互联网相关股票飙升至极端水平时,科技板块在六个月内上涨了 61%,而当年标普 500 指数的其他所有板块均下跌。与此同时,投资者也应当通过持有部分 “困境价值” 资产来对冲其在大型科技股泡沫中的敞口,目前此类潜在机会的例子包括巴西、英国以及全球能源股。