英伟达 50 亿美元投资,英特尔代工分拆或迎关键一步?

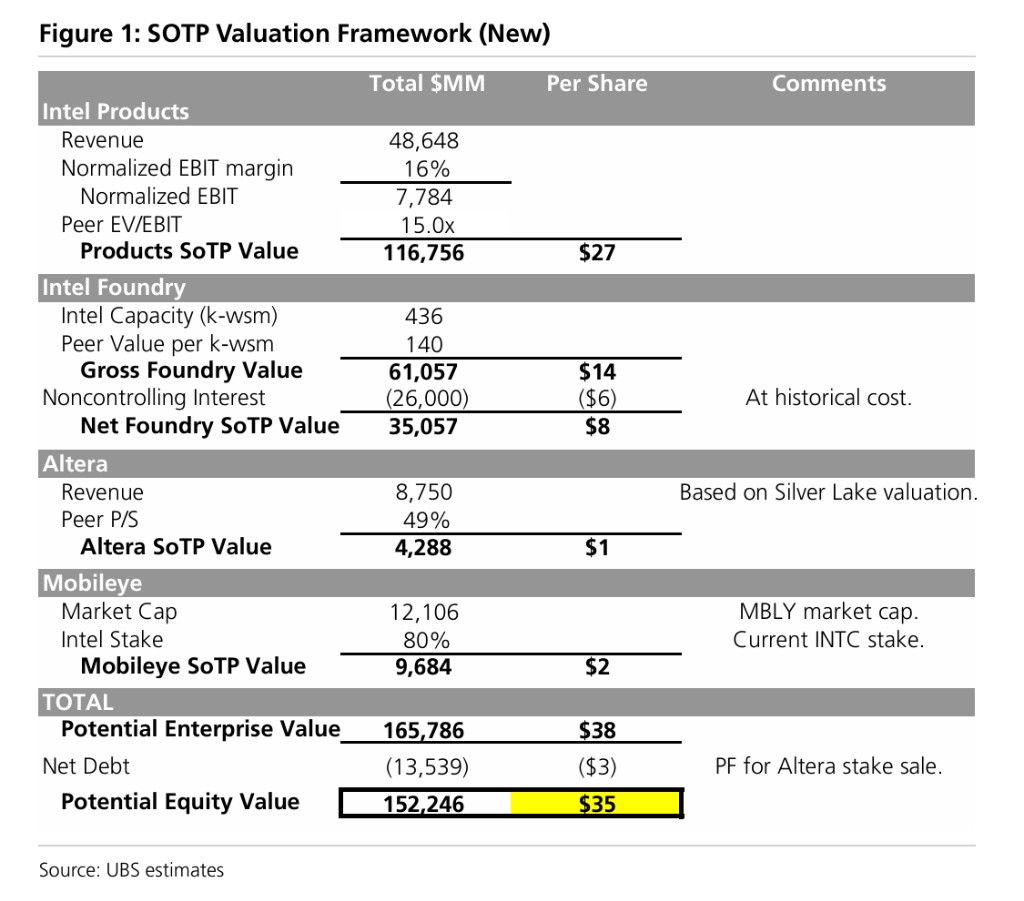

UBS believes that after NVIDIA's investment, other clients may also follow suit and invest in Intel, allowing Intel to continue investing in the development of the 14A process technology. This investment could drive Intel to separate its foundry and product businesses, increasing the company's valuation to $35-40 per share. UBS has raised its target price for Intel to $35

NVIDIA announced yesterday to invest $5 billion in Intel for the development of AI infrastructure and PC products, a move seen by analysts as an important signal of key customer support for Intel's foundry business.

According to news from the Chasing Wind Trading Desk, based on a research report released by UBS on the 18th, this investment could drive the separation of Intel's product business from its foundry business and elevate the company's valuation to a range of $35-40 per share.

UBS analysts pointed out that this investment is similar to the market's expected customer investment scenario after the Trump administration converted the CHIPS Act commitment into equity investment. The firm had previously predicted that key customers like NVIDIA and Broadcom would show strong interest in Intel's manufacturing roadmap and might make equity investments, a prediction that has now been validated.

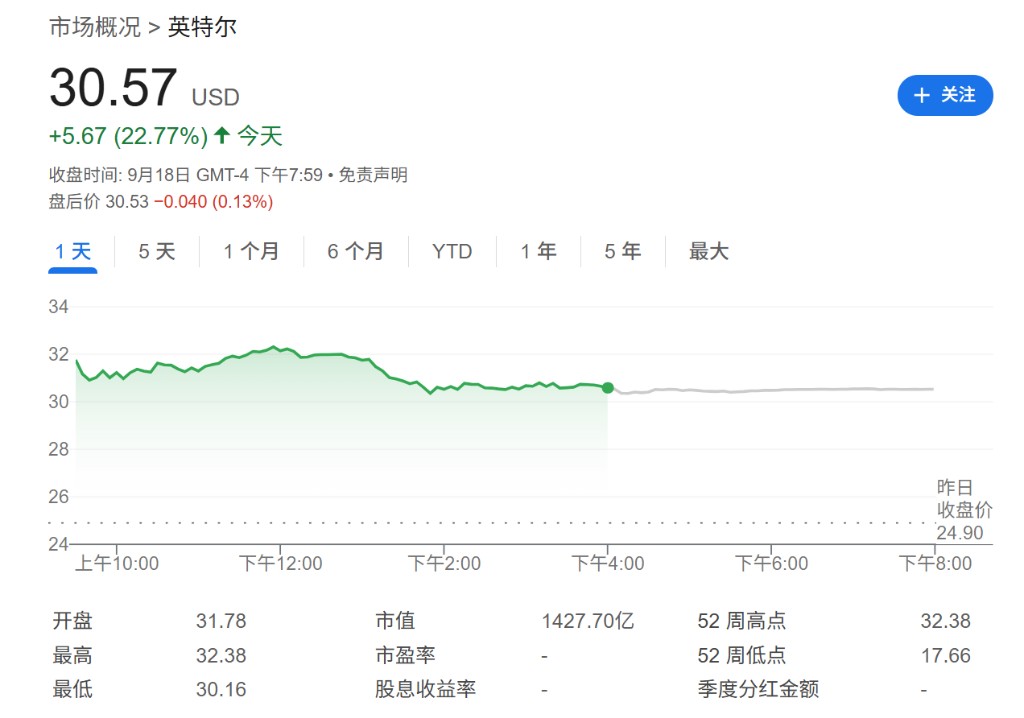

Analysts believe that in the long term, if such investments accelerate the separation of Intel's product and foundry businesses, it could pose a challenge to competitor AMD within a 3-4 year timeframe, as this would allow Intel's product business to more flexibly choose foundry partners. UBS has raised its target price for Intel from $25 to $35, believing that the market will begin to independently value the various business segments of this chip giant. As of the time of publication, Intel's stock rose 0.13% to $30 per share in pre-market trading, indicating a 16% upside potential relative to the target price.

Foundry business gains customer endorsement, expectations for separation rise

UBS analyst Timothy Arcuri stated that NVIDIA's $5 billion investment is significant for Intel's foundry business. The report noted that NVIDIA and Broadcom had previously engaged in highly participatory discussions with Intel regarding the manufacturing roadmap, initially focusing on the 18A process, but recently shifted to the 14A process expected to be mass-produced in 2029.

This investment is seen as an important milestone for Intel in gaining recognition from key customers. Analysts expect that after NVIDIA's investment, other customers may also follow suit in investing in Intel. This will enable Intel to continue investing in the development of the 14A process technology, which is expected to be quite competitive based on supply chain research.

More importantly, this development may lay the foundation for the separation of Intel's product business from its foundry business. UBS had previously discussed the possibility of such a separation, believing it would free Intel's product business to utilize TSMC's foundry services more flexibly.

Chain reaction in the industry

Although the investment involves AI infrastructure and PC product development, analysts believe the impact at the product level is relatively limited. NVIDIA is currently focused on its Grace CPU roadmap, and this investment may enhance the likelihood of NVIDIA offering x86 CPU versions in its Rubin Ultra rack However, analysts emphasize that the positive impact on Intel's product business is "relatively moderate," the greater significance of the investment still lies in the foundry business. It is expected to benefit semiconductor equipment manufacturers. UBS analysts believe that this investment increases the likelihood of Intel successfully establishing a viable foundry, thereby improving its long-term capital expenditure outlook, which is favorable for upstream equipment suppliers. Since the investment primarily targets foundry services, it is not expected to significantly enhance Intel's product roadmap competitiveness.

In the long term, if such investments accelerate the separation of Intel's product and foundry businesses, it may instead pose a challenge to competitor AMD within a 3-4 year timeframe. In the short term, due to the investment being more focused on Intel's foundry side rather than the product roadmap, the direct impact on AMD is limited. However, from a long-term perspective of three to four years, if such investments accelerate the separation of Intel's products and foundry, allowing the independent Intel product division to freely choose to utilize TSMC's capacity, this may negatively impact AMD.

Based on the positive changes brought about by NVIDIA's investment, UBS raised Intel's target price from $25 to $35, using a sum-of-the-parts (SOTP) valuation method. Intel's product business (Intel Products) is valued at $27 per share based on a 15x price-to-earnings ratio of comparable peers; while Intel's foundry business (Intel Foundry), excluding non-controlling interests, has a net value of $8 per share. Adding in other businesses such as Altera and Mobileye, the final potential equity value is $35 per share.