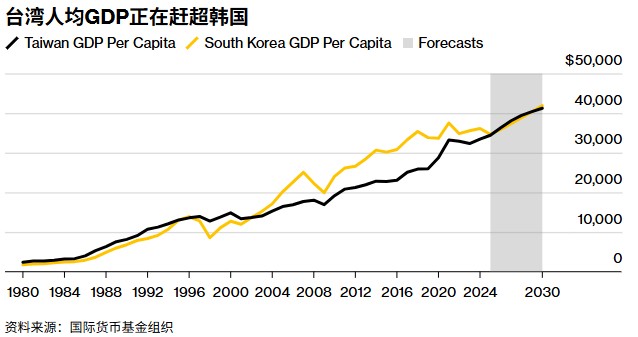

The rise of Taiwan Semiconductor Manufacturing Company boosts Taiwan's wealth, surpassing South Korea for the first time in 20 years, with per capita GDP expected to lead in 2025

台積電的崛起推動台灣省財富總額預計將首次超越韓國,標誌着 20 年來的重大轉變。2025 年,台灣省人均 GDP 有望領先韓國,預計達到 3.8 萬美元。台灣的 GDP 增速被上調至 4.55%,受益於人工智能消費熱潮,而韓國經濟增長乏力,面臨結構性問題。台灣省出口額首次超越韓國,推動新台幣升值,進一步縮小兩岸人均 GDP 差距。

智通財經 APP 獲悉,今年中國台灣省財富總額預計將超韓國,這是二十餘年來的首次突破,標誌着台積電 (TSM.US) 崛起推動亞洲經濟格局重塑。據週四最新預測,2025 年台灣省 GDP 增速將達 4.55%,較 8 月統計部門 4.45% 的預估進一步上調。按此增長軌跡,台灣省有望在 2025 年提前一年超過韓國的人均 GDP(比 IMF 今年 4 月預測提前一年)——這一衡量生活水平的核心指標,目前台灣省人均 GDP 預計約 3.8 萬美元,雖僅為新加坡水平的一半,但已領先日本,且與韓國差距正加速縮小。

圖 1

這一轉變背後,是人工智能消費熱潮對台灣省半導體產業的強力驅動。疫情期間全球芯片短缺使台企地位飆升,從歐美政要到企業高管紛紛求購維持經濟運行的半導體。ChatGPT 問世後,台積電、富士康等企業更迎來爆發式增長,它們承包了全球多數 AI 關鍵芯片與服務器的組裝。

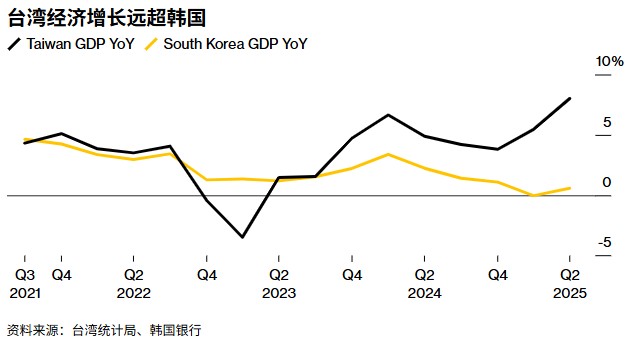

反觀韓國,其經濟支柱三星電子雖佔韓國經濟 11%,卻在先進製程競爭中漸顯頹勢。韓國經濟第二季度同比僅增長不足 1%,全年預計增速 0.9%,央行行長李昌鏞多次警示低生育率、老齡化等結構性問題已將潛在增長率拖入 1% 區間。

圖 2

彭博經濟研究指出,韓國產業跨度大、石化等傳統板塊低迷,而台灣省科技集中度高,更受益於 AI 熱潮,而韓國則受困於石化等傳統行業低迷及人口結構惡化。今年 8 月,台灣省出口額首次超越韓國——這一里程碑意義尤為突出,因韓國人口與整體 GDP 規模是台灣省的兩倍有餘。

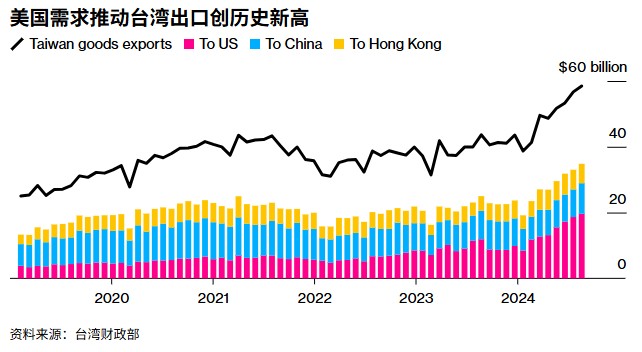

出口商搶先結匯疊加市場猜測當局願讓本幣升值以換取對美貿易談判籌碼,推動新台幣兑美元年內升值約 9%,而韓元同期僅上漲 6%,匯率差異進一步放大了兩岸人均 GDP 差距。

圖 3

但台灣省經濟亦面臨隱憂。過度依賴單一產業——尤其是美國在台灣省出口占比持續擴大——可能將優勢轉化為脆弱性,尤其在台海地緣風險與中方關係緊張背景下。

台北元大證券首席經濟學家陳伍茲指出,資源有限使台灣省產業多元化艱難,需推動傳統產業轉型為高科技供應鏈環節,同時政府需探索科技企業收益再分配機制以平衡發展。