NVIDIA and Intel's "century partnership" ignites the chip industry chain! The creators behind the chips embrace the "bull market frenzy"

NVIDIA and Intel have reached a cooperation agreement to jointly develop high-performance chips, driving a significant rise in the stock prices of the chip industry chain. NVIDIA's stock price increased by 3.5%, bringing its market value back to USD 4.3 trillion, while Intel's stock price surged over 22%. The Philadelphia Semiconductor Index (SOX) rose nearly 4% in a single day, demonstrating the strong performance of chip stocks and attracting global capital. This cooperation puts pressure on AMD and ARM, marking a significant positive development for the chip industry

According to Zhitong Finance APP, after "AI chip super giant" NVIDIA (NVDA.US) invested $5 billion in long-time competitor Intel (INTC.US) and announced plans to jointly develop high-performance chips for PCs and AI data centers, the stock prices of the two chip giants surged together. As of Thursday's close in the U.S. stock market, NVIDIA's stock price rose by 3.5%, bringing its total market value back to around $4.3 trillion, while Intel's stock price soared over 22%, with an intraday increase of up to 30%, pushing its market value towards $150 billion.

The collaboration between the green factory and the blue factory (referring to NVIDIA and Intel, respectively), two long-time rivals in the PC field, is a significant positive for the entire chip industry chain. However, it is a major negative for AMD and ARM. This is why, after the announcement of the collaboration between the two chip giants, the entire U.S. stock market chip stocks surged, except for AMD and ARM, especially the established American chip manufacturer Intel, as well as the "creators" behind the chips—namely EDA chip design software, semiconductor equipment manufacturers (including packaging equipment), and chip manufacturers, all saw their stock prices collectively rise, ultimately driving the Philadelphia Semiconductor Index (SOX), known as the "global chip stock barometer," to a nearly 4% increase in a single day.

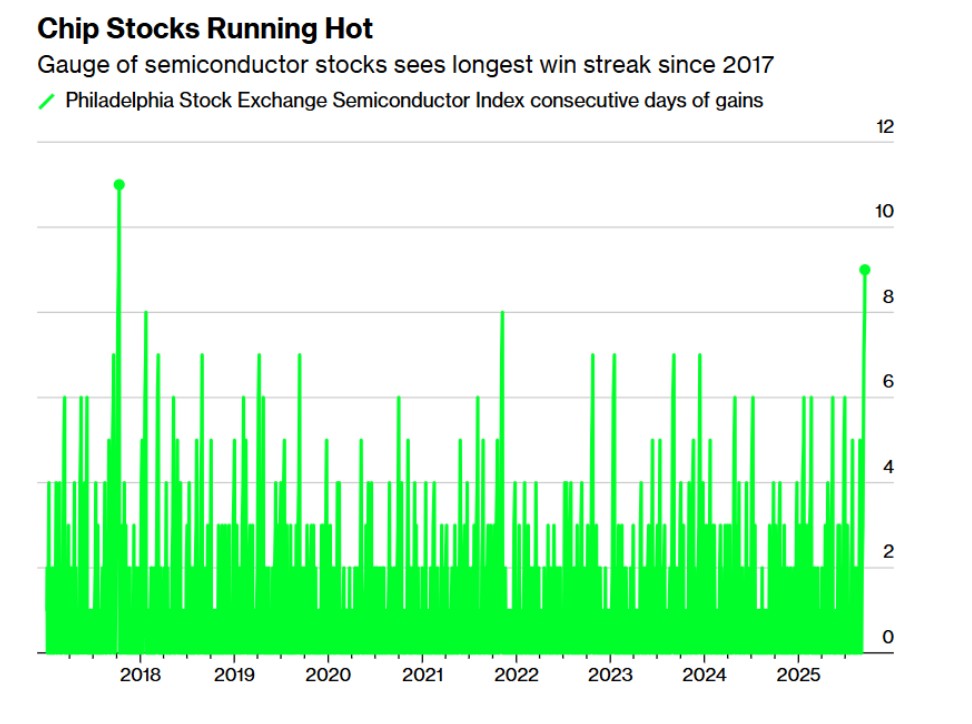

The Philadelphia Semiconductor Index, after a slight decline on Wednesday, has recently continued to attract global capital, leading to sustained increases and new highs. One of the core driving forces behind this round of "long-term bull market in U.S. stocks" since 2023—the chip stocks—has surged since the low in April, achieving the longest continuous upward trend in nearly eight years. As of this Tuesday, the Philadelphia Semiconductor Index has seen nine consecutive trading days of increases, marking the longest streak since 2017, with a cumulative rise of 8.7% during these nine trading days, and a year-to-date increase of as much as 26%, significantly outperforming the nearly 16% increase of the Nasdaq 100 Index during the same period.

The Bull Market Trajectory of Chip Stocks Ignited by AI Is Far from Over

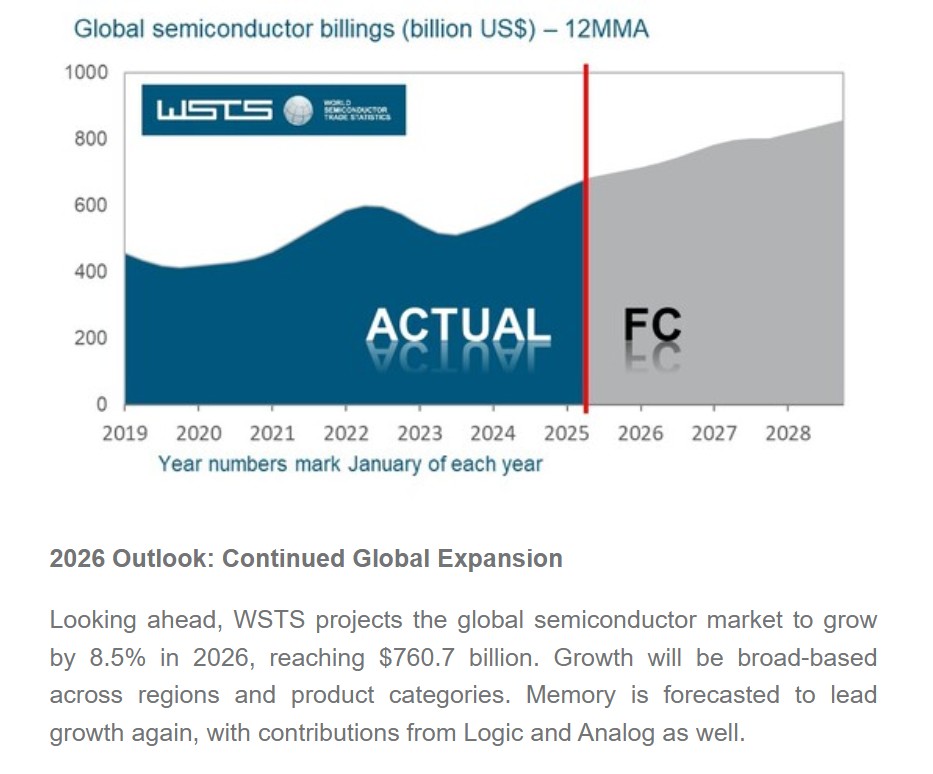

Undoubtedly, the recently announced contract reserve of $455 billion by global cloud computing giant Oracle, which far exceeded market expectations, along with the strong performance and future outlook announced last week by global AI ASIC chip "super giant" Broadcom, has significantly strengthened the "long-term bull market narrative" for AI GPU, ASIC, and HBM and other AI computing infrastructure sectors. The AI computing demand driven by generative AI applications and AI agents at the inference end can be described as "vast as the stars and the sea," and is expected to drive the artificial intelligence computing infrastructure market to continue showing exponential growth. The "AI inference system" is also considered by Jensen Huang to be the largest source of future revenue for NVIDIA Looking ahead at future trends, according to chip market research reports from authoritative institutions such as Wall Street financial giant Goldman Sachs and the World Semiconductor Trade Statistics (WSTS), under the unprecedented wave of global AI investment, chip stocks may still be one of the brightest-performing technology sectors in the U.S. stock market from a long-term investment perspective.

Recently, during the passionate performance of the global chip stock "super bull market," especially with semiconductor/chip stocks closely related to AI training/inference systems surging, Goldman Sachs' latest semiconductor industry research report has added fuel to the already hot bullish sentiment on AI. After the Communacopia + Technology conference, which covered the world's top semiconductor companies, Goldman Sachs' research team stated that they continue to maintain the judgment of a "structural bull market driven by AI" in the semiconductor industry.

“Everything we see in AI infrastructure construction and the entire technology sector can be said to be almost entirely driven by semiconductor-related stocks,” said Wayne Kaufman, Chief Market Analyst at Phoenix Financial Services. He added that Oracle's recent strong earnings report and the over $10 billion AI infrastructure deal between Microsoft and Nebius Group NV are both positive signals for the global chip sector.

“Companies are placing very long-term orders for AI infrastructure, indicating that they feel they might be falling far behind in meeting the computational infrastructure needs of AI,” Kaufman stated in an interview. “This means the surge in semiconductor/chip stocks looks very sustainable, even if some stocks may experience short-term overbought corrections, giants like NVIDIA and TSMC will still be the biggest winners.”

According to Wall Street investment giants Loop Capital and Wedbush, the global AI infrastructure investment wave centered around AI computing hardware is far from over and is only at the beginning. Driven by an unprecedented "AI computing demand storm," this round of AI investment is expected to reach a scale of $2 trillion. NVIDIA CEO Jensen Huang even predicts that by 2030, AI infrastructure spending will reach $3 trillion to $4 trillion, with the scale and scope of projects providing NVIDIA with significant long-term growth opportunities.

NVIDIA and Intel Join Forces to Create a "Green-Blue Chip Era"

NVIDIA is moving forward in collaboration with its long-time rival Intel, which is reshaping the development landscape of PCs and data centers. Especially with NVIDIA planning to increase its layout in AI PCs, it is expected to leverage the most powerful x86 architecture ecosystem on the PC side to fully penetrate the high-growth "edge AI field." NVIDIA may soon welcome a new revenue increment, while Intel is expected to leverage NVIDIA to reach the very center of the AI core track In terms of NVIDIA's current core revenue-generating business—data center (DC) business, NVIDIA NVLink has successfully integrated x86 architecture + GPU, launching a new artificial intelligence computing power integration system of "custom x86 architecture CPU + NVIDIA AI GPU + CUDA acceleration platform." The collaboration of "CPU + GPU" will undoubtedly give NVIDIA more say in the architectural construction of cloud computing vendors/supercomputing/enterprise DC.

The two parties will "seamlessly connect" their architectures, with Intel creating a custom x86 CPU for NVIDIA, which will be integrated into NVIDIA's AI computing infrastructure platform. The core idea is to utilize the bandwidth/interface advantages of NVLink and architectural consistency for high-speed coupling of x86 architecture CPU + NVIDIA Blackwell/future Rubin AI GPU, targeting system-level bottlenecks in large model training/inference, focusing on a more complete "system-level/AI computing cluster platform" solution; Intel will leverage the x86 architecture (non-foundry) that occupies the core architectural ecosystem of data centers to enter the AI infrastructure "golden growth zone."

For NVIDIA and Intel's recent joint focus on the AI PC field—currently led by AMD—integrating "x86 CPU + RTX GPU"/NVIDIA GPU chiplet into Intel's PC SoC is expected to completely reshape the AI PC market share, with both companies likely to dominate the AI PC field together. Reports and materials from the two chip giants' collaboration indicate that Intel's next-generation PC chips will integrate NVIDIA RTX cores/chiplets, primarily targeting efficient local execution of generative AI, graphics rendering, and mixed workloads for blockbuster games. For NVIDIA, this is a direct insertion of its ecosystem into the foundation of Windows PCs; for Intel, it is a way to regain differentiated selling points in the AI PC era.

Analyst Ming-Chi Kuo from TF International Securities stated in a recent blog post that the collaboration between NVIDIA and Intel primarily defines and accelerates the AI PC ecosystem. For NVIDIA, developing its own Windows-on-ARM processor carries high uncertainty; for Intel, establishing a competitive advantage in GPUs is fraught with challenges, thus the combination of x86 CPU + NVIDIA GPU may create strong synergies and competitive advantages in the PC ecosystem.

Secondly, Kuo noted the significant synergy potential in the x86/mid-range/inference AI server sector, with enterprises building local x86/mid-range/inference AI servers becoming a key trend. Kuo emphasized that Intel has a vast x86 architecture installed base and exclusive x86 CPU distribution channels, while NVIDIA brings unparalleled GPU technology advantages.

EDA, semiconductor equipment, and TSMC's bullish logic strengthened

Undoubtedly, NVIDIA's collaboration with its long-time rival Intel represents an alliance that elevates "CPU + GPU platformization" to a higher dimension: NVIDIA gains stronger x86 end synergy and AI PC sales channels, while Intel leverages this to enter the most core area of AI—AI data center infrastructure construction; At the end of the industrial chain, EDA software/equipment/packaging/interconnection can be said to be the first to benefit. The changes in the chip foundry landscape belong to long-term observation items—however, for TSMC, the "king of chip foundry," it still serves as a short to medium-term positive catalyst.

The semiconductor equipment and packaging equipment chain can be considered the most direct beneficiaries. A recent study by international investment bank UBS pointed out that this transaction enhances Intel's probability of successfully establishing a foundry business and the long-term CapEx (capital expenditure) profile of chip manufacturers. This is particularly positive for semiconductor equipment (semicaps), especially KLA (KLA.US), although Intel's CapEx may still decline in 2026. More complex and powerful CPU/GPU packaging heterogeneously (based on NVLink interconnection, as well as advanced chiplet packaging such as CoWoS/EMIB/Foveros) will significantly boost the structural demand for EUV/High-NA lithography machines, advanced packaging equipment, and measurement and inspection, especially benefiting ASML (ASML.US) and Applied Materials (AMAT.US).

UBS released a research report after the news that NVIDIA would invest $5 billion in Intel and collaborate on PC and data center chips, stating that this move is a significant long-term positive for semiconductor equipment manufacturers.

"First of all, we believe this is very positive for semiconductor equipment manufacturers because it increases the likelihood of Intel establishing a viable foundry business and improves Intel's long-term capital expenditure outlook. Although the impact on the 2026 calendar year may be limited, we still expect capital expenditures to decline significantly that year," wrote UBS analyst Timothy Arcuri in a report to clients.

"Furthermore, if we look at this from a longer-term perspective, such investments could accelerate Intel's trend of divesting its product business, essentially allowing Intel Products (Intel's x86 architecture product line) to utilize TSMC's industry-leading chip manufacturing processes. Combined with Intel's x86 distribution channels and NVIDIA's high-performance GPU product line, this could be very unfavorable for AMD, but this is from a 3 to 4-year long-term perspective, during which new developments may occur," Arcuri wrote in the report.

Since 2023, semiconductor equipment has also been one of the biggest beneficiaries of the unprecedented AI wave and is expected to benefit from the AI boom in the long term. With NVIDIA teaming up with Intel, the unprecedented product combination of x86 + NVIDIA GPU will inevitably lead to a surge in demand for x86 architecture CPUs and NVIDIA AI GPU computing clusters in the future, potentially resulting in stronger demand for semiconductor equipment and packaging equipment. Compared to chip giants like NVIDIA, Broadcom, and TSMC, which global investors are focusing on, these leaders in the semiconductor equipment field can be considered "low-key winners" benefiting from the unprecedented frenzy of global companies laying out AI.

Currently, global demand for AI chips is extremely strong, and this explosive demand is expected to continue until 2027. Therefore, chip manufacturers like TSMC, Samsung, and Intel will fully expand their production capacity. Additionally, storage giants like SK Hynix and Micron are expanding HBM capacity, all of which require large-scale procurement of semiconductor equipment needed for chip manufacturing and advanced packaging, with some core equipment even needing to be updated and replaced After all, AI chips have higher logic density, more complex circuit designs, and greater power and precision requirements for devices, which may lead to higher technical requirements in processes such as EUV/High-NA lithography, etching, thin film deposition, multilayer interconnection, and thermal management, thus necessitating customized manufacturing and testing equipment to meet these demands. Therefore, semiconductor equipment giants like ASML, Applied Materials, and Lam Research hold the "lifeline of chip manufacturing."

At the Goldman Sachs Communacopia + Technology Conference, Applied Materials President and CEO Gary Dickerson stated that HBM and advanced packaging manufacturing equipment will be strong growth vectors in the medium to long term. New chip manufacturing node equipment such as GAA (Gate-All-Around) and BPD (Back Power Delivery) will be the core driving force for the company's next round of strong growth. Especially in advanced packaging manufacturing equipment, Dickerson noted that the revenue doubling path for this business line is still on track, with significant incremental growth imminent, and the market share in the HBM equipment sector continues to expand, increasingly related to DRAM etching innovations. Applied Materials, a leader in semiconductor equipment focusing on cutting-edge GAA chip processes and advanced packaging equipment, is one of Goldman Sachs' top semiconductor investment targets for the next 12 months.

EDA software vendors and TSMC will also be beneficiaries of the collaboration between the two chip giants. EDA software is an essential tool for chip design, known as the "mother of chips." As leaders in chip design like NVIDIA, Broadcom, AMD, and cloud computing giants such as Amazon and Microsoft accelerate the development of high-performance AI chips, their demand for EDA software capable of designing more complex architectures and energy-efficient AI chips, while also accelerating chip design with new AI technologies, continues to expand.

Anirudh Devgan, President and CEO of EDA giant Cadence Design Systems, recently stated that the global chip design scale continues to expand robustly, with non-traditional computing customers from cloud computing/system-level companies contributing about 45% of revenue. Devgan emphasized that the adoption and penetration of AI-assisted tools in EDA software are increasingly expanding, with customers generally reporting faster design cycles and higher efficiency; additionally, the penetration rate of chip design R&D budgets has risen from 7-8% to about 11%, with still more room for growth.

TSMC's stock price hit a new all-time high on Thursday, with TSMC's ADR stock price showing strong gains, alongside NVIDIA and Broadcom, which have been leading the surge among U.S. chip stocks this year. In the chip supply chain, TSMC is known as the "eternal god" (YYDS), as the booming demand for AI GPUs and AI ASICs relies heavily on TSMC. With decades of chip manufacturing technology accumulation and being at the forefront of chip manufacturing technology improvement and innovation globally, TSMC has long dominated the vast majority of global chip foundry orders, especially for the most advanced process nodes of 5nm and below. Tianfeng International Securities analyst and Apple "prophet" Ming-Chi Kuo commented that the collaboration between NVIDIA and Intel poses overall controllable risks for TSMC. TSMC's advantageous position in advanced chip manufacturing processes can be sustained for at least another five years, AI chip orders will not be affected, and Intel may turn to TSMC for foundry services due to advanced process requirements imposed by NVIDIA, rather than pushing for manufacturing at Intel's chip factories. Kuo even predicts that NVIDIA and Intel will be long-term key customers of TSMC