The largest stablecoin issuer Tether has launched a new version of its US stablecoin, while its competitor Circle has dropped over 5%

Tether 週五在聲明中表示,這款名為 USAT 的新穩定幣將通過 Anchorage Digital Bank NA 的穩定幣發行平台進行鑄造和贖回,並符合美國監管要求。公司已任命前白宮加密貨幣官員 Bo Hines 負責該業務。此舉預計將加劇 Tether 與其最接近的競爭對手 Circle 之間的競爭。

總部位於薩爾瓦多的全球最大的穩定幣發行商 Tether 正在打造一款符合美國監管的數字美元版本,並已任命前白宮加密貨幣官員 Bo Hines 負責該業務。

Tether 週五在聲明中表示,這款名為 USAT 的新穩定幣將通過 Anchorage Digital Bank NA 的穩定幣發行平台進行鑄造和贖回,並符合美國監管要求。新穩定幣將提供最高標準的透明度、合規性和金融韌性。

Tether 於 8 月聘請了 Hines 協助協調其在美國的擴張行動,這距離他離開特朗普政府僅數週時間。Hines 曾是特朗普數字資產顧問委員會的負責人。已經負責管理 Tether 主要穩定幣 USDT 儲備資產的 Cantor Fitzgerald LP 也將監督這款新穩定幣的儲備資產。

穩定幣是一種旨在保持價值穩定的加密貨幣,通常通過持有一籃子資產作為儲備來模仿美元等法定貨幣的價值。今年早些時候,美國立法者通過了 Genius 法案,首次為該行業設立了聯邦規則,其中包括規定發行方儲備中可以持有哪些類型的資產等要求。當前全球流通的穩定幣總額約為 2800 億美元。

Tether 發行的 USDT 是全球最大的穩定幣,與美元掛鈎,流通量約為 1700 億美元,用户近 5 億人。雖然其儲備主要由短期國債等現金等價物組成,但 Tether 還使用了包括比特幣、擔保貸款和貴金屬在內的多種資產來支持 USDT——這些都不符合美國的監管要求,因此公司必須創建一個單獨的穩定幣,以獲得在美國本土的批准。

根據新的穩定幣規則,運營方必須以高評級資產,如美國國債,一比一地支持其儲備,並提供每月的儲備報告和年度審計。

Tether 的這一最新宣佈加深了其與美國市場的聯繫,而數年前它已停止直接為美國客户提供服務。這家非上市公司曾在 2021 年向美國當局支付 4100 萬美元罰款,以了結其被指虛報儲備情況的指控。

Tether 首席執行官 Paolo Ardoino 在接受採訪時表示:

我們認為這是共生的關係:USAT 是在美國境內購買的產品,如果有需要將其擴展到海外併發送至新興市場,它將使用 USDT 的管道來實現這種覆蓋範圍。

USAT 是我們對確保美元在數字時代不僅保持主導地位,而且繼續繁榮發展的承諾。

美國總統特朗普的親加密貨幣政府鼓勵更多數字資產企業重返美國本土。今年美國監管機構對幾家主要加密公司採取的多項執法行動已被暫停或駁回。

白宮希望,包括 Tether 和其競爭對手 Circle 在內的穩定幣發行商,能在投資者對誰將購買大量美國國債以資助美國財政赤字日益擔憂之際,成為美國政府債務需求的關鍵來源。

Tether 通過保留支撐其代幣的國債所產生的利息收入來盈利。該公司去年盈利 134 億美元,並表示自己是美國國債的第 18 大持有者,規模超過德國、韓國和澳大利亞。

此舉預計將加劇 Tether 與其最接近的競爭對手 Circle 之間的競爭。Circle 是第二大穩定幣 USDC 的發行方,總部位於紐約,並於今年 6 月上市。Circle 長期以來依靠遵守美國法規及其全球監管牌照組合,在機構級加密用户中保持競爭優勢。

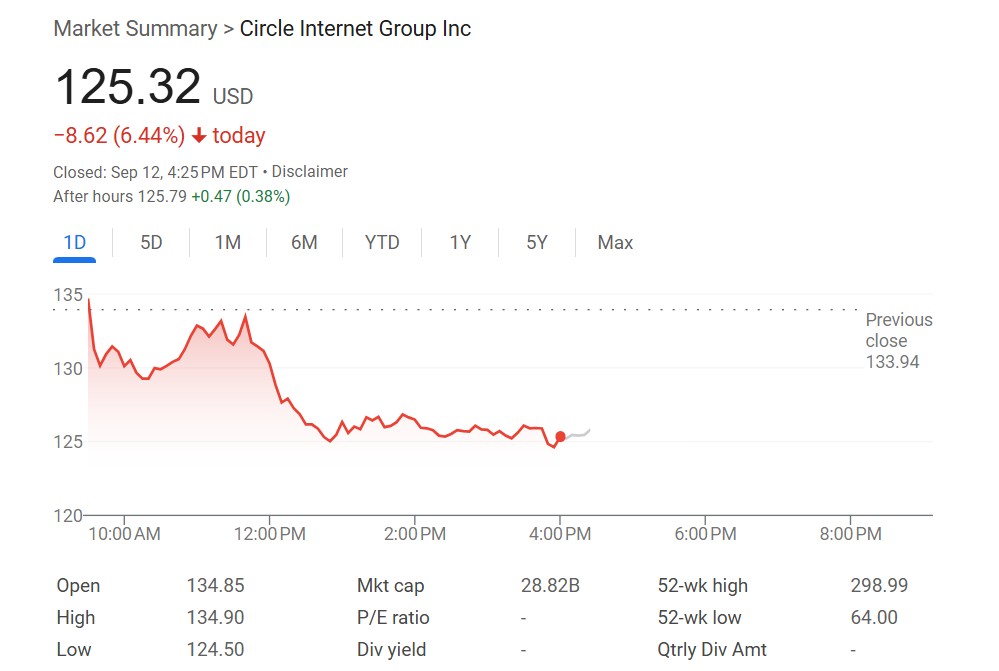

週五,Circle 股價收跌超 6%,不過此前週四大幅反彈,單日大漲超 17%,一度扭轉近來頹勢。