Trump takes strong action against the Federal Reserve, gold and silver hit new highs in response

美國總統特朗普對美聯儲的持續施壓,不斷侵蝕市場對美聯儲獨立性的信心,市場避險情緒急劇升温,直接將黃金和白銀價格推向創紀錄高位。週一,黃金拍賣價定格在每金衡盎司 3475 美元,超越 4 月 22 日創下的 3454 美元前高點,刷新歷史紀錄。同時,白銀價格也飆升至每盎司 40.76 美元的 14 年高位。

圍繞美聯儲獨立性的政治風波,為今年的貴金屬牛市再添了一把火。

9 月 1 日週一,在美元走軟和降息預期的共同作用下,黃金拍賣價格飆升。據倫敦金銀市場協會 (LBMA) 數據,下午的黃金拍賣價最終確認為每金衡盎司 3475 美元,超越 4 月 22 日創下的 3454 美元前高點,刷新歷史紀錄。

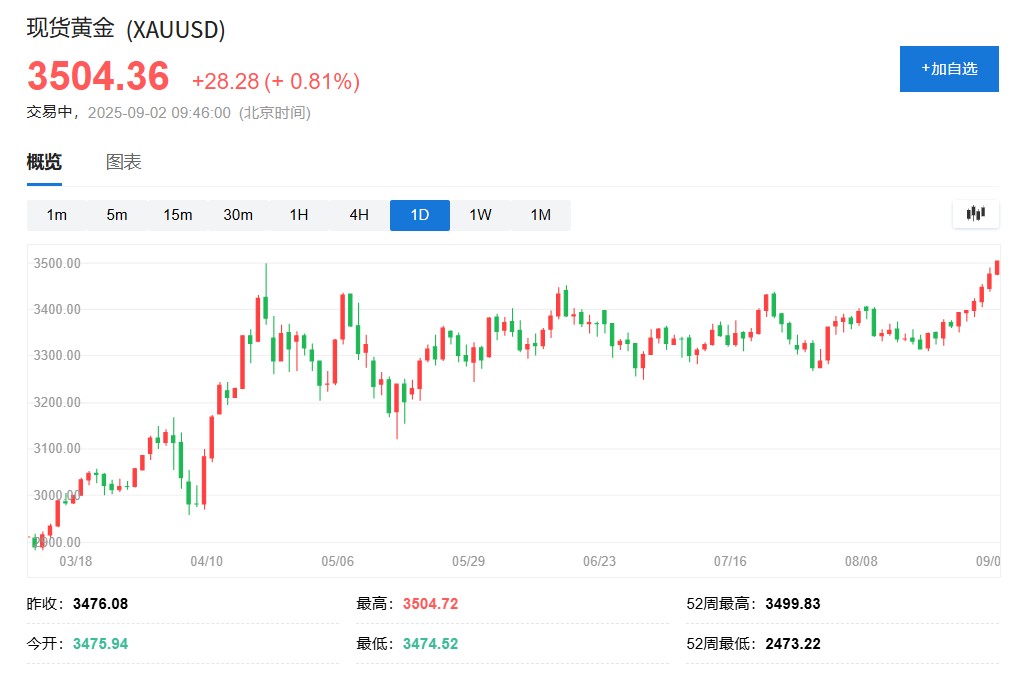

現貨市場上,現貨黃金今日盤中漲破 3500 美元關口,創歷史新高。與此同時,白銀價格也飆升至每盎司 40.76 美元的十四年高位。

分析指出,貴金屬市場的最新一輪上漲,與特朗普向美聯儲主席鮑威爾施壓並解僱理事莉薩·庫克的舉動密切相關。據英國《金融時報》報道,自一週前特朗普宣佈解僱正於法庭上抗辯此舉的庫克以來,黃金價格已連續多日上漲。

這一系列事件加劇了市場對美聯儲將在 9 月 17 日政策會議上降息的預期。作為無息資產,黃金在利率下降的環境中通常表現更佳,而對美國製度穩定性的擔憂則進一步放大了其作為避險資產的吸引力。

政治風波引爆避險需求

對美聯儲獨立性的擔憂,已成為推動金價上漲的新催化劑。

BMO 大宗商品分析師 Helen Amos 表示:“市場擔心的不僅是美聯儲,而是對美國整體機構實力的擔憂。從避險需求的角度來看,這對黃金自然是利好。”

特朗普政府針對美聯儲的舉動,被市場解讀為對貨幣政策獨立性的直接干預。在特朗普宣佈解僱庫克之後的一週內,黃金價格每日都在上漲,顯示出投資者正通過買入黃金來對沖政治不確定性風險。

降息預期為漲勢 “火上澆油”

除了政治因素,明確的貨幣政策預期也為貴金屬市場注入了強心劑。美聯儲主席鮑威爾近期在傑克遜霍爾的講話,以及上週五公佈的符合預期的美國個人消費支出 (PCE) 報告,都進一步鞏固了市場對美聯儲即將降息的看法。

利率下降會降低持有黃金等無息資產的機會成本,從而提升其吸引力。此外,週一美元匯率走軟,也使得以美元計價的黃金對持有其他貨幣的投資者而言更具價格優勢。

不過,分析師指出,由於週一是美國勞動節假期,市場交易量相對清淡,這可能加劇了價格的波動性。

貴金屬牛市延續

週一的破紀錄行情並非孤立事件,而是建立在貴金屬長達數月強勁漲勢的基礎之上。事實上,受多重因素推動,金價今年以來已累計上漲超過 30%,COMEX 白銀年內漲幅超過 40%。

這些驅動因素包括對美元在全球金融體系中角色的擔憂,促使多國央行增加黃金購買以實現儲備多元化。

此外,持續的地緣政治不確定性、通脹抬頭的恐懼以及對美國經濟健康狀況的憂慮,都共同支撐了這場歷史性的貴金屬牛市。

展望未來,貿易摩擦仍是市場關注的焦點。Peel Hunt 的分析師在一份客户報告中寫道,市場似乎在為本週可能疲軟的美國就業報告做準備,同時有傳言稱白銀可能成為特朗普下一輪關税的目標,這也為銀價提供了額外支撐。

目前,黃金和白銀還尚未被列入美國關税清單。儘管上月美國海關曾意外宣佈對金條徵收關税,但該政策在幾天後被撤銷,凸顯出政策的不確定性。在複雜的宏觀環境下,貴金屬市場的前景仍與政治和經濟動態緊密相連。