European stock futures rise, Indian markets under pressure, the dollar maintains a downward trend, Asian chip stocks in focus

美債漲跌互現,遠端國債表現優於短端,2 年期收益率漲 1.6 基點。美元指數三連跌。離岸人民幣創年內新高、升至 7.1188。黃金三連漲、突破 3400 美元關口。白銀漲 1.2%。原油寬幅震盪走高,美油較日內低點一度上漲超 2%。

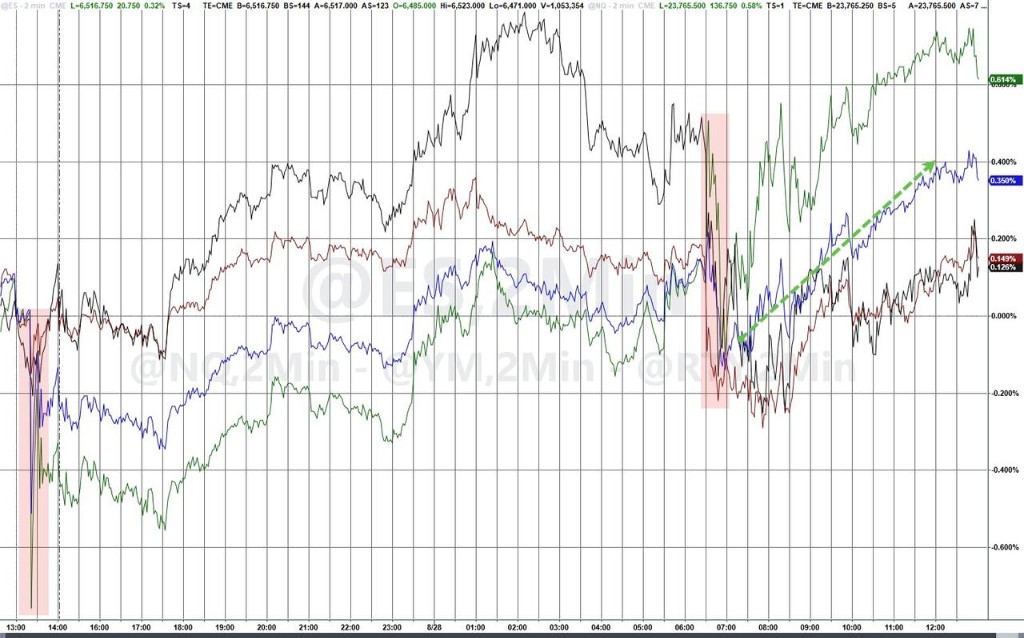

美國二季度 GDP 數據被上修,加之就業數據好於預期,投資者樂觀情緒蓋過了對降息路徑不確定性的擔憂,標普 500 創新高、突破 6500 點。受到投機性空頭頭寸創紀錄的推動,恐慌指數 VIX 跌至年內低點水平附近。

美元指數三連跌。離岸人民幣創年內新高、升至 7.1188。美債漲跌互現,遠端國債表現優於短端,2 年期收益率漲 1.6 基點。貴金屬普漲,黃金三連漲、突破 3400 美元關口,白銀則接近歷史高位。

以下是核心資產走勢:

美股盤前,據華爾街見聞,美國二季度實際 GDP 年化季環比上調至 3.3%。美國上週首申失業金人數小幅下降至 22.9 萬,續請人數降至 195.4 萬,雙雙低於預期。數據公佈後,美元指數日內跌幅一度收窄,隨後繼續下挫。

美股早盤,三大股指高開,納指一度漲約 0.4% 領漲。英偉達下挫,跌幅一度至 2.7%,二季度營收利潤超預期,但數據中心收入連續兩季遜色,本季指引不夠亮眼。

美股盤中,離岸人民幣盤中升值至 7.1187 元,為 2024 年 11 月 6 日以來首次突破 7.12 元,日內當前漲幅約 350 點。貴金屬普漲,黃金三連漲、突破 3400 美元。白銀震盪上行漲 1.2%、重回 39 美元上方,接近歷史高點 39.51 附近。

美股午盤,華爾街見聞快訊,美國財政部拍賣 440 億美元七年期國債,得標利率 3.925%(7 月 29 日報 4.092%)。7 年期國債標售後,長期國債漲勢進一步擴大,10 年期美債收益率收於約 4.21%,當日下行 2 個基點。

美股尾盤,標普 500 創新高、突破 6500 點。科技股漲幅居前,Snowflake 大漲 20%。受到投機性空頭頭寸創紀錄的推動,恐慌指數 VIX 跌至年內低點水平附近。

週四美股標普指數標普再創新高,首次收於 6500 點上方;納指科技指數漲超 0.9%,英偉達壓制芯片股的表現。Snowflake 大漲 20%,此前公司二季度財報強勁並上調全年指引。

美股基準股指:

標普 500 指數收漲 20.46 點,漲幅 0.32%,報 6501.86 點。

道瓊斯工業平均指數收漲 71.67 點,漲幅 0.16%,報 45636.90 點。

納指收漲 115.019 點,漲幅 0.53%,報 21705.158 點。納斯達克 100 指數收漲 137.605 點,漲幅 0.58%,報 23703.45 點。

羅素 2000 指數收漲 0.19%,報 2378.413 點。

恐慌指數 VIX 收跌 2.83%,報 14.43。

美股行業 ETF:

美國光伏板塊反彈上行 1.25,油氣漲 1.06%,標普能源漲 0.75%,公用事業和必選消費板塊下跌,前者跌 0.74%、後者跌 0.63%。

(8 月 28 日 美股各行業板塊 ETF)

科技七巨頭:

美國科技股七巨頭(Magnificent 7)指數漲 0.43%,報 190.17 點。

谷歌 A 收漲 2.01%,自 8 月 25 日以來再次創收盤歷史新高和盤中歷史新高。

亞馬遜漲 1.08%,蘋果、微軟、Meta Platforms 至多漲 0.57%,英偉達則收跌 0.79%,特斯拉跌 1.04%。

芯片股:

費城半導體指數收漲 0.49%,報 5853.052 點。

AMD 收漲 0.87%,台積電 ADR 跌 0.43%。

中概股:

納斯達克金龍中國指數收漲 0.14%,報 7791.84 點。

熱門中概股裏,理想、蔚來、網易收漲超 2%,小馬智行、小米、百度、騰訊漲超 1%,京東則跌 1.3%,阿里跌 2%,小鵬跌超 3%。

其他個股:

巴菲特旗下伯克希爾哈撒韋 B 類股漲 0.84%,禮來製藥則收跌 0.30%。

Snowflake 大漲 20%,此前公司二季度財報強勁並上調全年指引。

Cooper 公司重挫 13%,此前這家鏡片製造商下調了營收預測。

歐洲股市收跌 0.2%,路易威登母公司漲 2.2%,沃旭能源漲超 5.6%。法意股指收漲超 0.2%,丹麥股指漲 0.6%,英國股指跌超 0.4%。

泛歐歐股:

歐洲 STOXX 600 指數收跌 0.20%,報 553.67 點。

歐元區 STOXX 50 指數收漲 0.07%,報 5396.73 點。

各國股指:

德國 DAX 30 指數收跌 0.03%,報 24039.92 點。

法國 CAC 40 指數收漲 0.24%,報 7762.60 點。

英國富時 100 指數收跌 0.42%,報 9216.82 點。

(8 月 28 日 歐美主要股指表現)

板塊和個股:

歐元區藍籌股中,LVMH 集團收漲 2.21%,西班牙銀行桑坦德漲 2.13%,西門子漲 1.65%,保樂力加漲 1.37% 表現第四。

歐洲 STOXX 600 指數的所有成分股中,沃旭能源 Orsted 收漲 5.63%,比利時蓮花面包公司漲 5.18%,Zealand Pharma 漲 4.08% 表現第三。

美債收益率漲跌互現,法國中長期國債收益率衝高回落。

美債:

紐約尾盤,美國 10 年期國債收益率跌 2.52 個基點,報 4.2091%。

兩年期美債收益率漲 2.66 個基點,報 3.6351%。

(美國主要期限國債收益率)

歐債:

歐市尾盤,德國 10 年期國債收益率跌 0.5 個基點,報 2.695%,日內交投於 2.717%-2.679% 區間。

英國 10 年期國債收益率跌 3.6 個基點,兩年期英債收益率跌 2.8 個基點。

法國 10 年期國債收益率跌 3.9 個基點,報 3.478%。兩年期法債收益率持平。

美元跌至五週以來低點,日元和歐元至少漲 0.3%。離岸人民幣逼近 2024 年 11 月 5 日紐約尾盤最終報價 7.1017 元。

美元:

紐約尾盤,ICE 美元指數跌 0..40%,報 97.843 點,日內交投區間為 98.227-97.736 點。

彭博美元指數跌 0.33%,報 1200.93 點,日內交投區間為 1204.46-1199.90 點。

(彭博美元指數下挫)

非美貨幣:

紐約尾盤,歐元兑美元漲 0.38%,英鎊兑美元漲 0.10%,美元兑瑞郎跌 0.11%。

商品貨幣對中,澳元兑美元漲 0.41%,紐元兑美元漲 0.43%,美元兑加元跌 0.31%。

日元:

紐約尾盤,美元兑日元跌 0.30%,報 146.97 日元,日內交投區間為 147.49-146.66 日元。

離岸人民幣:

紐約尾盤,美元兑離岸人民幣報 7.1202 元,較週三紐約尾盤漲 337 點,日內整體交投於 7.1551-7.1183 元區間。

加密貨幣:

紐約尾盤,CME 比特幣期貨 BTC 主力合約較週三紐約尾盤跌 0.25%,至 11.2 萬美元下方。

(比特幣價格震盪下行)

CME 以太幣期貨 DCR 主力合約跌 2.46%,報 4458.50 美元。

美國原油期貨收漲 0.7%,荷蘭天然氣期貨跌 5%。

原油:

WTI 10 月原油期貨收漲 0.4 美元,漲幅 0.70%,報 64.60 美元/桶。

布倫特 10 月原油期貨收漲 0.57 美元,漲幅將近 0.84%,報 68.62 美元/桶。

天然氣:

NYMEX 10 月天然氣期貨收漲將近 2.01%,報 2.9440 美元/百萬英熱單位。

紐約期金漲超 0.8%,逼近 3480 美元。

黃金:

紐約尾盤,現貨黃金漲 0.57%,報 3416.55 美元/盎司。

(現貨黃金價格)

COMEX 黃金期貨漲 0.83%,報 3477.20 美元/盎司,日內交投區間為 3442.50-3478.70 美元。

白銀:

紐約尾盤,現貨白銀漲 1.19%,報 39.0598 美元/盎司。

COMEX 白銀期貨漲 1.36%,報 39.240 美元/盎司。

其他金屬:

紐約尾盤,COMEX 銅期貨漲 1.17%,報 4.4715 美元/磅。

現貨鉑金漲 1.16%,報 1363.92 美元/盎司;現貨鈀金漲 1.23%,報 1107.72 美元/盎司。