历史第一次!特朗普 “开除” 现任美联储理事,“掌控美联储” 计划迈出又一步

特朗普掌控美联储的 “三步法” 正推进:换掉鲍威尔、掌控理事会、开掉地方联储主席。若顺利开除库克,特朗普可能获得四个席位,在美联储七人理事会中占多数。据《华尔街日报》记者 Nick Timiraos 分析,若其在明年 3 月前掌握多数席位,可能拒绝续任地区联储主席,从而掌控 FOMC,重塑美联储体系。

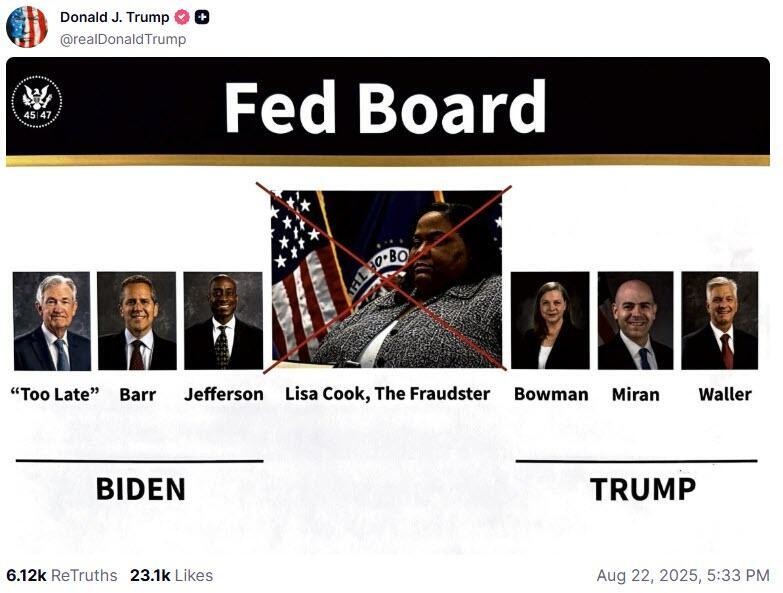

刚刚特朗普做出重大举动!他在社交媒体高调宣布,解除美联储理事丽莎·库克(Lisa Cook)职务"立即生效"。

这一史无前例的举动震动金融市场,质疑声四起。美国股指期货应声下跌,纳斯达克 100 指数合约下跌 0.2%,避险情绪推动日元兑美元上涨,黄金收复稍早跌幅。

特朗普此举一旦获得成功,距离 “掌控美联储” 将更近一步。如果库克离职,将让特朗普有可能获得四个席位,使其在七人理事会中占据多数。特朗普在第一任期内已任命了其中两位现任理事,并在不久前已提名其经济顾问委员会主席斯蒂芬·米兰(Stephen Miran)填补由拜登任命的阿德里亚娜·库格勒(Adriana Kugler)近期提前腾出的第三个席位。

对此有 “新美联储通讯社” 之称的华尔街日报记者 Nick Timiraos在最新文章中分析称,特朗普目前在美联储七人理事会中已任命两名成员。如果再获得两个提名席位,他将获得多数席位,从而可能从根本上重塑整个美联储体系。

并且按照 Timiraos 分析认为,如果特朗普在明年 3 月之前在美联储理事会获得多数席位,他们可能会拒绝重新任命地区联储主席,从而实现对 FOMC 会议的掌控。

解职 “史无前例” 震动华尔街

特朗普在信中指责库克在金融事务中存在 “欺诈性和潜在犯罪性行为”,并称此类行为已动摇其作为监管者的可信度。

信中援引美国宪法第二条及 1913 年颁布的《联邦储备法》相关条款,特朗普表示已认定存在足够理由撤销库克职务。信中提及一份 8 月 15 日由联邦住房金融局提交的刑事移交材料,认为库克涉嫌在抵押贷款文件中作出虚假陈述。例如,她先在密歇根州一份文件上声明该物业为其主要住所,随后又在佐治亚州另一份文件中作出同样声明。特朗普称此举 “不可想象”,质疑其诚信与作为金融监管者的胜任力。

特朗普对 Cook 的解职威胁标志着白宫对美联储施压的重大升级。如果特朗普成功罢免库克,将创下美国历史先例——此前从未有在任美联储理事被总统解职,对此市场担忧可能引发宪法危机并加剧市场动荡。

此前的政治冲突中,即便是约翰逊总统与美联储主席 William McChesney Martin 的激烈对抗,或尼克松总统对伯恩斯(Arthur Burns)的施压,都未曾出现实际解职行动。

New Century Advisors 首席经济学家、前美联储经济学家萨姆(Claudia Sahm)曾表示,

“这是本届政府试图控制美联储的新手段,他们正在动用能找到的所有手段来实现这种控制。”

总统有权力解除联储理事职务吗?有,但有前提

法律专家强调,《联邦储备法》明确规定理事"可因故被总统解职",但这需要确凿的不当行为证据,如失职、渎职或无法履行职责,而非政治动机。

虽然此前联邦住房金融局(FHFA)局长比尔·普尔特(Bill Pulte)指控库克在贷款申请中撒谎以获取更优惠条款,涉嫌抵押贷款欺诈。但目前针对库克的指控尚未经法庭证实,司法部也仅表示将调查相关指控。

此前特朗普在其社交平台 Truth Social 发布了标有红色叉号的 Cook 照片,称其为"欺诈者"。Cook 是美联储理事会首位黑人女性,于 2022 年加入美联储。马萨诸塞州参议员 Elizabeth Warren 在社交媒体上谴责特朗普的行动"违法且出于政治动机"。

特朗普掌控美联储的 “三步法”,正逐步实施

有分析认为,如果库克离职,特朗普将有机会任命第四位美联储理事,在七人理事会中获得多数席位。特朗普在第一任期内已任命了其中两位现任理事,并在不久前已提名其经济顾问委员会主席斯蒂芬·米兰(Stephen Miran)填补由拜登任命的阿德里亚娜·库格勒(Adriana Kugler)近期提前腾出的第三个席位。

8 月 24 日,有 “新美联储通讯社” 之称的华尔街日报记者 Nick Timiraos在最新文章中分析称,特朗普目前在美联储七人理事会中已任命两名成员。如果再获得两个提名席位,他将获得多数席位,从而可能从根本上重塑整个美联储体系。

此外,Timiraos 分析认为,如果特朗普在明年 3 月之前在美联储理事会获得多数席位,他们可能会拒绝重新任命地区联储主席。解雇那些履职尽责的主席将打破数十年来的先例,并突破自 1913 年美联储成立以来保护其独立性的关键防火墙。