Next week's heavy schedule: "The most important financial report in the entire market" is coming

下週重點關注:美國 7 月 PCE、二季度 GDP、7 月耐用品訂單數據,中國 8 月官方 PMI、7 月規模以上工業企業利潤同比,美國對印度 50%“對等關税” 生效。英偉達、阿里巴巴、美團、拼多多、立訊精密、新易盛、中際旭創將公佈財報。

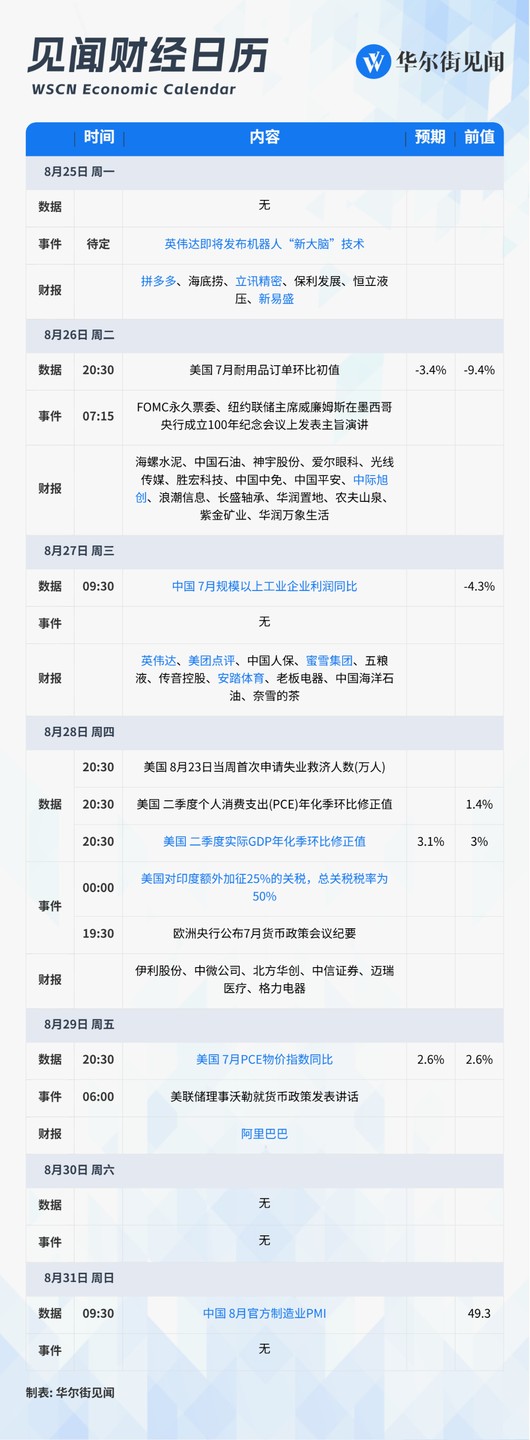

08 月 25 日 - 08 月 31 日當週重磅財經事件一覽,以下均為北京時間:

本週重點關注:美國 7 月 PCE、二季度 GDP、7 月耐用品訂單數據,中國 8 月官方 PMI、7 月規模以上工業企業利潤同比,美國對印度 50%“對等關税” 生效。英偉達即將發佈機器人 “新大腦” 技術。

財報方面,英偉達、阿里巴巴、美團、拼多多、立訊精密、新易盛、中際旭創將公佈財務數據。

經濟指標

-

美國 7 月 PCE 物價指數同比

29 日,美國公佈 7 月 PCE 物價指數。美國服務業通脹加速上行,關税衝擊凸顯。6 月 PCE 物價指數同比 2.6%,高於預期的 2.5%,前值上修 0.1 個百分點至 2.3%。環比 0.3% 持平預期。與此同時,消費者支出卻顯露疲態。經通脹調整後的實際消費支出 6 月僅增長 0.1%,與預期持平,未能扭轉前一個月的下滑趨勢。

在美國貨幣供應量 M2 重回 5% 的峯值、PPI 升至高位等多重因素作用下,通脹 “第二波” 擔憂正在積聚。經濟學家警告,當前形勢與 1970 年代央行過早降息導致通脹反覆的歷史驚人相似,美聯儲的審慎態度至關重要。

花旗認為,關税對消費價格的衝擊比市場預期的更緩慢、更持久,8-9 月份將是驗證這一趨勢的關鍵窗口期。PCE 價格指數在 2025 年第四季度可能達到 3.2%。

-

美國二季度實際 GDP 年化季環比修正值

上月公佈的初值顯示,美國二季度剔除通脹因素後的 GDP 以年化 3% 的速度增長,扭轉了第一季度的萎縮,並大幅超出市場預期的 2.6%。但深入分析顯示,這種繁榮具有欺騙性。進口量的大幅萎縮人為地抬高了整體數據,掩蓋了國內需求明顯放緩的事實。

瑞銀在近日的研報中預測,美國 GDP 將從二季度的 2.0% 年增長率大幅放緩至四季度的 0.9%,明顯低於經濟學家一致預期的 1%。研報指出,支撐這一判斷的理由包括:

關税上調前的購買需求透支、超額儲蓄消耗殆盡、移民放緩、《基礎設施投資和就業法案》在 2025 年構成小幅財政拖累,以及債務展期時有效利率上升。

不過,瑞銀也在報告中特別指出,儘管美國經濟存在上行風險,但經濟放緩趨勢難以避免。該行在報告中指出推動經濟上行的潛在因素包括:

股價上漲 10% 通過財富效應為 GDP 增加 0.6%-1%;

生成式 AI 相關資本支出:瑞銀預測超大規模公司今年資本支出將增長 60%;

投資回流美國:韓國、日本和歐盟在近期關税談判中承諾的投資相當於未來 3 年 GDP 的 5%;

寬鬆的金融條件。

-

美國 7 月耐用品訂單環比初值

26 日,美國公佈 7 月耐用品訂單環比初值。上月,美國 6 月耐用品訂單環比驟降 9.3%,降幅略好於市場預期,但仍為自 2020 年疫情以來的最差表現。這一劇烈波動主要源於非國防航空器訂單的大幅調整,從 5 月份環比激增 230% 轉為 6 月份下滑 50%。

剔除波音訂單影響後,核心數據表現穩健。耐用品訂單環比增長 0.25%,好於預期的 0.1%,同比增長 2.23%。 今年上半年,商業規劃者面臨着來自政策層面的雙重挑戰:頻繁變化的關税以及圍繞税收和支出立法的不確定性。這種環境顯著抑制了企業的投資意願。

-

中國 8 月官方製造業 PMI

31 日,中國公佈 8 月官方製造業、非製造業、綜合 PMI。上月,製造業 PMI 降至 49.3%,製造業景氣水平較上月回落。新訂單指數為 49.4%,表明製造業市場需求有所放緩。

民生宏觀陶川認為,“反內卷” 政策效應開始分化,雖然價格預期即時改善,但生產開始階段性放緩;邁入貿易新階段後出口景氣度發生變化,發佈領先的 PMI 新出口訂單指數預告了 7 月出口的邊際下行壓力。國盛證券認為,後續政策可能 “託而不舉”、靈活加碼。

-

中國 7 月規模以上工業企業利潤同比

上月數據顯示,6 月份,規模以上工業企業實現利潤降幅較 5 月份收窄 4.8 個百分點,其中製造業改善明顯,汽車行業在車企促銷帶動銷量快速增長疊加重點企業投資收益增長等因素作用下,利潤增長 96.8%。“兩新” 政策帶動效果持續顯現,智能無人飛行器製造、計算機整機制造等行業利潤分別增長 160.0%、97.2%。

財經事件

-

美國對印度額外加徵 25% 的關税,總關税税率為 50%

據新華社 8 月 6 日報道,美國總統特朗普 6 日簽署行政令,以印度 “以直接或間接方式進口俄羅斯石油” 為由,對印度輸美產品額外徵收 25% 的關税。這意味着美國對印度總體關税税率將達到 50%。公告表示,除一些例外情況,新的關税措施將在行政令公佈 21 天后實施。 根據特朗普 7 月 31 日簽署的行政令,美國將從 8 月 7 日開始對印度輸美商品徵收 25% 的關税。與 6 日公佈的額外關税疊加後,印度輸美商品將總體適用 50% 的關税税率。

印度企業正面臨亞洲最嚴重的盈利預測下調。分析師大幅削減了對印度公司的盈利預期,凸顯出貿易緊張局勢對這個亞洲第三大經濟體的衝擊。據 LSEG IBES 最新數據顯示,過去兩週內,印度大中型企業未來 12 個月的盈利預測被下調 1.2%,降幅為亞洲之最。美國銀行最新基金經理調研顯示,印度股市地位在短短兩個月內發生戲劇性逆轉,從最受青睞的亞洲股市淪為最不受歡迎的市場。

儘管印度經濟以內需為主,Nifty 50 指數成分股公司僅 9% 的收入來自美國市場,但關税威脅仍對經濟增長構成重大風險。為應對這一挑戰,據華爾街此前文章,印度總理莫迪擬進行商品及服務税改革,計劃將四個税檔 5%、12%、18% 和 28% 下調和簡化成兩檔 5%、18%,以提振經濟同時應對關税衝擊。渣打銀行經濟學家預計,這項税制改革將在 2027 財年為 GDP 增長貢獻 0.35-0.45 個百分點。

- 英偉達即將發佈機器人 “新大腦” 技術

8 月 24 日,英偉達機器人官方賬號在社交平台上發佈了一張黑色禮盒的照片,附着一張帶着創始人黃仁勳簽名、配文為 “好好享受” 的賀卡。

此次預熱的產品,是一款針對機器人的 “新大腦”。兩天前,英偉達便發佈了預熱視頻,黃仁勳寫下一張賀卡稱:“好好享受你的新大腦吧!”

隨後,一款人形機器人拿起禮盒上的賀卡,讀了起來,這款機器人來自中國廠商傅利葉。在打開禮盒環節,視頻中出現了多款不同型號的手臂,或暗示這款 “新大腦” 已經適配了多款人形機器人。

財報

-

英偉達

英偉達將於下週三公佈最新財報,屆時三季度指引將成為市場關注焦點。KeyBanc Capital Markets 的最新報告顯示,英偉達對下一財季的指引中可能會暫時排除來自中國市場的直接收入,因為在美國出口限制下,半導體出口許可證獲批的具體時間難以確定。

KeyBanc 分析師表示,如果將基於 H20 和 RTX6000D(B40)等芯片的中國業務計算在內,本可為英偉達帶來 20 億至 30 億美元的增量收入。 目前,市場普遍預期英偉達三季度營收 459.2 億美元,每股收益 1.01 美元。 產能提升支撐基本面。儘管面臨中國市場的短期不確定性,英偉達的業務基本面依然強勁,為其長期增長提供了有力支撐。

KeyBanc 在報告中強調,英偉達的 GPU 供應和產能正在顯著改善,這是其業績持續向好的核心驅動力。數據顯示,在截至 7 月的財季中,英偉達的 GPU 供應量增長了 40%,並預計隨着 B200 的放量,截至 10 月的財季供應量將再增長 20%;與此同時,更新、性能更強的 B300 芯片將於 10 月當季開始出貨,並有望佔據 Blackwell 系列出貨量的一半。

此外,服務器機架的生產效率也在提升。 報告指出,服務器 ODM 廠商的 GB200 機架製造良率已接近 85%,年底的機架出貨量有望達到 15000 至 17000 架。因此,該行將全年 GB200 機架出貨量的預測從 25000 架上調至 30000 架。

華爾街保持樂觀預期 KeyBanc 分析師 John Vinh 在發佈預警的同時,仍將英偉達的目標價從 190 美元上調至 215 美元,並維持 “增持” 評級。 Susquehanna 的分析師 Christopher Rolland 也看到了英偉達數據中心業務的持續動能,將其目標價從 180 美元上調至 210 美元,並維持 “正面” 評級。儘管有兩家華爾街機構上調目標價,市場反應仍相對謹慎。

-

阿里巴巴

阿里巴巴集團 29 日將公佈的 2026 財年第一季度業績,將成為檢驗其"用户為先、AI 驅動"戰略轉型成效的關鍵窗口。多家券商預測顯示,受淘寶閃購 500 億補貼計劃影響,集團整體利潤將顯著承壓。

根據國海證券預測,阿里巴巴 2026 財年 Q1 總營收預計達 2490 億元,同比增長 2%,但經調整 EBITA 同比下降 15% 至 382 億元,利潤率降至 15%。東方證券和摩根士丹利也給出類似預測,認為淘天集團與本地生活集團合併 EBITA 將大幅下滑 16%-20%。

券商普遍將利潤下滑歸因於閃購業務的鉅額補貼投入。自 7 月 2 日宣佈 500 億補貼計劃以來,淘寶閃購日訂單量從 1000 萬快速攀升至 8000 萬,但這一激進擴張策略導致本地生活分部經調整 EBITA 預計為-57.0 億元,較市場預期的-11.2 億元大幅惡化。

與電商業務利潤承壓形成對比的是,阿里雲業務展現出強勁增長勢頭。券商預測雲智能集團 Q1 營收將達 325 億元,同比增長 22%,其中 AI 相關產品收入連續七個季度實現三位數增長,有望成為集團新的利潤增長點。

-

美團

美團定於 2025 年 8 月 27 日公佈其第二季度業績。市場普遍預期,該公司將在即將發佈的第二季度財報中錄得穩健的營收增長,但其盈利能力正因核心外賣業務的激烈補貼戰而面臨顯著壓力,這使得本次業績披露成為檢驗其戰略韌性的重要時刻。

據朝陽永續提供的業績前瞻數據顯示,分析師預測美團第二季度營收將在 924.04 億元至 956.70 億元之間,同比增長 12.3% 至 16.3%。然而,盈利預測卻亮起了紅燈,預計淨利潤將同比下滑 29.3% 至 50.6%,經調整淨利潤也預計同比下降 17.7% 至 46.9%。這一預期與公司管理層在第一季度財報後的指引相符。儘管美團一季度業績超出市場預期,但管理層當時已明確警示,由於市場競爭加劇以及在外賣領域的激進補貼活動,第二季度的毛利率將出現 “顯著壓縮”。

外賣業務仍然是美團的戰略核心,也是當前利潤壓力的主要來源。海通國際證券在一份報告中指出,面對來自京東和餓了麼的補貼競爭,美團管理層已表明立場,願意 “採取一切必要措施” 來捍衞其市場領導地位。

即時零售業務(美團閃購)是最大亮點之一。據海通國際證券數據,該業務在一季度的訂單量實現了 50% 的同比增長,增長動力主要來自快速消費品以及電子產品、家電等高價值商品。這表明消費者對即時配送的需求正在從餐飲外賣向更廣泛的零售品類延伸。到店業務也表現穩健。得益於在教育、健身等項目的支持以及服務和醫療保健類別的擴展,美團的年活躍商户數在一季度同比增長超過 25%。

- 拼多多

拼多多將於美東時間 08 月 25 日盤前發佈財報,2025Q2 預計實現營收 1031.96 億元,同比增加 6.32%;預期每股收益 12.3 元,同比減少 43.08%。

-

立訊精密

立訊精密公告,公司已於 8 月 18 日向香港聯合交易所有限公司遞交發行境外上市股份 (H 股) 並在香港聯合交易所主板掛牌上市的申請,並於同日在香港聯交所網站刊登了本次發行的申請材料。

公開資料顯示,立訊精密創立於 2004 年,經過二十餘年的發展,現已成長為全球精密智能製造領域的創新科技企業。公司主要專注於為消費電子、汽車電子、通信與數據中心以及其他高科技領域提供全方位的產品和服務,涵蓋從精密零部件、功能模塊到完整系統的跨領域垂直一體化開發與智能製造解決方案。

招股書披露顯示,2022 年至 2024 年,立訊精密實現的收入分別為 2140 億元、2319 億元和 2688 億元人民幣。同期的淨利潤分別為 105 億元、122 億元和 146 億元,實現了穩步增長。2025 年一季度,立訊精密增長勢頭繼續延續,實現營收 618 億元,同比增長 17.9%。淨利潤 34 億元,同比增長 31.3%。

具體來看,立訊精密業務主要分為消費電子、汽車電子、通信與數據中心及其他四大板塊。其中,消費電子業務依然是其營收的絕對基石。2024 年,該業務板塊貢獻收入 2331 億元,佔總營收的比重高達 86.7%。招股書披露數據稱,以 2024 年銷量計,全球平均每兩部智能手機、每三部智能可穿戴設備中,就有一部使用其公司產品。

-

蜜雪集團

蜜雪集團在港交所公告稱,董事會會議將於 2025 年 8 月 27 日(星期三)舉行,藉以(其中包括)考慮及批准本集團截至 2025 年 6 月 30 日止的六個月中期業績及其發佈,以及處理其他事項。