U.S. pre-market Chinese concept stocks are mixed, European stocks opened higher, oil prices are under pressure, and the market is focused on Jackson Hole

納指跌超 1%,創 4 月關税衝擊以來第二大跌幅,標普三連跌;家得寶漲超 3% 力撐道指;英特爾反彈 7%;Palantir 跌超 9%;歐洲軍工股 Leonardo 跌 10%;績後小鵬汽車漲超 4%、小米美股跌超 2%。美債收益率四日來首降。美元指數兩日反彈。以太坊連續兩日盤中跌超 6%。原油回落超 1%,美油收創逾兩月新低。黃金再創逾兩週新低。

有望推動俄烏達成和平協議的俄烏領導人直接會晤在籌備中,國際原油和黃金齊跌,歐洲軍工股重挫。美股遭到科技巨頭回落的衝擊,兩大美股指標普和納指進一步下挫,財報業績向好的零售商家得寶力撐道指盤中創新高。比特幣等加密貨幣盤中跳水。

週二美股走勢分化,科技股打破美股 “夏日平靜”、大多下跌,帶頭拖累大盤,而獲大 “金主” 軟銀支持的英特爾在芯片股中一枝獨秀,道指在家得寶為首的個股帶動下驚險收漲。

據央視新聞,美俄總統週一通話,雙方支持俄烏代表團進行直接談判。週二美股盤中,美國總統特朗普稱,他已 “大致安排好” 俄烏領導人會晤;媒體稱布達佩斯成為白宮的三方會晤地點首選。歐洲軍工股大跌;國際原油回落,美油一度跌近 2%;黃金盤中再創逾兩週新低。

美股盤中,科技巨頭拖累納指跌超 1%,英偉達創四個月最大跌幅,而英特爾強勁反彈,刷新日高時漲 12%。週一軟銀宣佈與英特爾簽署 20 億美元投資協議,媒體稱特朗普政府考慮持有該司 10% 股份,美國商務部長盧特尼克週二確認在討論政府持股。

最近五個交易日,英偉達等科技七巨頭總體下行,其他 493 只標普成分股大致持平

美股盤前,美國家裝零售巨頭家得寶公佈,二季度營收和 EPS 盈利略低於預期、但全年指引保持不變,股價盤中一度漲近 5%,帶頭推動道指反彈。

加密貨幣盤中跳水,其中最高市值的比特幣一度跌超 4000 美元、跌破 11.3 萬關口, 第二高市值的以太坊盤中跌幅曾再度超過 6%。

三大美股指表現不一,週一反彈的納指收跌超 1%,創 4 月關税衝擊以來第二大跌幅,標普三連跌,週一回落的道指早盤創盤中歷史新高,午盤曾轉跌,尾盤收漲。英偉達收跌 3.5%,領跌科技七巨頭;軍工 AI 龍頭 Palantir 跌超 9%,五連跌。公佈財報的兩隻中概股小鵬汽車和小米漲跌互見。

美股基準股指:

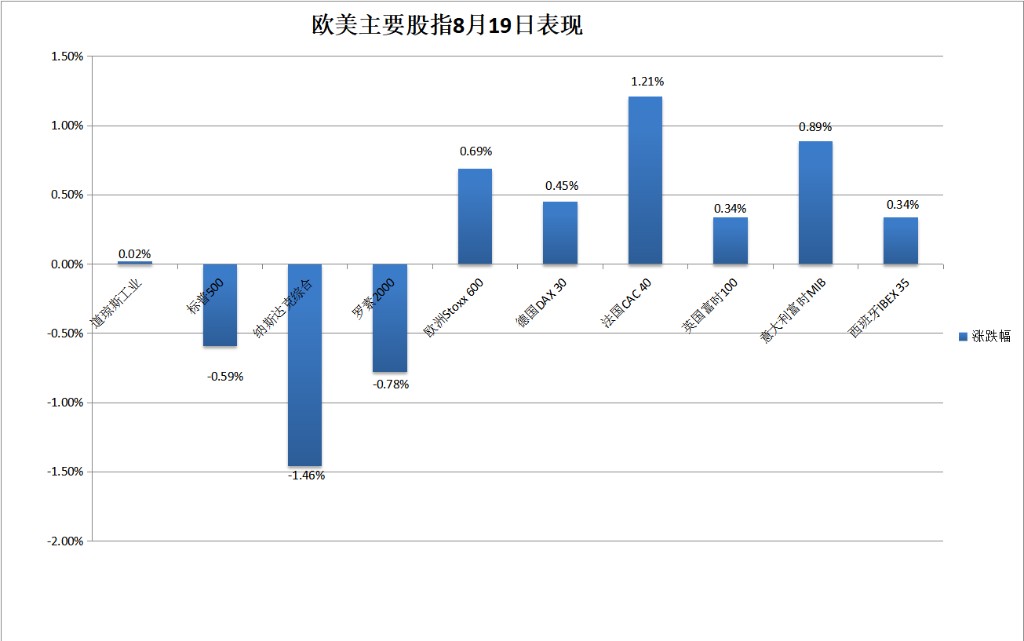

- 標普 500 收跌 0.59%,報 6411.37 點,納指收跌 1.46%,報 21314.952 點,分別刷新 8 月 11 日和 8 月 7 日以來低位。道指收漲 10.45 點,漲幅 0.02%,報 44922.27 點。

最近五個交易日,道指有四日表現強於納指

- 羅素 2000 收跌 0.78%,報 2276.606 點。納斯達克 100 指數收跌 1.39%,報 23384.77 點,和納指均創僅次於 8 月 1 日的四個月來第二大日跌幅。納斯達克科技市值加權指數收跌 2.00%,報 2058.5212 點。

主要美股指週二盤中曾齊跌,納指低開低走,道指早盤創新高後午盤曾轉跌

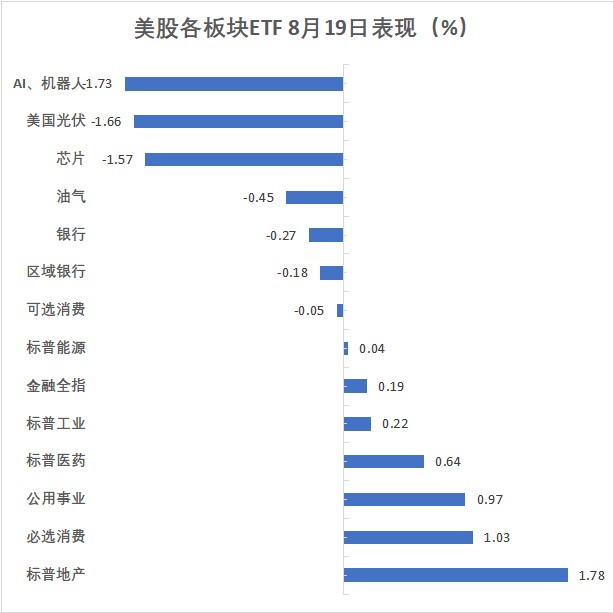

美股行業 ETF:

- 半導體行業 ETF 收跌 2.02%,領跌美股行業 ETF,全球科技股指數 ETF、科技行業 ETF、網絡股指數 ETF 跌 1.89%-1.34%,而日常消費品 ETF 漲 1.03%。

道指成份股:

- 家得寶(HD)收漲約 3.2%,Sherwin-Williams 漲 2.5%,寶潔漲 1.7%,可口可樂、Verizon、Travelers 漲超 1%,而微軟、亞馬遜、高盛、聯合健康均跌超 1%,英偉達表現最差。

標普各板塊:

- 週二僅四個板塊收跌,IT 跌 1.88%,電信跌 1.16%,可選消費跌近 0.4%,能源跌近 0.2%。收漲的七個板塊中,房產漲 1.8%,必需消費品和公用事業漲約 1%,醫療漲約 0.6%,材料漲約 0.5%,金融和工業漲近 0.2%。

科技七巨頭:

- 美國科技股七巨頭(Magnificent 7)指數跌 1.71%,報 186.88 點。

- 英偉達收跌 3.50%,創 4 月 21 日以來最差單日表現;Meta 跌 2.07%,特斯拉、亞馬遜、微軟跌 1.75%-1.42%,谷歌 A 跌 0.95%,蘋果跌 0.14%。

芯片股:

- 費城半導體指數收跌 1.81%,報 5761.51 點。AMD 收跌 5.44%,Arm 跌 5%,台積電美股跌 3.6%,而英特爾收漲 6.97%。

中概股:

- 納斯達克金龍中國指數收跌 0.90%,報 7581.89 點,止步兩連漲。

- 微博收跌 6.11%,金山雲跌 4.82%,老虎證券跌 3.72%,公佈二季度淨利潤同比增 75.4% 的小米美股粉單跌 2.22%,阿里跌 1.16%,而公佈營收翻倍創新高,淨虧損收窄 63% 的小鵬汽車漲 4.22%,蔚來漲 4.11%。

其他個股:

- Palantir 收跌 9.35%,在上週二收創歷史新高後五日連跌,五日累跌 15.6%。

- 公佈二期臨牀試驗結果顯示其實驗性口服減肥藥的副作用超出預期後,Viking Therapeutics 收跌 42.1%。

- 儘管第四財季和本財季的指引的業績優於預期,光收發器製造龍頭 Fabrinet 仍收跌 12.7%。

泛歐股指兩連漲至五個多月新高,英股反彈至歷史新高,歐洲汽車板塊漲超 2%,奢侈品巨頭走高,軍工股大跌。

泛歐股指:歐洲斯托克 600 指數收漲 0.69%,報 557.81 點,刷新 3 月 3 日以來高位。

板塊:汽車收漲 2.4%,成分股 Forvia 漲 4.21%、Stellantis 和法國雷諾均漲 3.19%、聖戈班漲 3.02%。

奢侈品和烈酒類股:瑞士歷峯集團收漲 3%,巴黎上市的 LVMH 和保樂力加分別漲 2.95% 和 3.36%,力挺法國股指漲超 1%。消息面上,中國召開消費品以舊換新工作電話會,稱將加快培育消費新增長點。

軍工股:意大利 Leonardo 收跌 10.16%,RENK 跌 8.27%,瑞典 Saab 跌 7.02%,Kongsberg Gruppen 跌 6.11%,德國萊茵金屬 RHM 跌 4.85%,法國泰雷茲 Thales 跌 4.11%。

主要歐洲國家股指:

- 兩連跌的德股、週一回落的英法意西股均反彈,英國股指刷新上週四所創的收盤最高紀錄。

- 德國 DAX 30 指數收漲 0.45%,法國 CAC 40 指數收漲 1.21%,英國富時 100 指數收漲 0.34%,意大利富時 MIB 指數收漲 0.89%,西班牙 IBEX 35 指數收漲 0.34%。

歐元區和美國國債價格齊漲。美債收益率扭轉三日連升,十年期收益率告別兩週高位。

美債:

美國 10 年期基準國債收益率在歐股早盤升破 4.34% 刷新日高,後持續下行,美股午盤下破 4.30% 刷新日低,脱離週一升破 4.35% 刷新的 8 月 1 日以來高位,到債市尾盤時約為 4.31%,日內降約 2 個基點。

2 年期美債收益率在亞市盤中升破 3.77% 刷新日高,後也下行,美股早盤下破 3.74% 刷新日低,到債市尾盤時約為 3.75%,日內降約 1 個基點。

美債收益率在三日連升後回落

歐債:

- 到債市尾盤,英國 10 年期基準國債收益率約為 4.74%,持平週一;2 年期英債收益率約為 3.97%,日內升 2 個基點;基準 10 年期德國國債收益率約為 2.75%,日內降 1 個基點;2 年期德債收益率約為 1.95%,持平週一。

美元指數兩日脱離逾兩週低位,盤中曾轉跌;人民幣隱含波動率降至去年 3 月以來最低;比特幣一度跌超 4000 美元、跌穿 11.3 萬關口,以太坊連續兩日盤中跌超 6%。

美元:

- ICE 美元指數(DXY)在歐股早盤跌破 98.00 刷新日低,日內跌逾 0.2%,美股早盤尾聲時轉漲後再未轉跌,美股午盤曾逼近 98.30、靠近亞市早盤刷新的日高,繼續脱離上週五跌破 97.80 刷新的 7 月 28 日以來低位。

- 到週二匯市尾盤,美元指數處於 98.20 上方,日內漲 0.1%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數日內漲逾 0.1%,和美元指數均連續兩日反彈。

彭博美元現貨指數週二窄幅波動,盤中曾轉跌但最終轉漲

非美貨幣:

- 日元反彈,美元兑日元在美股刷新日低至 147.45,日內跌約 0.3%,還未逼近上週四跌至 146.21 刷新的 7 月 24 日以來低位。

- 英鎊兑美元在歐股盤中漲破 1.3530 刷新日高,後回落,美股早盤轉跌,美股午盤跌破 1.3480 刷新 8 月 12 日上週二以來低位,日內跌約 0.2%。

- 人民幣:離岸人民幣(CNH)兑美元在亞市早盤跌至 7.1919,刷新上週二以來低位,亞市盤中轉漲後歐股盤中刷新日高至 7.1822,較日低漲 97 點,後回落,美股午盤曾轉跌,北京時間 8 月 20 日 4 點 59 分,報 7.1871 元,較週一紐約尾盤漲 4 點,在兩連跌後兩連漲。

加密貨幣:

- 比特幣(BTC)總體下行,在美股尾盤跌破 11.29 萬美元,刷新 8 月 5 日以來低位,較亞市盤初的日高跌超 4000 美元、跌超 3%,美股收盤時處於 11.33 萬美元下方,最近 24 小時跌近 3%。

- 市值僅次於比特幣的第二大加密貨幣以太坊(ETH)在美股尾盤曾跌破 4120 美元,刷新 8 月 9 日以來低位,較亞市盤初的日高跌超 6%,美股收盤時徘徊 4150 美元一線,24 小時內跌近 5%。

比特幣 6 月以來首次跌破 50 日均線

原油回落超 1%,美油收創逾兩月新低,布油逼近兩月低位。

原油:

- 美股午盤刷新日低時,美國 WTI 原油跌至 62.25 美元,日內跌超 1.8%,布倫特原油跌至 65.61 美元,日內跌近 1.5%。

- WTI 9 月原油期貨收跌近 1.69%,報 62.35 美元/桶,刷新 5 月 30 日以來低位。布倫特 10 月原油期貨收跌 1.21%,報 65.79 美元/桶,逼近上週三刷新的 6 月 5 日以來低位。

美油收創兩個多月來新低

美國汽油和天然氣:

- NYMEX 9 月汽油期貨收跌 0.46%,報 2.0890 美元/加侖,三連跌;NYMEX 9 月天然氣期貨收跌 4.29%,報 2.7660 美元/百萬英熱單位,兩連跌。

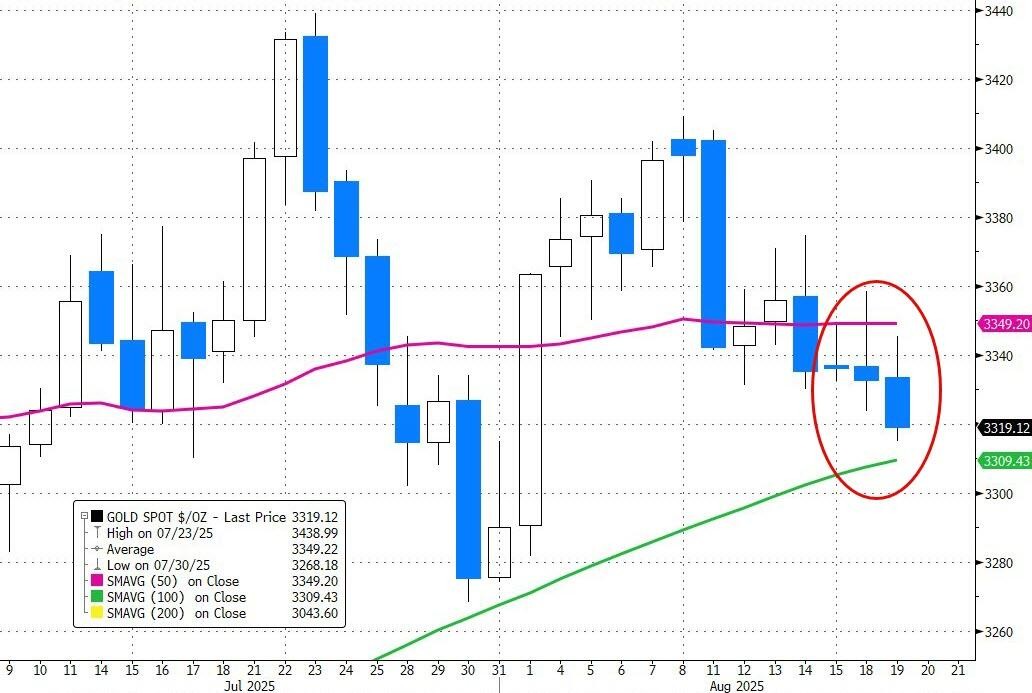

黃金反彈失利,再創逾兩週新低。倫銅倫鎳兩連跌,倫鋅倫鋁三連跌至兩週低位,倫錫倫鉛反彈。

黃金:

- 歐股盤中刷新日高時,紐約黃金期貨和現貨黃金分別日內漲逾 0.3% 和近 0.4%,美股午盤連續兩日刷新 8 月 1 日以來低位時,期金跌至 3358.1 美元,日內跌近 0.6%,現貨黃金跌至 3315.05 美元,日內跌逾 0.5%。

- 到美股午盤期金收盤,COMEX 12 月黃金期貨跌 0.57%,報 3358.7 美元/盎司,繼續刷新 7 月 31 日以來低位,四連跌。美股收盤時,現貨黃金約為 3316.20 美元,日內跌 0.5%。

現貨黃金四連跌,跌破 50 日均線後下測 100 日均線

倫敦基本金屬:

- 倫銅倫鎳分別創逾一週和逾兩週新低,而週一跌近兩週低位的倫鉛小幅反彈,兩連跌的倫錫也反彈。

- LME 期銅收跌 41 美元,報 9692 美元/噸。LME 期鋁收跌 25 美元,報 2564 美元/噸。LME 期鋅收跌 8 美元,報 2768 美元/噸。LME 期鎳收跌 145 美元,報 15006 美元/噸。

- LME 期鉛收漲 2 美元,報 1974 美元/噸。LME 期錫收漲 148 美元,報 33850 美元/噸。