The Russia-Ukraine negotiation process has begun, global stock markets are rising, and India is "leading the way."

道指微幅回落,標普微跌,納指止住兩連陰;Meta 跌超 2%,特斯拉反彈超 1%;英特爾跌近 3.7%。諾和諾德平價減肥藥合作方 GoodRx 大漲 37%。印度股指漲 1%。美債收益率連升三日,十年期收益率再創兩週新高。美元指數反彈,脱離逾兩週低位。“特澤會” 期間,原油盤中漲超 1%。黃金回落至兩週低位。

全球市場聚焦的傑克遜霍爾全球央行年會舉行前,美股大盤小幅波動。上週五的 “特普會” 未達成任何協議,市場關注的地緣政治局勢焦點俄烏和談也未有將要浮出水面的跡象,國際原油反彈。

本週一市場主要關注美國總統特朗普與烏克蘭總統澤連斯基在白宮的 “特澤會”,兩人先面對面會談,此後其他歐洲領導人蔘與,進行多方會晤。金融市場反應相對平靜。

美股午盤時段舉行的“特澤會”聚焦美俄烏會談。特朗普稱,美國將與俄烏合作,在安全領域提供大量幫助;下一步籌備美俄烏三方領導人會晤;澤連斯基稱已做好三方會晤的準備。德國總理默茨稱希望看到停火,但特朗普認為俄烏可以邊打邊談和平協議,不認為要停火才談。

“特澤會” 期間,國際原油盤中漲超 1%,三大美股指依然小幅波動。有分析認為,俄烏之間仍然存在重大分歧,仍有美國對俄羅斯實施制裁或對印度徵收二級關税的可能,儘管可能性不大,但仍值得一定的地緣風險溢價。

美股午盤,媒體稱,特朗普政府正在討論以入股英特爾約 10% 的方式進行投資。分析稱,此舉並不意味着美國政府投入英特爾的資金超過原計劃,可能只是資金髮放節奏加快。此前兩日累漲 10% 的英特爾股價回落,週一盤中一度跌 5.5%,收跌近 4%。

上週末諾和諾德宣佈,美國 FDA 已加速批准其重磅療法 Wegovy(2.4 mg 司美格魯肽)的補充新藥申請,用於治療一類肝病 MASH。週一美股盤前,諾和諾德宣佈推出現金支付優惠,司美格魯肽在美國售價月費從千元降至 499 美元。諾和諾德歐股漲近 7%,其美國合作銷售平台 GoodRx 漲近 40%。

新興市場中,印度總理莫迪擬進行商品及服務税改革。印度股市走高,印度國家證交所藍籌股 CNX Nifty 指數收漲 1.00%。兩個鄰國巴基斯坦和斯里蘭卡的股指創收盤歷史新高。

三大美國股指盤中多次小幅漲跌交替,到收盤,道指微幅回落,未能繼續逼近 7 月 23 日所創的最高紀錄,標普微跌,兩日跌離收盤紀錄高位,納指止住兩連陰;Meta 跌超 2%,特斯拉反彈超 1%;英特爾跌近 3.7%。諾和諾德平價減肥藥合作方 GoodRx 大漲 37%。

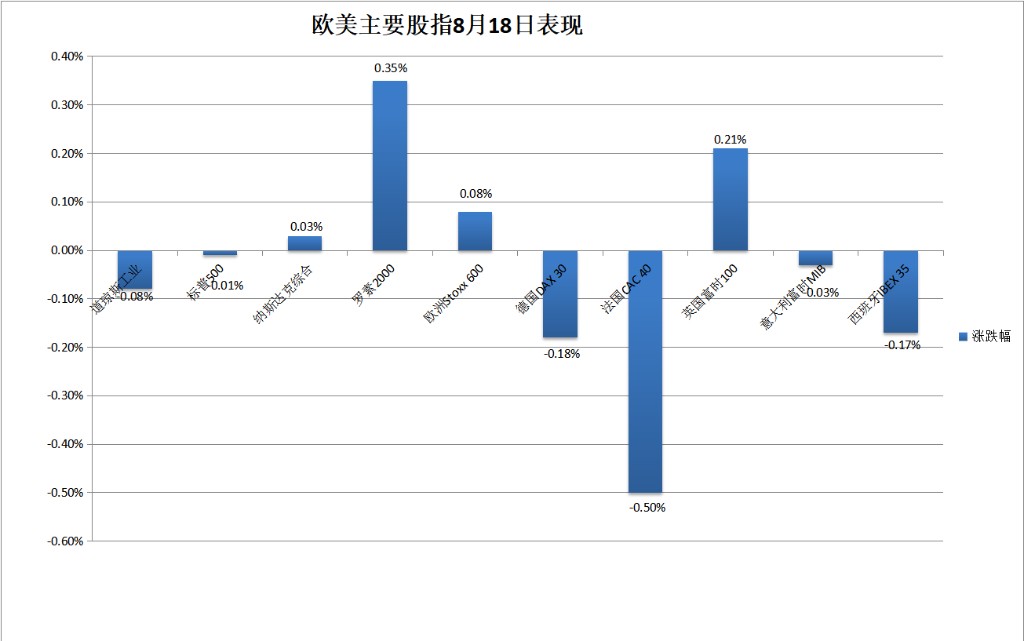

美股基準股指:

- 標普 500 指數收跌 0.01%,報 6449.15 點。道指收跌 34.30 點,跌幅 0.08%,報 44911.82 點。納指收漲 0.03%,報 21629.774 點。

- 小盤股指羅素 2000 收漲 0.35%,報 2294.47 點。納斯達克 100 指數收漲 0.01%,報 23713.759 點。納斯達克科技市值加權指數(NDXTMC)收跌 0.19%,報 2100.5711 點。

主要美股指中,週一小盤股指表現最佳

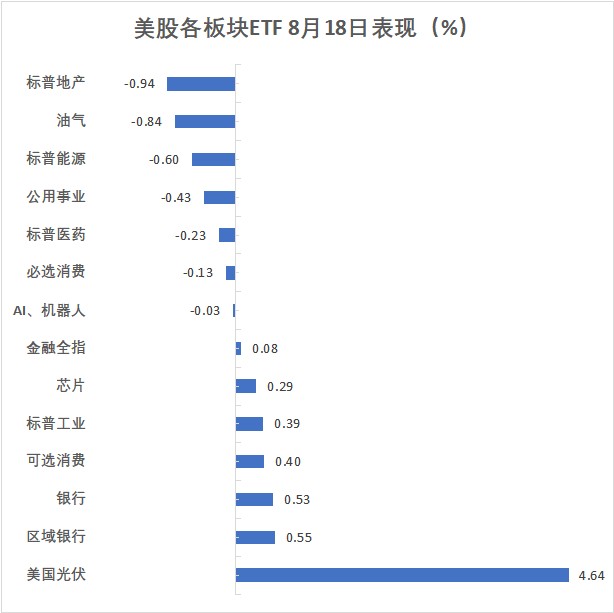

美股行業 ETF:

- 區域銀行 ETF 收漲 0.55%,領跑美股行業 ETF,網絡股指數 ETF、半導體 ETF、可選消費 ETF、銀行業 ETF 至少漲 0.4%,而能源業 ETF 跌 0.6%。

科技七巨頭:

- 美國科技股七巨頭(Magnificent 7)指數跌 0.11%,報 190.13 點。

- Meta Platforms 收跌 2.27%,微軟、蘋果、谷歌 A 至多跌 0.59%,亞馬遜、英偉達則至多收漲 0.86%,特斯拉漲 1.39%。

芯片股:

- 費城半導體指數收漲 0.41%,報 5776.31 點。英特爾收跌 3.66%,AMD 收跌 0.77%;台積電 ADR 漲 1.06%。

中概股:

- 納斯達克金龍中國指數收漲 0.12%,報 7650.61 點。富時中國 3 倍做多 ETF(YINN)收漲 1.66%。

- B 站收漲 2%,蔚來漲超 1%,小鵬漲近 1%,阿里漲 0.1%,拼多多跌 0.5%,騰訊美股粉單跌近 0.8%。

其他個股:

- 宣佈與諾和諾德合作、有條件推出售價 499 美元/月自費版司美格魯肽後,數字醫療平台 GoodRx Holdings(GDRX)收漲 37.27%。

- 本週四和週三將分別發佈財報的沃爾瑪(WMT)和塔吉特(TGT)分別收漲 0.7% 和 1.87%。

上週五止步三連漲的泛歐股指小幅反彈至三個多月高位,諾和諾德收漲 6.6%,力挺丹麥股指漲超 3%。

泛歐股指:歐洲斯托克 600 指數收漲 0.08%,報 554.01 點,刷新 5 月 20 日以來收盤高位。

板塊:醫療收漲逾 1.4%,得益於在美國監管方 FDA 加速批准其減肥藥用於治療嚴重肝病後,丹麥上市的歐洲最高市值藥企諾和諾德收漲 6.6%。

主要歐洲國家股指:

- 德股兩連跌,連漲十日的西股、連漲四日的法股以及上週五休市前三連漲的意股均回落,而上週五回落英股反彈,丹麥股指大漲。

- 德國 DAX 30 指數收跌 0.18%,法國 CAC 40 指數收跌 0.50%,意大利富時 MIB 指數收跌 0.03%,西班牙 IBEX 35 指數跌 0.17%,而英國富時 100 指數收漲 0.21%,丹麥 OMX 哥本哈根 20 指數收漲 3.47%。

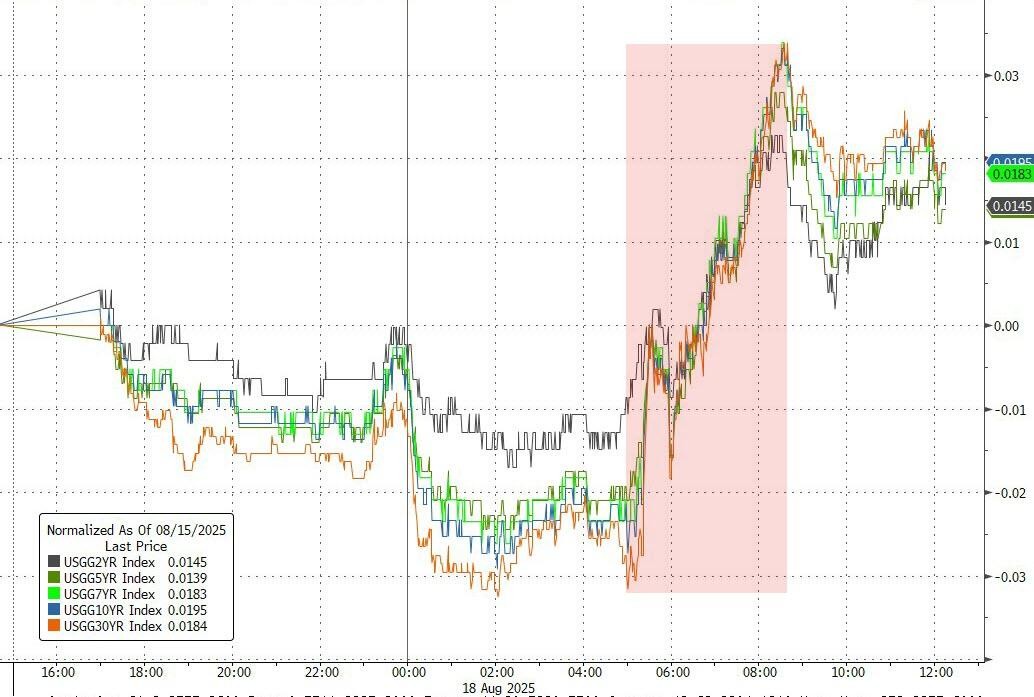

美債收益率連升三日,十年期收益率再創兩週新高。歐洲國債價格漲跌不一,英債連跌三日,歐元區國債反彈。

美債:

- 美國 10 年期基準國債收益率在歐股早盤下破 4.29% 刷新日低,隨後走高,美股早盤尾聲時升破 4.35%,連續兩個交易日刷新 8 月 1 日以來高位,到債市尾盤時約為 4.33%,日內升逾 1 個基點。

- 2 年期美債收益率在歐股早盤下破 3.74% 刷新日低,後也上行,美股早盤尾聲時升破 3.77%,刷新上週二以來高位,到債市尾盤時約為 3.76%,日內升約 1 個基點。

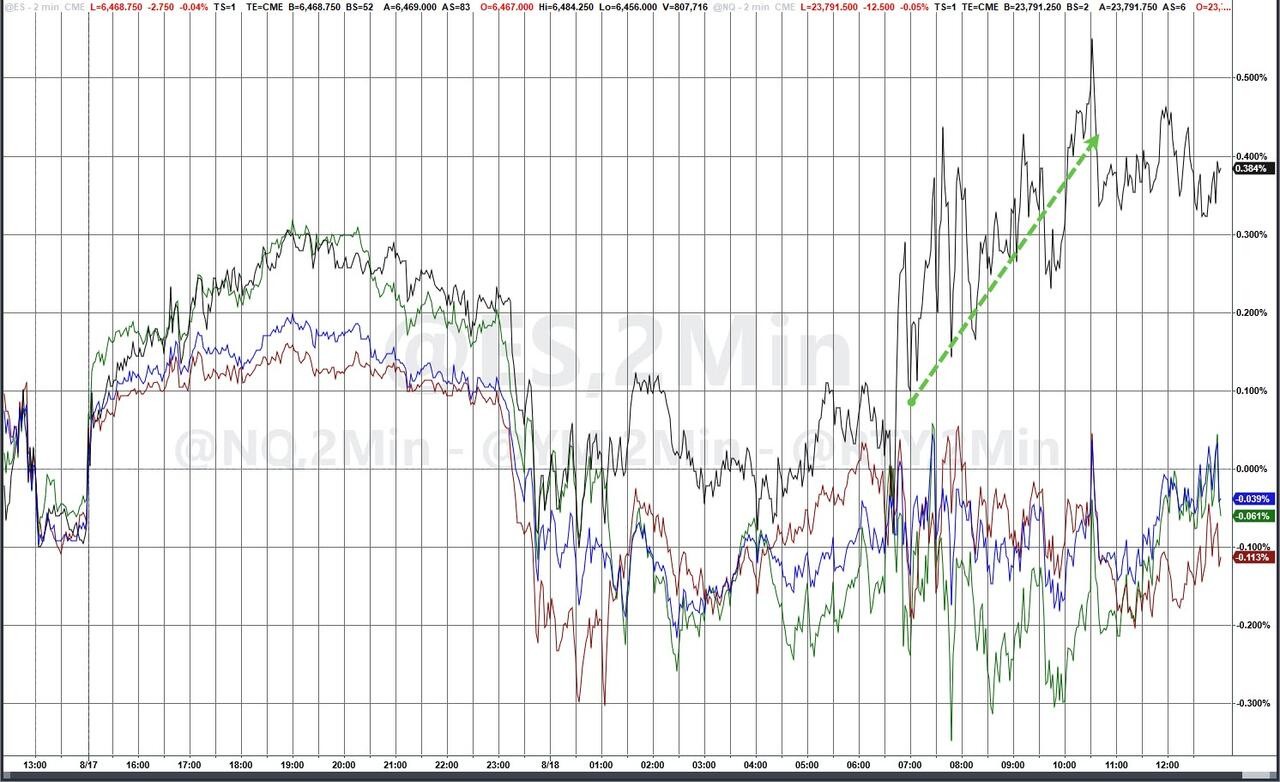

週一進入美股交易時段後,美債收益率普遍上行

歐債:

- 到債市尾盤,英國 10 年期基準國債收益率約為 4.74%,日內升 4 個基點;2 年期英債收益率約為 3.95%,日內升 3 個基點;基準 10 年期德國國債收益率約為 2.76%,日內降 2 個基點;2 年期德債收益率約為 1.95%,日內降 1 個基點。

美元指數反彈,脱離逾兩週低位;比特幣盤中跌超 3000 美元、跌破 11.5 萬關口至逾一週低位。

美元:

- ICE 美元指數(DXY)在亞市盤初刷新日低至 97.775,逼近上週五刷新的 7 月 28 日以來低位,亞市盤中多次轉漲,歐股早盤徹底擺脱跌勢,美股早盤刷新日高至 98.186,日內漲逾 0.3%。

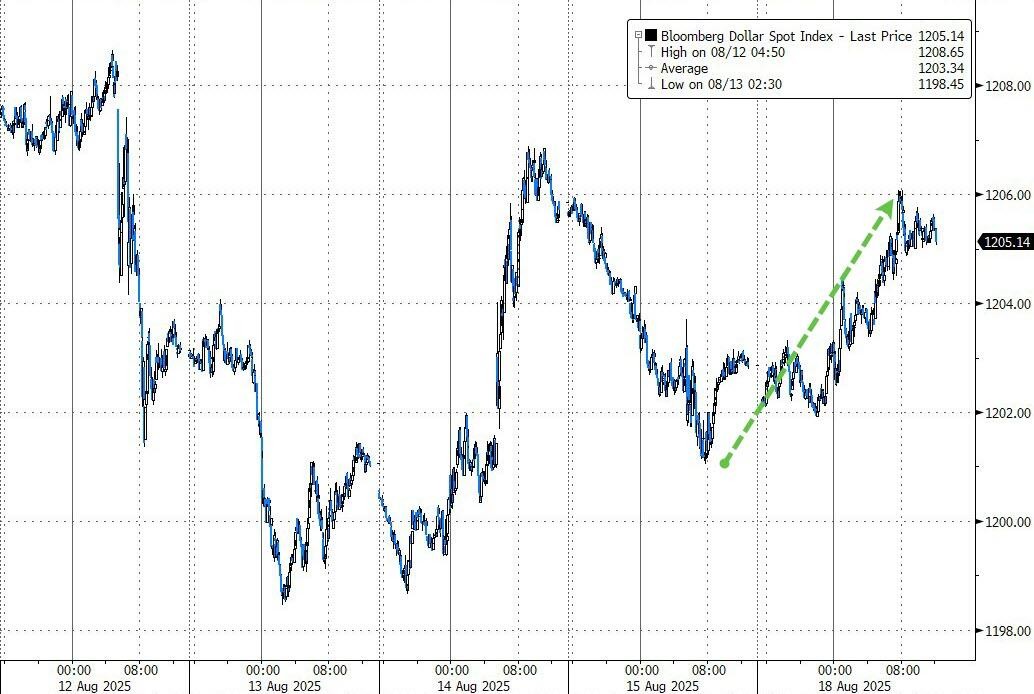

- 到週一匯市尾盤,美元指數處於 98.10 上方,日內漲約 0.3%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數日內漲 0.2%,和美元指數均在上週五回落後反彈。

彭博現貨美元指數抹平上週五回落的多數跌幅

非美貨幣:

- 上週五反彈的日元回落,美元兑日元在亞市早盤刷新日低至 147.05,亞市早盤轉漲後大多處於漲勢,僅歐市早盤曾轉跌,美股早盤逼近 148.00,刷新上週三以來高位,日內漲超 0.5%。

- 英鎊兑美元持續下行,美股午盤跌破 1.3510 刷新日低,未繼續靠近上週四漲至 1.3595 刷新的 7 月 10 日以來高位。

- 人民幣:離岸人民幣(CNH)兑美元在亞市早盤刷新日低至 7.1891,很快轉漲後保持漲勢,歐股早盤刷新日高至 7.1791,日內漲 95 點,美股早盤曾接近抹平漲幅,北京時間 8 月 19 日 4 點 59 分,報 7.1875 元,較上週五紐約尾盤漲 11 點,止住兩連跌。

加密貨幣:

- 比特幣(BTC)在歐股盤中跌破 11.48 萬美元,刷新 8 月 7 日以來低位,較亞市早盤的日高跌超 3000 美元、跌近 3%,美股收盤時處於 11.64 萬美元下方,最近 24 小時跌超 1%。

- 以太坊(ETH)在歐股盤中曾跌破 4230 美元,刷新 8 月 12 日以來低位,較亞市早盤的日高跌超 300 美元、跌超 6%,美股收盤時處於 4360 美元下方,24 小時內跌超 2%。

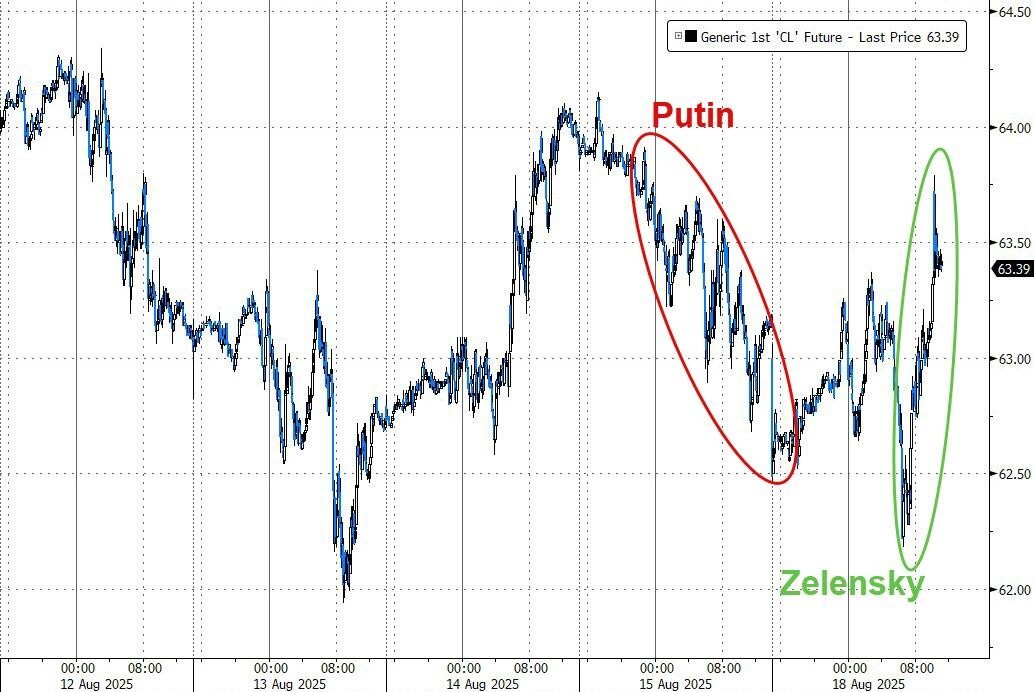

投資者對歐洲與特朗普的會談前景存疑,上週五回落的原油反彈,未繼續靠近上週三刷新的 6 月初以來收盤低位。特朗普與澤連斯基會晤期間,原油保持 1% 以上的盤中漲幅。

原油:

- 美股盤初刷新日低時,美國 WTI 原油跌至 62.18 美元,日內跌近 1%,布倫特原油跌至 65.3 美元,日內跌逾 0.8%,美股早盤轉漲後保持漲勢,美股午盤刷新日高時,美油漲至 63.79 美元,日內漲近 1.6%,布油漲至 66.82 美元,日內漲近 1.5%。

- WTI 9 月原油期貨收漲 0.62 美元,漲幅將近 0.99%,報 63.42 美元/桶;布倫特 10 月原油期貨收漲 0.75 美元,漲幅將近 1.14%,報 66.60 美元/桶。

特朗普與澤連斯基會晤期間,美油盤中漲超 1%

美國汽油和天然氣:

- NYMEX 9 月汽油期貨收漲 1.26%,報 2.0987 美元/加侖,兩連跌;三連漲的 NYMEX 9 月天然氣期貨收跌 0.89%,報 2.8900 美元/百萬英熱單位。

黃金盤中回落至兩週低位。倫銅倫鎳回落,倫鋅倫鋁倫鉛兩連跌,倫錫兩日反彈。

黃金:

- 亞市早盤刷新 8 月 1 日以來低位時,紐約黃金期貨跌至 3368 美元,日內跌與 0.4%,現貨黃金跌至 3323.6 美元,日內跌近 0.4%,亞市早盤轉漲後歐股盤前刷新日高時,期金漲至 3403.6 美元,日內漲逾 0.6%,現貨黃金漲至 3358.45 美元,日內漲近 0.7%,美股早盤幾度轉跌,午盤基本處於跌勢。

- 到美股午盤期金收盤,COMEX 12 月黃金期貨跌近 0.14%,報 3378 美元/盎司,刷新 7 月 31 日以來低位。美股收盤時,現貨黃金徘徊 3334 美元一線,日內跌近 0.1%。

現貨黃金週一盤中衝高回落

倫敦基本金屬:

- 倫銅回落至一週低位,倫鋅和倫鉛刷新至少近兩週低位,倫鋁刷新一週低位。倫錫連續兩日脱離一週低位。

- LME 期銅收跌 40 美元,報 9733 美元/噸。LME 期鋁收跌 18 美元,報 2588 美元/噸。LME 期鋅收跌 18 美元,報 2777 美元/噸。LME 期鉛收跌 10 美元,報 1971 美元/噸。LME 期鎳收跌 10 美元,報 15151 美元/噸。LME 期錫收漲 8 美元,報 33702 美元/噸。