Boeing Q2 revenue increased by 35% year-on-year, exceeding expectations, with net loss narrowing to $612 million | Financial Report Insights

得益于新签订单的增长,波音二季度新增净订单达 455 架,期末公司总积压订单规模达 6190 亿美元,创历史新高,其中商业飞机积压订单超过 5900 架,价值 5220 亿美元。

波音业绩在二季度释放出 “止跌企稳” 的信号:虽然净利润仍为负值,但核心亏损持续收窄,订单与交付明显回暖,商业航空业务的修复正在加快。与此同时,在经历监管危机和去年罢工重创后,波音正在稳步恢复生产能力。

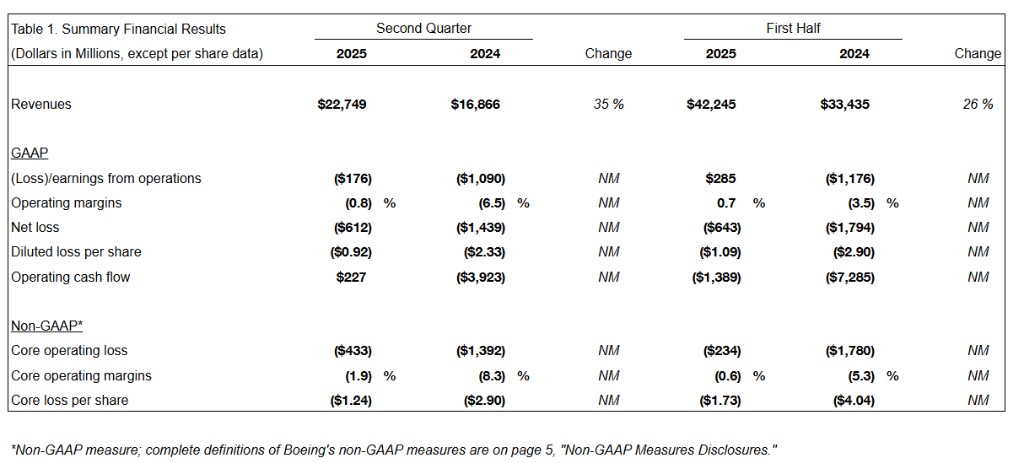

波音公司于 7 月 29 日公布了 2025 年第二季度财报:

得益于商用飞机交付量的回升,公司营收同比增长 35% 至 227.5 亿美元,超过市场预期的 216.8 亿美元;

净亏损为 6.12 亿美元,合每股亏损 0.92 美元,较去年同期 14.4 亿美元的亏损明显收窄。

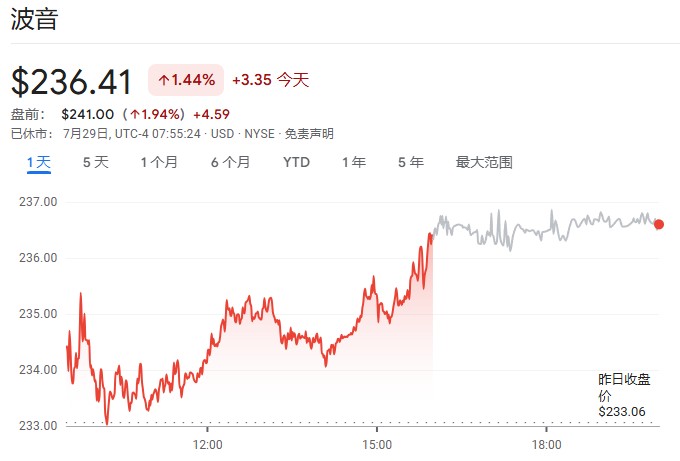

这一改善也提振了市场信心,公司股价在盘前交易中上涨近 2%。

商业航空业务强劲恢复,737 与 787 产能提升

波音在 2024 年初因 737 MAX 机型的一次机身面板爆裂事件受到美国联邦航空管理局(FAA)监管限制,产量受到压制。今年以来,波音在执行 “安全与质量计划” 的同时逐步恢复产能。在 5 月实现 737 单月产量 38 架后,生产保持稳定。

首席执行官 Kelly Ortberg 在致员工的信中表示:“随着我们持续执行安全与质量计划,运营正变得更加稳定。我们计划在关键绩效指标达到预期后,寻求 FAA 批准,将 737 产能提升至每月 42 架。”

2025 年上半年,波音共交付 206 架 737 MAX 飞机,并将 787 产能从每月 5 架提升至 7 架。强劲交付推动了公司营收回升,也强化了市场对其现金流修复能力的预期。

防务与服务板块持续盈利

防务、航天与安全部门(BDS)本季度营收为 66.2 亿美元,同比增长 10%,实现盈利 1.1 亿美元,扭转去年同期的 9.13 亿美元亏损,得益于项目执行表现的改善。本季度,该部门获得美国空军 T-7A 教练机订单,并启动 MQ-25 无人加油机的地面测试。

全球服务部门(BGS)继续保持稳定增长,营收同比增长 8% 至 52.8 亿美元,营业利润率达到 19.9%。该部门完成了盖特威克机场维修设施的出售,并获得韩国海军 P-8A 训练支持系统合同。

积压订单创纪录,商业机型最为强劲

得益于新签订单的增长,波音二季度新增净订单达 455 架,主要包括来自卡塔尔航空和英国航空的多型号 787 与 777-9 订单,前六个月净订单累计 625 架。

期末公司总积压订单规模达 6190 亿美元,创历史新高,其中商业飞机积压订单超过 5900 架,价值 5220 亿美元。

供应链与关税仍是拖累

尽管财务表现持续改善,但波音仍面临诸多挑战。全球供应链中断继续限制其生产节奏,制约其满足强劲航空需求的能力。去年,公司全年亏损接近 120 亿美元,部分来自防务项目的额外支出与生产延误。

此外,特朗普政府的新一轮关税计划也对波音构成威胁,可能推高零部件成本,进一步加剧供应链压力。