Is the alert on U.S. Treasuries lifted, leading to a major crisis? A liquidity "tsunami" of $500 billion is heading towards U.S. stocks!

The U.S. stock market may face a $500 billion liquidity shock as the U.S. debt ceiling crisis temporarily eases. Congress has raised the borrowing limit, which is expected to increase national debt by $3.4 trillion over the next 10 years. The rebuilding of the Treasury General Account (TGA) may tighten market liquidity, putting pressure on the stock market. The final value of the TGA in the July-September quarter is expected to reach $850 billion, and if fully rebuilt, liquidity will decrease by $510 billion

According to Zhitong Finance APP, as the "Big and Beautiful" tax and spending bill promoted by U.S. President Trump narrowly passed the House of Representatives, the U.S. debt ceiling crisis has temporarily eased. However, a critical shift is occurring, and the U.S. stock market may face a liquidity shock of $500 billion.

It is understood that as part of the "Big and Beautiful" bill, U.S. lawmakers raised the borrowing limit of the U.S. government to $36.1 trillion by $5 trillion. This move has temporarily alleviated concerns about a short-term default on U.S. debt but has exacerbated the long-term debt problem. The nonpartisan Congressional Budget Office (CBO) projects that this bill will increase national debt by $3.4 trillion over the next decade.

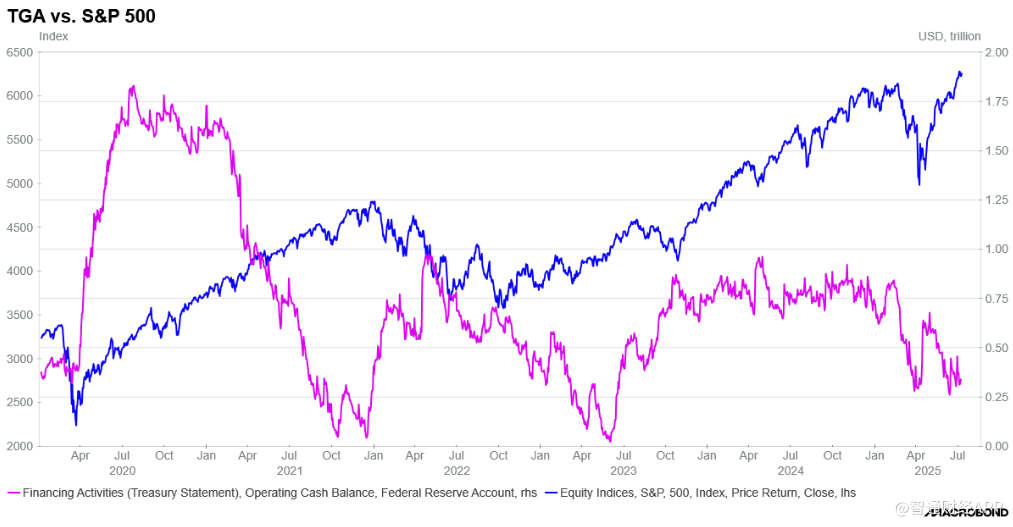

The U.S. government's settlement account, known as the Treasury General Account (TGA), was drained during the debt standoff, dropping to about $340 billion as of July 8, down from about $840 billion on February 11. Now, the TGA rebuilding process has begun, which may tighten liquidity conditions.

TGA Rebuilding May Tighten Market Liquidity

After reaching the debt ceiling, the U.S. Treasury could no longer issue new debt and had to rely on the TGA to fill the government spending gap. As the debt crisis eases, the TGA will be rebuilt, which could significantly reduce market liquidity, thereby putting pressure on the U.S. stock market.

The TGA plays a crucial role in the Federal Reserve's balance sheet. Since it is one of the most significant fluctuating components of the balance sheet, a decrease in the TGA's value helps increase the reserve balances held by the Federal Reserve; conversely, an increase in the TGA reduces reserve balances.

According to the quarterly refinancing documents from the April meeting, the final value of the TGA is expected to reach $850 billion in the July-September quarter. The Federal Reserve's meeting minutes also noted that once the debt issue is resolved, the TGA is likely to be rebuilt quickly.

According to estimates by Michael Kramer, founder of asset management firm Mott Capital, if the TGA is fully rebuilt, it would mean a liquidity loss of about $510 billion by the end of September, and the Federal Reserve's reserves could drop to between $2.7 trillion and $2.8 trillion. Even considering the use of reverse repurchase tools, the Federal Reserve's reserves could fall to between $2.9 trillion and $3.0 trillion.

In summary, with the large-scale TGA rebuilding, the Federal Reserve's reserve balances could decrease by $400 billion to $500 billion, which may put pressure on market liquidity and margin availability.

What Impact Will This Have on the U.S. Stock Market?

Generally speaking, historically, whenever reserve balances rise or fall, the overall market's margin levels change. Notably, the S&P 500 index, margin, and reserve balances typically exhibit synchronous trends. Therefore, a significant reduction in reserve balances is likely to negatively impact margin balances, thereby adversely affecting the stock market.

Historically, TGA rebuilding has had a negative impact on the S&P 500 index.

policy is still ongoing, and with the TGA set to be reconstructed, reserves are expected to decline. Theoretically, as the TGA increases and reserve balances drop to around $3 trillion or even lower, liquidity is expected to dry up