Focusing on U.S. trade signals, European stocks rose slightly, while U.S. pre-market Chinese concept stocks fell broadly, and New York copper dropped nearly 3%

標普收漲 0.61%。英偉達漲 1.8%。10 年期美債標售強勁、收益率下跌近 7 基點,抹去本週所有漲幅。巴西雷亞爾暴跌,特朗普表示將對南美洲國家進口商品徵收 50% 關税。比特幣一度突破 11.2 萬美元、今年已累計上漲近 19%。黃金先跌後漲,較日內低點上漲近 1%。原油走勢震盪,庫存出現自 1 月份以來的最大增幅。

大型科技股走強刺激風險偏好迴歸,三大美股指數反彈,英偉達一度突破 4 萬億美元市值。10 年期美債拍賣需求強勁,美債價格走強收復本週所有跌幅。比特幣紐約尾盤時段飆升至 11.2 萬美元、突破歷史新高。原油一度測試昨日高點,但在原油庫存出現自 1 月份以來的最大增幅後遭到拋售,最終收盤時價格持平。

科技七巨頭領漲美股,美債標售強勁:

美股早盤,英偉達漲超 2%、股價創歷史新高,成為首家市值達到 4 萬億美元的公司。其他主要科技股多數錄得漲幅,幫助推動市場整體上漲,盤中納指漲超 1%,道指漲 0.7%,標普 500 指數漲 0.7%。

- 美股盤中,據央視新聞,特朗普在社交媒體平台上發佈了致文萊、阿爾及利亞、摩爾多瓦、伊拉克、菲律賓和利比亞的信件。美股早盤走勢一度受挫、漲幅收窄。

- 美股午盤,華爾街見聞撰文,特朗普在社交媒體公佈發給斯里蘭卡的徵税函,稱將 8 月 1 日起對斯里蘭卡的產品徵收 30% 的關税。美聯儲會議紀要公佈後,美債收益率走低,隨着10 年期美債拍賣需求強勁,收益率跌幅繼續擴大。投資者無視貿易焦慮,三大美股指數均收漲,納指漲近 1%。

- 美股盤後,特朗普公佈,從 8 月 1 日起對進口自巴西的產品徵收 50% 的關税,這遠超特朗普 4 月 2 日公佈的對巴西對等關税水平 10%。巴西雷亞爾暴跌。

週三,大型科技股領漲美股,納斯達克指數上漲 0.9%,道瓊斯工業平均指數漲超 200 點。英偉達漲 1.8%,領漲科技七巨頭。Meta Platforms 漲 1.68%,特斯拉則跌 0.65%。

美股指數:

標普 500 指數收漲 37.74 點,漲幅 0.61%,報 6263.26 點。

道瓊斯工業平均指數收漲 217.54 點,漲幅 0.49%,報 44458.30 點。

納指收漲 192.87 點,漲幅 0.94%,報 20611.34 點。納斯達克 100 指數收漲 162.66 點,漲幅 0.72%,報 22864.91 點。

羅素 2000 指數收漲 1.07%,報 2252.49 點。

恐慌指數 VIX 收跌 5.18%,報 15.94。

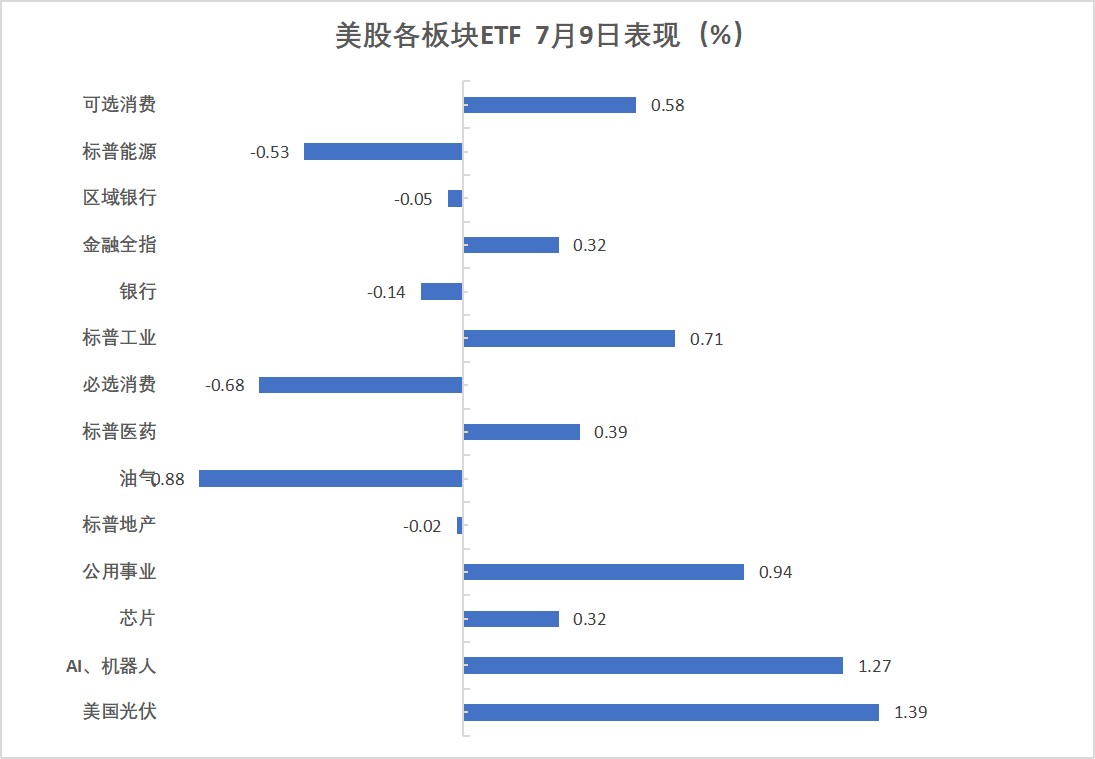

美股行業 ETF:

美股光伏板塊反彈 1.39%,AI 機器人 ETF 上漲 1.27%,公用事業 ETF 上漲 0.94%。油氣板塊下跌 0.88%、美股行業板塊中表現最差。

“科技七姐妹”:

美國科技股七巨頭 ETF(Magnificent 7 ETF)漲 1.09%。

英偉達收漲 1.80%,Meta Platforms 漲 1.68%,亞馬遜漲 1.45%,微軟收漲 1.39%,谷歌 A 漲 1.30%,蘋果漲 0.54%,特斯拉跌 0.65%。

芯片股:

費城半導體指數收漲 0.44%,報 5665.99 點。

AMD 漲 0.43%,台積電 ADR 漲 1.76%。

AI 概念股:

Palantir 上漲 2.45%,Applovin 收漲 2.32%,Tempus AI 跌 0.17%。

中概股:

納斯達克金龍中國指數收跌 1.11%,報 7401.71 點。

熱門中概股裏,老虎證券漲 3.34%,理想汽車漲 0.74%,蔚來跌 0.57%,極氪跌 0.76%,阿里巴巴跌 3.85%,B 站跌 3.54%,京東跌 3.36%,美團 ADR 跌 2.84%,小馬智行跌 2.8%。

其他個股:

“特朗普關税輸家” 指數中,成分股 Fluence Energy 漲 3.92%,Wayfair 漲 2.69%,紐威漲 2.45%。

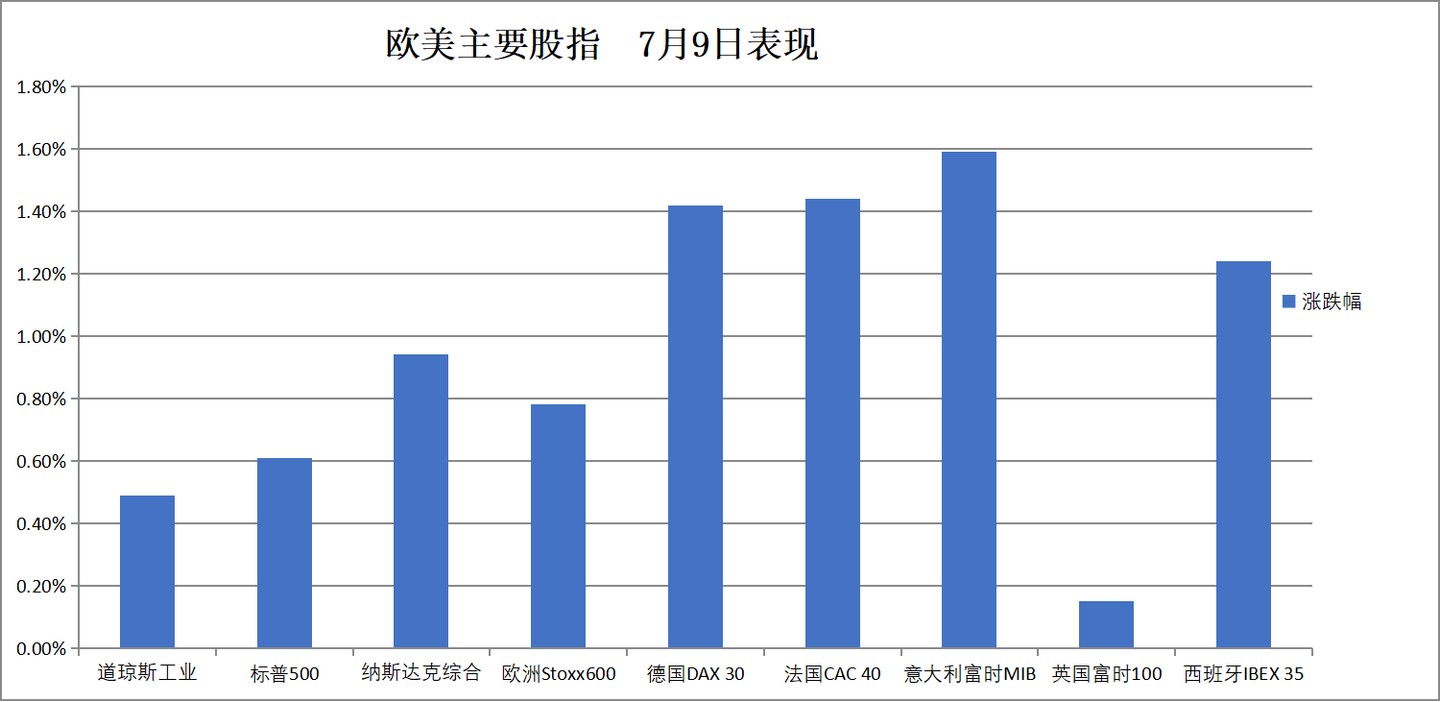

歐股集體收漲,德國 DAX 30 指數收漲 1.42%,盤中創歷史新高。

泛歐歐股:

歐洲 STOXX 600 指數收漲 0.78%,報 549.96 點。

歐元區 STOXX 50 指數收漲 1.37%,報 5445.65 點。

各國股指:

德國 DAX 30 指數收漲 1.42%,報 24549.56 點。

法國 CAC 40 指數收漲 1.44%,報 7878.46 點。

英國富時 100 指數收漲 0.15%,報 8867.02 點。

板塊和個股:

歐元區藍籌股中,寶馬漲 2.73%、梅賽德斯奔馳漲 2.69%、大眾汽車收漲 1.56%、阿迪達斯漲 1.58%、愛馬仕漲 1.25%。

歐洲 STOXX 600 指數的所有成分股中,基立福漲 5.19%,維斯塔斯風力技術漲 2%,EDP Renovaveis 漲 1.99%。

美聯儲會議紀要公佈後,美債收益率走低,而 10 年期美債標售強勁壓制收益率持續下跌。德國國債小幅上漲,在連續兩個交易日下跌後企穩。英國國債走勢分化,短期債券價格回落,長期債券結束連續三個交易日的下跌走勢。

美債:

紐約尾盤,美國 10 年期國債收益率下跌 7.12 個基點,報 4.330%。

兩年期美債收益率下跌 4.97 個基點,報 3.843%。

歐債:

歐市尾盤,10 年期德國國債收益率一度下跌 3 個基點至 2.66%,兩年期收益率回落 1 個基點至 1.86%。

10 年期英國國債收益率跌 3 個基點,至 4.60%。

意大利 10 年期國債收益率跌 2 個基點,至 3.52%。法國 10 年期國債收益率跌 1 個基點,至 3.35%。

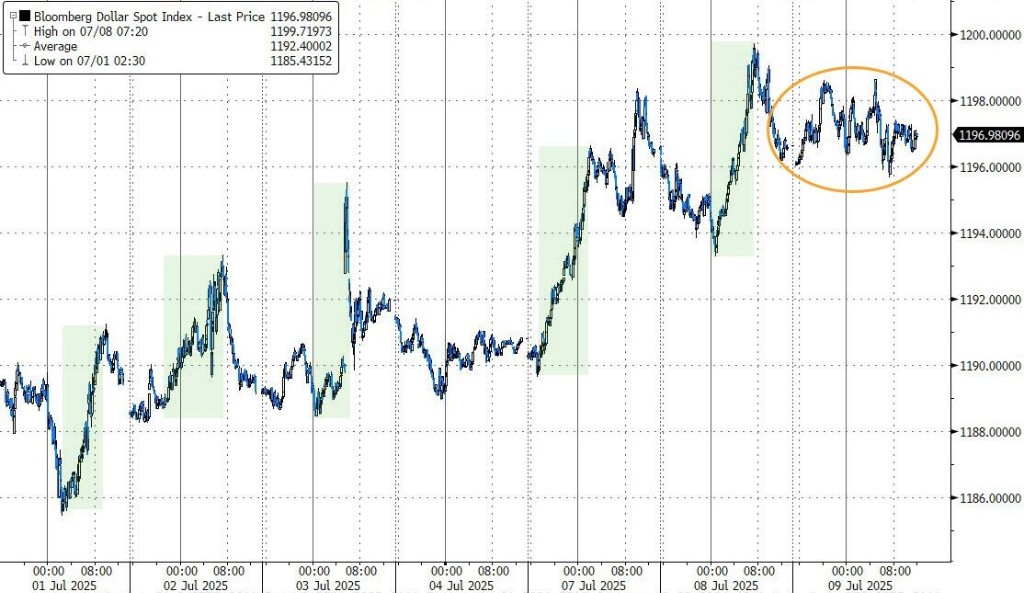

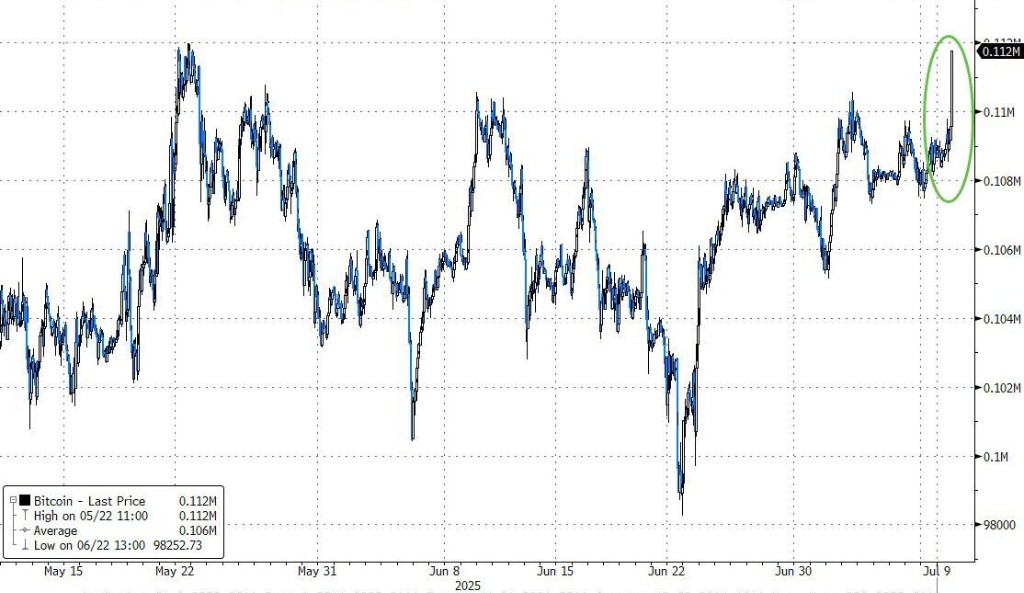

美元持穩,日元和瑞郎表現出色。離岸人民幣持穩,隱含波動率指標跌至近一年來的最低水平。巴西雷亞爾暴跌,特朗普表示將對南美洲國家進口商品徵收 50% 關税。比特幣紐約尾盤時段飆升至 11.2 萬美元,突破歷史新高,今年已累計上漲近 19%。

美元:

紐約尾盤,ICE 美元指數漲近 0.03%,報 97.541 點,日內交投區間為 97.46-97.75 點。

彭博美元指數跌近 0.01%,報 1196.55762 點,日內交投區間為 1195.65-1198.65 點。

非美貨幣:

歐元兑美元基本持平,報 1.1722,美元兑瑞郎跌 0.2%。

商品貨幣對中,美元兑加元漲 0.2%。

新西蘭元兑美元漲 0.1%,新西蘭央行維持利率 3.25% 不變。

日元:

紐約尾盤,美元兑日元跌近 0.2%,報 146.32 日元,日內交投區間為 146.25-147.18 日元。

離岸人民幣:

紐約尾盤,美元兑離岸人民幣報 7.1843 元,較週二紐約尾盤漲 25 點,日內整體交投於 7.1794-7.1882 元區間。

加密貨幣:

紐約尾盤,現貨比特幣漲超 1.9%,盤中突破歷史新高至 11.2 萬美元后回落。

原油一度測試昨日高點但在原油庫存出現自 1 月份以來的最大增幅後遭到拋售,最終美油、布油基本持平,紐約天然氣跌近 3.8%。

原油:

WTI 8 月原油期貨收漲 0.02 美元,漲幅約 0.03%,報 68.35 美元/桶。

布倫特 9 月原油期貨收漲 0.04 美元,漲幅近 0.06%,報 70.19 美元/桶。

天然氣:

NYMEX 8 月天然氣期貨收跌 3.77%,報 3.2140 美元/百萬英熱單位。

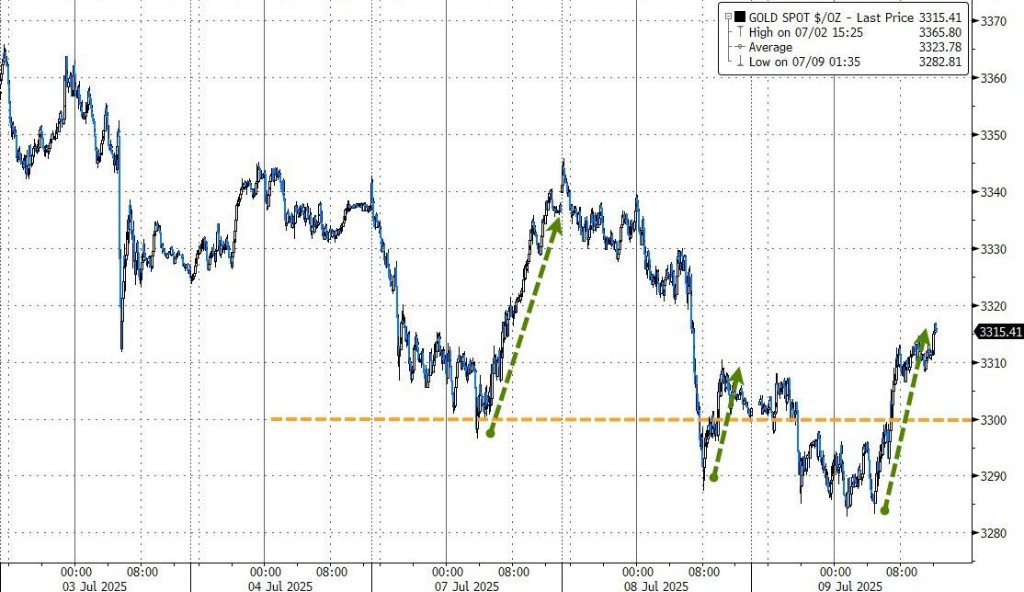

黃金先跌後漲,較日內低點上漲近 1%。

黃金:

紐約尾盤,現貨黃金漲 0.38%,報 3314.30 美元/盎司,日內交投區間為 3282.87-3316.90 美元。

COMEX 黃金期貨漲 0.18%,報 3322.80 美元/盎司。

白銀:

紐約尾盤,現貨白銀跌 1%,報 36.399 美元/盎司,日內交投區間為 36.271-36.79 美元。

COMEX 白銀期貨跌 0.37%,報 36.612 美元/盎司。

其他金屬:

紐約尾盤,COMEX 銅期貨漲 1.05%,報 5.4656 美元/磅。

LME 期銅收跌 160 美元,報 9630 美元/噸。

LME 期錫收跌 114 美元,報 33283 美元/噸。LME 期鎳收跌 63 美元,報 14979 美元/噸。