Waiting for non-farm payroll data! Most Asian stock markets fell, the New Taiwan Dollar broke through the 29 mark, and gold and crude oil slightly declined

納指也新高。英偉達漲 2.6%。甲骨文漲逾 5%。耐克漲超 4%。醫療股拖累道指回落,UnitedHealth 跌 5.7%。英股回落;英債領跌歐美國債;英鎊盤中跌超 1%。比特幣一度漲超 4000 美元、漲破 10.9 萬美元逼近 11 萬大關。倫銅三個月來首次漲破 1 萬美元,黃金創一週新高。

受美越貿易協議消息推動,標普和納指都創新高,醫療股則拖累道指回落。英國 50 億英鎊福利削減計劃受挫,英國股債匯均受挫下跌。ADP 數據意外爆冷,降息預期抬頭疊加貿易利好,大宗商品普漲,倫銅近三個月來首次漲破 1 萬美元,原油上漲脱離近 5 個交易日的震盪區間。

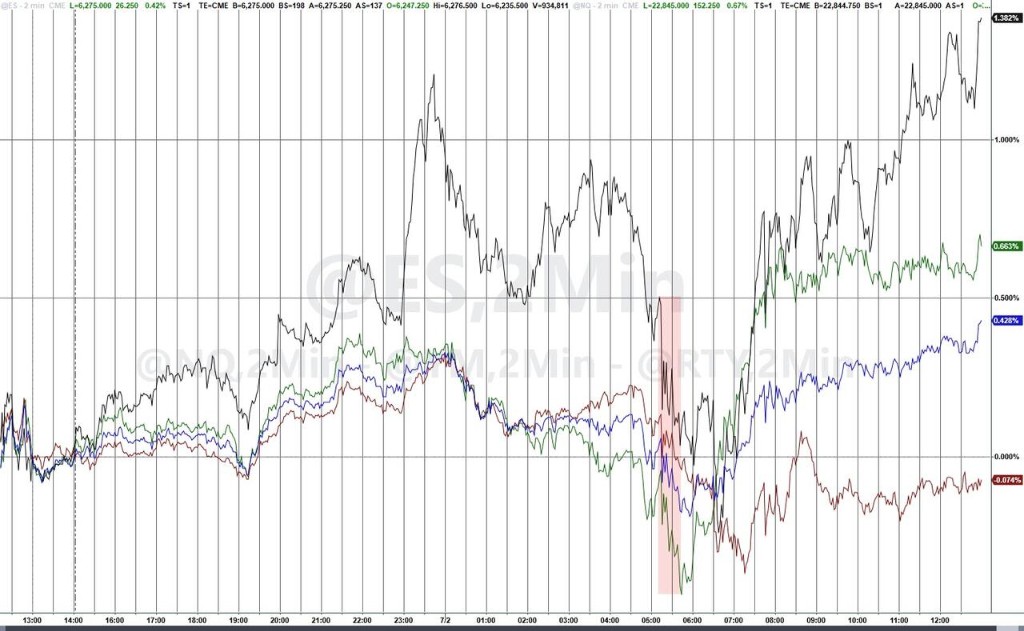

美股標普和納指都創新高,道瓊斯指數回落:

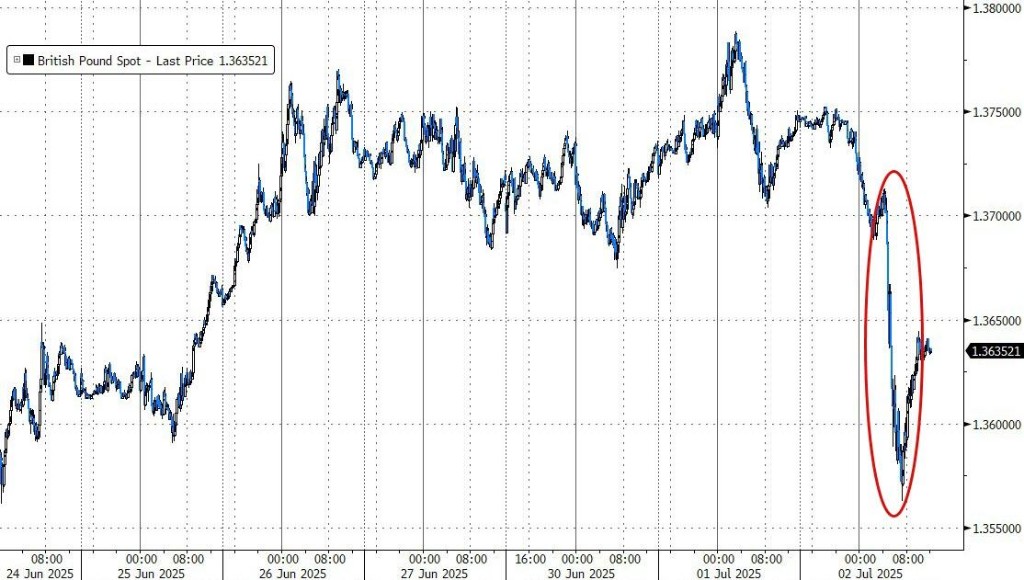

歐股盤中,華爾街見聞撰文,英國股債匯三殺,50 億英鎊福利削減計劃受挫,財政大臣離任猜測發酵。英國富時 100 指數盤中跌近 0.5%,英國國債延續跌勢,30 年期收益率一度飆升 21 個基點,至 5.44%。英鎊兑美元較高點跌超 1.3%。

美股盤前,據華爾街見聞,“小非農” ADP 意外爆冷,美國 6 月 ADP 就業人數驟降至-3.3 萬人,為 2023 年 3 月以來最差,再添經濟放緩跡象。降息預期升温,市場預期到年底美聯儲大概會降息 66 個基點,高於週二的 63 個基點。現貨黃金短線拉昇、美元指數短線跌約 20 點、美債收益率短線走低。

美股早盤,華爾街見聞報道,特朗普稱美越達成貿易協議,美國對越南商品徵關税至少 20%。科技股提振標普反彈創新高,特斯拉漲近 5%,英偉達漲近 2.6%。受醫療保險股頹勢影響,道瓊斯指數則回落。醫療保險公司 Centene 暴跌 40%,其撤回了全年盈利預期。

美股盤中,越南貿易利好消息,提振 “特朗普關税輸家” 指數漲 1.55%,其中耐克一度轉跌後上行收漲超 4%。大宗商品普漲,原油脱離近 5 個交易日的震盪區間,盤中漲逾 3%。倫銅自 3 月 25 日以來首次漲破 1 萬美元關口。

美股盤後,SaaS 公司 DatadogDatadog 被納入標普 500 指數,Robinhood 和 AppLovin 被納入的預期再次落空。美股盤後 Datadog 拉昇近 10%,網紅券商 Robinhood 則一度跳水 3.48%、AppLovin 也跌 1.4%。

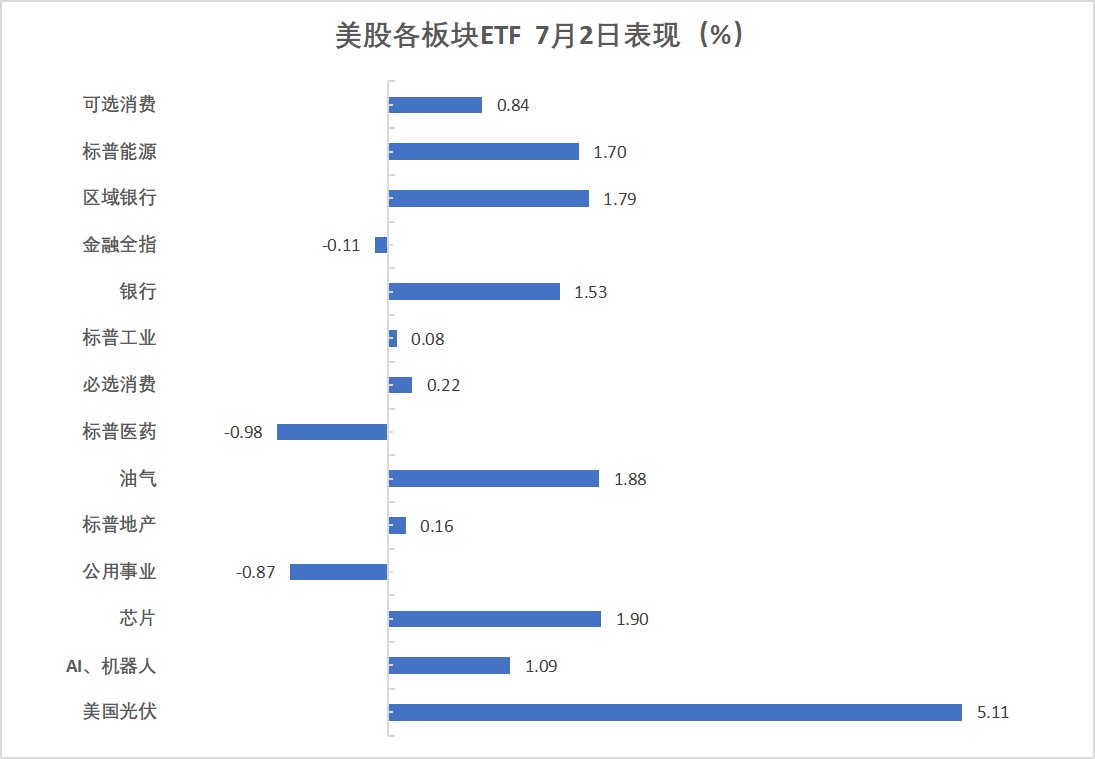

週三,美股股指標普和納指創收盤歷史新高,小盤股指漲 1.3% 連續兩天領跑三大股指。半導體 ETF 收漲超 1.9%,領跑美股行業 ETF。特斯拉收漲 4.97%,脱離 6 月 9 日以來最低收盤位。

美股基準股指:

標普 500 指數收漲 29.41 點,漲幅 0.47%,報 6227.42 點,突破 6 月 30 日所創收盤歷史最高位 6204.95 點。

道瓊斯工業平均指數收跌 10.52 點,跌幅 0.02%,報 44484.42 點。

納指收漲 190.24 點,漲幅 0.94%,報 20393.13 點,突破 6 月 30 日所創收盤歷史最高位 20369.73 點。納斯達克 100 指數收漲 163.75 點,漲幅 0.73%,報 22641.89 點。

羅素 2000 指數收漲 1.31%,報 2226.38 點。

恐慌指數 VIX 收跌 1.07%,報 16.65。

美股行業 ETF:

半導體 ETF 收漲 1.96%,區域銀行 ETF、能源業 ETF、銀行業 ETF、全球航空業 ETF、生物科技指數 ETF 漲 1.77%-1.50%,金融業 ETF 則收跌 0.08%,醫療業 ETF 跌 0.99%。

“科技七姐妹”:

美國科技股七巨頭(Magnificent 7)指數漲 1.26%,報 173.68 點。

特斯拉收漲 4.97%,脱離 6 月 9 日以來最低收盤位;英偉達漲 2.58%,蘋果漲 2.22%,谷歌 A 漲 1.59%,微軟則收跌 0.20%,亞馬遜跌 0.24%,Meta Platforms 跌 0.79%。

芯片股:

費城半導體指數收漲 1.88%,報 5611.05 點。

台積電 ADR 收漲 3.97%,時隔兩個交易日再創收盤歷史新高。超微電腦漲 3.26%,AMD 漲 1.77%。

中概股:

納斯達克金龍中國指數收漲 0.06%,報 7358.39 點。

其他個股:

“特朗普關税輸家” 指數漲 1.55%,報 102.51 點。成分股普遍上漲,Wayfair 漲 8.6%,SharkNinja 漲 7.15%,海倫特洛伊 HELE 漲 7.02% 表現第三。

醫療保險公司 Centene 暴跌 40%,其撤回了全年盈利預期。拖累其他健康保險提供商的股價,莫利納醫療保健 (MOH) 股價下近 22%,聯合健康股價下跌 5.7%。

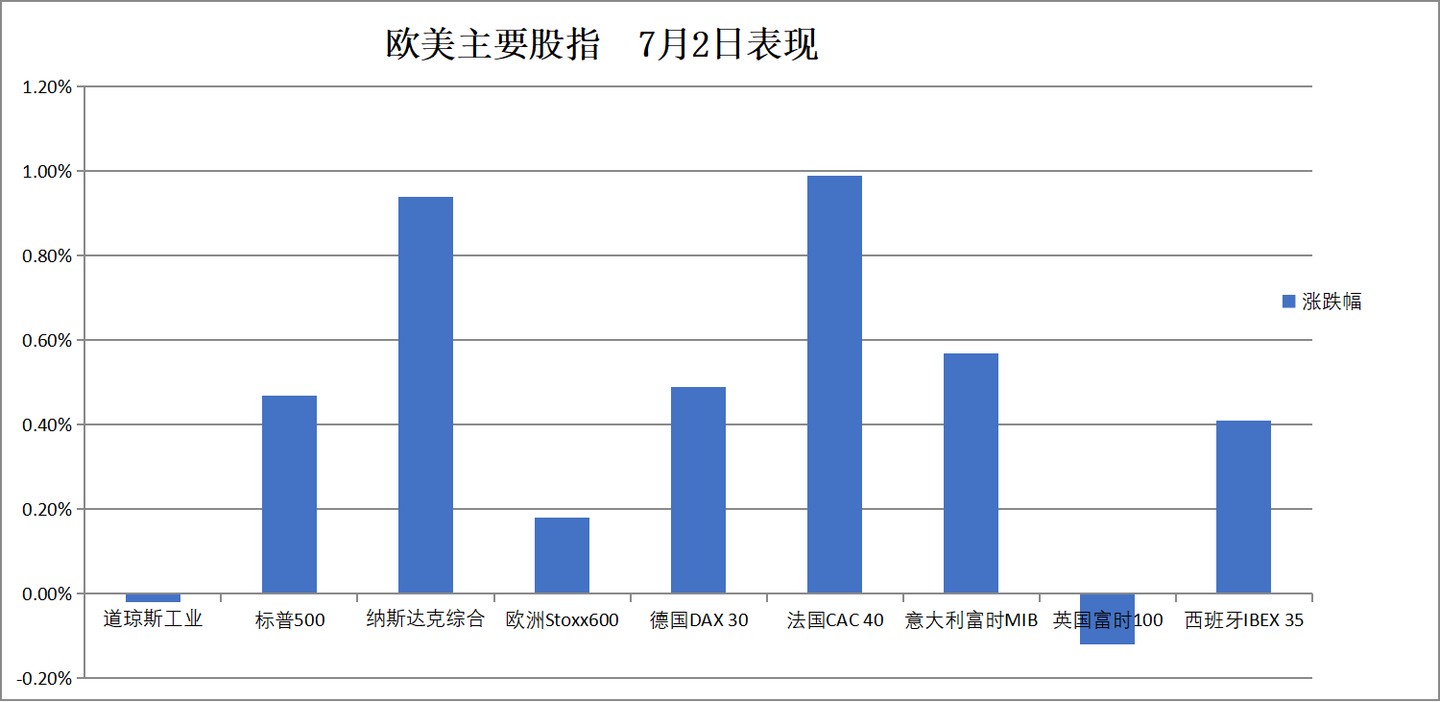

歐元區藍籌股指收漲將近 0.7%,寶馬、路易威登母公司至少漲超 4% 領跑。德國股指收漲不到 0.5%,意大利銀行指數漲 1.1%,英國富時 250 指數跌超 1.3%。

泛歐歐股:

歐洲 STOXX 600 指數收漲 0.18%,報 541.21 點。

歐元區 STOXX 50 指數收漲 0.69%,報 5318.72 點。

各國股指:

德國 DAX 30 指數收漲 0.49%,報 23790.11 點。

法國 CAC 40 指數收漲 0.99%,報 7738.42 點。

英國富時 100 指數收跌 0.12%,報 8774.69 點。

板塊和個股:

歐元區藍籌股中,寶馬汽車收漲 5.02%,LVMH 集團漲 4.15%,梅賽德斯奔馳集團漲 2.77%,安盛、皇家阿霍德德爾海茲集團、達能股份則至多收跌 1.11% 進入跌幅前四大,德意志交易所集團跌 2.15%。

歐洲 STOXX 600 指數的所有成分股中,維斯塔斯風力技術集團收漲 10.10%,蒂森克虜伯漲 8.85%,Nibe Industrier 漲 6.85%,伯克利集團控股則收跌 7.88%,Bellway 跌 7.96%,Greggs 跌 15.19%。

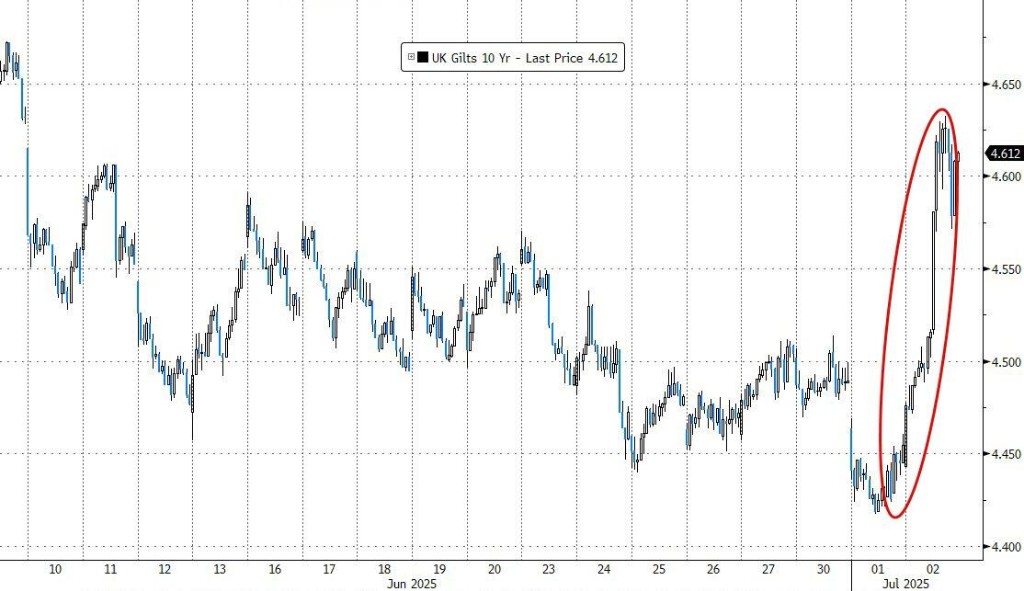

中長期美債收益率漲超 3 個基點,“小非農” 帶來短端美債收益率膝跳式跳水。投資者關注英國政治局勢,英國政府中長期融資成本顯著走高。

美債:

紐約尾盤,美國 10 年期基準國債收益率漲 3.52 個基點,報 4.2769%。

兩年期美債收益率漲 1.23 個基點,報 3.7848%,美國 ADP 就業數據時從日高 3.7992% 附近急劇跳水,轉而跌至 3.7437% 刷新日低。

歐債:

歐市尾盤,德國 10 年期國債收益率漲 9.0 個基點,報 2.664%。兩年期德債收益率漲 1.4 個基點,報 1.863%,日內交投於 1.841%-1.872% 區間。

英國 10 年期國債收益率上漲 15.8 個基點,創 4 月 7 日以來最大單日漲幅,報 4.612%。兩年期英債收益率漲 5.4 個基點,報 3.881%。

法國、意大利、希臘、西班牙四國 10 年期國債收益率平均漲 6.7 個基點。

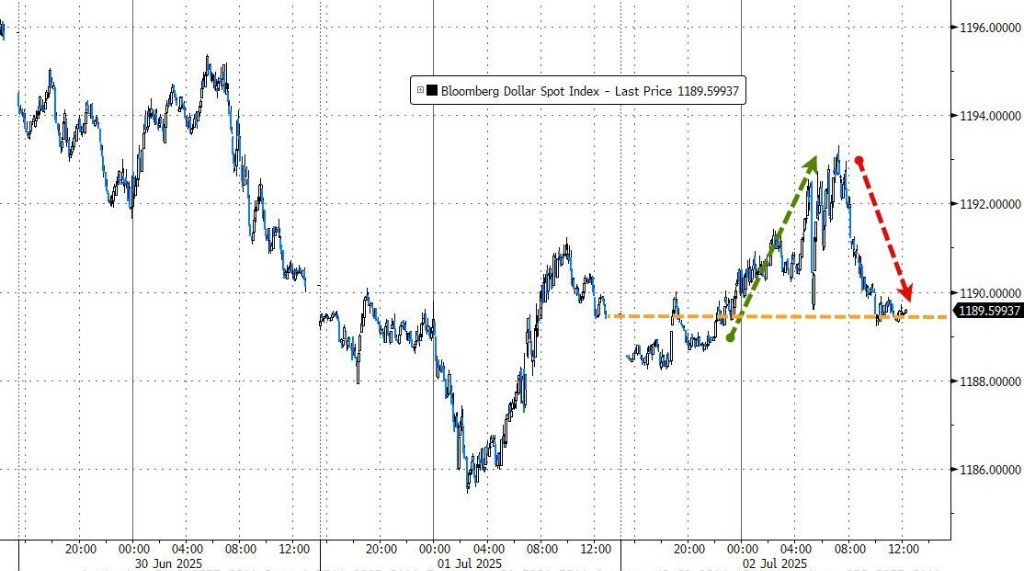

ADP 數據爆冷導致年內降息預期再度抬頭,美元指數衝高回落。英國 50 億英鎊的財政開支縮減落空,英鎊兑美元一度跌超 1.3%。

美元:

紐約尾盤,ICE 美元指數跌 0.04%,報 96.780 點,日內交投區間為 97.152-96.621 點。

彭博美元指數漲 0.00%,報 1189.56 點,日內交投區間為 1193.32-1188.23 點。

非美貨幣:

歐元兑美元跌 0.08% 全天 V 形走勢,英鎊兑美元跌 0.81%,英鎊兑歐元跌 0.74%,美元兑瑞郎漲 0.09%。

商品貨幣對中,澳元兑美元漲 0.04%,紐元兑美元跌 0.18%,美元兑加元跌 0.40%。

日元:

紐約尾盤,美元兑日元漲 0.17%,報 143.66 日元。

歐元兑日元漲 0.08%,英鎊兑日元跌 0.64%。

離岸人民幣:

紐約尾盤,美元兑離岸人民幣報 7.1612 元,較週二紐約尾盤跌 3 點,日內整體交投於 7.1598-7.1699 元區間。

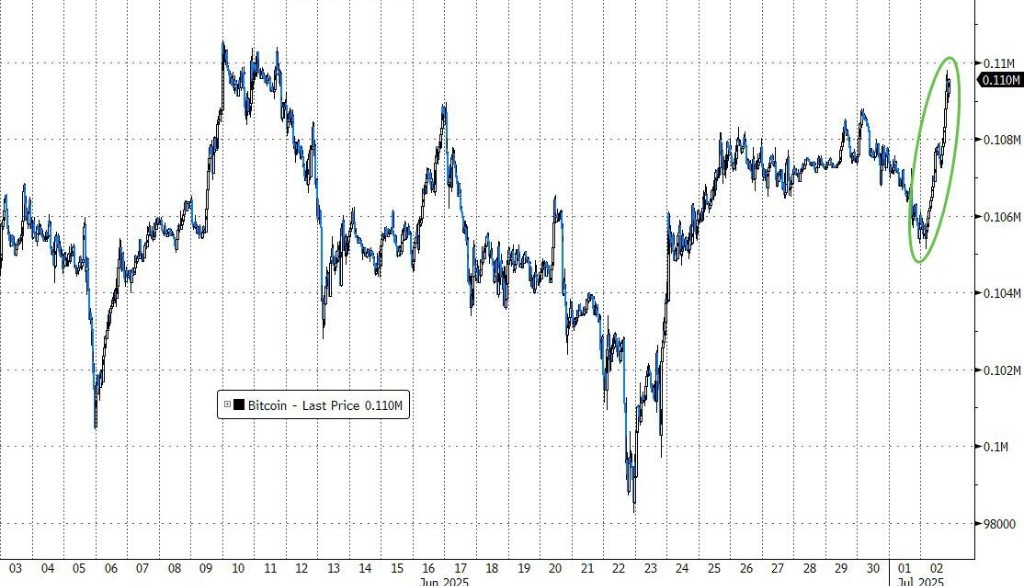

加密貨幣:

紐約尾盤,CME 比特幣期貨 BTC 主力合約較週二紐約尾盤漲 3.93%,報 1.10 萬美元,全天持續震盪上行。

CME 以太幣期貨 DCR 主力合約漲 8.19%,報 2615 美元。

原油上漲脱離近 5 個交易日的震盪區間,美國原油收漲 3%,紐約天然氣漲超 2.1%。

原油:

WTI 8 月原油期貨收漲 2.00 美元,漲幅超過 3.05%,報 67.45 美元/桶。

布倫特 9 月原油期貨收漲 2.00 美元,漲幅 2.98%,報 69.11 美元/桶。

天然氣:

NYMEX 8 月天然氣期貨收漲約 2.14%,報 3.4880 美元/百萬英熱單位。

貴金屬普漲,鉑金一度漲近 6%,現貨黃金則收漲 0.6%、一週新高。倫銅自 3 月 25 日以來首次收漲至 1 萬美元關口上方。

黃金:

紐約尾盤,現貨黃金漲 0.51%,報 3355.98 美元/盎司。

COMEX 黃金期貨漲 0.57%,報 3368.90 美元/盎司。

白銀:

紐約尾盤,現貨白銀漲 1.46%,報 36.5612 美元/盎司。

COMEX 白銀期貨漲 1.12%,報 36.805 美元/盎司。

其他金屬:

紐約尾盤,COMEX 銅期貨漲 1.99%,報 5.2010 美元/磅,逼近 4 月 2 日頂部 5.1980 美元和 3 月 26 日頂部 5.4615 美元。

現貨鉑金漲 4.58%,報 1422.25 美元/盎司。現貨鈀金漲 4.72%,報 1159.84 美元/盎司。

LME 期銅收漲 79 美元,報 10013 美元/噸。LME 期鎳收漲 96 美元,報 15302 美元/噸。LME 期錫收漲 53 美元,報 33714 美元/噸。