Li Xunlei: Do not have any illusions about the U.S., China will continue to cut interest rates this year, optimistic about gold, there are two opportunities in the stock market

中泰國際首席經濟學家李迅雷在平安基金中期策略會上表示,對美關係不應抱有僥倖心理,預計下半年中國將繼續降息並推出增量政策以刺激消費和投資。他看好黃金的長期走勢,並指出 A 股市場的投資機會主要集中在科技進步領域,如人工智能和芯片等。儘管面臨外部壓力,中國經濟韌性較強,資本市場仍有較大發展空間。

6 月 25 日下午,中泰國際首席經濟學家李迅雷在平安基金中期策略會上,對下半年中國經濟和政策走勢作出展望。

李迅雷從事宏觀經濟、金融與資本市場研究工作三十餘載,是我國最早從事證券市場研究的專家之一,被公認為中國證券行業賣方研究體系的創始者。

投資作業本課代表整理了要點如下:

1、我想我們對美國不要抱有僥倖心理,認為我們可能會重歸於好,或者中美之間能夠重新建立一個緊密的合作關係,我想這種可能性不太大。

2、與美國之間的較量不僅是在關税貿易領域,還可能在科技領域、金融領域。我們的準備相對來講還是比較充分的。

3、下半年應該還會推出一些新的增量政策。這些增量政策既有關促消費的,也有關於投資的,多管齊下。

4、今年政府工作報告提到的目標財政赤字率是 4% 左右,有可能還會進一步提升,或者發行超長期特別國債,繼續增發。增加 5000 億或者增加 1 萬億的額度,這個可能性還是有的。

5、利率下行的長期趨勢沒有改變,降息還會繼續。

6、就中國債券市場而言,今年機會不大,因為去年債券收益率下降較多,但未來來看還是有投資機會。

7、A 股市場,我想投資機會主要還是在科技的進步,人工智能的進步與應用,正在撬動新一輪科技革命,由此帶來一系列機會。比如芯片、機器人、人工智能應用等方面,影響深遠且長期。

主題投資機會有兩個......

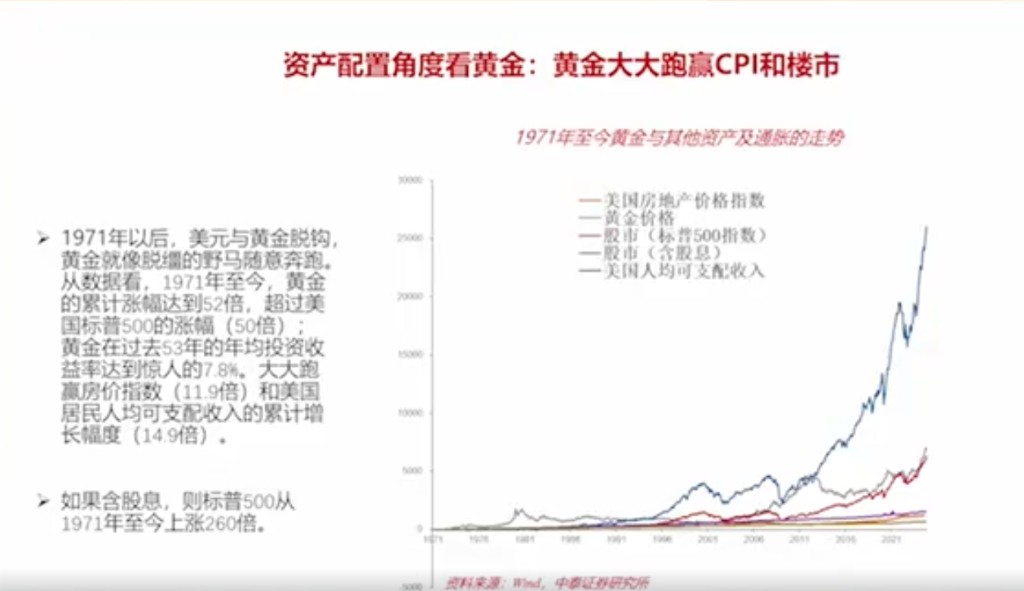

8、看好黃金的長期走勢。從資產配置角度看,黃金在過去也大幅跑贏了物價和樓市,其漲幅與標普 500 剔除股息後的漲幅幾乎一致。

李迅雷認為,雖然中國面臨外部環境變差和內循環受阻的雙重壓力,但中國經濟韌性較足,財政政策、貨幣政策會持續寬鬆,下半年會有增量政策出台,赤字提升和舉債空間還有,外資在 A 股佔比仍較低,有較大流入空間,資本市場的發展空間比較大。

以下是投資作業本課代表(微信 ID:touzizuoyeben)整理的精華內容,分享給大家:

對美不要抱有僥倖心理,重歸於好可能性不大

我們現在正在進行的是中美的多次談判,總體來講還是帶來諸多的不確定性。

美國從長期來看,也面臨着通脹壓力和債務風險,當然最終怎麼演繹,我覺得這個還不好説。

因為畢竟美國還是一個全球經濟的霸主,它的軍事力量、政治勢力還都比較強大,所以我也不能斷言美國經濟會一瀉千里。

但總體來講,它對全球帶來了負面效應,使得中國的外部環境變差。

也就是我們國家也面臨外部環境變差和內循環受阻的雙重壓力。

首先來看,特朗普的內閣成員當中,遏華的勢力還是比較強大,所以我想我們對美國不要抱有僥倖心理,認為我們可能會重歸於好,或者中美之間能夠重新建立一個緊密的合作關係,我想這種可能性不太大。

所以我們還是要堅持原則,不能退讓,要以理服人。當然,他的政策確實也存在可變性,就是所謂的特朗普 “TACO交易”,我覺得可變性還是存在的。

今年全年出口增速有可能出現負增長

中美之間的談判正在進行,但不管談得成談不成,我想對中國經濟帶來的負面影響還是存在的。

今年下半年我們的外貿壓力會明顯增大,我估計今年全年出口增速有可能出現負增長,對 GDP 也會帶來一定程度的拖累。

出口的下滑是直接的,同時還有間接的影響,比如我們銀行的不良率肯定會上升,一些出口的中小企業面臨一定的生存壓力。這樣也會對銀行不良率的上升帶來一定的促進作用。

下半年會推出新的增量政策,增發 5000/10000 億超長期特別國債的可能性存在

同時,就業壓力也是問題,我們去年其實已經提到了就業壓力問題。今年我想隨着外貿增速的下降,和外貿相關的就業也會受到影響。

與外貿相關的所謂 “新三樣” 出口製造業的投資增速也會出現下降。在本身就面臨產能過剩壓力的情況下,出口增速進一步下降會使得產能過剩加劇。我們可能面臨的有效需求不足問題還是要引起重視。

儘管我們的中央經濟工作會議和政府工作報告都提出要大力度促消費,但是消費本身是個慢變量,它不會一蹴而就,不會立竿見影。

在這方面,我們可能會面臨一個長期的任務,就是要把消費提升上去。要提升消費,還是要提高居民收入。要增加居民收入,還可能需要比較長的時間。

在這方面,我想中國經濟結構要從過去的投資拉動型轉變為消費拉動型,需要一個比較長的時間。

怎麼提升居民收入水平,可能要多管齊下。不僅僅要直接增加居民收入,還要增加就業,提高社會保障水平。

我們面臨的壓力其實是整個宏觀槓桿率水平偏高。我們現在雖然是一個發展中國家,但宏觀槓桿水平已經領先全球了。

所謂宏觀槓桿率,就是居民部門、政府部門和企業部門的債務餘額佔 GDP 的比重。

在這方面,一方面要優化財政支出結構,另一方面也要進一步加大宏觀調控力度,釋放更多積極政策,包括財政政策、貨幣政策。

所以我想下半年應該還會推出一些新的增量政策。這些增量政策既有關促消費的,也有關於投資的,多管齊下。

今年政府工作報告提到的目標財政赤字率是 4% 左右,有可能還會進一步提升,或者發行超長期特別國債,繼續增發。

超長期特別國債不直接體現在財政赤字率中,財政赤字率可能還是穩定的,但超長期特別國債會進一步增加額度,或者增加 5000 億,或者增加 1 萬億,我覺得這個可能性還是有的。

利率下行趨勢沒變,降息還會繼續

貨幣政策方面,目前還面臨物價下行壓力,政府工作報告也提出要讓物價合理回升。要實現物價回升,我覺得利率還有下調空間,所以利率的下調是一個長期動力。

我們的實際利率水平與 20 年前相比並沒有明顯下降,但經濟增速已經大幅下降了。所以政策空間上還是可以逐步降準降息,使貨幣政策更加寬鬆,為資本市場和實體經濟營造一個良好環境。

當前,人民幣匯率對美元呈現上升勢頭。由於特朗普加徵關税,帶來了美國的不確定性。今年以來美債壓力加大,因為美國通脹導致美國國債收益率上升,美國今年大概有 9 萬億美元的國債要到期,不得不借新還舊。

舊的融資成本雖然比較低,但借新的話成本會提高。這樣使得人們對美債信用產生擔憂,美元也同樣承壓。

所以趁着現在美元貶值壓力加大的時候,人民幣國際化的推進速度可以加快。這樣也有利於中國加快對外開放的步伐,更多吸引外資進入國內實體經濟乃至資本市場。

所以在這方面的改革開放步伐也可以進一步加快,資本市場的發展空間還是比較大。目前外資在 A 股市場上的持股市值比重還是比較低,最高的時候佔到 A 股市值接近 4%。

債券市場今年機會不大,A 股市場有兩個機會

就中國債券市場而言,今年機會不大,因為去年債券收益率下降較多,但從長期來看,利率還會繼續下行。所以債券市場的機會,長期來看還是比較多的。

對於 A 股市場,我想投資機會主要還是在科技的進步,人工智能的進步與應用,正在撬動新一輪科技革命,由此帶來一系列機會。比如芯片、機器人、人工智能應用等方面,影響深遠且長期。

所以我們要站在第四次工業革命——以人工智能為主線,包括創新藥、機器人應用、科技等各個方面,我想都會有產業升級和進步。

我們的主題投資機會,一是在供應鏈安全要求下,國產替代空間非常廣闊。因為美國對中國也進行了制裁,我們要獨立自主,通過國產替代拉動相關行業發展,比如電子、計算機、通訊等科技領域有全面國產替代的機會。

另一個主題,我覺得還是要看好大消費板塊,因為過去以投資主導的模式難以為繼。中國與其他國家有顯著區別,過去三十多年裏,中國投資對 GDP 的貢獻率大約在 40% 以上,42% 左右,而全球平均水平只有 20%。投資增速下降,消費增速必然要上去,這樣才能實現穩增長目標。所以我覺得大消費板塊更值得看好,尤其是新型消費。

同時,在人口老齡化的背景下,醫藥生物行業的機會也比較多。最近國家提出 “兩新”,即大規模設備更新和消費品以舊換新,通過國內方式促進消費。所以政府主導的這些消費領域,我認為還是有比較多的機會。

另一方面,傳統產業需要更新迭代,併購重組的機會還會比較多。隨着經濟發展,分化會越來越明顯。縱觀美國的七巨頭,之所以能發展和成長那麼快,主要是通過大規模併購實現的。比如蘋果、微軟、谷歌、亞馬遜、英偉達、臉書、特斯拉,它們的併購次數都在三位數。我們這方面還不多,應該更多利用資本市場這個平台,加大併購力度,讓企業做強做大,快速發展。所以我認為未來在資本市場併購方面的機會還是比較多,值得參與和把握。

看好黃金長期走勢

最後講講貴金屬。從避險角度來看,黃金在過去十年表現比較強勁,主要是因為全世界不確定性增加和貨幣氾濫,軍事衝突不斷。

黃金既有貴金屬屬性,也有貨幣屬性,具有保值功能和避險功能。所以我還是看好黃金的長期走勢。

從資產配置角度看,黃金在過去也大幅跑贏了物價和樓市,其漲幅與標普 500 剔除股息後的漲幅幾乎一致。

小結

我認為全球經濟未來會步入一個低增長、高震盪的階段,中國經濟韌性還是比較足。

今年下半年,中國經濟的增量政策有望出台。對於經濟增長來説,今年依然要實現 5% 的增長目標。財政政策、貨幣政策的積極和寬鬆會持續。

對於大類資產配置,我還是繼續看好債券市場,因為利率下行是個長期趨勢。雖然今年國債市場機會不太多,因為去年國債收益率下降幅度較大,但未來來看還是有投資機會。

股票市場更多來自結構性機會,這一方面來自中國經濟高質量增長、科技發展帶來的產業轉型升級和企業分化,少數企業能夠做強做大,崛起新興產業,具有更多機會。另一方面,在全球經濟衝突加大、低增長高震盪的大背景下,黃金作為避險和保值工具,作用依然明顯,所以我還是看好黃金的長期投資價值。

來源:投資作業本 Pro 作者王麗

更多大佬觀點請關注↓↓↓