The ceasefire has taken effect, and expectations for interest rate cuts have boosted optimistic sentiment, leading to a slight rise in global stock markets, a nearly 2% rebound in oil prices, and an increase in gold

標普收平、道指回落。英偉達奪回最高市值個股寶座。特斯拉收跌 3.8%。美光盤後先漲近 8%,後曾轉跌。美債收益率盤中衝高回落。歐元再創近四年新高。

美股漲跌互現,英偉達和谷歌大漲提振納指收漲。投資者評估美聯儲主席鮑威爾的最新評論,同時新屋銷售數據的慘淡促使降息預期進一步上升。美元跌至近三年低位,歐元創近四年新高。由於庫存暴跌,連跌兩日的原油波動放緩,震盪持平於前一日收盤價附近。

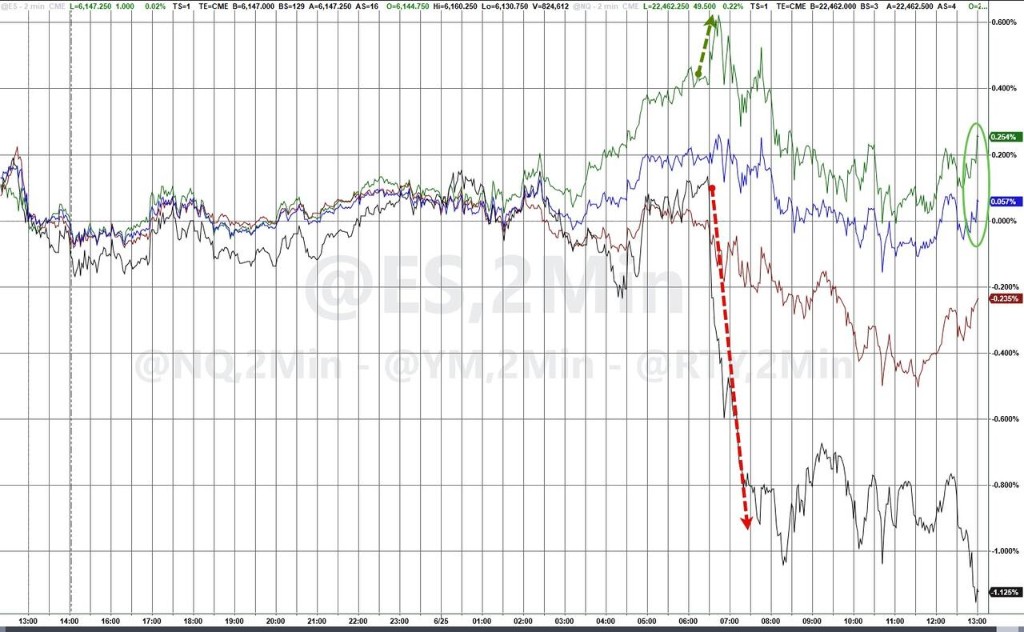

大型股支撐納指收漲,小型股則大幅下跌,道瓊斯指數也收跌:

美股早盤,華爾街見聞撰文,鮑威爾國會聽證次日,聲稱貿易協議可能讓聯儲考慮降息。此外,美國新屋銷售創 2022 年以來最大降幅。降息預期提升,美債收益率多數下跌,兩年期美債收益率跌超 4 基點。美元指數先漲後跌,盤中較高點回落超 0.5%,歐元近四年新高。

美股午盤,特朗普稱以色列和伊朗的衝突可能再次爆發,或許很快。此前美國公佈石油庫存創 2014 年以來季節性新低。美油一度漲 2% 後回落至昨日收盤價附近。

華爾街見聞報道,美國聯邦住房金融局擬將加密貨幣當作房貸抵押品,加密貨幣概念股 Sharplink Gaming 一度漲超 23%,隨後漲幅回落至 6.42%。Coinbase 收漲超 3%。

美股盤後,美光業績向好,季度收入指引也超預期,股價盤後一度漲超 6%,隨後大幅回落。

週三美股三大股指漲跌互現,納指科技指數收漲 1%,小盤股指收跌超 1.1%。大多數板塊收盤下跌,房地產板塊領跌,而科技板塊漲幅最大。英偉達收漲超 4.3%,特斯拉則跌將近 3.8%。加密貨幣概念股 Sharplink Gaming 一度漲超 23%,Coinbase 一度漲逾 6%。

美股主要股指:

標普 500 指數收跌 0.02 點,跌幅 0.00%,報 6092.16 點。

道瓊斯工業平均指數收跌 106.59 點,跌幅 0.25%,報 42982.43 點。

納指收漲 61.02 點,漲幅 0.31%,報 19973.55 點。納斯達克 100 指數收漲 47.22 點,漲幅 0.21%,報 22237.74 點。

羅素 2000 指數收跌 1.16%,報 2136.18 點。

恐慌指數 VIX 收跌 4.18%,報 16.75。

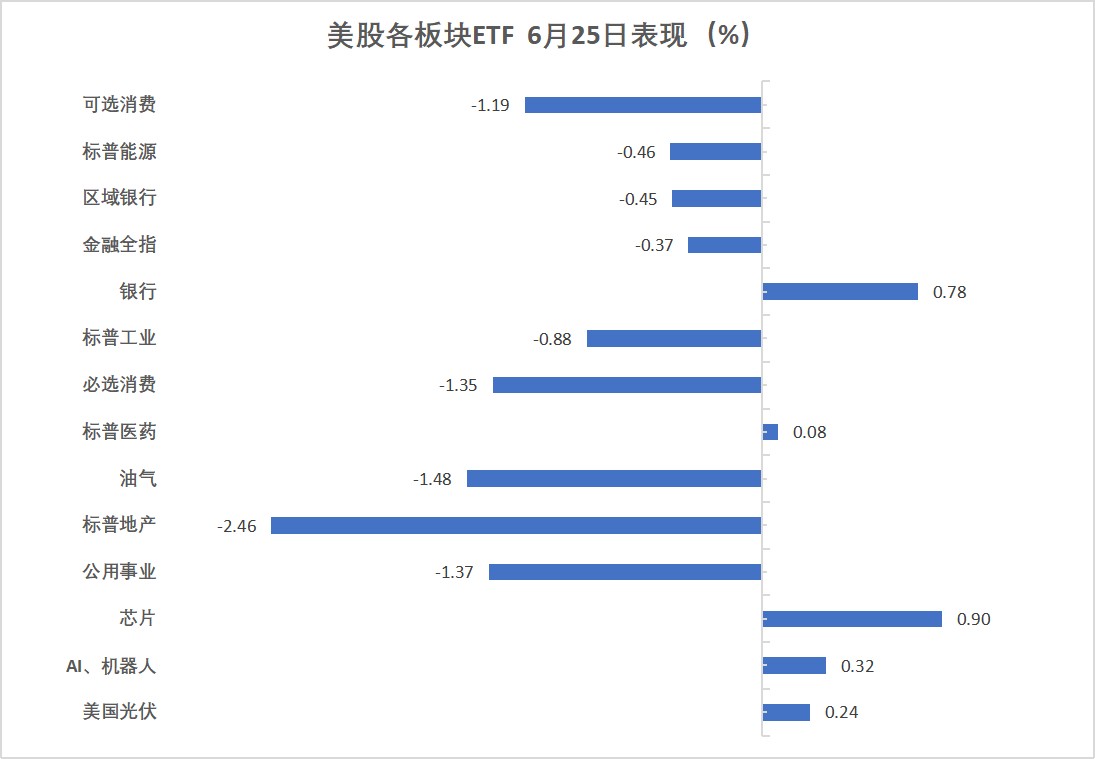

行業 ETF:

全球航空業 ETF 收跌 1.59%,日常消費品 ETF 跌 1.34%,公用事業 ETF 跌 1.34%,可選消費 ETF 跌 1.18%,能源業 ETF 跌 0.44%。

科技行業 ETF 則收漲 0.85%,全球科技股指數 ETF 漲 0.98%,半導體 ETF 漲 1.35%。

“科技七姐妹”:

美國科技股七巨頭(Magnificent 7)指數漲 1.11%,報 169.99 點。

英偉達收漲 4.33%,報 154.31 美元,突破 1 月 6 日所創收盤歷史最高位 149.43 美元和 1 月 7 日所創盤中歷史最高位 153.13 美元;谷歌 A 漲 2.34%,蘋果漲 0.63%,微軟漲 0.44%,亞馬遜則收跌 0.35%,Meta Platforms 跌 0.50%,特斯拉跌 3.79%。

芯片股:

費城半導體指數收漲 0.95%,報 5493.30 點。

成分股相干公司 COHR 收漲 5.77%,AMD 收漲 3.59%,台積電 ADR 漲 1.20% 表現第七。

AI 概念股:

Applovin 下跌 3.06%,Tempus AI 收跌 4.12%。

中概股:

納斯達克金龍中國指數收跌 0.60%,報 7380.73 點。

熱門中概股裏,文遠知行跌 2.48%,霸王茶姬跌 8.82%,有信科技跌 13.80%,納比特跌 23.57%。老虎證券收漲 22.39%,逸仙電商漲 13.04%。

其他重點個股中:

禮來製藥漲 1.83%,巴菲特旗下伯克希爾哈撒韋 B 類股則收跌 1.47%。

美股加密貨幣概念股表現亮眼,Coinbase 漲逾 3%,Sharplink Gaming 漲 6.42%。

麥片製造商 Cheerios 通用磨坊收跌超 5%,全年調整後利潤的預期低於華爾街預期,原因是消費者在雜貨方面更加謹慎支出。

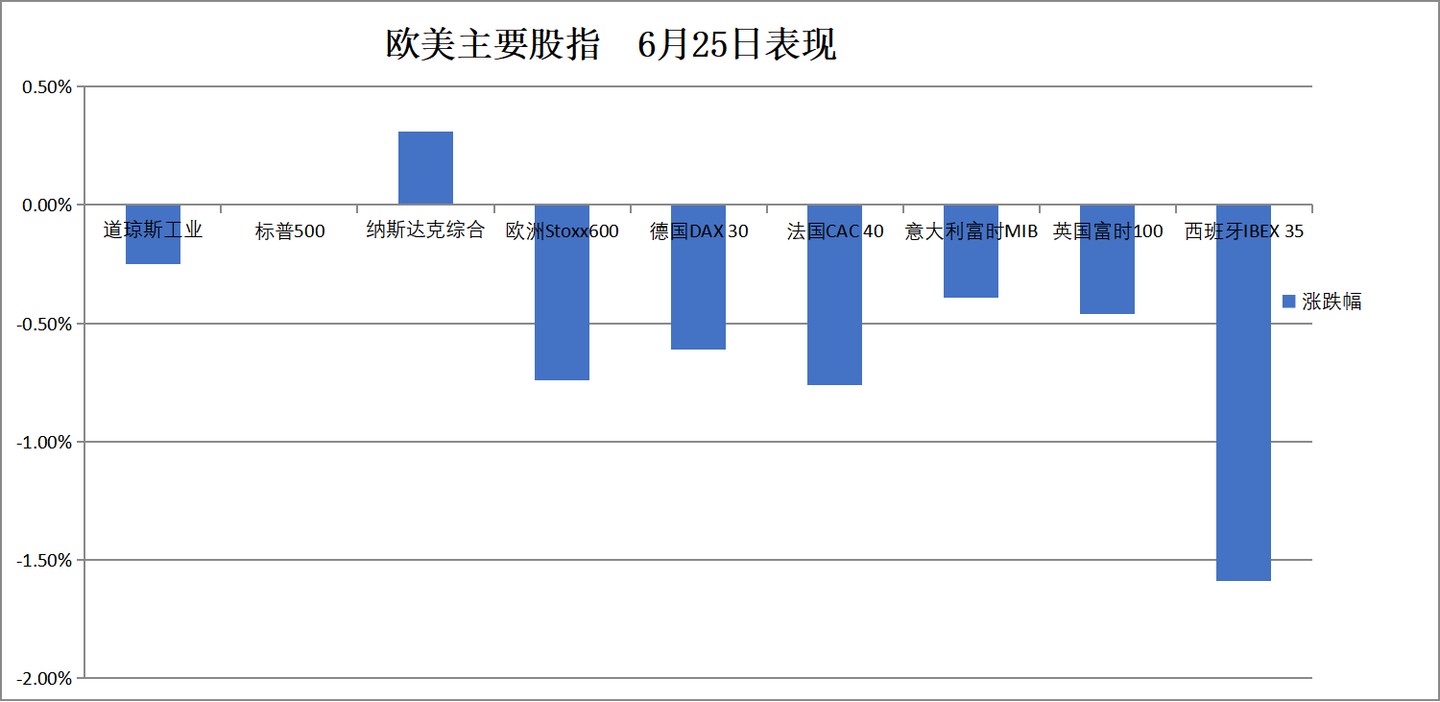

特朗普就軍費問題對西班牙釋放關税威脅。歐元區藍籌股指收跌超 0.8%,西班牙對外銀行收跌超 3% 表現倒數第二。德國股指收跌 0.6%,西班牙股指跌約 1.6%。

泛歐歐股:

歐洲 STOXX 600 指數收跌 0.74%,報 536.98 點。

歐元區 STOXX 50 指數收跌 0.85%,報 5252.01 點。

各國股指:

德國 DAX 30 指數收跌 0.61%,報 23498.33 點。

法國 CAC 40 指數收跌 0.76%,報 7558.16 點。英國富時 100 指數收跌 0.46%,報 8718.75 點。西班牙 IBEX 35 指數收跌 1.59%。

板塊和個股:

歐元區藍籌股中,百威英博、西班牙對外銀行、德國電信收跌 3.57%-3% 表現最差,法拉利則收漲 2.21% 表現第三,德國萊茵金屬 RHM 漲 3.08%,斯泰蘭蒂斯 Stellantis 漲 3.09%。

歐洲 STOXX 600 指數的所有成分股中,阿卡迪斯收跌 8.42%,德國商業銀行跌 5.68%,斯道拉恩索跌 5.01% 表現倒數第三,薩博公司漲 3.66%,博柏利漲 4.78%,Hensoldt 漲 5.70%,巴布考克國際集團漲 10.75%。

美聯儲降息預期進一步抬升,美債收益率普漲。中長期德債收益率守住超過 2 個基點的漲幅,特朗普就軍費問題釋放關税威脅,西班牙主權債收益率也漲超 2 個基點。

美債:

紐約尾盤,美國 10 年期基準國債收益率跌 0.39 個基點,報 4.2906%,日內交投於 4.33%-4.2749% 區間。

兩年期美債收益率跌 4.44 個基點,報 3.7807%,全天處於下跌狀態,整體交投於 3.8155%-3.7664% 區間。

歐債:

歐市尾盤,德國 10 年期國債收益率漲 2.1 個基點,報 2.565%。兩年期德債收益率跌 0.8 個基點,報 1.843%,日內交投於 1.863%-1.819% 區間。

英國 10 年期國債收益率漲 0.8 個基點,兩年期英債收益率跌 1.6 個基點。

西班牙 10 年期國債收益率漲 2.3 個基點。

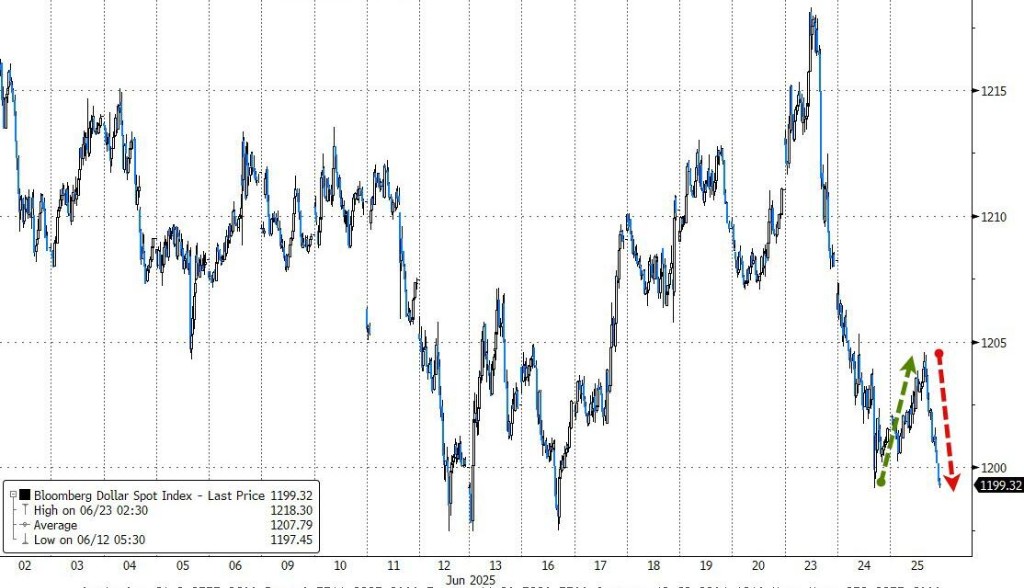

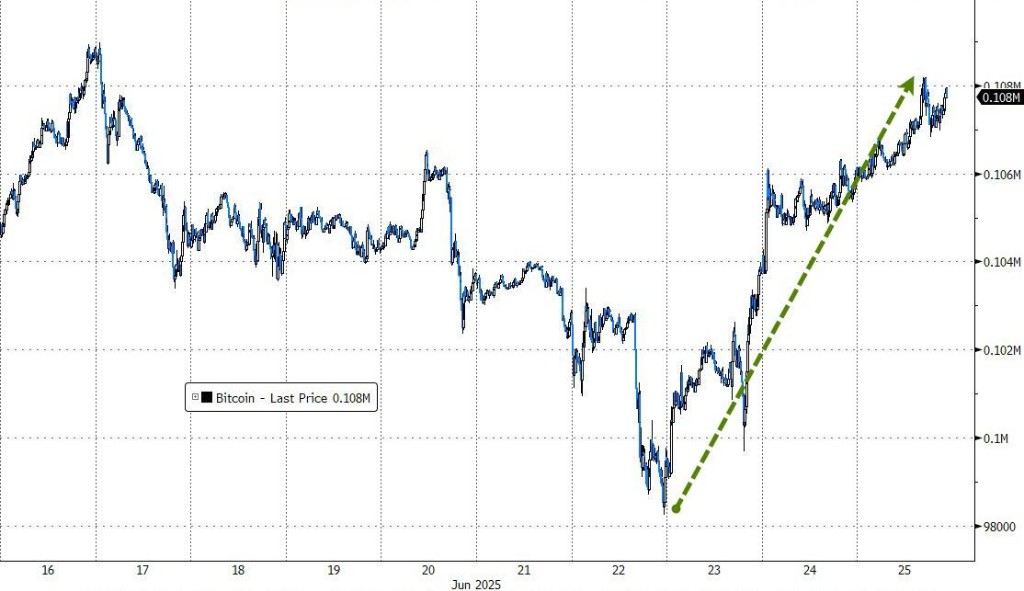

美元指數先漲後跌,盤中較高點回落超 0.5%,歐元近四年新高。比特幣延續昨日漲幅,一度回升至 10.8 萬美元附近。

美元:

紐約尾盤,ICE 美元指數跌 0.20%,刷新日低至 97.651 點,全天呈現出衝高回落走勢,北京時間 21:10 曾漲至 98.201 點刷新日高。

彭博美元指數跌 0.20%,刷新日低至 1199.17 點,20:49 也曾漲至 1204.58 點刷新日高。

非美貨幣:

紐約尾盤,歐元兑美元漲 0.40%,英鎊兑美元漲 0.37%,美元兑瑞郎跌 0.05%。

商品貨幣對中,澳元兑美元漲 0.36%,紐元兑美元漲 0.55%,美元兑加元漲 0.02%。

日元:

紐約尾盤,美元兑日元漲 0.25%,報 145.28 日元。

歐元兑日元漲 0.63%,英鎊兑日元漲 0.60%。

離岸人民幣:

紐約尾盤,離岸人民幣兑美元報 7.1731 元,較週二紐約尾盤跌 75 點,日內整體交投於 7.1604-7.1794 元區間。

加密貨幣:

紐約尾盤,CME 比特幣期貨 BTC 主力合約較週二紐約尾盤漲 1.98%,報 10.8 萬美元。

CME 以太幣期貨 DCR 主力合約大致持平,報 2435.50 美元。

特朗普稱以色列和伊朗的衝突可能再次爆發,或許很快。此前美國公佈石油庫存創 2014 年以來季節性新低。美油一度漲 2% 後回落至昨日收盤價附近。國際油價收漲 0.8%,紐約天然氣收跌 3.7%。

原油:

WTI 8 月原油期貨收漲 0.55 美元,漲幅超過 0.85%,報 64.92 美元/桶。

布倫特 8 月原油期貨收漲 0.54 美元,漲幅超過 0.80%,報 67.68 美元/桶。

天然氣:

NYMEX 7 月天然氣期貨收跌超 3.70%,報 3.4060 美元/百萬英熱單位。

黃金走勢跟隨美元指數。黃金亞盤時段持續疲軟,美聯儲降息預期上升後,黃金回升至 3330 美元上方,紐約白銀期貨和銅期貨漲超 1%。

黃金:

紐約尾盤,現貨黃金漲 0.29%,報 3333.42 美元/盎司。

COMEX 黃金期貨漲 0.40%,報 3347.30 美元/盎司。

白銀:

紐約尾盤,現貨白銀漲 0.99%,報 36.2725 美元/盎司。

COMEX 白銀期貨漲 1.38%,報 36.225 美元/盎司。

其他金屬:

紐約尾盤,COMEX 銅期貨漲 1.14%,報 4.9280 美元/磅。

LME 期銅收漲 44 美元,報 9712 美元/噸。

LME 期錫收漲 874 美元,報 33193 美元/噸。LME 期鎳收漲 154 美元,報 15074 美元/噸。LME 期鋅收漲 23 美元,報 2704 美元/噸。