Trump's statement eases tensions, crude oil and gold retreat, European stocks rise broadly, and U.S. stock futures dip slightly before the market opens

谷歌 A 收跌近 4%,領跌科技七巨頭。Circle 大漲 20%。芯片概念股受負面消息影響下跌,英偉達跌一度逾 1.8%。沃勒發表鴿派言論,引發了美債收益率下跌,2 年期收益率跌至 3.906%。美元指數震盪收跌 0.21%,本週依舊累漲超 0.5%,創五週最大漲幅。比特幣倒 V 反轉,從日內高點一度下跌 4%。中東局勢不明,原油低位震盪。黃金盤中一度跌近 0.9%,後收平。

美聯儲理事沃勒降息言論一度助推美股高開走強,隨後芯片負面消息打壓升勢,美股指數漲跌不一。蘋果走強支撐道指驚險收漲,谷歌則領跌科技七巨頭。特朗普推遲美國對伊朗發動打擊的決定,導致原油盤中低位震盪。

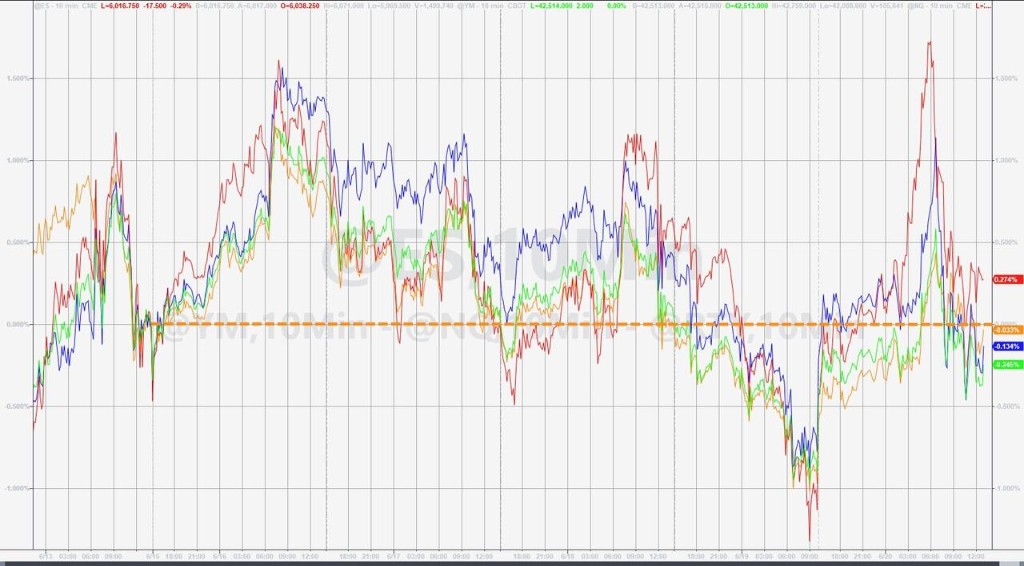

投資者權衡地緣政治形勢和貿易局勢,美股高開低走,美債全線走強:

美股盤前,據央視新聞報道,白宮表示特朗普總統將在兩週內做出決定,並且有相當大的機會通過談判解決問題。原油盤中低位震盪,美油持續在 75 美元價位徘徊。黃金受挫下跌,一度跌近 0.9%。

華爾街見聞報道,美聯儲理事沃勒聲稱,無需等待太久就可以降息,最早在 7 月。鴿派言論引發美債收益率下跌,對利率敏感的 2 年期收益率持續下跌至 3.906%。美股開盤後,三大股指小幅高開,其中納指漲超 0.5%。科技股多數走高,特斯拉、蘋果均漲超 1%。

美股早盤,“穩定幣第一股” Circle 延續此前漲勢,上漲超 20%,此前參議院通過《Genius 法案》。據報道,美國可能撤銷對部分半導體制造商的豁免,芯片股因此承壓。英偉達跌一度逾 1.8%,後跌幅收窄。台積電一度下跌 2.5%。芯片設備製造商的股價也出現下跌,應用材料公司股價早盤中下跌 4%,隨後跌幅收窄至 1.96%。

週五三巫日美股漲跌不一,蘋果漲超 2%,支撐道指驚險收漲。谷歌 A 收跌近 4%,領跌科技七巨頭。芯片概念股受負面消息影響下跌,英偉達跌一度逾 1.8%。“穩定幣第一股” Circle 收漲 20.39%,連續第二個交易日創收盤歷史新高。

美股基準股指:

標普 500 指數收跌 13.03 點,跌幅 0.22%,報 5967.84 點。

道瓊斯工業平均指數收漲 35.16 點,漲幅 0.08%,報 42206.82 點。

納指收跌 98.86 點,跌幅 0.51%,報 19447.41 點。納斯達克 100 指數收跌 93.30 點,跌幅 0.43%,報 21626.39 點。

羅素 2000 指數收跌 0.18%,報 2109.27 點。

恐慌指數 VIX 收跌 6.95%,報 20.63。

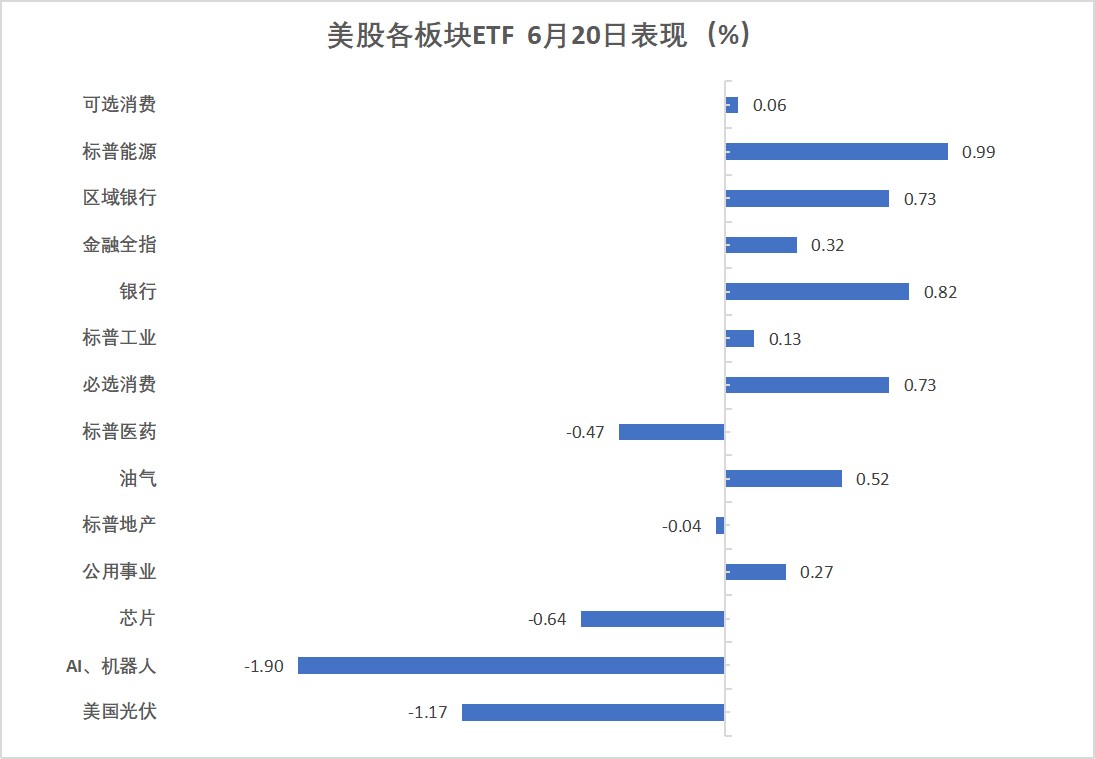

美股行業 ETF:

AI 機器人板塊跌 1.90%,光伏板塊跌 1.17%。能源板塊 ETF 漲近 1%,銀行 ETF 則漲 0.73%。

“科技七姐妹”:

美國科技股七巨頭(Magnificent 7)指數跌 0.72%,報 164.76 點,本週累計上漲 0.08%。

谷歌 A 收跌 3.85%,Meta Platforms 跌 1.93%,亞馬遜跌 1.33%,英偉達跌 1.12%,微軟跌 0.59% 脱離收盤歷史最高位,特斯拉則收漲 0.03%,蘋果漲 2.25%。

本週,蘋果累計反彈 2.32%,英偉達漲 1.32%,微軟漲 0.51%,Meta 大致持平,特斯拉跌 0.97%,亞馬遜跌 1.14% 連跌兩週,谷歌 A 累跌 4.60%。

芯片股:

費城半導體指數收跌 0.75%,報 5211.48 點。

台積電 ADR 跌 1.87%——本週累計下跌 0.75%,AMD 則漲 1.14%。

- 芯片設備製造商應用材料公司股價收跌 1.96%,荷蘭阿斯麥控股公司下跌 0.67%。

AI 概念股:

Applovin 收跌 5.71%,Palantir 下跌 1.90%,Tempus AI 下跌 1.14%。

中概股:

納斯達克金龍中國指數收跌 0.92%,報 7126.70 點,本週累跌 1.48%,週一上漲,隨後持續回落。

熱門中概股小馬智行跌 6.1%,京東跌 3.3%,B 站、文遠知行跌超 2%,極氪、多尼斯、Boss 直聘、中通快遞、世紀互聯、唯品會至多漲 0.8%。

其他個股:

禮來製藥收跌 2.84%,巴菲特旗下伯克希爾哈撒韋 B 類股跌 0.06%。

“穩定幣第一股” Circle 收漲 20.39%,報 240.28 美元,連續第二個交易日(週四美股休市)創收盤歷史新高。

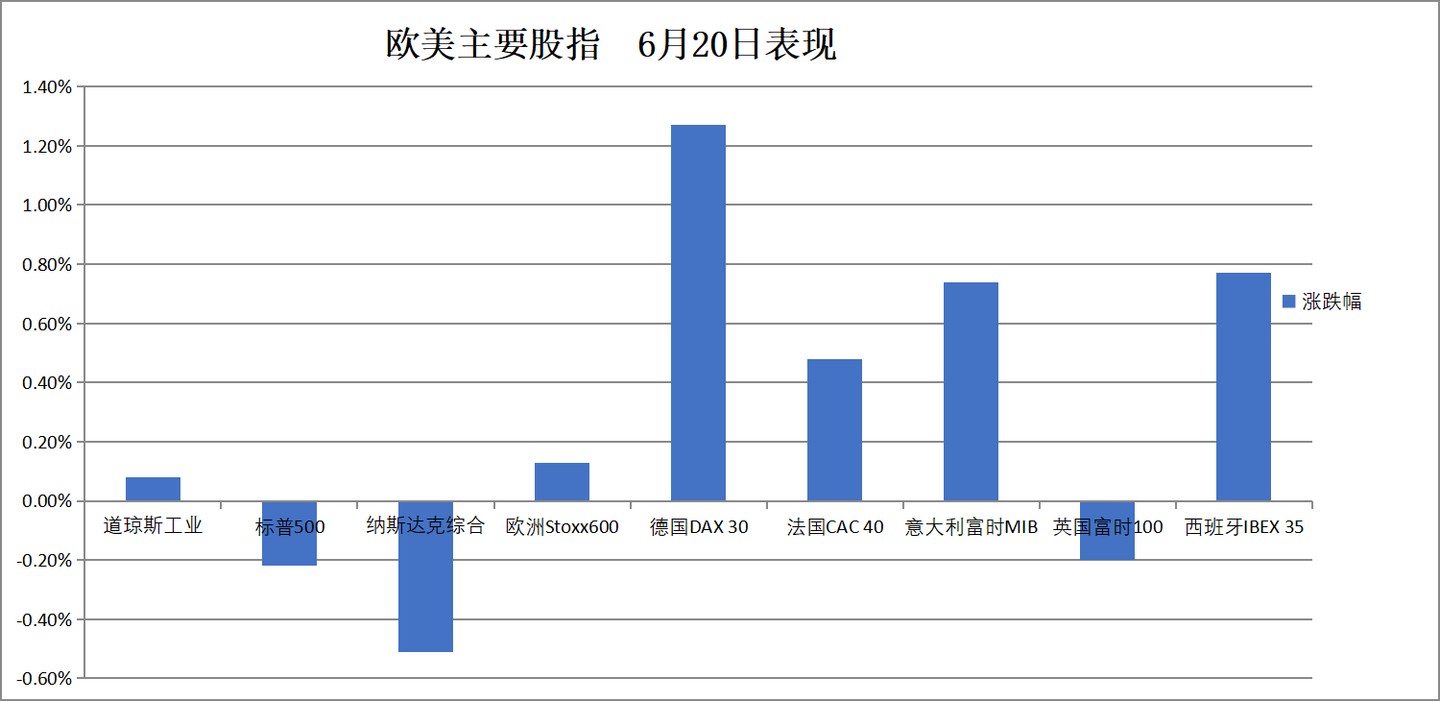

歐股旅遊和休閒股票領漲。德國股指收漲將近 1.3%,丹麥股指本週跌超 5.8%,匈牙利股指累漲 3.4%。

泛歐歐股:

歐洲 STOXX 600 指數收漲 0.13%,報 536.53 點,本週累計下跌 1.54%。

歐元區 STOXX 50 指數收漲 0.70%,報 5233.58 點,本週累跌 1.08%。

各國股指:

德國 DAX 30 指數收漲 1.27%,報 23350.55 點,本週累計下跌 0.70%。

法國 CAC 40 指數收漲 0.48%,報 7589.66 點,本週累跌 1.24%。

英國富時 100 指數收跌 0.20%,報 8774.65 點,本週累跌 0.86%。

板塊和個股:

歐元區藍籌股中,空中客車收漲 3.55%,安盛漲 2.45%,開雲集團漲 2.36% 表現第三,在收跌的九隻成分股裏,阿斯麥控股跌 0.41%,LVMH 集團跌 0.57% 跌幅第三大。

歐洲 STOXX 600 指數的所有成分股中,途易集團收漲 6.46%,Hensoldt 漲 4.24%,蒂森克虜伯漲 4.24%,RENK 集團漲 4.13%,嘉年華張 3.99% 表現第四。

10 年期美債收益率本週累跌超 7 個基點。兩年期美債收益率本週累跌 5.87 個基點,僅僅在週一美股開盤之後短暫上漲,週三美聯儲宣佈 FOMC 連續四次按兵不動、披露經濟預期概要時 “急劇” 下挫至本週最低位。

美債:

紐約尾盤,美國 10 年期基準國債收益率跌 1.57 個基點,報 4.3751%,本週累計下跌 7.11 個基點,一直處於下跌狀態,整體交投於 4.4443%-4.3377% 區間。

兩年期美債收益率跌 3.337 個基點,報 3.9077%,本週累跌 5.87 個基點,整體交投於 3.9749%-3.8824% 區間。

20 年期美債收益率漲 6.24 個基點,30 年期美債收益率漲 6.67 個基點。

歐債:

歐市尾盤,德國 10 年期國債收益率跌 0.4 個基點,報 2.517%,本週累計下跌 1.8 個基點,交投於 2.589%-2.486% 區間,整體上持續震盪下行。

英國 10 年期國債收益率漲 0.7 個基點,報 4.537%,本週累計下跌 1.3 個基點,整體交投於 4.591%-4.494% 區間。

法國 10 年期國債收益率累跌 0.8 個基點,報 3.245%。意大利 10 年期國債收益率累漲 1.3 個基點,報 3.498%。希臘 10 年期國債收益率累漲 3.0 個基點,報 3.313%。

美元指數週五低位震盪,本週累漲超 0.5%。本週日元跌超 1.4%,下探 146 日元,瑞郎跌 0.8%。離岸人民幣連續兩天走強,本週 V 形反轉。比特幣期貨本週跌約 2.1%,以太幣期貨跌 5.6%。

美元:

紐約尾盤,ICE 美元指數跌 0.21%,報 98.699 點,本週累計上漲 0.52%,整體交投區間為 97.685-99.157 點。

彭博美元指數漲 0.05%,報 1210.04 點,本週累漲 0.63%,整體交投區間為 1197.48-1210.04 點。

非美貨幣:

紐約尾盤,歐元兑美元漲 0.24%、報 1.1522,本週累跌 0.24%。

英鎊兑美元跌 0.12%、報 1.3449,本週累跌 0.90%。

美元兑瑞郎漲 0.17%、報 0.8182,本週累漲 0.81%。

商品貨幣對中,澳元兑美元跌 0.46%、本週累跌 0.57%,紐元兑美元跌 0.41%、本週累跌 0.77%,美元兑加元漲 0.26%、本週累漲 1.08%。

日元:

紐約尾盤,美元兑日元上漲 0.45%,報 146.10 日元,本週累計上漲 1.44%,整體持續震盪上行,交投區間為 143.65-146.22 日元。

歐元兑日元漲 0.70%,本週累漲 1.17%;英鎊兑日元漲 0.33%,本週累漲 0.55%。

離岸人民幣:

紐約尾盤,離岸人民幣兑美元報 7.1791 元,較週四紐約尾盤漲 69 點,連續兩個交易日走強,日內整體交投於 7.1876-7.1742 元區間。

本週,離岸人民幣呈現出 V 形反轉,週一漲至 7.18 元上方,隨後持續、平滑地下挫,週四亞太早盤跌至 7.1975 元,之後持續反彈,週五美股開盤前半小時漲至 7.1742 元。

加密貨幣:

紐約尾盤,CME 比特幣期貨 BTC 主力合約較週四紐約尾盤跌 0.80%,報 10.3 萬美元,本週(五個交易日)累計下跌 2.09%。

CME 以太幣期貨 DCR 主力合約跌 3.86%,報 2400.50 美元,本週累跌 5.61%。

紐約原油維持 0.7% 的漲幅,特朗普稱美國 “可能沒必要” 襲擊伊朗。

原油:

WTI 7 月原油期貨較 6 月 18 日(19 日休市)收盤價下跌 0.21 美元,跌幅將近 0.28%,收報 74.93 美元/桶,本週(四個交易日)累計上漲 2.67%。

布倫特 8 月原油期貨較週四收跌 1.84 美元,跌幅 2.33%,報 77.01 美元/桶,本週(連續五個交易日)累漲超 3.74%。

天然氣:

NYMEX 7 月天然氣期貨較 6 月 18 日收盤價上漲將近 3.56%,收報 3.8470 美元/百萬英熱單位,本週(四天)累漲將近 7.43%。

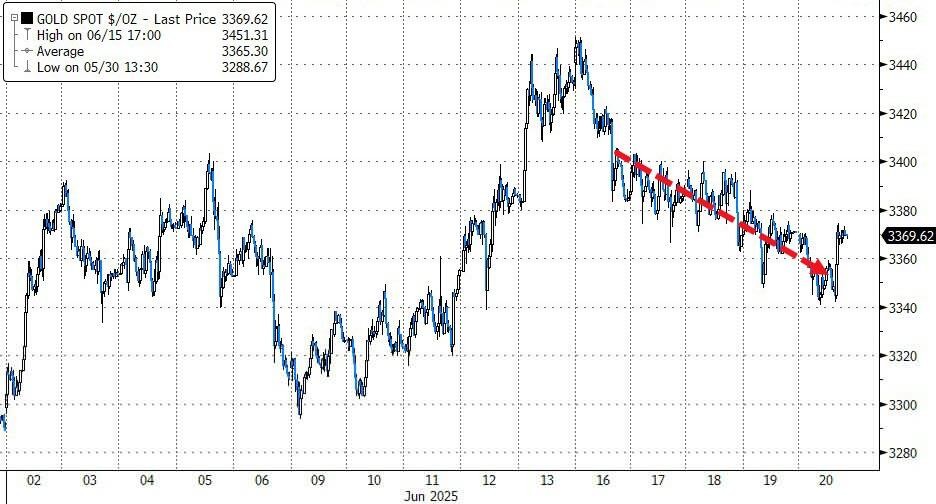

紐約期銀週五跌超 2.5%,本週紐約期金跌 2% 持續走低。華爾街見聞報道,LME 對鉅額頭寸的持有者施加新限制。倫敦金屬交易所(LME)近月銅合約的升水水平躍升至 2022 年 10 月以來的最高水平。

黃金:

紐約尾盤,現貨黃金跌 0.07%,報 3369.02 美元/盎司,本週(五個交易日)累計下跌 1.86%。

COMEX 黃金期貨跌 0.70%,報 3384.10 美元/盎司,本週(五天)累跌 2.00%。

白銀:

紐約尾盤,現貨白銀跌 1.03%,報 36.0073 美元/盎司,本週(五天)累跌 0.86%。

COMEX 白銀期貨跌 2.55%,報 35.970 美元/盎司,本週(五天)累跌 1.07%。

其他金屬:

紐約尾盤,COMEX 銅期貨跌 0.36%,報 4.8355 美元/磅,本週(五天)累漲 0.44%。

LME 期銅收漲 18 美元,報 9634 美元/噸。

LME 期錫收漲 674 美元,報 32683 美元/噸。LME 期鎳收跌 45 美元,報 15011 美元/噸。LME 期鋁收漲 28 美元,報 2550 美元/噸。