The Federal Reserve may reveal a "hawkish" dot plot tonight, and a rate cut once this year will become the new consensus in the market?

本次 FOMC 會議,美聯儲利率或仍維持不變,鷹派點陣圖成為市場焦點,部分華爾街大行預計暗示年內僅有一次降息,而帶有滯脹色彩的經濟預測將考驗美聯儲平衡能力。但即使點陣圖向鷹派方向調整,美元的漲勢或曇花一現。

美聯儲即將公佈利率決定與經濟預測,這一次會議的焦點並非是否降息,市場屏息以待的可能是一份 “鷹派” 點陣圖,這或重塑投資者對 2025 年降息路徑的預期。

根據安排,北京時間 6 月 20 日(週四)凌晨 2:00,美聯儲將公佈利率決定和更新的經濟預測摘要 (SEP),隨後主席鮑威爾將召開新聞發佈會。

市場共識與路透社的調查高度一致,預計美聯儲將維持利率在 4.25%-4.50% 區間不變。路透調查顯示,105 名經濟學家中有 103 人預期維持利率在 4.25%-4.5% 不變,另外 2 人預期降息 25 個基點。

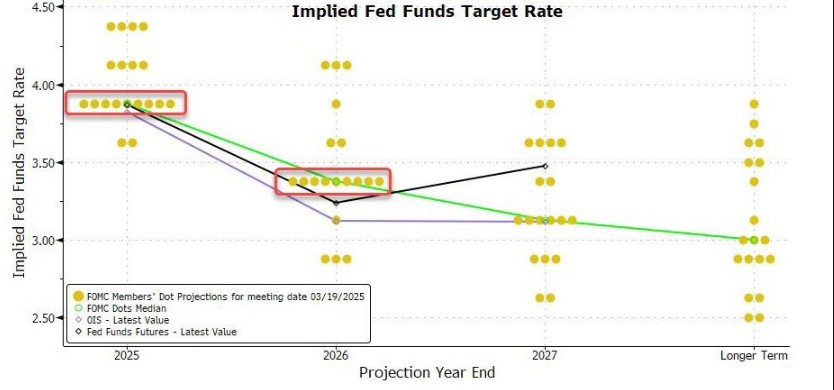

雖然利率決定幾無懸念,但關鍵看點在於點陣圖的重大調整。此前的 3 月點陣圖顯示 2025 年降息兩次,如今一個愈發強烈的鷹派聲音認為,點陣圖的中位數可能上移,暗示年內僅有一次降息。美銀預計今年僅降息一次,高盛和摩根大通同樣預期點陣圖可能釋放鷹派信號,這或是本次會議最可能引爆市場的 “鷹派炸彈”。

與點陣圖同步調整的經濟預測(SEP),將為美聯儲的謹慎立場提供數據支撐。由於關税的潛在影響,美聯儲或將描繪一幅更為 “滯脹” 的經濟圖景:通脹預測將被顯著上調,而經濟增長和失業率則面臨下調。

鷹派點陣圖成最大變數:今年一次降息會否成新共識?

回顧 3 月的會議,當時的點陣圖顯示 2025 年降息兩次(50 個基點),為市場提供了相對清晰的寬鬆路徑。然而,此後關税政策的不確定性成為了主導市場的核心變量,讓這份藍圖充滿了變數。

如今,華爾街對點陣圖的走向分歧顯著,但鷹派的聲浪正逐漸佔據上風:

鷹派陣營(美銀、摩根大通)

- 美國銀行的立場最為鮮明,其分析師預計 2025 年的點陣圖中位數將被上調 25 個基點,即明確暗示年內僅有一次降息。然而,美銀同時指出,2026 年點陣圖可能顯示 75 個基點的降息空間,暗示被推遲的降息並未消失,只是時間後移。

- 摩根大通也認為,點陣圖將向 “温和鷹派” 方向修正,中位數很可能從兩次降息變為一次。他們的邏輯在於,鮑威爾在 5 月會議上已將重心放在價格穩定上,委員會內部的鷹派傾向正在增強。

謹慎維持派(高盛、花旗)

高盛和花旗則預計,點陣圖的中位數將維持在兩次降息不變。然而,這並非鴿派信號。高盛特別指出,這可能是一個 “非常接近的分裂”,即支持兩次降息的官員(10 名)僅以微弱優勢壓過支持一次或零次降息的官員(9 名)。

花旗則認為,美聯儲傾向於將關税影響視為 “一次性” 價格衝擊,因此沒有動力通過上調點陣圖來釋放過度的鷹派信號。

經濟預測:滯脹陰影下的艱難平衡

經濟預測摘要(SEP)將是理解美聯儲決策邏輯的 “説明書”。本次 SEP 的調整將是一場典型的 “滯脹式” 修正,為美聯儲的 “按兵不動” 提供充分理由。

GDP 增長預測將下調,高盛預計將從 1.7% 降至 1.4%,失業率預測上升至 4.5%。

通脹預測(PCE)顯著上調:這是各家機構的共識。由於需要計入關税的傳導效應,2025 年的核心 PCE 通脹預測將被大幅上修。花旗預計 2025 年核心 PCE 將從 2.8% 跳升至 3.3%,摩根大通預計從 2.8% 上調至 3.2%,高盛和美銀也持相似觀點。這是推遲和減少降息的最直接依據。

經濟增長(GDP)預測下調:關税的負面影響將體現在增長預期上。高盛預計 2025 年 GDP 增長將因此減少近 1 個百分點,第四季度 GDP 增長將放緩至 1.25%。摩根大通和美銀也預計增長預測將從 1.7% 下調至 1.4%。

失業率預測微幅上調:伴隨增長放緩,失業率預期將從 4.4% 微升至 4.5% 左右。但這依然是歷史健康水平,遠未到觸發美聯儲緊急降息的警報線。

值得注意的是,儘管通脹預測大幅上調,但各大投行普遍認為美聯儲官員將關税相關通脹視為"一次性"性質,這為未來的政策調整保留了空間。

華爾街文章此前提及,美聯儲真正在意的是通脹預期,Timiraos 文章指出,經濟學理論認為,當企業預期未來成本上漲時,會提前漲價以轉嫁成本;工人若預期生活費用上升,也會要求更高工資。若這種心理預期蔓延,可能造成通脹的自我強化。美聯儲今年是否降息以及降息幅度,將部分取決於官員如何看待通脹預期風險。

關於關税的衝擊,高盛預計有效關税税率將最終上升 14 個百分點,通過類似税收的方式打擊消費者支出,並因政策不確定性影響企業投資,最終使 2025 年 GDP 增長減少近 1 個百分點。

荷蘭合作銀行 (Rabo Bank) 指出,關税的滯脹影響可能將美聯儲拉向兩個相反方向:關税對失業率的上升影響要求降息以支持經濟活動,而通脹反彈則可能需要加息來控制總需求。

FOMC 聲明與鮑威爾表態:在不確定性中 “走鋼絲”

除了數字,措辭的藝術同樣關鍵,FOMC 聲明的微調和鮑威爾的講話也至關重要。

聲明措辭的關鍵變化方面,美國銀行均預測,關於經濟前景的描述,可能會從 5 月份的 “不確定性進一步增加” 調整為更為中性的 “不確定性仍然高企”(remains high)。這反映了儘管局勢有所緩和(如美中關税削減),但整體前景依然迷霧重重。

關於通脹的表述也可能調整。儘管近期通脹數據普遍低於預期,但摩根士丹利認為,考慮到預期的關税效應和中東地緣政治風險導致的油價上漲,美聯儲對通脹的評估可能保持不變。

鮑威爾的平衡藝術。鮑威爾預計將重申 5 月新聞發佈會的核心信息:政策處於良好位置,美聯儲無需急於行動。分析認為,他將極力淡化點陣圖的預測作用,強調其只是特定情境下的假設,高度依賴於極不確定的經濟和政策前景。

花旗分析師指出,如果鮑威爾將近期通脹放緩與今年晚些時候降息計劃聯繫起來,這種討論可能會顯得特別鴿派。

美元前景:鷹派信號難救 “結構性疲軟”?

從傳統邏輯看,一個更鷹派的美聯儲,理應是美元走強的催化劑。然而,本次會議對美元的影響可能更為複雜和微妙。

美銀分析顯示,過去一個月美元貶值約 3.8%,觸及 2022 年 3 月美聯儲開始加息週期以來的低點。儘管點陣圖可能釋放鷹派信號,但美銀預計任何基於此的美元反彈都將是短暫的。

這一判斷基於一個關鍵觀察:外匯市場繼續忽視美國數據的韌性,轉而關注潛在的下行風險。全球實際資金投資者持續的美元拋售行為構成結構性阻力,這種行為模式在美元每次上漲時都會重現。

因此,即使美聯儲在本週釋放出比預期更強的鷹派信號,也可能難以逆轉美元的結構性疲軟趨勢,美元的任何上漲都可能遭遇來自長期投資者的拋售壓力。

本次 FOMC 會議,美聯儲將在關税迷霧中謹慎前行。一份指向更少降息、更滯脹前景的鷹派指引幾乎已成定局。然而,對於美元而言,這劑 “鷹派猛藥” 或許只能帶來短暫的提振,卻難以治癒其在結構性拋售壓力和未來降息預期下的 “慢性疲軟”。